1. AI takes heart stage at CES

Unsurprisingly, CES underscored the rising affect of synthetic intelligence (AI) throughout the tech panorama, with AI chips for PCs, new electrical automobiles and the affect of robotics on the workforce taking heart stage.

AI was outstanding, featured in the whole lot from appliances to pets. Following substantial funding, firms are beneath stress to show the worth and justify the price of AI integration of their merchandise.

As talked about, tech shares rose on Monday because the occasion started, with chipmakers like NVIDIA (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO), Micron Know-how (NASDAQ:MU), Superior Micro Gadgets (AMD) (NASDAQ:AMD) and Taiwan Semiconductor Manufacturing Firm (NYSE:TSM) main the surge.

NVIDIA, whose CEO Jensen Huang gave the keynote deal with at CES, was a key focus.

Following the corporate’s weaker-than-expected revenue outlook in November, funding curiosity in AI has been dispersing to incorporate firms akin to Broadcom and Marvell Know-how (NASDAQ:MRVL), whose share costs elevated within the fourth quarter of 2024 whereas NVIDIA’s remained comparatively flat.

Broadcom, NVIDIA and Marvell Know-how efficiency, This autumn 2024.

Chart through Google Finance.

After a product reveal, NVIDIA noticed its share worth fall 8.5 p.c to US$140.01 on Tuesday (January 7), its largest intraday drop since October 15. Chief among the many AI bellwether’s lengthy record of recent merchandise are the GeForce RTX 50 collection GPUs, constructed on the Blackwell structure. The flagship RTX 5090 for demanding workloads can be obtainable this month for US$1,999, whereas the RTX 5070, a extra budget-friendly model, will arrive in February for US$549.

NVIDIA additionally unveiled Challenge Digits, a desktop PC designed to empower AI researchers, knowledge scientists and college students; it has the flexibility to run very giant AI fashions on laptops. Developed in collaboration with Taiwan’s MediaTek (TPE:2454), the mannequin is supplied with a Grace Blackwell Superchip and runs a model of the Linux working system. Challenge Digits primarily places an AI-powered private supercomputer inside attain for US$3,000 beginning in Might.

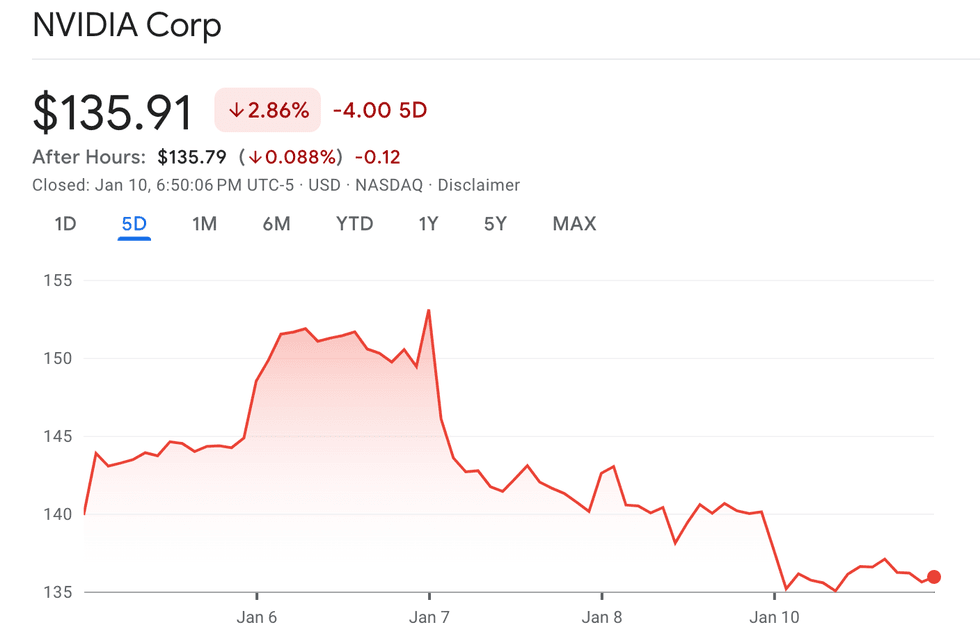

NVIDIA efficiency, January 6 to 10, 2025.

