The QQQ is predicated on the NASDAQ 100 index.

hapabapa

The Invesco QQQ Belief ETF (NASDAQ:QQQ) has carried out extraordinarily properly over most timeframes that traders have a tendency to have a look at. Utilizing In search of Alpha’s handy charting characteristic, we are able to see that it beats the S&P 500 over three, 5 and 10 yr timeframes. So, the QQQ is an enormous winner in the long run. Nevertheless, it is also probably the most unstable indexes on the market; often, shopping for it on the highs has resulted in intervals of extended unfavourable returns.

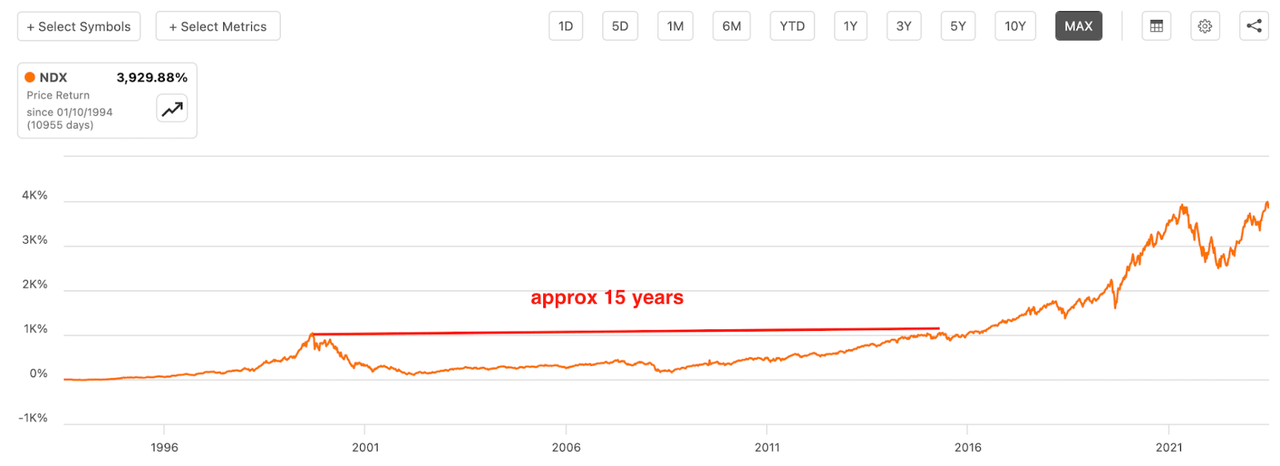

Essentially the most instructive case right here would after all be the tech bubble of the late 90s and early 2000s. If you happen to had purchased the QQQ on the high in that interval, you’d have waited a full 15 years to interrupt even. And in contrast to with the “15-year breakeven” that traders shopping for the Dow in 1929 would have skilled, this one was not a lot improved by factoring in revenue: the QQQ pays subsequent to nothing in dividends.

NASDAQ-100 chart (In search of Alpha Quant)

What all this implies is that, though the QQQ tends to outperform over lengthy timeframes, shopping for it at its most excessive highs has at occasions been a severely dropping technique. The NASDAQ’s 15-year bear market is correct up there with the Dow’s 15-year 1929 bear market and Japan’s 34-year Nikkei bear market. Which means that QQQ is just not an asset that you would be able to purchase with out considering of the worth and/or valuation. Like each different asset on earth, it is a loser for those who pay an excessive amount of for it.

On that be aware:

At right now’s costs, the NASDAQ-100 index (the index that QQQ is predicated on) trades at:

-

29.15 occasions earnings.

-

7.25 occasions e-book worth.

These multiples are derived from the QQQ’s reality sheet and are per the multiples that the Wall Road Journal has on file. It is more durable to get different multiples equivalent to worth/money circulation and EV/EBIT, however we are able to have a look at the multiples for the “Magnificent 7” shares, which collectively are weighted at 50% of QQQ’s portfolio.

