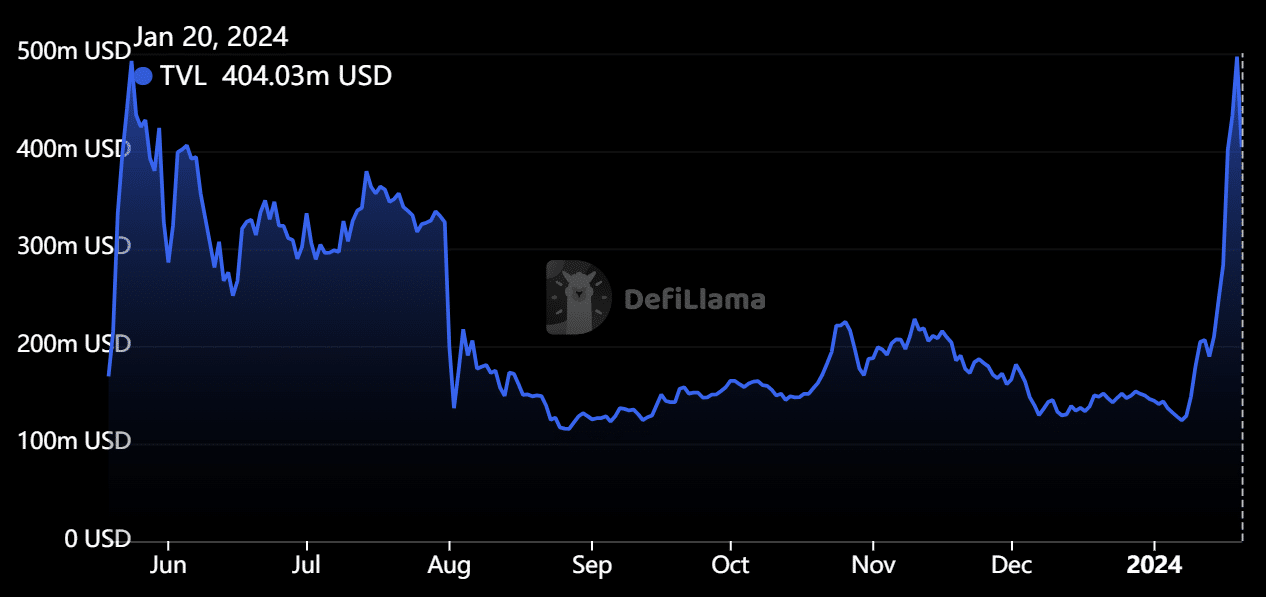

PulseChain, an Ethereum fork, has the Whole worth locked (TVL) of $403 million. The expansion makes it the eleventh largest by way of TVL, in keeping with DefiLlama.

PulseChain hosts 34 protocols and has seen a 110% TVL enhance previously week.

Supply: DefiLlama

PulseX is the biggest protocol on PulseChain. It’s a decentralized alternate (DEX) that contributes a TVL of $234.45 million to the chain. Like a Ethereum competitor born to unravel the scalability downside on the OG blockchain continues to be lagging behind.

PulseChain is 0.71% of the whole TVL

When it comes to complete {dollars} locked up, PulseChain represents simply 0.71% of the market, whereas Ethereum dominates with over 57%.

Nonetheless, the latest enhance is outstanding. This enhance in TVL began after January 8, when it was simply over $128 million. On the similar time the approval of the primary spot Bitcoin ETF was simply across the nook. The US SEC permitted the long-awaited ETP on January 10, bringing extra liquidity to the market.

This additionally contributed to the chain’s rise, with TVL reaching $209 million on January 14 and rising to $496.5 million on January 19. On this course of, the dialog round Ethereum ETFs has additionally added optimism to the chain. In December, GoPulse mentioned in an announcement that it has unleashed interoperability by permitting buying and selling between Pulse and Ethereum.

PulseChain was launched in Might final yr and has been operational for eight months. In the meantime, PulseX permits customers to alternate tokens on the blockchain in a decentralized setup. It’s considerably just like Uniswap on Ethereum.

PulseChain has been surrounded by controversies

Richard Coronary heart, the founding father of HEX and developer of PulseChain and PulseX, mentioned in a latest submit on He mentioned this might enhance security and cut back prices.

For those who let $DAI, $USDC, and $USDT have their stablecoins straight on PulseChain, like they do on different networks, it could enhance safety and cut back prices. PulseChain is sort of essentially the most decentralized and safe L1 on this planet. PulseChain has labored flawlessly since launch… pic.twitter.com/xVWRuWkfjn

— Richard Coronary heart (@RichardHeartWin) January 20, 2024

DeFi analyst @goldk3y_ underlined PulseChain’s development, citing greater than 700,000 lively wallets. He’s betting on PulseChain’s development and states: “At present $112 million has been bridged to PulseChain. A rise of +$42 million within the final 7 days.”

He highlighted that PulseChain provides 100% uptime, low transaction charges, a rising developer neighborhood and over 52,000 validators, making it a robust competitor within the area.

The Pulse pockets famous Saturday that DAI is more and more switching from Ethereum to PulseChain. It has reportedly surpassed its earlier report, which was reached in June 2023. Though confidence within the chain is rising, this isn’t with out setbacks.

In July final yr, the SEC sued Coronary heart for providing unregistered securities focusing on HEX, PulseChain and PulseX.

In the meantime, the founder can also be credited with boosting his venture with large claims. He was busted not solely by regulators but additionally by the neighborhood for misrepresentation and making probably fraudulent claims.