Ilja Enger-Tsizikov

The Cohen & Steers Choose Most well-liked and Revenue Fund (NYSE:PSF) is a closed-end fund or CEF, that may be employed by these buyers who’re searching for to earn a excessive stage of revenue from the property in their portfolio. This fund within reason profitable at that job, as its present yield of seven.81% is increased than many different issues available in the market as we speak. Nevertheless, that is removed from the best yield that buyers can presently receive from a most well-liked inventory fund. In any case, as we mentioned just a few days in the past, the John Hancock Most well-liked Revenue Fund III (HPS) and a few of the different funds from John Hancock beat this one by way of yield by a snug margin. The Cohen & Steers Choose Most well-liked and Revenue Fund doesn’t have the worst yield obtainable amongst its friends although, and it additionally manages to beat the iShares Most well-liked and Revenue Securities ETF (PFF), so it would nonetheless be value contemplating as an possibility.

As common readers are little question effectively conscious, we final mentioned the Cohen & Steers Choose Most well-liked and Revenue Fund again in August of 2023. The general setting available in the market has modified significantly since that point. On the time that the earlier article was revealed, most fixed-income securities had been affected by a normal perception that the Federal Reserve was severe about its “increased for longer” dedication and long-term rates of interest had been rising with a view to readjust for that setting. Thus, the fund’s share worth declined for a month or two after that article was revealed. The market setting modified in mid-October when buyers started to count on that the central financial institution would pivot and minimize rates of interest dramatically in 2024. That brought on the fund’s share worth to reverse course and it usually rose for the rest of the 12 months.

As we are able to see right here, the fund’s share worth is up 3.92% since we final mentioned this fund, which is healthier than the two.55% achieve of the popular inventory index:

Looking for Alpha

Sadly, there might be some causes to imagine that the fund’s shares won’t be able to carry onto its current good points. It’s because the rate of interest cuts which were priced into the fund’s shares and the popular shares in its portfolio require that the financial system enter a extreme recession inside the subsequent few weeks. That may be very troublesome to imagine contemplating current studies from the varied authorities companies which are liable for monitoring such issues. As well as, inflationary pressures stay very robust and the Federal Reserve dangers igniting one other bout of inflation if it had been to chop rates of interest to any important diploma. If the Federal Reserve fails to ship on the required rate of interest cuts which are essential to justify the present worth of the property which are held by this fund, it may hand over a few of the good points that buyers have benefited from in current months.

The fund’s buyers have acquired way more good points than are seen just by wanting on the fund’s share worth. It’s because closed-end funds such because the Cohen & Steers Choose Most well-liked and Revenue Fund sometimes pay out all of their funding income to their house owners, which leads to their realized returns being a lot increased than the share worth efficiency would indicate. Within the case of this fund, buyers have realized a 7.57% whole return because the date that my earlier article was revealed. That’s considerably above the overall return of the popular inventory index, largely as a result of the Cohen & Steers Choose Most well-liked and Revenue Fund has a a lot increased yield:

Looking for Alpha

That whole return was realized over the course of about 5 months, so it’s sufficiently giant to justify taking a few of the cash off of the desk merely to scale back total danger. This works effectively with my total thesis and reasoning behind this downgrade of the fund.

About The Fund

In line with the fund’s website, the Cohen & Steers Choose Most well-liked and Revenue Fund has the first goal of offering its buyers with a really excessive stage of present revenue. Not like the web sites of closed-end funds from different managers, this one doesn’t present an in-depth description of the fund’s methods. All that it states is:

The first funding goal of the Fund is excessive present revenue via funding in most well-liked and different securities. The secondary funding goal is capital appreciation.

Thus, all that we all know from this description is that the fund’s property can be primarily invested in most well-liked securities. The fact sheet does not likely enhance on this description, though it does state that buyers ought to count on that almost all of the securities within the fund can be issued by banks, actual property funding trusts, insurance coverage corporations, and utilities. This could be in step with most different most well-liked inventory funds.

