SawitreeLyaon/iStock by way of Getty Photographs

Written by Nick Ackerman.

Traders are available all differing types; the broader classifications appear to be “progress” or “earnings” buyers. Even throughout the earnings group, there are going to be different forms of buyers, akin to dividend progress investments or simply these searching for excessive yields.

I lean in the direction of an earnings strategy reasonably than progress. Nevertheless, that does not imply I solely chase no matter is a high-yielding funding selection. Whereas I’ve a high-yield sleeve of investments, I additionally have a look at dividend progress names.

Dividend progress buyers may very well be thought of a kind of center floor between the expansion and earnings classifications as nicely. Dividend progress buyers typically search for shares which are rising their dividend, and that is typically fueled by the expansion of the underlying earnings within the enterprise. A few names that match this grouping may very well be names like Microsoft (MSFT) or Mastercard (MA).

As we speak, I wished to take a look at a few faster-growing dividend funding choices which are value happening the watchlist. These are names that do not essentially have the best yields now, however the place they carry in a decrease yield, they will make up for sooner potential progress going ahead.

We usually do a month-to-month publication of excessive dividend yield shares with constant progress. On this, I wished to search for the reverse, sooner growers even when the yield itself was smaller.

The preliminary screening parameters that I had included to get an preliminary checklist was dividend progress over the past 5 years of no less than 10%. The subsequent was taking a look at constant growers, the place they needed to have no less than a decade of dividend progress underneath their belt. There have been a complete of 113 left at that time, which I sorted by these with the best dividend progress previously 5 years for probably the most aggressive growers.

There have been undoubtedly some new and fascinating names that I had not been conscious of, which I imagine is the entire level of screening for shares within the first place: to seek out these names that you just would not sometimes run throughout however may advantage consideration. Listed below are the couple that I assumed have been fascinating based mostly on constant dividend progress previously but additionally anticipated progress going ahead.

Primerica, Inc. (NYSE:PRI)

PRI is a monetary firm that operates primarily as a time period life insurance coverage firm, however the firm additionally gives funding and financial savings merchandise, in addition to a senior well being phase of its enterprise. Lastly, additionally they have a “company and different distributed merchandise phase.” The corporate would at present be thought of a mid-cap inventory with its roughly $7.21 billion market cap.

The life insurance coverage phase is their largest in terms of revenue and one the place they boast a 138,000 “life-insurance licensed gross sales power.” From 2020 to 2021 year-end, there was a slight dip in licensed gross sales power members, however they have been rising steadily since. Their newest quarter confirmed that they grew their consultant depend by 10% year-over-year.

Although it must be talked about that Primerica has been described as a multi-level advertising as they’ve completely different tiers of representatives and recruiters. That being mentioned, they promote professional monetary merchandise, so I will be attempting to stay to the information by way of their fundamentals.

Rising the variety of representatives is not simply including to the uncooked gross sales power by way of progress for this firm both. Every consultant was extra productive as nicely. The variety of insurance coverage insurance policies grew 9% YoY, and the quantity of time period life insurance policies additionally grew considerably by 16% YoY as nicely.

PRI Manufacturing Metrics (Primerica)

Everyone knows that insurance coverage premiums hardly ever, if ever, go down. This will imply that investing in an insurance coverage firm could be a good hedge towards inflation if that’s nonetheless a fear on some buyers’ minds.

That is mirrored by the corporate’s earnings progress over time. They’ve been very constant, with solely a slight journey in 2022. Nevertheless, the expansion expectations going ahead would make up for this slight decline after which some to supply a strong development of upward progress to proceed.

PRI EPS Progress and Projections with Share Value Overlay (Portfolio Perception)

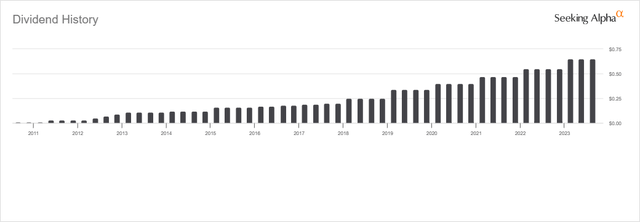

It’s this kind of consistency that has pushed PRI to 12 years of dividend progress, with the final 5 years of dividend progress sporting a median of 21.96% will increase. Equally spectacular is the corporate, over the past decade, has seen the CAGR of the dividend coming in at 19.53%.

So this fast dividend progress is not one thing that simply occurred within the final a number of years however has been happening for a decade now, backed by the corporate’s fast clip of strong earnings progress.

PRI Dividend Historical past (Looking for Alpha)

Even with this spectacular progress, the EPS payout ratio comes to only 16.5% based mostly on the most recent ahead estimated EPS. When it comes to FCF per share, this firm simply gushes money too.

PRI FCF, EPS and Dividends (Portfolio Perception)

Then again, that is the place the present yield of 1.3% based mostly on the most recent dividend may not seem spectacular to some earnings buyers with a extra high-yield focus. This looks like an ideal candidate for a dividend progress portfolio, the place an investor can anticipate a robust chance that this progress can proceed based mostly on the most recent estimates, and probably, we’d even anticipate some share worth appreciation over the long run.

