timsa

Written by Nick Ackerman, co-produced by Stanford Chemist.

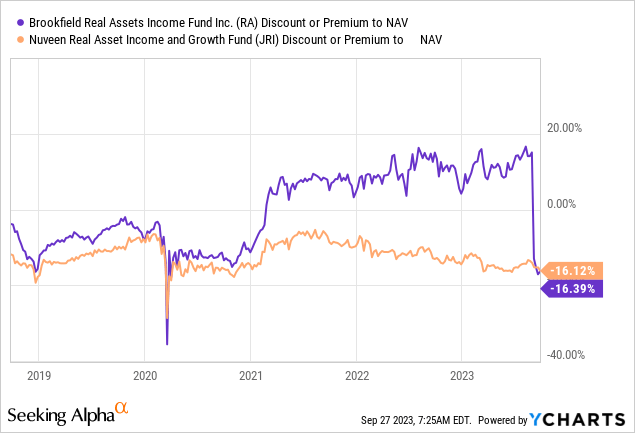

We have seen a lot of higher-yielding closed-end funds (“CEFs”) minimize their distributions this 12 months. A few noteworthy funds had been buying and selling at wealthy premiums, which then subsequently noticed these premiums collapse upon the introduced cuts. Typically talking, excessive, unsustainable yields blended with funds which might be buying and selling at wealthy premiums do not combine properly. The timing is at all times completely different, however the finish result’s normally devastating losses for traders who purchased at wealthy premiums.

A type of funds was the Brookfield Actual Property Earnings Fund Inc. (NYSE:RA). I have not lined this fund since going again to the tip of 2020. No less than not particularly masking it, though I discussed it alongside discussing Nuveen Actual Asset Earnings and Progress Fund (JRI). On this planet of CEFs, it is laborious to seek out actual friends, however these two funds share a number of related traits.

The primary thought right here was that JRI was a extra enticing choice than RA in many of the final a number of years now on account of valuation. That was till RA’s distribution minimize of round 40%, which took the month-to-month distribution from the $0.199 monthly quantity that it paid for years all the way down to $0.118. That is now the place the potential alternative lies in profiting from the fund dropping to such a deep low cost. On the very least, the prospects going ahead for this fund are rather more promising than they had been a month in the past.

The Fundamentals

- 1-12 months Z-score: -3.46

- Low cost: -16.39%

- Distribution Yield: 11.53%

- Expense Ratio: 1.69%

- Leverage: 16.35%

- Managed Property: $970 million

- Construction: Perpetual.

RA’s investment objective is looking for “excessive complete return, primarily by excessive present earnings and secondarily by progress of capital.” To attain this, the fund will make investments “primarily in actual property corresponding to infrastructure and actual property securities, throughout fairness and glued earnings around the globe.”

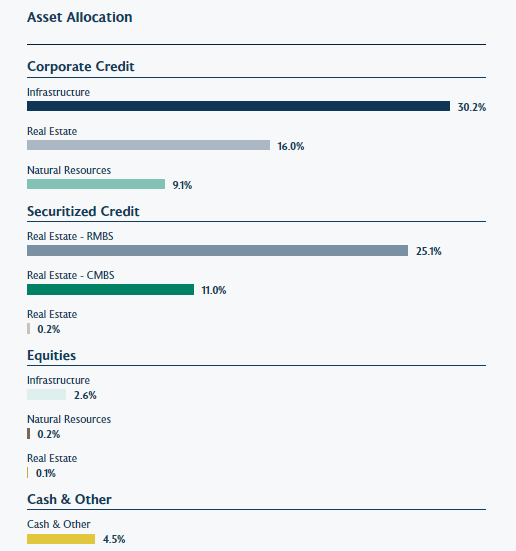

Whereas the fund mentions no constraints on asset class allocation, they’ve switched to virtually solely being a fixed-income fund with little or no left within the fairness sleeve. The fund can be not constrained to investing simply within the U.S., though in implementing its technique, the fund is very dominated by U.S. publicity presently.

