- For each loss-making switch on the community, about 2.3 transfers had been discovered to be worthwhile.

- All ETH holders had been realizing good points over 20% on their investments on common.

Ethereum [ETH] broke by $3,300 as bullish momentum into the world’s second-largest cryptocurrency continued to propel it upwards. At press time, ETH was up 2.61% within the 24-hour interval, and greater than 12% over the week, in line with CoinMarketCap.

Profitability highest since November

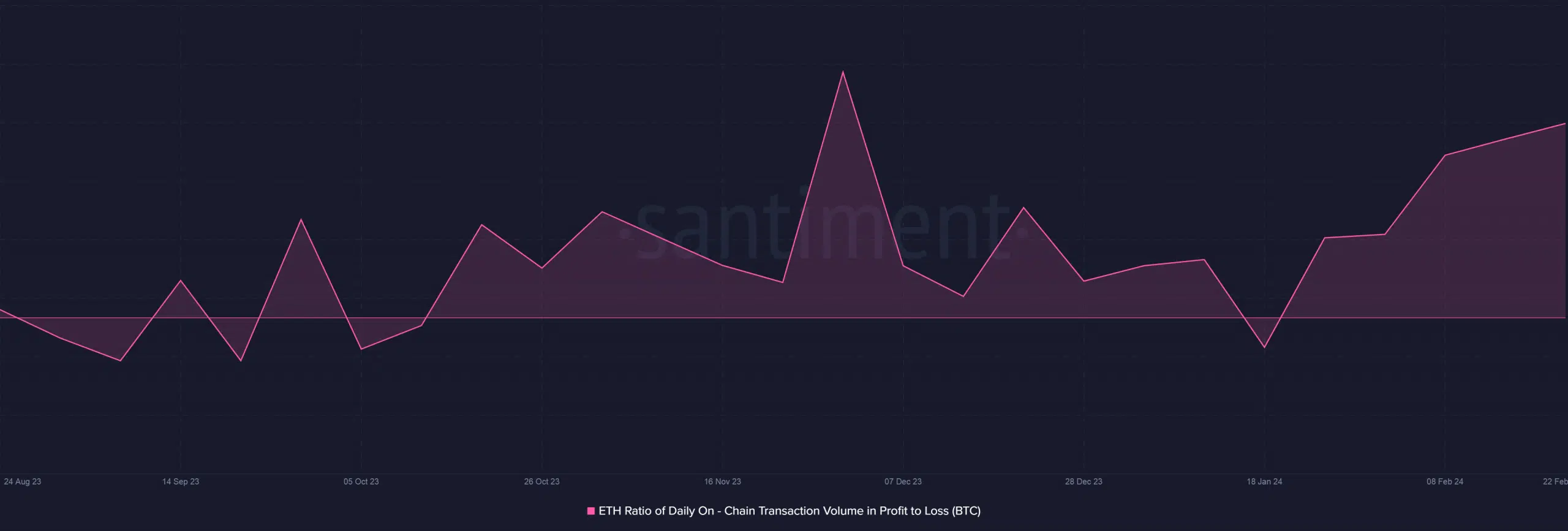

With the value growth, many of the merchants had been making income on their transactions. In accordance with blockchain analytics agency Santiment, Ethereum’s on-chain revenue/loss ratio within the final week was at a three-month excessive.

For each loss-making switch on the community, about 2.3 transfers had been discovered to be worthwhile.

