Authored by Charles Hugh Smith via OfTwoMinds blog,

There are not any extra “saves” out there for the subsequent market meltdown.

The previous 24 years could be seen as an period during which danger declined as a result of dynamics of globalization and financialization.

The ascent of China as “workshop of the world” generated a deflationary wave of decrease costs for merchandise (resulting from decrease labor prices and decrease high quality parts) that blunted the inflationary impression of the worldwide economies including $150 trillion in debt since 2000. Global debt, public and private, now tops $315 trillion, 333% of global GDP.

Absent the deflationary impression of globalization, this huge enhance in cash sloshing round would have sparked inflation. Absent the huge enlargement of cash by way of financialization, the enlargement of manufacturing and consumption enabled by globalization couldn’t have occurred.

On the similar time, central banks coordinated insurance policies to steadily scale back rates of interest, reaching successfully zero or detrimental charges (when adjusted for inflation) in 2009 and past. This discount of charges far beneath historic norms enabled collectors to borrow extra at the same time as their debt service prices fell.

Financialization vastly elevated leverage and the commodification of credit score/debt, enabling emerging-market nations and enterprises and shoppers globally to extend their borrowing/spending.

Globalization generated incentives for nations and their central banks to “play good” and cooperate with different governments and banks to spur worthwhile (and fortunately deflationary) commerce. These coordinated efforts enabled the worldwide economic system to keep away from the possibly deadly disruptions of the World Monetary Disaster (GFC) in 2008-09.

Regardless of localized droughts and excessive climate, international meals manufacturing elevated by increasing land in manufacturing and intensifying agricultural strategies.

All of those risk-reducing tendencies are reversing or reaching diminishing returns.

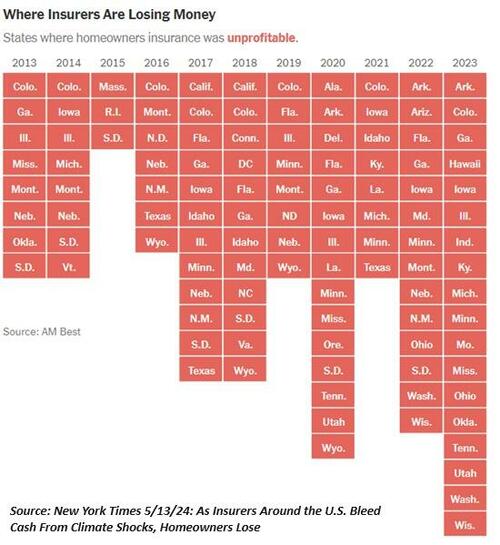

Excessive climate occasions are growing, resulting in huge losses by insurers, a development described in As Insurers Around the U.S. Bleed Cash From Climate Shocks, Homeowners Lose (New York Occasions)(seechart beneath):

“In 2023, insurers misplaced cash on owners protection in 18 states, greater than a 3rd of the nation, based on a New York Occasions evaluation of newly out there monetary knowledge. That is up from 12 states 5 years in the past, and eight states in 2013. The result’s that insurance coverage firms are elevating premiums by as a lot as 50 % or extra, chopping again on protection or leaving complete states altogether. Nationally, during the last decade, insurers paid out extra in claims than they obtained in premiums, based on the rankings agency Moody’s, and people losses are growing.

The rising tumult is affecting folks whose houses have by no means been broken and who’ve dutifully paid their premiums, yr after yr. Cancellation notices have left them scrambling to search out protection to guard what is commonly their single greatest funding. As a final resort, many are ending up in high-risk insurance coverage swimming pools created by states which might be backed by the general public and provide much less protection than customary insurance policies. By and enormous, state regulators lack methods to revive stability to the market.”

A lot of the rising value is a results of international insurance coverage losses, which enhance the reinsurance charges insurers should pay to cowl the dangers of maximum occasions producing excessive losses that push insurers into chapter 11. Hawaii insurance chief doesn’t see carrier exit as costs rise:

Reinsurance is one thing insurance coverage firms purchase to cowl extraordinary losses, and it’s a part of a coverage’s value. This reinsurance value, which is tied to the worldwide insurance coverage trade, has elevated 20% to 50% yearly in the course of the previous a number of years, based on Ito.

