bjdlzx

ProFrac’s (NASDAQ:ACDC) income and margins continued to slip within the third quarter, because the impression of a softer demand atmosphere continues to take a toll. A scenario exacerbated by ProFrac’s giant debt place. Whereas the corporate has important scope to chop prices and scale back CapEx within the short-run, ProFrac will want the demand atmosphere to stabilize in some unspecified time in the future. Administration stays pretty upbeat on the again of a swap in focus to buyer devoted fleets and an expectation of improved sand mine capability utilization. This seemingly hinges on the macro atmosphere although, with an extra deterioration doubtlessly forcing ProFrac to make tough selections.

Buyers have typically been fairly upbeat about ProFrac because the firm went public in 2022. This appears to have stemmed from a misunderstanding of each ProFrac’s enterprise and the late stage of the enterprise cycle within the US onshore market. Oilfield providers is usually a extremely cyclical trade, significantly in aggressive markets like onshore US. For a commodity service like fraccing, pricing relies on the stability of provide and demand. Hydraulic fracturing is actually able to turning a dry gap right into a fountain of money, which means that demand will be inelastic when oil and fuel costs are excessive. Conversely, service corporations have costly and specialised tools which may’t be redeployed. Firms can lay off staff and deactivate tools to try to assist costs, however this will solely be taken thus far. These dynamics result in durations of quickly rising and declining costs.

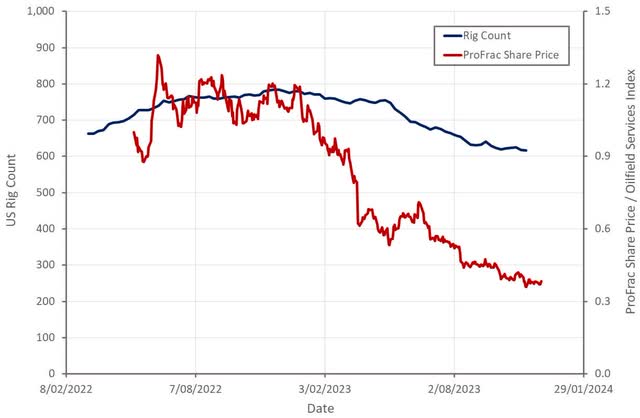

Regardless of macro uncertainty, upstream funding continues to be pretty strong, however ProFrac just isn’t actually benefitting from this. ProFrac has been disproportionately hit attributable to its reliance on the US onshore frac market, and comparatively excessive publicity to fuel basins and personal operators. This may be seen within the firm’s share worth efficiency relative to a broader oilfield service index. Whereas many traders imagine that we’re getting into a commodity supercycle on the again of a interval of underinvestment, oil and fuel demand development has been delicate in recent times. Consequently, provide development has managed to maintain up with demand with out a providers growth.

Determine 1: US Rig Rely and ProFrac Share Value Relative to Oilfield Companies Index (supply: Created by creator utilizing knowledge from Baker Hughes and Yahoo Finance)

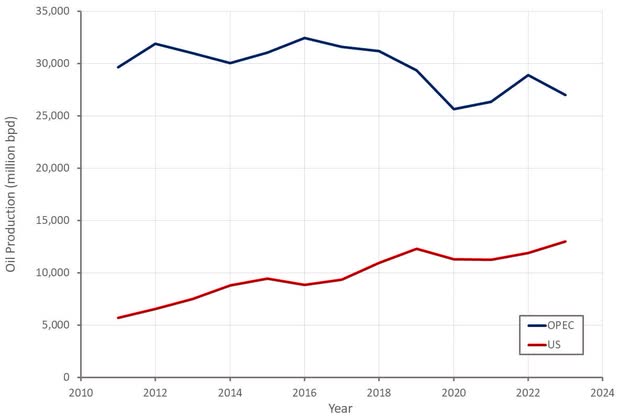

The oil market can be at present being propped up by OPEC’s willingness to chop manufacturing to assist oil costs. It’s unclear how lengthy this example will be maintained although. EIA estimates that OPEC at present has near 4 million bpd extra capability, effectively above a current historic norm of round 2 million bpd. US manufacturing development stays strong, along with strong development in locations like Brazil. Confronted with declining market share and an oil worth that refuses to maneuver larger, there’s a risk OPEC will flood the market to flush out high-cost producers in some unspecified time in the future.