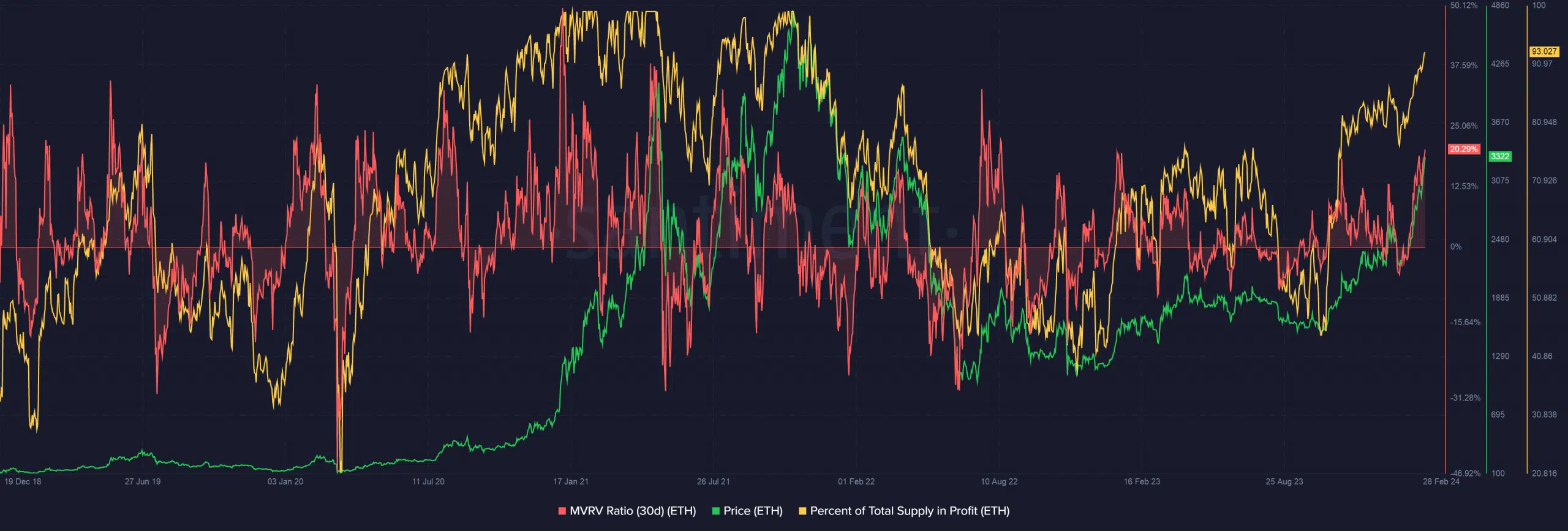

The proportion of complete provide in revenue exceeded 93% as of this writing. On a rising curve, this degree was final seen throughout August 2021, three months earlier than ETH hit all-time highs (ATH).

Furthermore, on a mean, all ETH holders had been realizing good points over 20% on their investments, as evidenced by the 30-day MVRV Ratio. Usually, the extra the ratio will increase, the extra seemingly merchants have traditionally demonstrated their willingness to promote.

