Robert Method

Shares of PVH Corp. (NYSE:PVH) surged 7% on Thursday in response to stable quarterly earnings. Shares are actually up over 50% from a yr in the past, although they’re nonetheless down over 10% from 5 years in the past. The corporate is seeing significant margin features because it right-sizes inventories and focuses on decreasing manufacturing prices whereas its manufacturers are displaying affordable momentum. Even after this rally, shares don’t look costly.

Looking for Alpha

Within the firm’s third quarter, PVH earned $2.90, which was $0.16 forward of consensus as income rose by 3.5% to $2.4 billion. A weaker US greenback has been a tailwind for outcomes as about 65% of gross sales come from outdoors the US. On a continuing foreign money foundation, gross sales progress was a extra muted 1%. It now expects to earn $10.45 in adjusted EPS, up over 15% from final yr, from $10.35 beforehand.

Whereas it decreased its income progress forecast by 2.5% to 1%, this was because of the sale of the Heritage Manufacturers intimate attire model. With the $150 million in proceeds, PVH is growing buybacks and expects to repurchase $550 million in inventory this yr. The corporate’s steerage implies a 3-4% income decline in This autumn, partially because of the sale of the Heritage Manufacturers enterprise Nonetheless, earnings are anticipated to rise practically 50% to $3.45, due to enhanced working margins. It additionally expects a 12% This autumn working margin from 8.6% final yr.

That is according to what PVH was in a position to ship in Q3. Its North American EBIT margin was 13.1% up 800bp from final yr, leaving the agency properly positioned for the mid-teens 2025 aim. Its hallmark Calvin Klein and Tommy Hilfiger manufacturers grew by 2% in North America. On this area, we noticed Tommy Hilfiger up 6% whereas Calvin Klein fell 1% because of weak point within the wholesale channel. Internationally, its Calvin Klein unit grew gross sales a sturdy 10%. Whole Tommy Hilfiger gross sales have been $1.2 billion, with Calvin Klein gross sales of $1.0 billion. Europe is extra problematic nonetheless because the macroeconomic situations have been much less favorable, and the climate within the fall was fairly heat, decreasing demand for its winter clothes line. As a consequence, administration sees Europe income flat this yr from up low single-digits, beforehand. There was progress in China because the nation continues to get well from final yr’s zero-COVID lockdowns.

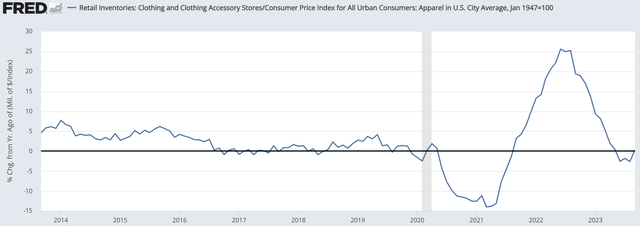

We’re nonetheless seeing significant divergences in outcomes amongst channels. Wholesale gross sales rose simply 1%. Direct-to-consumer gross sales rose by 8%. Digital gross sales rose by 13% with a 20% penetration of complete income. Wholesale income comes from promoting merchandise to department shops, like Macy’s (M), one in every of its largest companions. The problem right here has been that department shops like Macy’s have been aggressively chopping stock (Macy’s stock is down 6% from final yr). As they cut back the stock of clothes they carry, that reduces wholesale demand. As you may see beneath, retailers aggressively constructed attire inventories in 2022, leaving many overstocked as client demand stagnated amidst increased inflation. This has been a headwind for PVH and a purpose wholesale demand is weak.

St. Louis Federal Reserve

Importantly, the corporate is seeing double-digit progress at take a look at Tommy Hilfiger shops at Macy’s whereas Calvin Klein necessities gross sales jumped 50% there. With department shops having introduced inventories right down to extra affordable ranges, their demand ought to start to enhance subsequent yr, notably for a product that’s promoting properly, which has been the case for PVH. Certainly, even in Europe, its orders for subsequent yr are up single-digit.