Determine 2: US and OPEC Oil Manufacturing (supply: Created by creator utilizing knowledge from OPEC and EIA)

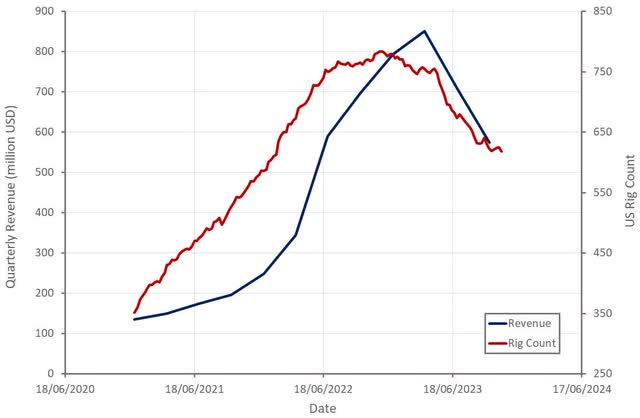

The path of the market in coming quarters is essential to ProFrac, as a result of leverage inherent in its enterprise, and the corporate’s excessive debt load. Whereas market situations aren’t at present that dangerous, ProFrac has already being compelled to deactivate fleets, furlough staff and in the reduction of on CapEx. Market situations have softened because the third quarter however have stabilized considerably in current weeks, and there may be motive to imagine frac demand might decide up in 2023.

ProFrac is making ready fleets for reactivation as early as December and expects to have 30 lively fleets in Q1 of 2024. The corporate plans of shifting its buyer combine away from smaller, non-public corporations going ahead, with 75% of its fleets anticipated to be buyer devoted subsequent yr. ProFrac continues to be attempting to keep up relationships with smaller clients although. This shift in buyer combine will assist to offer pricing and exercise stability however will even seemingly take among the upside out of the enterprise.

Determine 3: ProFrac Income and US Rig Rely (supply: Created by creator utilizing knowledge from ProFrac and Baker Hughes)

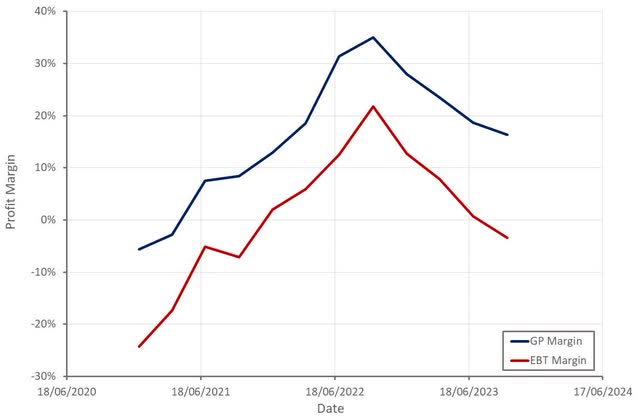

ProFrac reported a loss within the third quarter, largely as a result of firm’s excessive curiosity prices. That is considerably deceptive although as ProFrac continues to be producing optimistic free money flows. ProFrac is attempting to deleverage, lowering web debt by 123 million USD within the third quarter, which ought to have a considerable impression on profitability over the subsequent few years.

The corporate is lowering prices consistent with income declines and is reducing CapEx to assist money flows, deferring its fleet improve program into 2024. Whereas the corporate has important leeway to cut back CapEx within the brief time period, it has a capital-intensive enterprise that may ultimately require funding.

Determine 4: ProFrac Revenue Margins (supply: Created by creator utilizing knowledge from ProFrac)

ProFrac’s profitability is essentially depending on pricing. Administration has advised that pricing has been secure over the previous few quarters, however ProFrac’s gross revenue margin is effectively beneath its peak and possibly nearer to a sustainable degree underneath regular market situations.