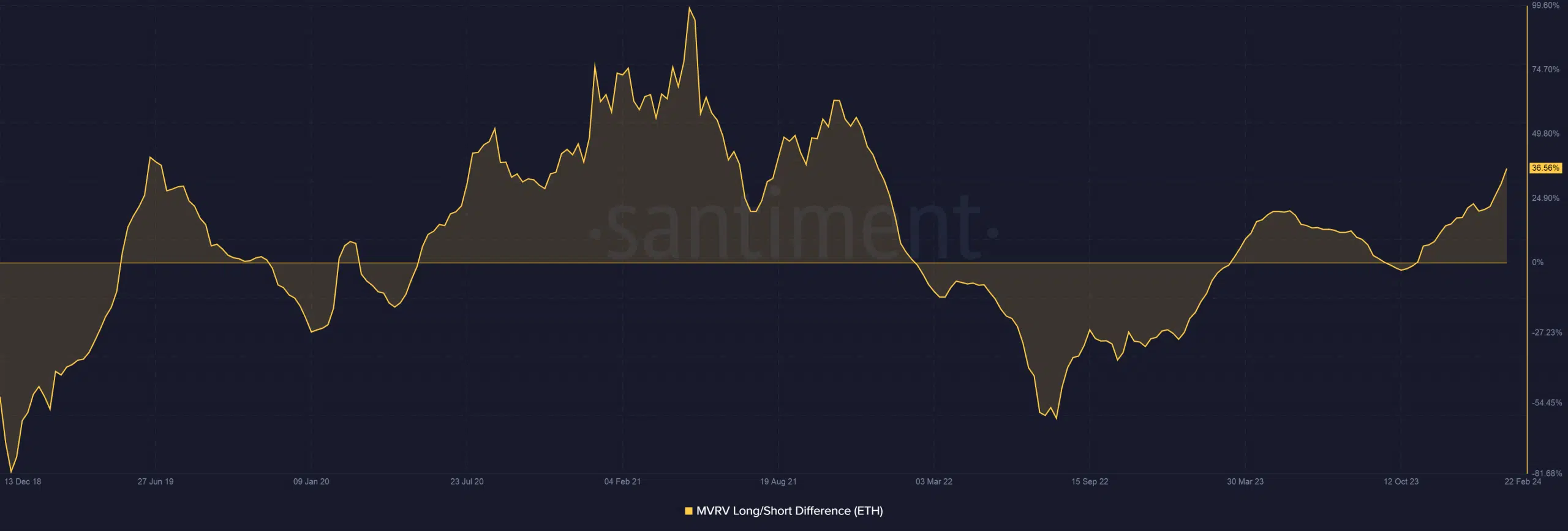

Nevertheless, AMBCrypto’s investigation of MVRV Lengthy/Brief Distinction indicator confirmed that long-term holders had been realizing larger income than short-term holders.

Therefore, it was extremely seemingly that these diamond fingers would watch for costs to experience to ATH and past earlier than distribution.

Be aware of pullbacks

ETH’s bullish impetus shouldn’t make you lose sight of potential corrections on the best way.

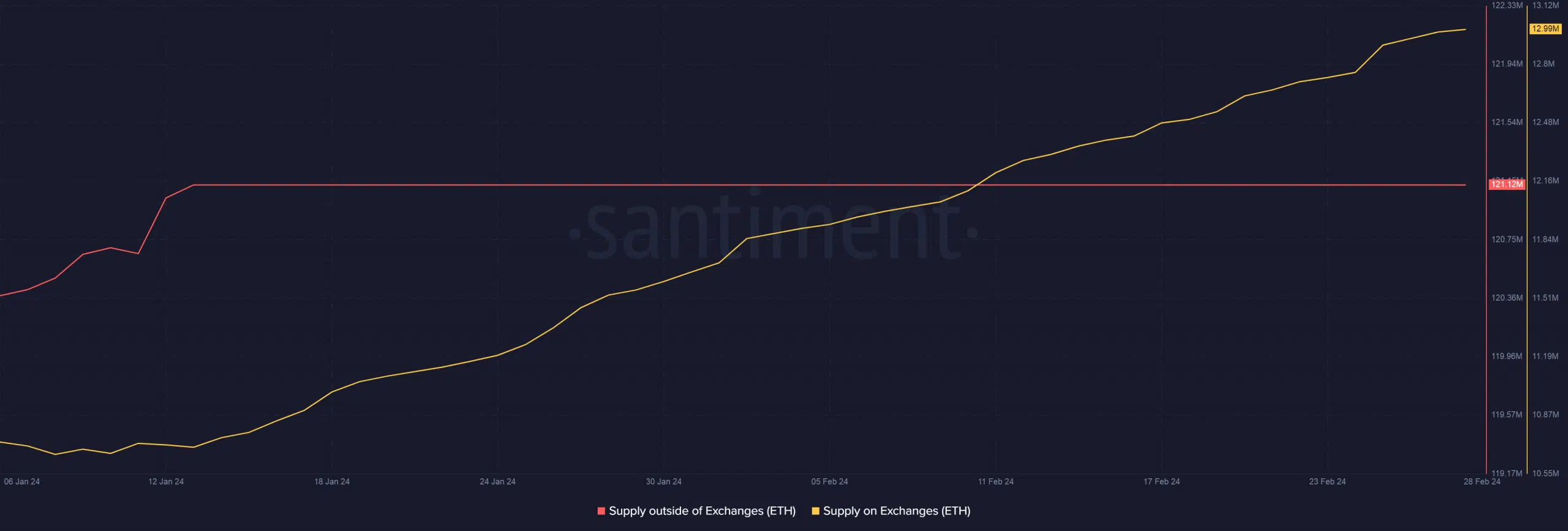

The entire quantity of ETH on exchanges has elevated steadily for the reason that begin of 2024, whereas the availability outdoors has plateaued. That is typically interpreted as rise in short-term promote stress. Such corrections may be an excellent time to purchase the dip.

Is your portfolio inexperienced? Try the ETH Revenue Calculator

All prepared for Dencun

That being mentioned, with sturdy bullish catalysts to comply with, ETH supporters had been assured of an prolonged bull market.

One amongst these was the hugely-anticipated Dencun Improve, supposed to decreased transaction charges on layer-2 (L2) chains. In accordance with a current weblog put up by Ethereum Foundation, the improve was activated on all testnets, and was set for mainnet launch on thirteenth March .