Chart through Google Finance.

NVIDIA’s transfer highlights a broader development at CES this 12 months: the rise of AI PCs. AMD, Intel (NASDAQ:INTC) and Qualcomm (NASDAQ:QCOM) all launched chips designed to convey AI to on a regular basis computing. AMD’s high-powered Ryzen CPUs, which can energy Dell’s (NYSE:DELL) company PCs, reportedly outperform Macs and supply an extended battery life.

In the meantime, Qualcomm is broadening its business past cell phone chips with the Snapdragon X Platform, an reasonably priced chip for laptops and PCs that may run Microsoft’s (NASDAQ:MSFT) Copilot+ software program. The corporate can even quickly launch a small desktop pc constructed with the chip. PC makers together with Dell — which announced a rebranding of its PC line — will reportedly supply laptops based mostly on the brand new product in early 2025.

AMD, Qualcomm and Dell noticed share worth will increase of between 2 and three.5 p.c between Monday and Tuesday. Nevertheless, Intel’s new processors that includes built-in AI acceleration and a devoted neural-processing unit in choose fashions weren’t sufficient to impress traders, and its share worth was little modified over the identical interval.

2. Autonomous automobiles have their second

Whereas AI PCs generated pleasure at CES, one other development emerged: the rise of generative bodily AI.

Throughout his keynote, Huang emphasised how this forthcoming shift will revolutionize manufacturing unit and warehouse automation, a rising subsector he described as “a multi-trillion greenback alternative.”

This sentiment is seemingly shared by OpenAI founder Sam Altman, who wrote in a weekend blog post of a close to future the place “AI brokers be part of the workforce and materially change the output of firms.”

To speed up this transition, Huang unveiled NVIDIA Cosmos, an open-source platform designed to simulate real-world environments and speed up the coaching of bodily AI fashions like robots and automobiles. Inside Cosmos, AI brokers will be educated utilizing Nemotron, a brand new household of enormous language fashions optimized for agentic AI. Based mostly on Meta’s (NASDAQ:META) Llama fashions, Nemotron leverages NVIDIA’s CUDA and AI acceleration applied sciences.

“Cosmos will dramatically speed up the time to coach clever robots and superior self-driving automobiles,” Rev Lebaredian, vice chairman of omniverse and simulation expertise at NVIDIA, said at a press conference on Monday.

Later, information broke of a partnership between NVIDIA and Toyota (NYSE:TM) that may see the carmaker use NVIDIA’s autonomous driving chips and software program to advance its self-driving automobiles. NVIDIA additionally announced a partnership with Uber (NYSE:UBER) to make use of its drive logs for AI mannequin coaching.

“After so a few years, with Waymo and Tesla’s (NASDAQ:TSLA) success, it is very clear (autonomous automobiles) have lastly arrived,” mentioned Huang on Monday. Later, during an interview with Yahoo Finance’s Dan Howley, he disclosed that NVIDIA’s expertise for autonomous driving is projected to generate US$5 billion in annual gross sales.

3. Bitcoin worth falls beneath US$100,000

The Bitcoin worth rose above US$102,000 early on Monday, following a weekend wherein the cryptocurrency regained its 50 day easy transferring common, an indicator often described as essential for a continued bull market.

Including to the momentum was sturdy hypothesis that MicroStrategy (NASDAQ:MSTR) was getting ready to extend its holdings additional after CEO Michael Saylor hinted at a potential acquisition over the weekend.

The corporate in the end purchased 1,070 Bitcoins for a complete worth of US$101 million.

Including to bullish sentiment was a research report from JPMorgan (NYSE:JPM); it signifies that Bitcoin miners’ income elevated for the second consecutive month in December. The positivity prolonged to altcoins as Solana’s DEX buying and selling quantity exceeded that of Ethereum and Base; the worth motion prompted analysts to set a US$15 target for XRP.

Nevertheless, as conflicting US jobs and inflation knowledge rolled in, merchants’ hopes of an rate of interest minimize by March diminished. Yields for 10 12 months Treasuries touched 4.73 p.c, leading to a broad selloff affecting cryptocurrencies and different risk-on belongings like tech shares. The highest cryptocurrencies dropped between 4 and 9 p.c in early buying and selling on Tuesday.