Beneath you will note a desk containing the “much less recognized” multiples for the Magnificent 7 shares:

|

Apple Inc. (AAPL) |

Microsoft Company (MSFT) |

Alphabet Inc. (GOOG) (GOOGL) |

Amazon.com, Inc. (AMZN) |

Meta Platforms, Inc. (META) |

NVIDIA Company (NVDA) |

Tesla, Inc. (TSLA) |

|

|

Worth/cashflow |

26 |

29 |

16 |

21.5 |

14 |

68.5 |

63 |

|

Worth/gross sales |

7.6 |

12.8 |

6 |

2.8 |

7.3 |

29 |

8 |

|

EV/EBIT |

25 |

29 |

20 |

62 |

20.5 |

62 |

70 |

As you’ll be able to see, the valuation multiples for the QQQ’s high parts are excessive, identical to the P/E and worth/e-book multiples for the entire index.

After I final lined the QQQ in June 2023 I rated it a ‘promote,’ on the grounds that it was getting very dear. I nonetheless have the identical primary concern in regards to the fund now. Nevertheless, since my final article was revealed, a string of huge tech earnings releases got here out with a lot larger earnings development than I anticipated. That surprising improvement calls for a re-rate. Going by multiples alone, the QQQ is actually overpriced, however massive tech has a recognized tendency to beat earnings estimates, as many of the high QQQ shares did in Q3. Accordingly, I am upgrading my QQQ score to carry. I will clarify that call within the ensuing paragraphs.

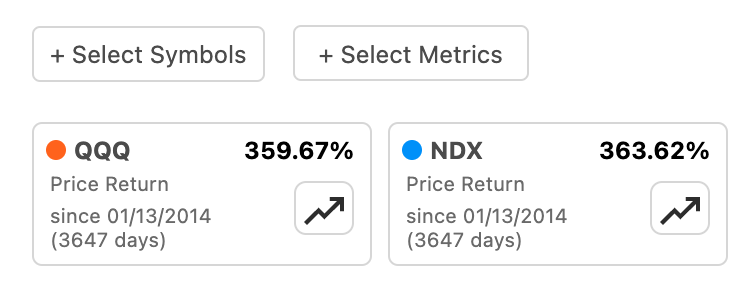

QQQ – The Primary Information

Earlier than moving into QQQ’s parts and their efficiency, I ought to assessment the fundamental information in regards to the fund itself. Though QQQ very intently tracks the NASDAQ-100, it’s not precisely the identical factor because the index. For one factor, the fund’s MER is 0.2%, which is definitely pretty low, however is excessive sufficient to end result within the fund performing barely worse than the underlying index. Certainly, if we plot the QQQ and the NASDAQ-100 on the identical 10-year chart, we do the truth is see the index pulling ever so barely forward of the fund, as we might count on.

QQQ vs NASDAQ-100 (In search of Alpha Quant)

There are some primary traits a couple of fund that any potential investor ought to know. For QQQ, these information embrace:

-

A 0.2% MER.

-

43.91 million 30-day quantity.

-

101 holdings.

-

A $0.15 bid-ask spread, which works out to .04%.

-

A 0.63% yield.

These are all fairly fascinating traits. A 0.2% MER is low by the requirements of all funds, though on the excessive finish for index ETFs. The 43.91 million quantity signifies that the fund ought to have a low bid-ask unfold. The $0.15 or 0.04% unfold is the truth is low, as the quantity would predict. The 101 holdings are greater than sufficient to attain the complete statistical good thing about diversification, which maxes out at 25-30 shares. Lastly, the 0.63% yield, although not excessive, has the potential to develop over time, as QQQ shares have above common earnings development.

High QQQ Elements’ Earnings Efficiency

Talking of earnings development, it is time to have a look at the index’s earnings efficiency. As an index ETF, QQQ does not likely have quarterly earnings that analysts are attempting to forecast, however its high parts do. So, we are able to use these as a information to how a lot QQQ is rising its earnings.

