- Polygon’s income fell in Q1.

- This occurred regardless of the expansion in its community utilization throughout that interval.

In a brand new report, Messari discovered that Layer-2 scaling platform Polygon [MATIC] recorded a decline in quarterly income between January and March.

In keeping with the on-chain information supplier, the income decline occurred regardless of the uptick in Polygon’s community exercise throughout the interval below assessment.

Between 1st January and thirty first March, the community’s income totaled $7 million, representing a 19.3% decline from the $10 million recorded within the final quarter of 2023.

Q1’s determine additionally marked a 42% lower from the $12 million Polygon noticed in quarterly income in Q1 2023.

Surge in community exercise

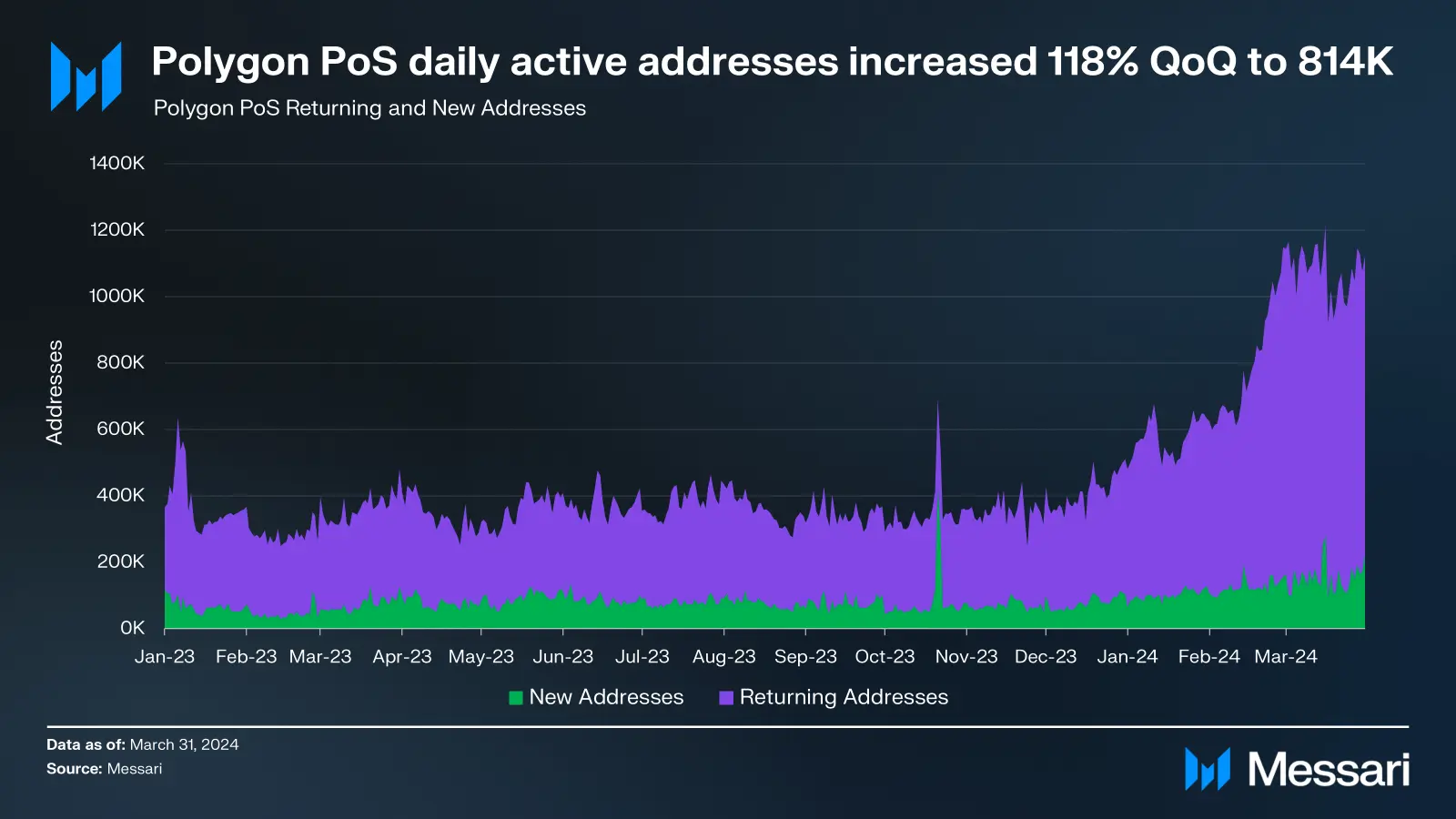

As highlighted above, the quarter below assessment was marked by an uptick in exercise. Throughout that interval, the community recorded a median day by day lively handle rely of 814,000.

In keeping with Messari’s information, this was a 118% spike in quarterly day by day lively addresses on the community, marking its highest over a 12-month interval.

Supply: Messari

New demand for Polygon additionally elevated. Through the quarter below assessment, the common variety of new addresses that have been created on the L2 community was 127,400, marking a 69% development from the earlier quarter’s 75,900.

