joebelanger/iStock through Getty Photographs

We’re downgrading Qualys (NASDAQ:QLYS) to a maintain; we’re selecting up our protection of the inventory after QLYS outperformed the S&P 500 by 44% since our buy-rating on the finish of 2021. Our constructive thesis of QLYS displaying indicators of reaccelerating income development as Vulnerability Administration stays a high three IT-spending precedence performed out properly. Now, 3Q23 outcomes and outlook lead us to imagine that QLYS inventory has priced within the expectation of restoration and can now see slower top-line development because of macro headwinds spilling into 2024 and inflicting longer deal cycles. Gartner expects world end-user spending on safety and threat administration to extend 14% Y/Y in 2024; this makes us extra assured within the cloud safety house, however we do not see any near-term catalyst distinctive to QLYS driving outperformance.

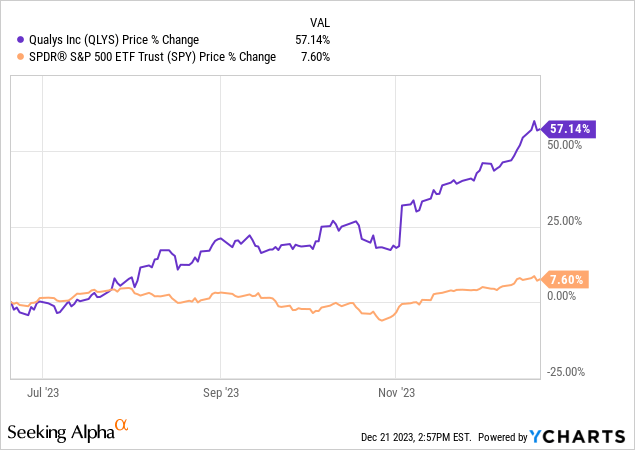

We’re involved over a slowdown in the QLYS development fee after the inventory’s run-up this 12 months, up 57% over the previous 6M versus the S&P 500, up 8% throughout the identical interval. We count on cloud-based options for networked belongings, significantly servers and community gadgets (e.g., routers, switches, firewalls, and many others.), to see a more healthy spending surroundings in 2024, and we expect this has been priced into the inventory. Now, we see extra problem for QLYS to develop its high line materially because of longer sale cycles and see investor confidence within the inventory lowering into early 2024. The corporate reported income up ~13% Y/Y this quarter to $142M and non-GAAP EPS of $1.51, each forward of consensus, with administration noting, “We began to see some indication of stabilization within the promoting surroundings with prospects confirming their prioritization of safety with an IT price range, however imagine ongoing price range scrutiny will linger for the foreseeable future” on the earnings name.

The next outlines QLYS inventory in opposition to the S&P 500 over the previous 6M.

YCharts

We do not suppose QLYS is resistant to the macro weak spot spilling into 1H24; income development Y/Y has slowed in 3Q23 YTD, however we imagine the corporate can be comparatively resilient. The corporate’s margins have been sustained regardless of the lingering price range scrutiny, at 45% in 3Q22 YTD and 47% in 3Q23 YTD. Nonetheless, we do not see any catalyst at play, offering QLYS with a aggressive benefit in 1H24.

Valuation

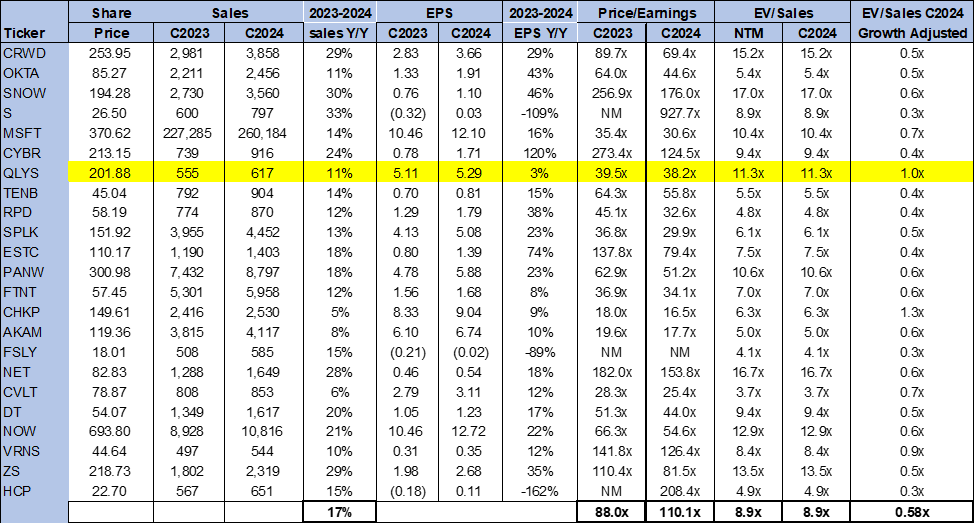

QLYS is dear, buying and selling above the peer group common. The is buying and selling at 11.3x EV/C2024 Gross sales versus the peer group common of 8.9x. We expect the upper a number of is not justified at present ranges. We see QLYS’ development fee slowing early within the New 12 months and suppose the present valuation is pricing in future earnings that we do not see essentially taking part in out. We advocate buyers to remain on the sidelines and anticipate extra engaging entry factors down the road.

The next chart outlines QLYS valuation in opposition to the peer group common.

TSP

Phrase on Wall Road

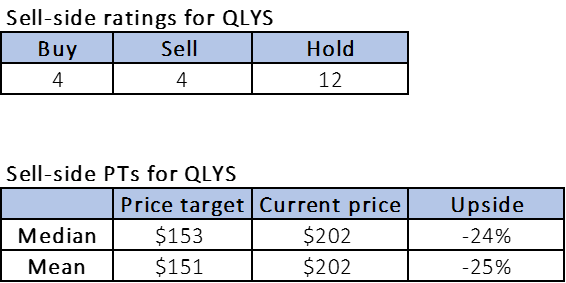

Wall Road is much less optimistic concerning the inventory. Of the 20 analysts masking the inventory, 4 are buy-rated, 12 are hold-rated, and the remaining are sell-rated. We expect Wall Road is extra cautious about IT spending in 2024 amid macro uncertainty. The inventory is presently priced at $202. The median sell-side price-target is 153, whereas the imply is $151, with a possible draw back of 24-25%.

The next chart outlines Wall Road’s sentiment on QLYS.

TSP

What to do with the inventory

We proceed to love QLYS’ place within the Vulnerability Administration market within the mid-to-long run, however we see extra near-term strain because of the macro backdrop. We do not see room for extra near-term upside and imagine valuation is just too excessive at present ranges. We expect QLYS will stay resilient however do not see materials outperformance and therefore advocate buyers keep on the sidelines and anticipate higher entry factors down the road.

Our investing group, Tech Contrarians, mentioned this concept in additional depth alongside the broader {industry} and macro tendencies. We cowl the tech {industry} from the industry-first method, sifting by way of market noise to seize outperformers.

Be at liberty to check the service on a free two-week trial at present.