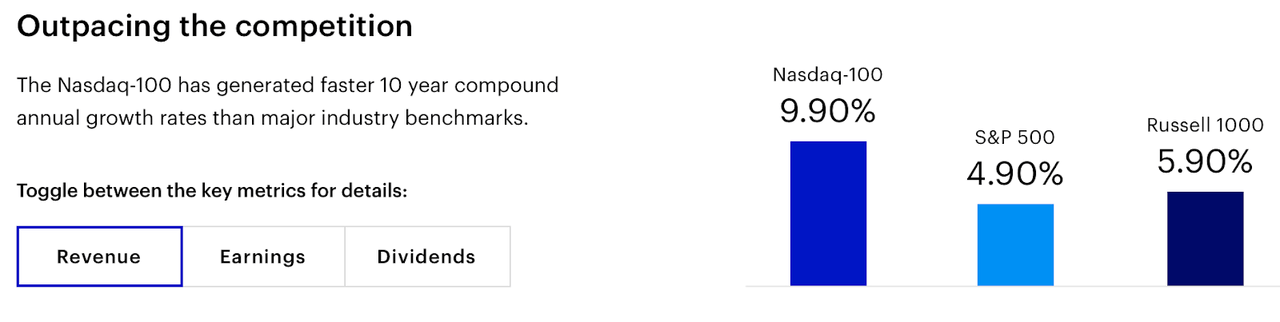

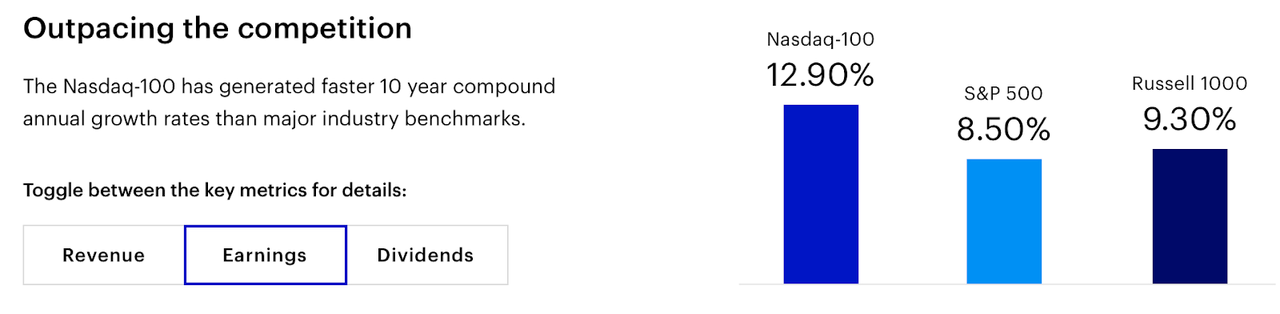

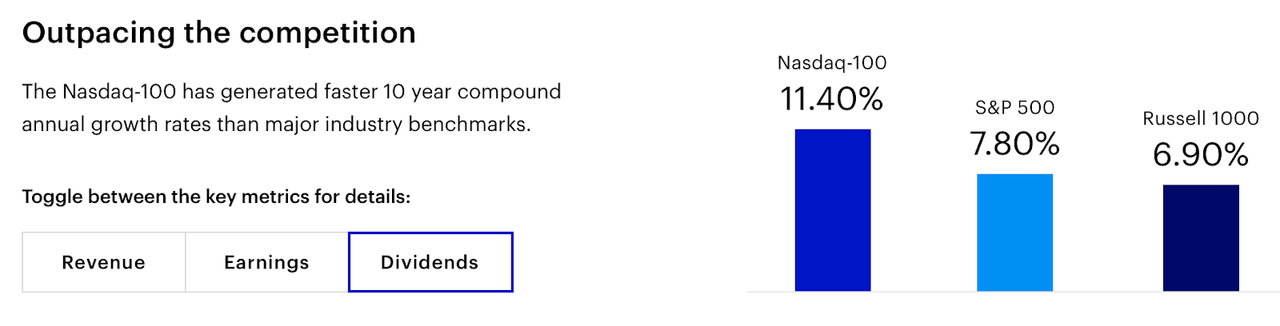

First, we are able to have a look at Invesco’s personal numbers under. As you’ll be able to see, the fund has achieved 9.9% CAGR in income, 12.9% CAGR in EPS and 11.4% CAGR in dividends.

QQQ income CAGR (Invesco)

QQQ earnings CAGR (Invesco)

QQQ dividend CAGR (Invesco)

These are all respectable development charges. And we are able to use the “Magnificent 7” shares as a tough information to EPS development within the TTM, 3-year and 5-year timeframes.

|

Apple |

Microsoft |

|

Amazon |

Meta |

Nvidia |

TSLA |

|

|

TTM |

0.33% |

11% |

3.3% |

72% |

7.5% |

222% |

121% |

|

3 yr |

23.1% |

18.5% |

26.3% |

4% |

8.8% |

71% |

161% |

|

5 yr |

15.5% |

33.5% |

31.3% |

17% |

11.25% |

32% |

N/A |

These shares all have good development, however be aware that most often, the TTM development is way worse than the three-year and five-year development. After many a long time of compounding, most of the high QQQ shares are working into the issue of diminishing returns. Warren Buffett likes to say “measurement is the anchor of efficiency,” by which he signifies that, as one thing scales, ever bigger uncooked greenback development is required to provide the identical share development. With QQQ parts now flirting with $3 trillion market caps, it is solely to be anticipated that their earnings development would decelerate over time.