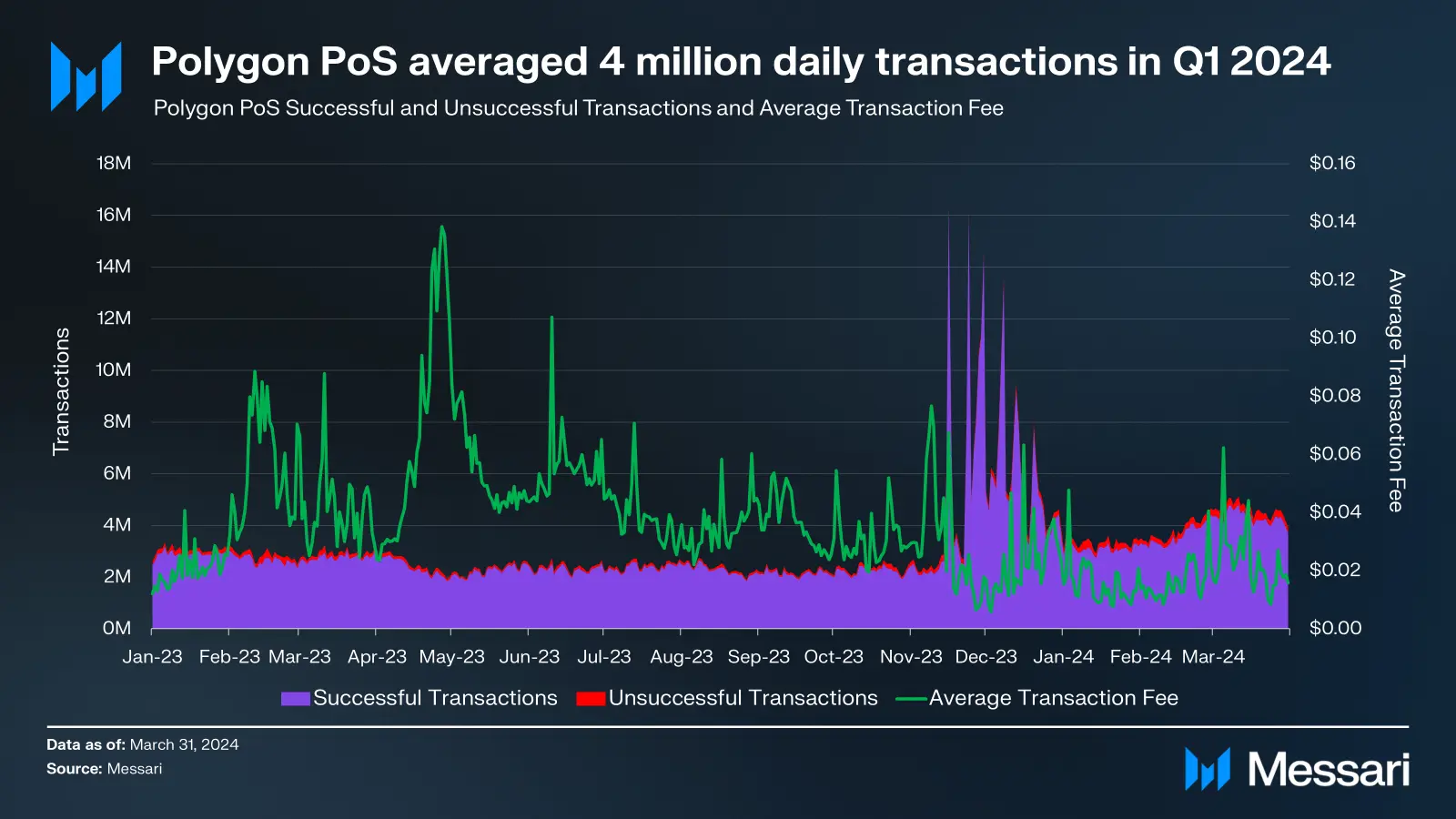

As a result of rise within the variety of lively addresses that frequented Polygon in Q1, the variety of transactions accomplished on it additionally skyrocketed. Per the report, the proof-of-stake (PoS) community averaged 4 million day by day transactions in Q1 2024.

Supply: Messari

Concerning the community’s decentralized finance (DeFi) vertical, Polygon closed Q1 with a complete worth locked (TVL) of $1.4 billion. This was a 30% leap from its Q3 2023 DeFi TVL of $1.1 billion.

Sensible or not, right here’s MATIC’s market cap in ETH phrases

On how the DeFi protocols housed inside Polygon fared throughout the quarter in assessment, Messari famous:

“In Q1 2024, Aave continued to guide because the dominant protocol by TVL on Polygon PoS, with its TVL rising to $705 million, marking a 35% enhance from the earlier quarter. Uniswap jumped to the second place, with its TVL reaching $130 million, up 41% QoQ.”

Lastly, Polygon’s non-fungible tokens (NFTs) ecosystem noticed an 18.4% spike in gross sales quantity within the first three months of the yr.