HIGHLIGHTS

- Strategic deal with scaling Envirostream, the Battery Recycling division, as a result of potential of elevated recycling volumes and cashflows through the years forward

- Battery Recycling: Continued secure operations, rising volumes and working income, and search companions to scale operations consistent with the anticipated waste outlook

- Livium is nicely superior on the near-term commercialisation pathways of its different applied sciences:

- Battery Supplies: Outlined pathway for improvement of an Australian LFP demonstration plant with funding to be secured instantly into VSPC from strategic companions

- Lithium Chemical substances: Full JDA actions with MinRes, together with evaluation of alternate commercialisation pathways and choice of the popular lithium product

- Restructuring of the organisation and price reductions being undertaken with estimated annual ongoing financial savings of A$1.5m

Remark concerning the strategic replace from Livium CEO and Managing Director, Simon Linge

“We have now superior our technique to inflection factors, with the subsequent phases of development for every division requiring strategic companions to underpin their development and improvement. With a deal with strategic development companions, now we have reviewed our resourcing and made the choice to restructure our organisation and cut back prices.

Livium stays dedicated to delivering returns for shareholders. While organisational adjustments could influence our capacity to react to alternatives, proper sizing the organisation assists in resetting the Firm’s price base to turn out to be sustainable over this crucial interval.”

NEAR TERM PLANS

The next actions have been recognized as key to delivering worth within the close to time period:

- Battery Recycling: Continued secure operations, rising end-of-life volumes, and looking for companions to scale operations consistent with the anticipated waste outlook and to develop into associated providers

- Battery Supplies: Safe funding for an Australian LFP demonstration plant from authorities and personal strategic companions, who will make investments instantly into VSPC

- Lithium Chemical substances: Full JDA actions with MinRes, together with evaluation of alternate commercialisation pathways and choice of the popular lithium product

- Company: Full implementation of organisation restructure and different price saving initiatives.

BATTERY RECYCLING GROWTH OUTLOOK

The Battery Recycling division generates income immediately, is the most important recycler of lithium-ion batteries within the nation, attracts on our technical experience to offer value-added providers and has robust industrial relationships. Strategic focus is being positioned on Battery Recycling, by means of Envirostream, as a result of potential of elevated recycling volumes over the approaching years.

Throughout CY2024, Envirostream efficiently elevated volumes of EV’ andESS2 with many of the quantity being acquired beneath unique buyer preparations. Over CY2024, Envirostream collected 736k tonnes of huge format batteries and it’s estimated that there are 5 instances these volumes accessible immediately that are more and more anticipated to be recycled as a consequence of shopper demand and authorities regulation. Of their Battery Market Evaluation, B-cycle present how EV and ESS batteries are anticipated to dominate3.

Determine 1. EOL Battery Projections by Market Segment3

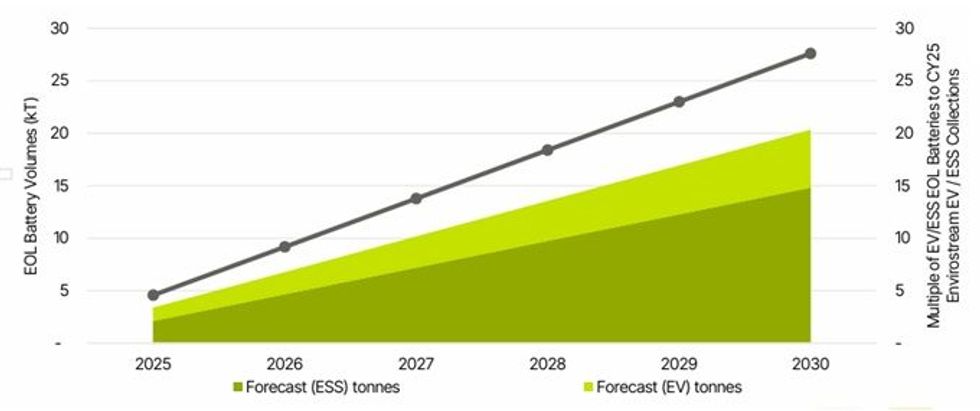

Specializing in solely EV / ESS for the stability of the last decade demonstrates the near-term alternative for Envirostream collections development relative to present efficiency.

Determine 2. 5-12 months EV and ESS EOL Battery Projections3

Determine 2. 5-12 months EV and ESS EOL Battery Projections3

The near-term outlook for Envirostream is optimistic, enabling will increase of volumes collected and processed, and offering a chance to develop our service choices consistent with market necessities.

To accommodate expectations of market development, the enterprise intends to discover deploying development capital to enhance working efficiencies and develop capability. The corporate has appointed advisors to coordinate discussions round partnership and development funding choices, which incorporates each strategic companions and different financiers.

Click here for the full ASX Release

This text contains content material from Livium Ltd, licensed for the aim of publishing on Investing Information Australia. This text doesn’t represent monetary product recommendation. It’s your duty to carry out correct due diligence earlier than appearing upon any info supplied right here. Please discuss with our full disclaimer right here.