In any case, as I identified in a current article on the John Hancock Most well-liked Revenue Fund III (linked within the introduction), banks are by far the biggest issuers of most well-liked securities available in the market. From that article:

The very first thing that we discover right here is that all the securities within the fund’s largest positions record are both utilities or banks. This isn’t unusual for a most well-liked inventory fund as a result of banks and utilities are the biggest issuers of most well-liked inventory available in the market. In consequence, virtually any most well-liked inventory fund can be very closely weighted in direction of these two forms of corporations. With that mentioned although, often the overwhelming majority of corporations within the high ten record are banks. This is because of worldwide banking laws that require banks to carry a sure proportion of their property within the type of Tier One capital. Tier One capital refers to that proportion of a financial institution’s property that aren’t concurrently a legal responsibility to any person else (reminiscent of a depositor). When regulators require {that a} financial institution improve its Tier One capital, its solely choices are to concern both widespread or most well-liked inventory. The financial institution will typically select to concern the popular inventory with a view to keep away from diluting the widespread shareholders.

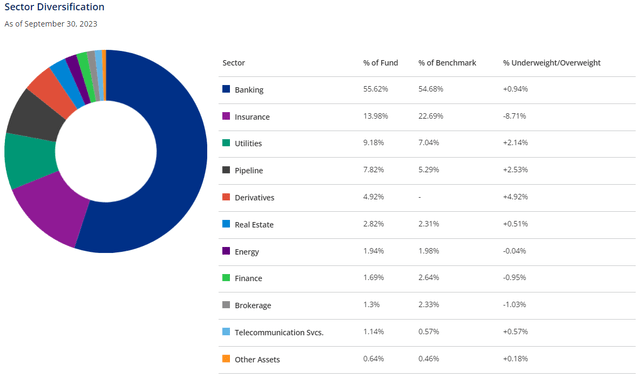

The Cohen & Steers Choose Most well-liked and Revenue Fund is actually not an exception to this rule concerning the dominance of banking corporations in its portfolio. As we are able to see right here, the banking sector presently accounts for 55.62% of the fund’s property:

Cohen & Steers

That’s lower than the burden that another most well-liked inventory funds have assigned to the banking sector. For instance, the Flaherty & Crumrine Whole Return Fund (FLC) presently has 57.00% of its property invested in banks. Nevertheless, it’s nonetheless increased than the 54.68% of the fund’s benchmark index, which is a particular index presumably created by Cohen & Steers. The actual fact sheet states that it’s a composite index consisting of the next:

- 55% ICE Financial institution of America U.S. Funding Grade Institutional Capital Securities Index.

- 20% ICE Financial institution of America Core Mounted Fee Securities Index.

- 25% Bloomberg Developed Market USD Contingent Capital Index.

The fund’s benchmark has modified just a few occasions over time, nevertheless it has at all times been a composite index consisting of different most well-liked inventory and contingent capital indices. That would make it tougher to trace its efficiency over time, so I’ve opted to benchmark this fund in opposition to the ICE Alternate-Traded Most well-liked and Hybrid Securities Index which is tracked by the iShares Most well-liked and Revenue Securities ETF. That’s the index fund that the Cohen & Steers Choose Most well-liked and Revenue Fund is in comparison with within the introduction to this text.

The truth that this fund has a reasonably excessive allocation to the banking sector is one thing that may be regarding contemplating the challenges that this sector confronted final 12 months. Nevertheless, as I mentioned in a current article,

The banking sector is presently sitting on $600-$700 billion of unrealized losses. That is largely as a result of fixed-rate U.S. Treasuries, mortgage loans, and different devices that declined in worth in a rising rate of interest setting. The dimensions of those losses is enough that it might fear some buyers, however this can be a very completely different drawback than the banking sector skilled again in 2007. There has not been a spike in defaults that’s forcing banks to comprehend losses. So long as there aren’t any extra financial institution runs, the unrealized losses ought to ultimately be erased because the securities mature, or rates of interest decline and trigger capital appreciation within the presently depreciated securities. The Federal Reserve applied a program again within the Spring of 2023 that has usually been efficient at stopping banks from needing to promote their depreciated property to fulfill the withdrawal calls for of depositors, so we most likely do not need to fret about this drawback.

As such, there’s most likely no motive to keep away from the Cohen & Steers Choose Most well-liked and Revenue Fund simply because you might have some issues concerning the banking sector publicity. Nevertheless, as is at all times the case, it is vital that your portfolio has applicable diversification to make sure that you do not need an extreme diploma of publicity to any particular person sector. As such, it might be a good suggestion to carry different funds which have low monetary sector publicity if this one is in your portfolio.