Wanting Forward

Having explored the large QQQ parts’ historic development charges, it is time to have a look at the elements that may drive development going ahead.

First, impacting the large ad-tech corporations like Meta and Google, we have now the rise of Chinese language e-commerce apps like Temu and Shein. The businesses behind these apps are spending closely on promoting, and nearly all of it’s going to Meta and Google. These corporations are more likely to put up optimistic development in income and earnings on a year-over-year foundation.

Second, there’s final November’s record-breaking Black Friday, which introduced in 7.5% more sales than the prior yr’s Black Friday. That may doubtless give corporations like Apple and Amazon a lift to income, since they get quite a lot of orders across the holidays.

Third and eventually, there’s the sheer scale that most of the high QQQ shares have reached. This can be a much less bullish issue than the earlier two: when corporations get very massive they ultimately attain diminishing returns, some extent the place extra spend doesn’t translate to extra revenue. Apple is already doing about $90 billion in quarterly income, Tesla (the ‘smallest’ Magnificent 7 inventory by gross sales) is doing $23.3 billion per quarter. Whereas the prior two elements are clear development catalysts for a number of QQQ shares, the ‘scale’ issue argues that the income impression won’t be large on a share foundation. For that reason I count on the High QQQ shares to develop the highest line at 5-10% on common in This autumn, per what was seen in Q3.

The Dangers to Watch Out For

In a way, I’ve already lined the most important danger going through QQQ traders, which is the opportunity of unfavourable returns as a consequence of a valuation-driven drawdown. It is primarily due to this danger that I contemplate QQQ a maintain quite than a purchase. Nevertheless, there are different dangers to bear in mind as properly.

-

U.S./China tensions. Apple does 95% of its manufacturing in China, and Chinese language companies are massive clients for chipmakers like NVIDIA. Often, U.S. tariffs have disrupted U.S. companies’ capacity to do enterprise with China. So, the opportunity of future tariffs on China is a significant danger for QQQ traders to bear in mind.

-

The opportunity of rates of interest rising additional. In discounted money circulation fashions, larger rates of interest lead to larger truthful worth estimates for belongings. The upper the asset’s development charge, the extra extreme the hit to truthful worth. This did not cease QQQ from rising final yr, however there have been quite a lot of non-quantitative elements influencing inventory costs in 2023, equivalent to traders not eager to “miss out” on the AI gold rush. If This autumn earnings disappoint, whereas rates of interest stay at round 5%, then the QQQ will in all probability decline in worth. The excellent news is that the Fed is now signaling dovishness, with Jay Powell having predicted 75 BPS worth of cuts in 2024. That is a trigger for optimism, however you’ll be able to by no means low cost the opportunity of an inflation spike that results in charge hikes.

Why I am Score QQQ a Maintain

As a concluding be aware, I ought to clarify why I contemplate QQQ a maintain quite than a promote. Going by standard valuation methods, equivalent to multiples and DCFs, the NASDAQ-100 is certainly overpriced. The factor is that this index is overwhelmingly composed of tech shares, in addition to technologically savvy financials (e.g., bank card corporations). At any time when tech is an enormous a part of what an organization does, there’s the opportunity of an upside shock in earnings introduced on by an unexpectedly well-received innovation. As all of us noticed in 2023, the rise of generative AI was sufficient to set off a 50% rally in tech shares, although most of them have been nonetheless posting unfavourable earnings development at the beginning of the yr. Factoring in non-financial variables like these can justify giving tech shares a premium that may’t be captured in a DCF mannequin. For that reason I contemplate QQQ a maintain quite than a full-on promote. Those that purchased the fund at costs decrease than right now’s worth are doubtless not at nice danger, though it does seem to be there are higher locations to deploy contemporary capital right now.