lucky-photographer

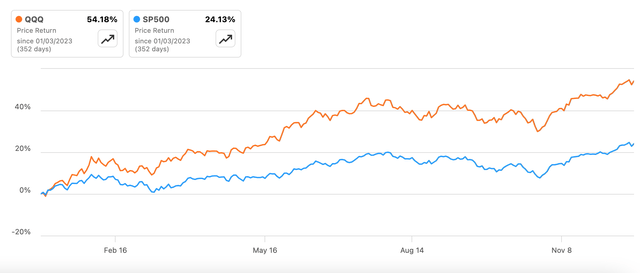

The NASDAQ 100 tracker fund Invesco QQQ Belief ETF (NASDAQ:QQQ) has had 2023. It has raced forward of the S&P 500 (SP500) index, which hasn’t had a foul yr in any respect itself (see chart beneath). However can the QQQ retain momentum in 2024 is the query now.

Worth Returns (Supply: In search of Alpha)

A steadiness of the outlook for the US economic system and the fund’s market valuations reveals that whereas there are dangers, there are potential upsides too. Right here I take a look at the hidden positives in these broad dangers, which truly point out cautious optimism for 2024.

The softening US economic system

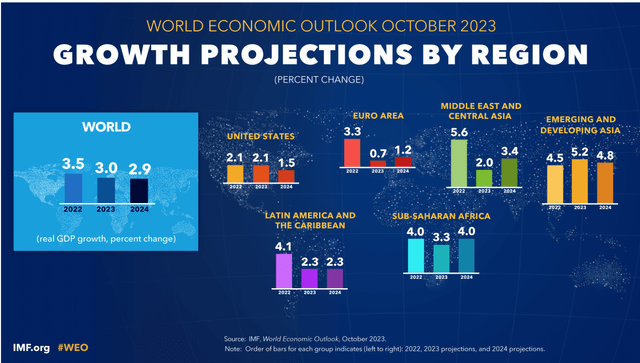

The US economic system is broadly anticipated to melt subsequent yr. The IMF expects the economic system to develop by 1.5% in 2024, down from an estimate of two.1% this yr because it continues to really feel the aftereffects of excessive inflation and rate of interest hikes. There’s benefit to this danger issue. Among the many corporations I’ve tracked just lately from luxurious vogue to eating places, the slowdown in demand from the US is evident and common, suggesting warning.

Nonetheless, on the flip aspect, there are three positives to contemplate as effectively, which could soften the slowdown blow, if not considerably reverse it.

Supply: IMF

Constructive inflation tendencies

The primary is inflation. Inflation primarily based on the Shopper Worth Index [CPI] fell to a five-month low in November of three.1% year-on-year [YoY] and has greater than halved for the reason that begin of the yr. It is anticipated to say no even additional in 2024. Which means that the erosion of actual revenue will proceed to decelerate, which in flip can encourage shopper spending.

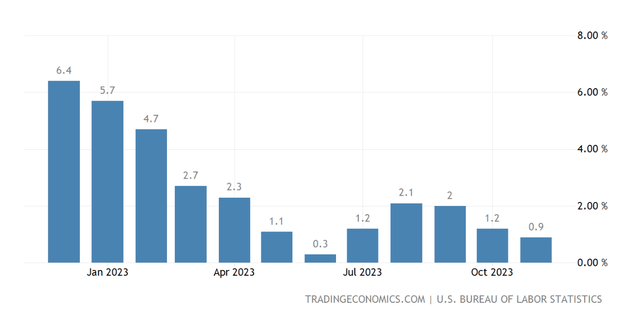

Producer value index [PPI] primarily based inflation is operating even decrease at 0.9% year-on-year [YoY] for November, the bottom improve this yr after it clocked 0.3% in June. It is also notable as a result of it is solely the second month this yr when it has been at sub-1% ranges.

PPI inflation has even flipped into deflation for classes like power in addition to transport and warehousing. If it continues on the trajectory, even with declining CPI inflation, there’s an opportunity that corporations’ margins might proceed to broaden in 2024. And what’s optimistic for earnings is optimistic for inventory costs.

PPI Inflation, US (Supply: Buying and selling Economics)

Softer rates of interest

Additional, rates of interest are anticipated to start out coming off late subsequent yr, which might even be a optimistic for each shopper’s spending capability and corporations’ prices. Additional, contemplating that inventory markets reply to future potential, they might be buoyant in anticipation a lot earlier.

Upside potential

Lastly, it is price contemplating how puzzlingly improper forecasts for this yr have gone. The danger of a recession was seen by some till earlier this yr, however the consensus was one among at the least a slowdown. As an alternative, development has been surprisingly strong, even coming in a considerably above-trend 4.9% within the third quarter of 2023.

