tadamichi

By Carrie King

Q3 earnings season had many acquainted refrains relative to the yr’s first two quarters. One distinction was a return to optimistic earnings progress for the primary time since Q3 2022.

Nonetheless, the market wasn’t unanimously cheering the outcomes. Elementary Equities investor Carrie King seems at two areas the place earnings dispersion could also be creating alternative for inventory pickers.

Acquainted refrains

Not not like the primary two quarters of the yr, earnings for S&P 500 corporations largely got here in higher than anticipated for Q3, with 62% of corporations beating on gross sales (high line) and 83% on earnings (backside line).

And like the 2 quarters earlier than, the market had a reasonably muted response to the better-than-expected outcomes, whereas the share costs of corporations reporting misses had been extra deeply punished.

However this quarter was completely different for one key motive: The S&P 500 is about to notch its first quarter of earnings progress in a yr, estimated at practically 5%. That the index might have seen and surfaced from its earnings recession is optimistic, however the market can’t be painted with a broad brush.

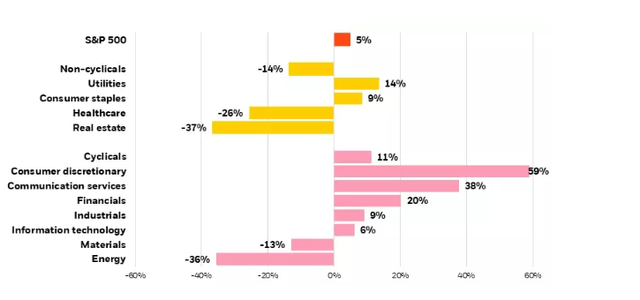

As proven within the chart under, dispersion is clear throughout sectors, with cyclicals broadly doing higher than non-cyclicals regardless of fears of an financial recession. We additionally see rising dispersion on the particular person inventory stage and spotlight two areas the place this can be creating alternative for inventory pickers.

Q3 2023 earnings abstract

S&P 500 Index year-over-year earnings progress by sector

Supply: BlackRock Elementary Equities, with knowledge from Refinitiv and FactSet, Nov. 8, 2023. Information displays earnings outcomes with 406 S&P 500 corporations (82% of market cap) reporting. Previous efficiency shouldn’t be indicative of present or future outcomes. Indexes are unmanaged. It isn’t potential to take a position immediately in an index.

New shopper pains

The considerations we mentioned final quarter across the fragility of the American shopper stay firmly in place. Whereas each the discretionary and staples sectors posted optimistic year-over-year earnings progress, indicators of shopper lethargy proceed to mount and will cloud the long run earnings image.

Firm feedback recommend the patron is “pulling again,” “value-seeking” and rising extra “discerning.” A few of that is manifesting in lowered pricing energy, or the flexibility of corporations to move on increased enter prices to the tip purchaser.

Fatigue is most pronounced amongst low-end shoppers, and we’re seeing this mirrored in underwhelming efficiency from greenback shops. Outcomes from monetary establishments additionally uncovered some cracks, exhibiting an uptick in bank card delinquencies amongst lower-end shoppers. Whereas general delinquencies are nonetheless under regular, we imagine the course of journey bears watching.

On the similar time, the higher-income shopper is rising sheepish amid increased charges. We’re seeing this play out within the reporting of corporations concerned in such big-ticket discretionary objects as boats and bikes, the place increased charges are affecting affordability and deterring or delaying purchases.

Key takeaway: Sector-level outcomes nonetheless look good, however it’s value noting that shopper discretionary is essentially underpinned by a few of the high mega-cap shares which have powered the market this yr.

The alternatives and dangers in shopper sectors are literally fairly idiosyncratic. Omni-line enterprise fashions, for instance, might make some discounters extra resilient than others. And we nonetheless see shoppers prioritizing experiences over items, with brighter rhetoric coming from the lodge, restaurant and leisure classes.

As fundamental stock pickers, we’re sharpening our pencils to pinpoint these corporations finest positioned to climate a possible consumption slowdown and defend share as patrons develop extra guarded and discriminating of their spending.

Good points and losses in healthcare

Good points and losses in healthcare have entered a brand new dimension with the breakthrough in so-called GLP-1 agonists, a category of medicine used to deal with diabetes and weight problems.

On the general sector stage, earnings had been challenged for the quarter. But healthcare stays a well-liked space throughout our world Elementary Equities platform for its defensive traits, long-term progress prospects amid growing older populations, and file of innovation.

We see ample alternative to establish potential winners and losers as the brand new weight-loss therapies proceed to make their impression identified.

Whereas makers of the GLP-1s have seen robust earnings and inventory value appreciation, hypothesis round areas which may undergo due to their effectiveness is hurting different industries inside healthcare and past.

As a result of these medication have been proven to resolve for a lot of well being points, we’ve seen reactions in med tech resembling insulin pumps, gadgets resembling hip and knee replacements, sleep apnea machines, and even dialysis gear as illnesses that result in kidney failure are addressed.

The market has extrapolated different potential impacts, resembling on snack and beverage corporations which may see a decline in gross sales because the medication curb not solely urge for food however demand for his or her merchandise.

Key takeaway: GLP-1s are comparatively new and a few of the early reactions to their potential impression could also be overdone – or misconstrued. We see this creating alternatives not solely in healthcare however elsewhere amongst shopper merchandise corporations.

Our evaluation discovered GLP-1s are unlikely to current a big headwind for staples corporations, with minimal earnings detraction throughout time even for these corporations most uncovered.

Our healthcare staff can also be starting to look at early indications of oblique beneficiaries of the brand new medication, resembling corporations which may see elevated volumes for injectors required to manage the medicines.

Whereas the patron sectors and healthcare provide simply two examples, Q3 earnings confirmed to us that dispersion abounds available in the market at the moment. This factors to the essential function that basic evaluation and expert inventory choice can play in driving portfolio outcomes.

This post initially appeared on the iShares Market Insights.

Editor’s Observe: The abstract bullets for this text had been chosen by Searching for Alpha editors.