Not solely have department shops decreased inventories, however PVH has been doing the identical. Stock is down 19% from final yr, leaving the corporate poised to realize its aim of 25% stock discount relative to gross sales forward of its 2025 plan. Due to decrease stock ranges, PVH might be much less promotional because it doesn’t want to maneuver outdated merchandise. Accordingly, gross margins rose by 80bp to 56.7% aided by normalizing transportation prices. Moreover, with administration targeted on streamlining manufacturing, it expects unit prices to say no by 5% within the first half of 2024. That ought to assist to additional assist working margins subsequent yr. SG&A expense remained at 47.6% of gross sales.

As the corporate grows gross sales and shifts its focus from stock and product administration prices, which have been comparatively low-hanging fruit, I might count on it to focus effectivity efforts right here and cut back the SG&A depth of the enterprise. DTC must be extra SG&A-centric than wholesale because it maintains its personal storefronts. The actual fact DTC gross sales are rising extra shortly than wholesale whereas SG&A’s share of income was flat is probably going an indication of improved efficiencies inside every enterprise unit.

On the similar time, PVH maintains a wholesome steadiness sheet. It carries $358 million in money on its steadiness sheet alongside $2.2 billion in debt. PVH has $100 million of seven.75% USD debt and $577 million of euro-denominated debt at 3.625% due subsequent yr. With the ten-year German bund at 2.46%, this debt could also be rolled over at a barely increased fee whereas its USD debt may very well be rolled over at a decrease fee. That is unlikely to be greater than a $5 million per yr affect relative to This autumn’s $25 million in curiosity expense, or lower than $0.06 per share per yr.

With robust money circulate and a stable steadiness sheet, PVH is concentrated on repurchases. It did $68 million in Q3 buybacks, which brings the year-to-date complete to $268 million. That has decreased the share rely by 6.2% from final yr. Additionally it is poised to cut back the share rely by at the least 5% extra in This autumn, given its $550 million goal. This could present additional assist to earnings progress.

PVH is delivering stable margin growth because it focuses on prices, right-sizing stock, and sustaining the relevance of its model. Importantly, it’s doing this throughout an imperfect macro atmosphere. In any case, wholesale income stays constrained by stock discount by way of the channel. As this headwind fades, demand could improve additional.

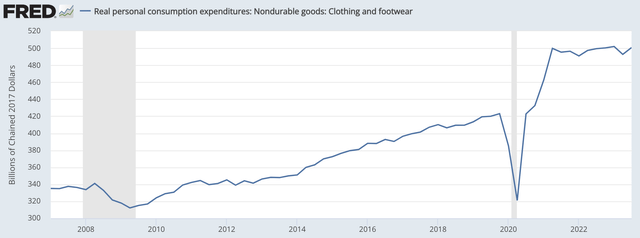

Moreover, as you may see, attire gross sales have stagnated within the US after vastly overshooting their development post-COVID. Nonetheless, as a result of they’ve flat-lined, they’re now solely up 4% from 2019 annualized, vs the three% long-term development. With shoppers now not critically over-spending on garments, this could enhance demand additional in 2024 and make income progress simpler to return by.

St. Louis Federal Reserve

Markets reacted strongly to PVH as a result of the corporate is making it clearer that it’s at an inflection level. Its manufacturers are rising, and we are actually seeing the margin accretion from its cost-cutting plans on stock, which ought to proceed in 2024. With a declining share rely, low-single-digit gross sales progress, and 50bp of margin growth, PVH can probably ship over $11.50 in 2024 EPS in my opinion. As a result of vogue might be fickle, PVH is more likely to structurally have a lower-than-market earnings a number of. However even at 10-11x earnings, shares can commerce towards $120. PVH has rallied lots, however I imagine the bull run has considerably extra room to go. I might keep a purchaser of shares.