“The fee to insure houses or condos goes up due to this great surge within the reinsurance prices,” he stated.

Ito stated there have been 23 climate-related disasters in america in 2023 that induced at the very least $1 billion in losses, and that in 5 of the previous six years, the reinsurance trade incurred losses of over $100 billion worldwide.

“Reinsurance is worldwide,” he stated. “Occasions that occur in Europe, or in Asia, or in Kansas, or in Florida, all impression the price of reinsurance that insurers pay no matter the place they write enterprise.”

The rising prices of insurance coverage mirror a important dynamic of danger: in a tightly sure, interconnected international system of finance and commerce, dangers arising anyplace within the system enhance prices and dangers all through the system.

That is the draw back of accelerating our dependence on tightly sure international techniques to decrease costs: disruptions and danger now unfold quickly to each node and participant within the international system: occasions far-off set off the cancellation of your insurance coverage coverage or an astounding enhance in its value.

What had been helpful within the low-risk development section–increasing dependence on international capital and commerce flows to decrease costs and enhance borrowing–at the moment are sources of rising danger–risk that can not be totally hedged at the same time as the price of hedges comparable to insurance coverage rise sharply.

Let’s contemplate the opposite dynamics turning a low-risk period into an unstable, high-risk period.

Our start line in an examination of danger is the character of the worldwide system we’re depending on / embedded in. The dominant financial mannequin on this system is “the market,” an idealized assemble during which consumers and sellers “uncover the worth” of every little thing from currencies, danger, items, providers, labor and capital, and any scarcities are crammed by new manufacturing (as folks rush to reap increased income by increasing manufacturing) or substitution (beef too costly? Exchange it with rooster).

This assemble creates a contented phantasm: the system operates as a closed system during which all of the shifting components are seen and measurable. This creates the phantasm that the system is inherently self-correcting and due to this fact steady, as consumers, sellers, producers and shoppers all pursuing their very own self-interests will keep what’s generally known as dynamic equilibrium: costs might spike or collapse for a short while, however the system will rapidly adapt and equilibrium shall be restored.

The true world will not be a closed system during which all of the shifting components are seen and measurable. The true world is an open system working not solely by the pursuit of self-interest however by pure choice unguided by any objective or vacation spot.

We presume “Progress” has an inherently upward trajectory: every little thing inevitably will get higher as expertise advances. In different phrases, we view the dynamics of historical past and Nature as teleological: they’re on a path heading towards a objective.

It is a misunderstanding of Nature. Pure choice has no objective. If exterior adjustments disrupt an ecosystem, some species could also be worn out. From their standpoint, this was not inevitable progress towards a objective.

The tightly interconnected international system is akin to an ecosystem. It’s an unpredictable, unstable open system, not a predictable, steady market. Exterior occasions can result in scarcities for which there are not any substitutes or will increase in manufacturing, and irreplaceable hyperlinks could be damaged, collapsing the system past restore.

When the Vandals wrested the North African wheat manufacturing away from Roman management, the Roman Empire misplaced the first meals supply feeding the half-million residents of Rome, a lot of whom had been granted a free bread stipend–hence the time period “bread and circuses.”

Since there was no substitute for this misplaced wheat, and the residents grew little or no meals themselves, the consequence was the collapse of your entire construction. (There have been different elements, in fact, such because the unaffordable value of sustaining a paid mercenary navy, pandemics, and many others.–what we now name a polycrisis.)

The purpose right here is danger is commonly hidden in techniques which might be steady for lengthy durations of time. It is not non-existent; it’s merely out of sight. This situations us to consider that the system is self-correcting, and so we turn out to be complacent.

A current instance of that is the best way the Federal Reserve and different central banks have “saved” the inventory market each time it stumbled for the previous 15 years, for the reason that World Monetary Disaster of 2008-09. We’re now conditioned to “purchase the dip” as a result of each time the market dips, the banks leap into motion and markets soar to new highs. That is like clockwork, and so solely fools doubt that the subsequent dip may also be “saved” and markets will as soon as once more soar to new heights.