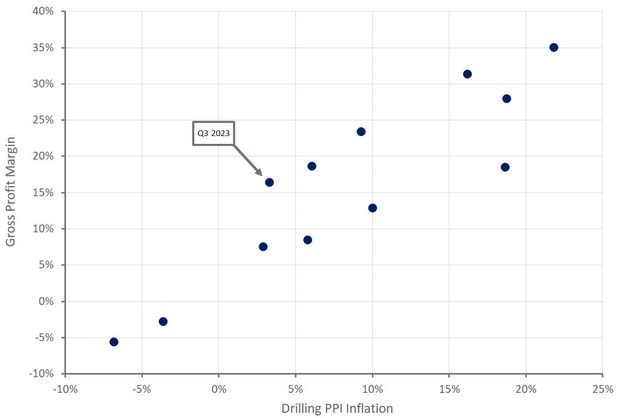

Determine 5: Value Inflation and ProFrac Gross Revenue Margins (supply: Created by creator utilizing knowledge from The Federal Reserve and ProFrac)

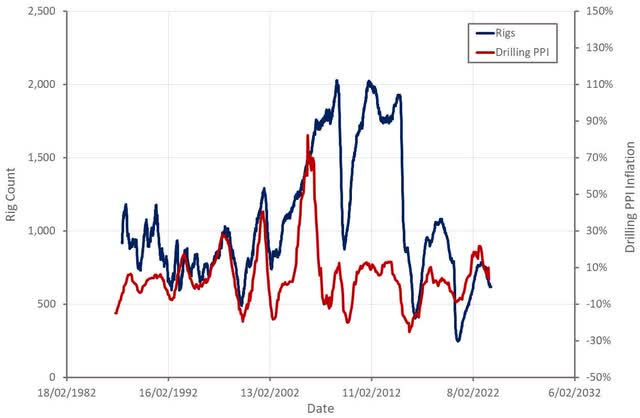

In flip, pricing is closely depending on exercise ranges, which have softened within the face of decrease oil and fuel costs and quickly growing US manufacturing. It ought to be famous that whereas the rig depend is an inexpensive proxy for ProFrac’s demand, the frac unfold depend and rig depend don’t observe one another precisely. The frac unfold depend is barely down around 6% YoY in comparison with the rig depend which is down roughly 20%. That is seemingly why pricing has been secure in current quarters and ProFrac’s margins have held up moderately effectively.

Determine 6: US Rig Rely and Value Inflation (supply: Created by creator utilizing knowledge from The Federal Reserve and Baker Hughes)

Whereas there may be little that ProFrac can do concerning the macro atmosphere, there are a selection of levers it might probably pull to enhance its enterprise. Particularly, ProFrac seems to be relying closely on Alpine Silica to drive efficiency enhancements going ahead. The corporate already has 52% of its capability contracted for 2024 and expects to be bought out (~21 million tonne capability). Third-party gross sales proceed to extend, reaching round 70% of gross sales within the third quarter. Realized proppant pricing was down although, which is a headwind to each development and margins.

ProFrac nonetheless had 137 million USD liquidity on the finish of the third quarter, and is producing free money stream, however lowering debt would go an extended strategy to supporting the long-term well being of the enterprise. ProFrac has advised that the proppant enterprise can be utilized to assist enhance its stability sheet. This might take the type of asset degree financing to simplify its capital construction and prolong maturities, or a potential IPO of the proppant phase. Regardless, ProFrac needs to keep up management of this enterprise.

ProFrac’s inventory might look cheap, however this should be seen in gentle of the corporate’s debt and the cyclical commodity enterprise wherein it operates. Buyers have tended to level in direction of ProFrac’s vertical integration as a supply of benefit, however it’s not actually clear that that is the case, significantly as electrical frac pumps change into the norm. A lot of the complexity of a frac pump comes from the diesel engine and energy finish. An electrical motor negates quite a lot of this complexity. Halliburton (HAL) is extra vertically built-in, together with growing its personal frac chemical compounds, however it’s not clear that this has supplied a significant benefit.

Whereas ProFrac’s EV/S a number of is now at a big low cost to Halliburton’s (HAL), it’s extra consistent with service corporations which have elevated publicity to the US onshore market. Frac exercise within the US seems to have picked up considerably over the past three months or so, however there’s a excessive chance that OPEC won’t implicitly assist this exercise indefinitely. ProFrac’s inventory in now starting to look extra moderately priced, however in a real downturn there would seemingly nonetheless be important draw back.

Determine 7: ProFrac EV/S A number of (supply: Looking for Alpha)