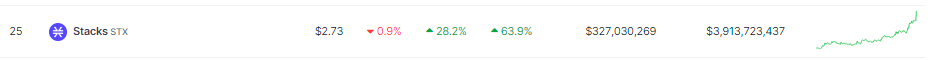

Stacks (STX), a cryptocurrency facilitating sensible contracts on the Bitcoin blockchain, has defied broader market turbulence to emerge as a standout performer. Over the previous week, STX price skyrocketed over 60%, reaching a nine-day excessive of $2.15 and flirting with its all-time peak of $2.45. This spectacular rally has propelled Stacks into the highest 25 cryptocurrencies by market cap, leaving many questioning: what’s driving the surge?

Stacks (STX) Climbs Over 60% On Again Of Bitcoin Ascent

A number of elements seem like fueling Stacks’ ascent. Firstly, its distinctive capability to deliver sensible contract performance to Bitcoin resonates with buyers in search of superior functions on the world’s oldest blockchain. In contrast to Ethereum, Bitcoin inherently lacks assist for sensible contracts, limiting its DeFi and NFT capabilities.

Supply: Coingecko

Stacks bridges this hole by anchoring itself to Bitcoin whereas providing sensible contract options. This modern strategy has garnered vital consideration, notably as Bitcoin itself enjoys a current worth appreciation, reaching more than $52,000 on the time of writing.

The correlation between Stacks and Bitcoin is simple. Each property noticed pronounced recoveries in February’s second week, with STX mirroring Bitcoin’s climb from $38,500 to $50,000. This intertwined destiny highlights the affect of Bitcoin’s broader sentiment on Stacks’ worth motion.

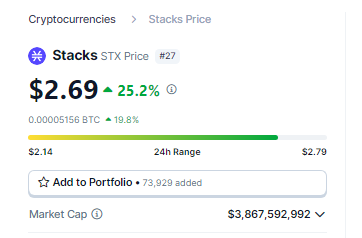

STXUSDT buying and selling at $2.69 the 24-hour chart: TradingView.com

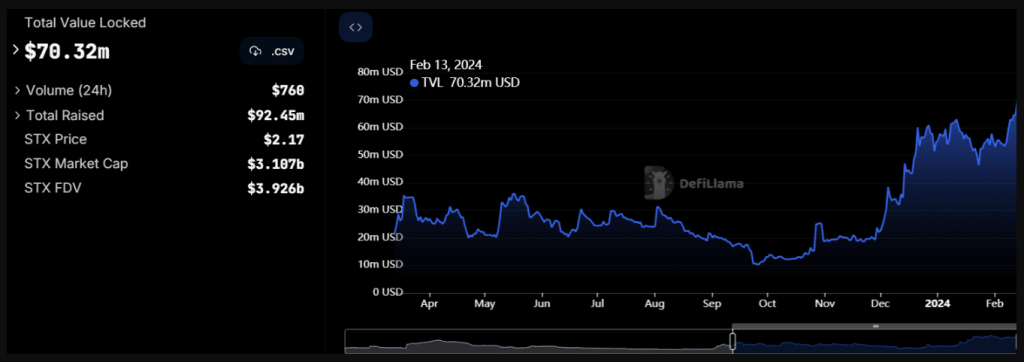

STX Will get Enhance On Hovering TVL

Past worth actions, one other bullish indicator emerges from Stacks’ DeFi ecosystem. In accordance with DefiLlama, the overall worth locked (TVL) inside Stacks’ DeFi protocols has surged over 50% within the final three weeks, reaching $70.21 million. This development signifies rising investor confidence and lively capital dedication inside the Stacks DeFi panorama.

Technical evaluation additional amplifies the optimistic outlook. Analysts predict a possible continuation of the rally, with worth targets starting from $2.475 to $2.82. This bullish forecast hinges on STX breaching the current swing excessive resistance of $2.06, a decisive technical milestone achieved earlier this week.

Stacks Whole Worth Locked. Supply: Defillama

.@Stacks has gone from round #60 ranked coin market cap to #34 in a yr, passing many family names in the identical

Anticipate it to enter high 20 across the halving as Bitcoin L2 narratives begin dominating the discourse and L1 community charges attain new all-time-highs

As we go into…

— trevor.btc — b/acc (@TO) February 12, 2024

Nevertheless, it’s essential to acknowledge the inherent volatility of the cryptocurrency market. Latest US inflation information triggered a sell-off throughout your entire market, reminding buyers of the unpredictable nature of this asset class. Whereas Stacks managed to get better quickly, the episode underscores the significance of accountable funding practices and thorough danger evaluation.

Regardless of the dangers, Stacks’ distinctive worth proposition and up to date momentum can’t be ignored. Its capability to attach the sensible contract performance of Ethereum with the safety and immutability of Bitcoin positions it as a doubtlessly disruptive power within the blockchain area.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal danger.