Furthermore, not everybody buys the slowdown idea. Banks like Goldman Sachs and Morgan Stanley have forecasts of two.1% and 1.9% respectively, which do not mirror an actual financial stoop.

Excessive market valuations

The second danger to QQQ is the fund’s elevated trailing twelve months [TTM] price-to-earnings (P/E) ratio is at 32.9x in comparison with the common end-of-year determine for the previous 5 years (together with 2023) at 29.8x. This means that some correction is due particularly if the economic system slows down subsequent yr.

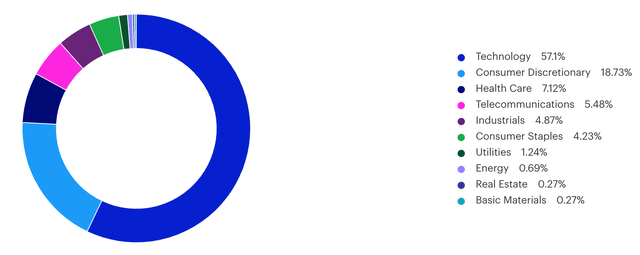

Shopper Discretionary sector might sag

There are causes for issues in regards to the efficiency of the buyer discretionary sector subsequent yr, which is the fund’s second-biggest holding by sector (see chart beneath). As I identified earlier, corporations’ numbers throughout the sector are certainly exhibiting a slowdown in US demand, which in flip might drag down the fund’s efficiency however then once more, enhance its P/E too.

Additionally, going by the funds’ holdings in massive globalised corporations’ shares, with important worldwide pursuits, this danger might be managed. Furthermore, if each inflation and rates of interest play a considerably optimistic position, as famous earlier, the slowdown may simply be contact and go.

Sectorwise Holdings, QQQ (Supply: Invesco)

Balanced high holdings

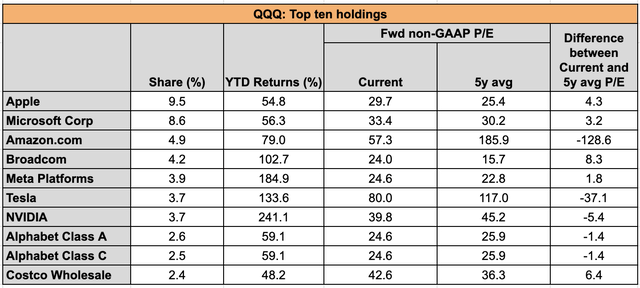

Apparently, in distinction to the fund’s P/E is in distinction with the image after we zone into the highest 10 fund holdings. 5 of them are at the moment buying and selling at non-GAAP ahead P/Es which can be beneath their five-year averages (see desk beneath). In different phrases, regardless of the spectacular improve in QQQ this yr, the market multiples aren’t wanting excessive in any respect for half of the massive holdings.

Supply: In search of Alpha, Creator’s Estimates

Actually, they’re manifestly low for Amazon (AMZN), which has seen a robust restoration in income this yr. There’s additionally an enormous distinction for Tesla (TSLA), however I’m a bit extra cautious about it due to its latest labour troubles. Since I final checked on the corporate, these challenges have turn into solely greater with the Danish labour union becoming a member of the Swedish workforce in strike motion. Its shrinking income are additionally disappointing. But when it is in a position to resolve its points, then its decrease than five-year common P/E does give room for optimism.

Additional, for the 5 high holdings which can be buying and selling increased than their five-year common a number of, the hole is far smaller on common in comparison with those buying and selling decrease. If their earnings find yourself surpassing expectations, shares like Apple (AAPL), Microsoft (MSFT) and Meta (META) might effectively look pretty priced sooner fairly than later.

The important thing level right here is that even with an elevated P/E, QQQ can nonetheless obtain help from its greatest holdings which account for 49.5% of the full, although they’re topic to vary, in fact.

What subsequent?

Each the macros and market multiples for QQQ point out that there are undoubted dangers forward. Nonetheless, there’s motive for hope too. On the macro degree, there’s nonetheless an opportunity that the dangers may not fairly materialise, particularly as inflation drops, easing shoppers’ pockets and even decrease PPI inflation ranges point out potential for margin growth. An anticipated drop within the rates of interest generally is a optimistic, even in anticipation, for the inventory markets too.

So far as the P/E ratio goes, it’s forward of the five-year common, however a take a look at the highest 10 holdings for QQQ signifies potential for help to the fund’s efficiency going ahead. Additionally, if the macro slowdown would not materialise sufficiently, the chance from the second largest holding of shopper discretionary, may not be impactful both.

In sum, there’s room for optimism for QQQ in 2024. In any case, its previous 5 years’ returns of 184% point out that there is a case for holding it for at the least the medium time period. I am going with a Purchase score.