As talked about within the quote above, it’s typical {that a} fund such because the Cohen & Steers Choose Most well-liked and Revenue Fund will embrace quite a lot of banks amongst its largest positions. That is actually the case right here, as we are able to see by wanting on the largest positions on this fund’s portfolio:

Fund Reality Sheet

There are 4 banks among the many fund’s largest positions, which is definitely fewer than I actually anticipated to see. We would definitely count on to see greater than this contemplating that 55.62% of the fund’s whole property are invested within the banking sector. Nevertheless, it appears doubtless that we’d see extra banks among the many largest positions if it weren’t for these two interest-rate swaps. As I’ve identified in just a few earlier articles on different closed-end funds, the fast improve in rates of interest that we noticed in 2022 and early 2023 created issues for a lot of closed-end funds that are likely to make use of important ranges of leverage of their methods. Mounted-income funds, particularly, are pretty well-known for this, as leverage has been one of many solely methods to earn respectable yields from fixed-income securities within the extremely low-interest price setting that existed over the previous decade.

Cohen & Steers funds hedge their rate of interest publicity to basically assure that their curiosity bills can be at a set price no matter rate of interest actions within the broader market. It’s truly a fairly good factor contemplating the issues that leverage has brought on for most well-liked inventory funds from another fund homes. The scale of those swaps leads to them being among the many largest holdings on this fund, but when they weren’t right here then it appears doubtless that we’d see extra banks on the record.

The Thesis And Potential Threats

As talked about within the introduction, the current market setting has confirmed to be excellent for this fund. The US 10-12 months Bond Yield (US10Y) peaked on October 19, 2023, and has usually been declining since that point:

CNBC

The share worth of most well-liked inventory sometimes correlates with the ten-year U.S. Treasury. Thus, as yields declined since mid-October, the value of the property which are held by the Cohen & Steers Most well-liked and Revenue Fund have gone up. That is mirrored within the worth of this fund’s shares, which have gone up by a formidable 14.55% since October 19, 2023:

Looking for Alpha

Nevertheless, we are able to see that the value efficiency of the shares has moderated considerably because the begin of 2024. The shares are up 2.49% year-to-date, however they’re nonetheless down from their December peak. It’s because the market has begun to doubt the narrative that the Federal Reserve will aggressively scale back rates of interest over the course of this 12 months. This makes a substantial amount of sense because the rate of interest minimize expectations which are presently baked into most well-liked inventory costs are very optimistic and unrealistic.

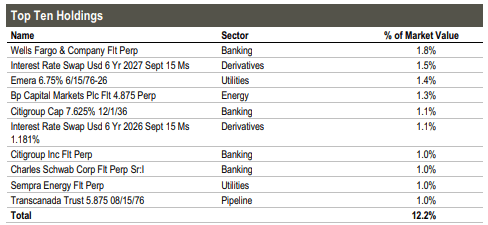

As of as we speak, the market is anticipating that the efficient federal funds price will decline by 1.384 proportion factors by the tip of 2024:

Zero Hedge/Knowledge from Bloomberg

This could require 5 – 6 25-basis level cuts within the subsequent eight conferences of the Federal Open Market Committee. There’s nearly no one that expects a price minimize in January, though the market did suppose that was doable again in December. The market presently expects that the primary price minimize will are available in March, and it’s possible that this fund will hand over a few of its current good points if that situation turns into uncertain.

There has solely been one time in historical past (through the Nineteen Eighties) when the Federal Reserve lowered the federal funds price by 125 foundation factors or extra within the absence of a really extreme recession. I discover it very exhausting to imagine that the unemployment price will abruptly go to 10% inside the subsequent three weeks. Thus, it appears most unlikely {that a} extreme recession is on the horizon that may drive the Federal Open Market Committee to suppose that financial situations have to be loosened with a view to stop financial issues. Certainly, the market has already achieved an amazing deal to loosen up financial situations by driving long-term rates of interest down by almost 100 foundation factors because the center of October. The minutes from the Federal Reserve’s December assembly counsel largely the identical factor, and so they counsel that the committee members suppose that financial situations are already free sufficient, and it doesn’t have to be minimize.