Regardless of this spectacular file, PRI may truly be thought of low-cost at present. The inventory is buying and selling beneath its longer-term historic P/E vary with its 12.80x P/E.

PRI Truthful Worth Vary (Portfolio Perception)

This a number of is definitely nicely beneath the S&P 500’s personal P/E ratio of round 20x, which PRI has been capable of dominate handily by way of complete returns.

PRI Complete Returns Relative to the S&P 500 Index (Portfolio Perception)

Consolation Techniques USA (NYSE:FIX)

FIX is an industrial inventory that’s described in its corporate profile as,

composed of greater than 43 working firms in roughly 173 places throughout the USA. We’re a number one constructing and repair supplier for mechanical, electrical, modular, and plumbing constructing methods.

This firm can be a mid-cap inventory with its roughly $6.67 billion market cap.

New development for the corporate counts as the most important slice of the activity pie whereas current constructing development is not too far behind.

FIX Income Breakdown (Consolation Techniques USA)

Whereas the corporate is an industrial inventory and one that’s targeted on development and engineering, it could be protected to imagine it may very well be fairly delicate to present financial situations. In a softer financial system, we would naturally assume that development can be approach down, and due to this fact, the corporate’s earnings must be approach down.

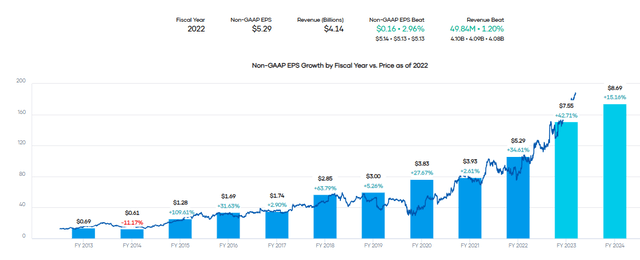

Nevertheless, if we have been to take a look at the historic earnings of this firm, they have not been risky in any respect. The truth is, they’ve put up spectacular earnings progress and are anticipated to proceed this development going ahead over the following couple of years.

Regardless of this constant earnings progress, we have now seen no less than the share worth of the inventory change into risky throughout unsure intervals, going towards the basics. That is typically the place alternatives exist, throughout these occasions of panic when the share worth loses sight of the basics.

FIX EPS Progress and Projections with Share Value Overlay (Portfolio Perception)

As I mentioned, that is searching for potential names to incorporate on the watchlist. Which I imagine is the place FIX can be probably the most acceptable. As we will see within the above graph, the businesses’ share worth has been on an absolute explosion larger. That has pushed the corporate to commerce nicely above its longer-term historic P/E vary.

FIX Truthful Worth Estimate (Portfolio Perception)

Maybe that is justifiable given the anticipated earnings progress this yr, however I do suspect the following recession – even when it would not materially influence the corporate’s earnings and we nonetheless see progress – will see the share worth react fairly negatively as we have seen traditionally.

Paying up a bit for progress is okay in some circumstances, however we do not wish to get too carried away, and one thing like PRI above gives an affordable entry at the moment with out having to pay up. So, there are alternate options that exist to spend money on now whereas being affected person for others to come back down.

FIX piqued my curiosity, and I wished to incorporate it in right this moment’s write-up, even whether it is too costly to personal proper now. It additionally not solely suits the factors above however then some because it, in more moderen years, has been upping the dividend on a quarterly foundation.

FIX Dividend Historical past (Looking for Alpha)

FIX has seen a 5-year dividend progress of 18.95%. The expansion within the dividend over the past decade was a bit slower at a CAGR of 13.85%, however rising, nonetheless. The beginning yield right here is 0.48%, which, if an investor waits for the following downturn, may very doubtless see a probably larger beginning yield as a reward for being affected person.

Along with that, the corporate has additionally been paying a dividend constantly for 17 years. That implies that even throughout the international monetary disaster, they have been paying buyers; actually, they nonetheless bumped up their payout in that interval, too.

As one would think about, with the spectacular earnings progress, the payout ratio for this firm at shy of 12% additionally leaves loads of room to gasoline additional progress into the long run. The corporate, much like PRI, gushes FCF as nicely.

FIX FCF, EPS and Dividends (Portfolio Perception)

Conclusion

PRI and FIX are two names displaying explosive earnings progress that has led to fast progress of their dividends. They’re additionally anticipated to proceed to develop their earnings at a wholesome clip going ahead, which may result in but additional dividend progress. Right now, PRI looks like it is a purchase at or close to these ranges.

For FIX, I believe we must be a bit extra affected person as we have seen traditionally the share worth make some main strikes. The inventory has almost doubled over the past yr, so actually, this has been a brisk ascent throughout a brief time period. If historical past is any information, at sub-$160, we may begin to take into account this title.