Within the context of world danger, “shopping for the dip” seems to be low danger. However this conditioning / complacency overlooks the truth that China “saved the worldwide monetary system” by quickly increasing its personal debt load, what we name “leveraging up” debt, very similar to a home-owner with a modest mortgage and loads of dwelling fairness can borrow towards that fairness, leveraging the collateral into a lot increased debt masses.

China is now mired in the identical slow-growth, over-indebted, property-bubble, rising inflation, decaying international commerce surroundings as each different nation which precludes it “saving the world” once more.

Now that the deflationary impulse of rising international commerce has reversed, there’s nothing to counter the inflationary pressures generated by the decay of globalization and financialization: rates of interest can’t be pushed again right down to zero, as that can solely enhance inflationary forces. Since collateral has already been “levered up,” there is not any extra pool of collateral to help a brand new credit score bubble.

Ought to central banks try and “save the market” by dropping rates of interest to zero, that will not enhance borrowing and spending as a result of the system is already over-levered: staggeringly giant sums of debt are already unsupported by collateral, for instance, business actual property within the U.S.: buildings that bought for $200 million a couple of years in the past at the moment are getting into foreclosures and being auctioned off for $10 million or much less. The underlying worth of the property–the collateral supporting the loan–has collapsed.

In different phrases, there are not any extra “saves” out there for the subsequent market meltdown.

One other systemic supply of danger was described by Benoit Mandelbrot in his e-book The (Mis)Behavior of Markets. (The e-book’s unique 2004 subtitle was “a fractal view of danger, break, and reward.” The present version’s subtitle is “A Fractal View of Monetary Turbulence.” I desire the unique subtitle, which is extra to the purpose: danger and break.)

Within the typical view of danger / portfolio administration, “100-year floods” happen, effectively, each 100 years or so. This danger of such a devastating catastrophe occurring in anybody yr is thus low.

However as Mandelbrot defined, these catastrophic floods do not happen each 100 years–they happen each 5 years or so, because the mathematical fashions used to ascribe danger are deeply flawed. Nature is fractal, and thus susceptible to sudden instability.

Nassim Taleb explored the character of unpredictable/inconceivable danger in his e-book The Black Swan: The Impact of the Highly Improbable.

The many years of relative stability between 2000 and 2020 conditioned us to complacently consider the worldwide system was now so sturdy and our stabilizing establishments (central banks) so highly effective that danger was if not banished, manageable and might be readily hedged.

This isn’t life like, and so we’re ill-prepared for shocks to the system that fatally destabilize commerce and capital flows we assume are completely dynamically steady, i.e. any spot of hassle shall be corrected by one establishment or one other.

One other systemic supply of danger is the thinning of systemic buffers will not be seen. In different phrases, the rising danger of instability is invisible to us so long as the system seems to be functioning usually. So we’re shocked when fisheries collapse, floor water dries up, monetary techniques implode, and so forth, as a result of every little thing gave the impression to be roughly the identical.

We are able to view the human physique as a metaphor for the best way a system makes an attempt to take care of homeostasis / equilibrium, however the effort required overtaxes the techniques tasked with correcting / rebalancing your entire system. The person feels “regular” and has no consciousness of rising danger till they expertise a cardiac arrest or their metabolic dysfunction strikes them down.

Danger is slowly being repriced globally, as prices rise and commerce and capital dependencies undercut stability. What we at present view as predictable closed techniques shall be revealed as unpredictable and probably destabilized open techniques that can not be restored to earlier types of stability.

How will we function in a world during which danger can’t be totally hedged, and apparently small occasions can collapse important techniques on which we’re dependent? Step one is to put aside conditioning that results in complacency and false assumptions of security / stability. The second step is to mitigate danger earlier than it rises up like a tsunami: scale back debt, publicity to monetary dangers, scale back our dependency on international, tightly sure interconnected techniques, transfer to locations with a range of necessities, and spend money on our personal self-reliance. I wrote my e-book Self-Reliance in the 21st Century as a basic information to this de-risking course of

* * *

It is a pattern essay from my Weekly Musings Experiences despatched solely to subscribers, patrons and Substack subscribers. Thanks very a lot for supporting my work.

Become a $3/month patron of my work via patreon.com. Subscribe to my Substack for free

Loading…