Why The Distribution Lower?

The fund is modestly leveraged, however this was a newer change as they have been taking down their borrowings. On the finish of fiscal 2021, the entire quantity excellent on their credit score facility or reverse repo was ~$405 million. This was introduced all the way down to ~$316 million by the tip of 2022 and is now all the way down to ~$162.3 million as of their final semi-annual report.

As with most different leveraged funds, they’re having to cope with larger borrowing prices. The whole expense ratio climbs to three.54% when together with borrowing prices, up from 2.76% on the finish of 2022 and a couple of.13% the 12 months earlier than that. Their borrowings are primarily based on OBFR plus 0.90%. That places their newest borrowing prices at 6.22% – you then add within the fund’s advisory and different working bills, and you can begin to see why a minimize was mandatory for the distribution.

The world the place you possibly can earn a diffusion above that, with out rising threat considerably, will get smaller and smaller the extra short-term charges rise. After all, this has all been pushed by the Fed bumping up rates of interest, which is having the next impression on the short-term charges relative to the long-term, which have not reacted as a lot. Thus, the state of affairs we’re in is the place the yield curve is inverted.

The fund additionally has some floating charge publicity in its fixed-income sleeve. They’d additionally recorded some features from futures contracts, which had been utilized to assist hedge towards a number of the larger rates of interest that had been anticipated. As of their final semi-annual report, they confirmed no features ensuing from futures. On the finish of their annual report, for the interval ending December 2022, in addition they had no excellent futures contracts at the moment. Although they did report some features, which means sooner or later final 12 months, that they had these derivatives arrange as a little bit of a hedge.

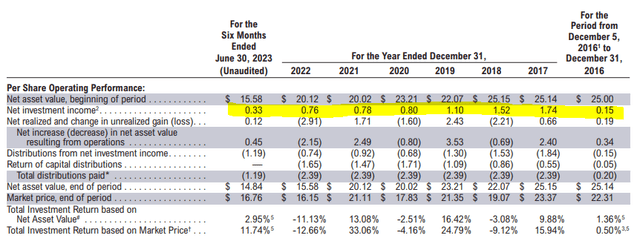

Now, let’s placed on high of this the truth that the fund was additionally struggling to cowl its distribution beforehand, and the writing was on the wall. For the final a number of years, the fund’s web funding earnings had been persevering with to lower whereas nonetheless sustaining what seemed like an interesting distribution charge on the floor. Since 2017, the fund’s NII has been in decline mode.

So, the newest enhance in borrowing prices was simply the ultimate push they wanted to succumb to what ought to have occurred a number of years in the past. At this tempo, NII for this 12 months would lead to a decline of practically 14% year-over-year.

RA Monetary Highlights (Brookfield (spotlight from writer))

Is The New Payout Sustainable?

Due to the deep fall within the fund, the precise distribution charge for RA hasn’t moved that a lot, comparatively talking. Previous to the minimize announcement, primarily based on the outdated charge, it was buying and selling with a 14.1% distribution charge. With the brand new charge towards the decrease share worth, we’re a nonetheless tempting distribution charge of 11.76%.

Nevertheless, one of many bigger questions seemingly on the minds of traders is that if the brand new charge is sustainable. On a NAV distribution charge foundation, the 9.83% is definitely trying rather more cheap than it had been beforehand. Previous to the minimize, it was at a 16.3% distribution charge.

That mentioned, as we will clearly see, the fund’s NII goes to appear like it could run at about $0.66 this 12 months. That is nonetheless properly under the brand new decrease annualized charge of $1.416, which means that it nonetheless is not actually comfortably being lined. As we famous beforehand, the fund is dominated by fixed-income investments, with solely round a 3% weighting in equities presently. Subsequently, capital features could also be more durable to return by, as we would count on with equity-focused funds.