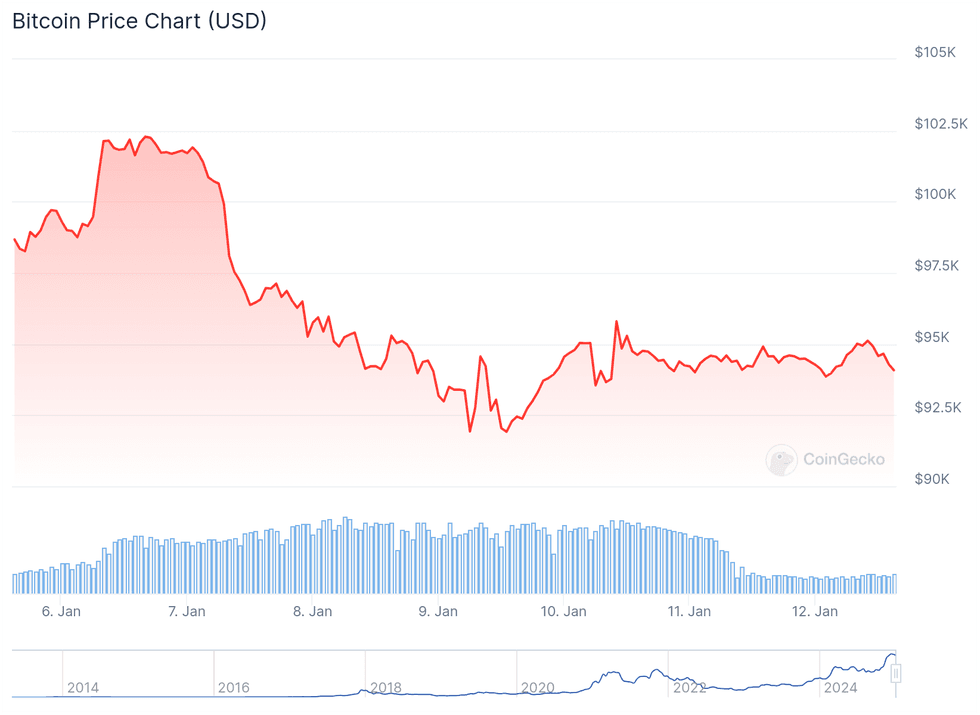

Bitcoin efficiency, January 6 to 10, 2025.

Chart through CoinGecko.

US Bitcoin exchange-traded funds (ETFs) noticed near-record outflows of US$582 million on Wednesday (January 8) because the downward trajectory continued. Ether ETFs noticed substantial outflows totaling US$159.3 million on Wednesday, their largest on report since July. By Thursday (January 9), US$655 million in Bitcoin futures contracts had been liquidated.

Including to the uncertainty, the US Division of Justice has reportedly been cleared to promote US$6.5 billion price of Bitcoin seized from Silk Highway, which could put downward pressure on Bitcoin’s worth.

Altcoins noticed higher losses, with XRP being the only real exception.

Ripple’s native cryptocurrency noticed intervals of restoration on Wednesday after it was reported that CEO Brad Garlinghouse and Chief Authorized Officer Stuart Alderoty met with Trump for dinner. Analysts at Cointelegraph project XRP may surge 40 p.c if costs can get away of the present “descending triangle” sample.

Friday’s (January 10) US jobs knowledge launch coincided with a 2.24 p.c drop in Bitcoin’s worth to beneath US$92,000 earlier than the markets opened, adopted by an increase to US$95,000 noon. Bitcoin’s newest downtrend has led market analysts to consider that the coin’s worth might retest areas round US$90,000 as merchants cope with uncertainty concerning tariffs and their results on the US financial system, stoking considerations about the potential of renewed inflation.

According to Santiment analyst Brianq, Bitcoin’s efficiency can be partly attributed to decreased buying exercise by wallets holding between 100 and 1,000 Bitcoin, which drove Bitcoin’s most up-to-date bull cycle.

Do not forget to observe us @INN_Technology for real-time information updates!

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.