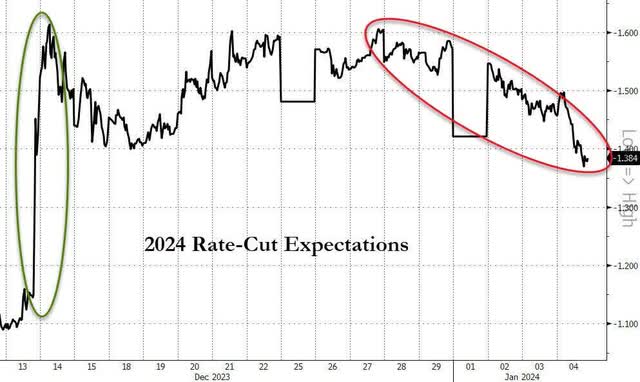

The dot plot reveals that every one however 5 of the 13 committee members expects that there can be three or fewer price cuts in 2024. Of these 5 that count on 4 or extra rate of interest cuts, 4 of them suppose that there can be 4 rate of interest cuts. Solely one of many committee members expects something near the market’s present expectations:

Zero Hedge/Knowledge from FOMC

That is the rationale why we began to see the market weaken final week, as merchants realized that the euphoria had gone too far. Nevertheless, because the Fed futures market expectations chart above reveals, the market nonetheless expects extra rate of interest cuts in 2024 than the Federal Open Market Committee members. Thus, the value of the popular shares held by the Cohen & Steers Choose Most well-liked and Revenue Fund is just too excessive, and the fund is susceptible to a near-term correction.

With that mentioned a doable danger to this thesis might be the tip of the momentary program that the Federal Reserve set as much as shield the nation’s banking system in opposition to additional financial institution runs that might set off gross sales of depreciated property. Simon White, Bloomberg’s macro strategist points out that the tip of this program may barely strengthen the case for a March 2024 rate of interest minimize. It’s because a price minimize would reverse a few of the unrealized losses that banks are presently sitting on. Nevertheless, the market has already achieved loads of work at erasing these unrealized capital losses so such a price minimize might not be obligatory. It’s nonetheless a possible danger to this thesis, although.

In brief, buyers within the Cohen & Steers Choose Most well-liked and Revenue Fund might need to promote a few of their positions with a view to lock of their good points earlier than a market correction that may undoubtedly happen if the Federal Reserve fails to scale back the federal funds price in March. If nothing else, such a transfer would assist scale back the general danger that’s doubtless sitting within the fixed-income portion of most portfolios proper now.

Leverage

As is the case with most closed-end funds, the Cohen & Steers Choose Most well-liked and Revenue Fund employs leverage as a technique of accelerating the efficient yield of the property in its portfolio. I defined how this works in my earlier article on this fund:

In brief, the fund is borrowing cash and utilizing that cash to buy most well-liked inventory and bonds. So long as the bought securities have a better yield than the rate of interest that the fund has to pay on the borrowed cash, the technique works fairly effectively to spice up the efficient yield of the portfolio. As this fund is able to borrowing cash at institutional charges, that are significantly decrease than retail charges, this can often be the case. It is very important consider although that this technique is way much less efficient as we speak with charges at 6% than it was just a few years in the past when charges had been close to 0%. It’s because the distinction between the rate of interest paid by the fund and the yield of the property that it purchases is way lower than it as soon as was.

Nevertheless, the usage of debt on this style is a double-edged sword as a result of leverage boosts each good points and losses. As such, we need to be sure that the fund just isn’t using an excessive amount of leverage as a result of that may expose us to an extreme quantity of danger. I usually don’t wish to see a fund’s leverage exceed a 3rd as a proportion of its property because of this.

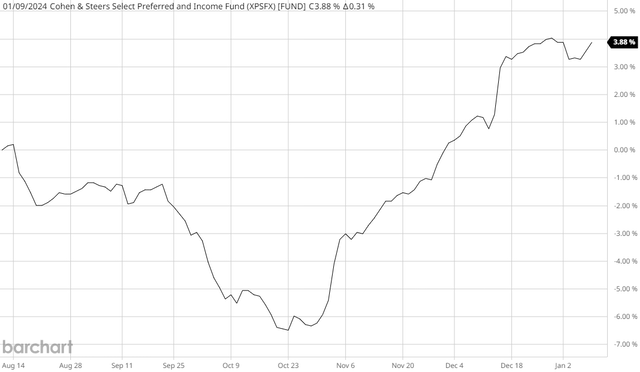

As of the time of writing, the Cohen & Steers Choose Most well-liked and Revenue Fund has leveraged property comprising 34.52% of its portfolio. That is fairly a bit decrease than the 35.42% leverage that the fund had the final time that we mentioned it, which makes a certain quantity of sense. In any case, the fund’s web asset worth has elevated by 3.88% because the date that the earlier article was revealed:

Barchart

Thus, if its leverage had been to stay utterly static then it might now symbolize a decrease proportion of a bigger portfolio. Closed-end funds not often considerably improve or lower the precise quantity of borrowings of their portfolios in greenback phrases, so that is the doubtless situation.