RA Asset Allocation (Brookfield)

On condition that they only lately minimize and their prior hesitation to even do this, I do not suspect a minimize anytime quickly. It’s even attainable that in a black swan occasion or a deep recession, regardless of the fund’s MBS publicity, they’d proceed to hold on with the identical distribution as properly. That’s, if historical past is any information, as that is what the fund had beforehand carried out in the course of the Covid crash.

Alternatively, ought to the Fed again off rates of interest on account of a light recession or “mushy touchdown,” that might ease up the strain from RA, which might present bettering protection going ahead. Moreover, most count on that we’re at or very near near-peak charges for this cycle. That would imply getting some stabilization when it comes to their borrowing prices would cease rising.

This may be the extra optimistic view. Decrease rates of interest would ease the borrowing prices and will see elevated costs for his or her underlying debt portfolio. In line with CEFConnect, the typical bond worth of their debt involves $88.51.

Huge Premium Set Up For Huge Fall

After all, a excessive distribution charge that’s unsustainable by itself is not essentially going to trigger a number of harm when it is minimize. If a fund is already at a deep low cost, it’s going to face some strain, however nothing practically like what we noticed with RA on account of its large premium.

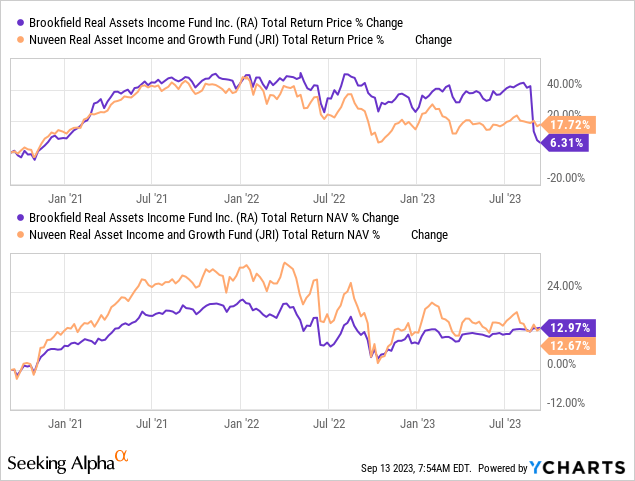

Thus, JRI appeared like a a lot better place to cover out and wait if one nonetheless needed publicity to a number of the similar locations that RA was invested. At one time, RA had a bit extra in its fairness sleeve, which had a extra significant impression on the probabilities of producing capital features. Admittedly, that made it extra just like JRI, and so these funds have drifted a bit within the final a number of years when it comes to publicity.

Nonetheless, the precise underlying complete NAV return of the 2 funds within the final 12 months ended up virtually equivalent. JRI took a little bit of a divergence when it headed larger because of the fund’s bigger fairness publicity by 2021.

Ycharts

Regardless of this, it was RA who had supplied the mirage that made it appear to be it was a greater funding when it comes to complete share worth return exactly due to that enormous premium.

At the moment, with the minimize in now, we have seen JRI appear like the higher performer on a complete share worth return foundation. Nevertheless, the valuations when it comes to reductions now put these two proper on the similar stage.

Whereas the minimize is more likely to depart RA with a scar for a very long time and proceed to commerce at a deep low cost for what may very well be a substantial interval, it little doubt represents a more sensible choice at present than it had by many of the previous few years.

Conclusion

Brookfield Actual Property Earnings Fund minimize their distribution. It definitely took longer than I anticipated, nevertheless it was a fund ripe for an enormous tumble when it did on account of its giant premium. At the moment, the fund’s distribution charge is rather more cheap, however they nonetheless are displaying an absence of protection primarily based on their principally fixed-income portfolio that’s failing to provide sufficient NII.

That mentioned, the valuation of the fund is rather more tempting and places it in a great place for a few of this to contract over time. Based mostly on the a lot decrease share worth now, the distribution charge for shareholders remains to be a tempting ~11.5%. Those that purchased earlier than the minimize within the final couple of years most likely aren’t joyful, however there typically comes a time to take advantage of these collapses primarily based on the drastic valuation shift for brand new capital.