As we are able to see although, the fund’s present leverage continues to be above the one-third of property determine that we’d ordinarily choose to see. Nevertheless, on this case, it’s most likely acceptable. In any case, one of many defining traits of fixed-income securities is that they’re often much less unstable than widespread equities. It’s volatility that causes issues with leveraged methods, so a fund that’s investing in much less unstable securities ought to be capable of carry a better quantity of leverage than a fund that’s investing in widespread equities. As such, the fund’s leverage might be okay proper now as it’s not very a lot above the one-third stage that we choose.

General, the steadiness between the chance and reward with Cohen & Steers Choose Most well-liked and Revenue Fund might be acceptable. Danger-averse buyers mustn’t have to lose sleep over this fund’s use of leverage.

Distribution Evaluation

As talked about earlier on this article, the first goal of the Cohen & Steers Choose Most well-liked and Revenue Fund is to offer its buyers with a really excessive stage of present revenue. In pursuance of this goal, the fund invests in a portfolio that primarily consists of most well-liked shares. Most well-liked inventory sometimes delivers the vast majority of its whole funding returns within the type of direct funds which are made to its proprietor. On this case, that may be the fund that collects these funds on behalf of its shareholders. The fund swimming pools the cash that it receives from the securities in its portfolio after which pays it out to its shareholders, web of the fund’s bills. As most well-liked inventory often has a better yield than many different issues available in the market and this fund makes use of leverage to gather funds from extra securities than it may afford with simply its personal fairness capital, we are able to count on that this enterprise mannequin would end result within the fund’s shares having a really excessive yield.

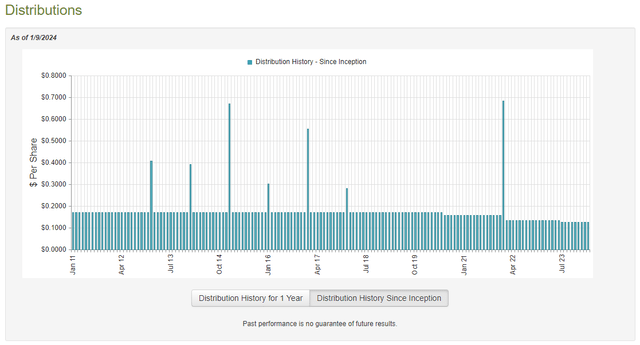

That is actually the case, because the Cohen & Steers Choose Most well-liked and Revenue Fund pays a month-to-month distribution of $0.1260 per share ($1.5120 per share yearly), which provides it a 7.81% yield on the present worth. This isn’t the best yield that’s obtainable within the closed-end fund area, however it’s not too dangerous in comparison with widespread equities and comparable issues. Sadly, the fund has not been particularly in step with respect to its distribution, and it has been lowering its payout over the previous few years:

CEF Join

Previous to the COVID-19 pandemic, this fund was a reasonably dependable supply of revenue, however the current cuts have undoubtedly lowered its enchantment within the minds of these buyers who’re searching for a secure and constant revenue from the property of their portfolios. The technology of revenue is maybe extra vital than it was in previous years because of the damaging impression that as we speak’s excessive ranges of inflation have had on our lifestyle. It prices far more to take care of a sure way of life as we speak than it did just a few years in the past, so we’d like our incomes to be climbing with the passage of time. This fund’s distribution cuts have been doing the precise reverse.

Nevertheless, as I’ve identified quite a few occasions previously, the fund’s distribution historical past just isn’t essentially an important factor for brand spanking new purchasers proper now. In any case, anybody who buys the fund as we speak will obtain the present distribution on the present yield and won’t be adversely affected by any occasions that the fund has needed to cope with previously. A very powerful factor for anybody who’s contemplating buying the fund as we speak is how effectively the fund can maintain its present distribution. Allow us to examine this.

Sadly, we do not need an particularly current doc that we are able to seek the advice of for the aim of our evaluation. As of the time of writing, the fund’s most up-to-date financial report corresponds to the six-month interval that ended on June 30, 2023. As such, this report is not going to have any details about the fund’s efficiency over the previous six months. That’s disappointing, because the fixed-income market has been considerably unstable over that interval. Over the summer season, rates of interest had been rising, and the value of most well-liked inventory was usually declining. That undoubtedly brought on this fund to endure some realized and unrealized losses. Nevertheless, it might need been in a position to undo a few of these losses through the extremely euphoric interval that started in the midst of October.

The newest monetary report is not going to embrace any details about how effectively the fund dealt with both of those intervals. Nevertheless, it’s a newer report than the one which we had obtainable to us the final time that we mentioned this fund, so it’s nonetheless good to have some newer information to work with.

Throughout the six-month interval, the Cohen & Steers Choose Most well-liked and Revenue Fund acquired $9,289,167 in curiosity and $2,096,415 in web dividends from the property in its portfolio. This offers the fund a complete funding revenue of $11,385,582 over the interval. The fund paid its bills out of this quantity, which left it with $6,191,688 obtainable for the shareholders.

This was sadly nowhere close to sufficient to cowl the $9,741,564 that the fund paid out in distributions through the interval. At first look, that is virtually actually going to be regarding as a result of we’d ordinarily choose a fixed-income closed-end fund to completely cowl its distributions out of web funding revenue. This one clearly failed to perform that objective.

Nevertheless, there are different strategies via which the fund can receive the cash that it must cowl its distributions. For instance, it would be capable of exploit the value adjustments that most well-liked shares exhibit when rates of interest change. Income from this are realized capital good points and are subsequently not thought of to be funding revenue for tax or accounting functions. Nevertheless, they clearly lead to cash coming into the fund that may be distributed to the shareholders.

Sadly, this fund usually failed at that job through the interval in query, because it reported web realized losses of $16,414,855 that had been solely partially offset by $4,720,867 web unrealized good points. General, the fund’s web property declined by $15,243,864 after accounting for all inflows and outflows through the interval.

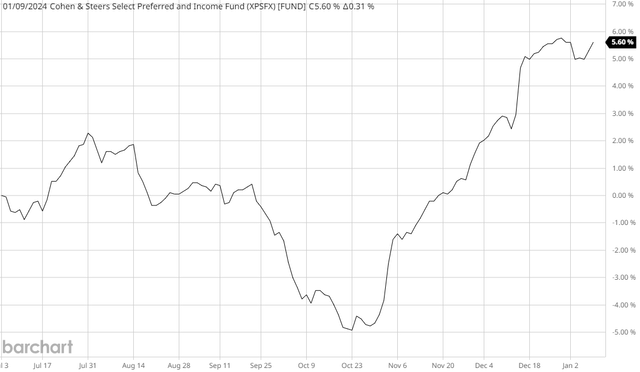

Thus, this fund clearly didn’t cowl its distributions through the first half of 2023. That actually explains the distribution minimize in July because the fund wanted to scale back its outflow of cash with a view to stop the continued destruction of its web property. Fortuitously, it does seem that the newest distribution minimize was enough. The fund’s web asset worth is up 5.60% since July 1, 2023:

Barchart

This strongly implies that the fund managed to completely cowl all the distributions that it paid out because the time limit of the newest monetary report with a substantial amount of cash left over. This can be a good signal, nevertheless it doesn’t assure that the fund can maintain its distribution on the present stage. In any case, as we mentioned on this article, there’s a very actual probability that the securities within the fund’s portfolio will decline in worth within the close to future because the market adjusts to the chance that near-term price cuts might not be as substantial because it presently has priced in.

Valuation

As of January 9, 2024 (the newest date for which information is presently obtainable), the Cohen & Steers Choose Most well-liked and Revenue Fund has a web asset worth of $20.35 per share. Nevertheless, the shares presently commerce for $19.43 every. This offers the fund’s shares a 4.52% low cost on web asset worth on the present worth. That is nowhere close to as engaging because the 7.13% low cost that the fund’s shares have had on common over the previous month. As such, the fund’s entry worth doesn’t look notably engaging proper now, however the smaller-than-average low cost does work fairly effectively as an exit worth for many who are searching for to scale back their danger by taking some good points.

Conclusion

In conclusion, the Cohen & Steers Choose Most well-liked and Revenue Fund has delivered pretty robust efficiency over the previous few months on expectations that the Federal Reserve will considerably scale back rates of interest this 12 months. Nevertheless, present financial information is just too robust to assist the market’s expectations and there’s a very actual danger that the fund will hand over a few of its current good points if the central financial institution doesn’t ship on price minimize expectations. As such, it might make sense to take some revenue sharing, particularly with the fund’s valuation wanting richer than common.