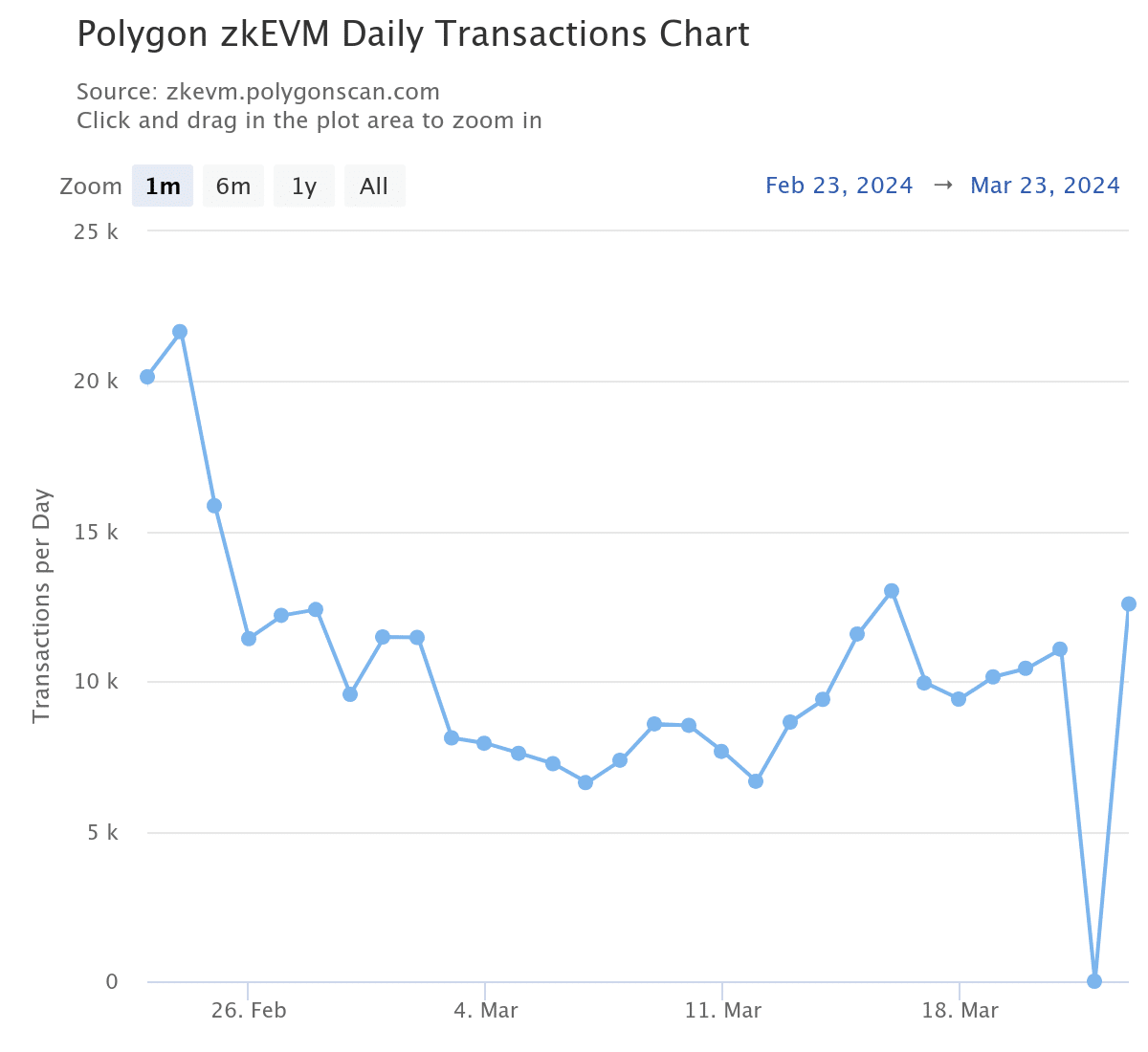

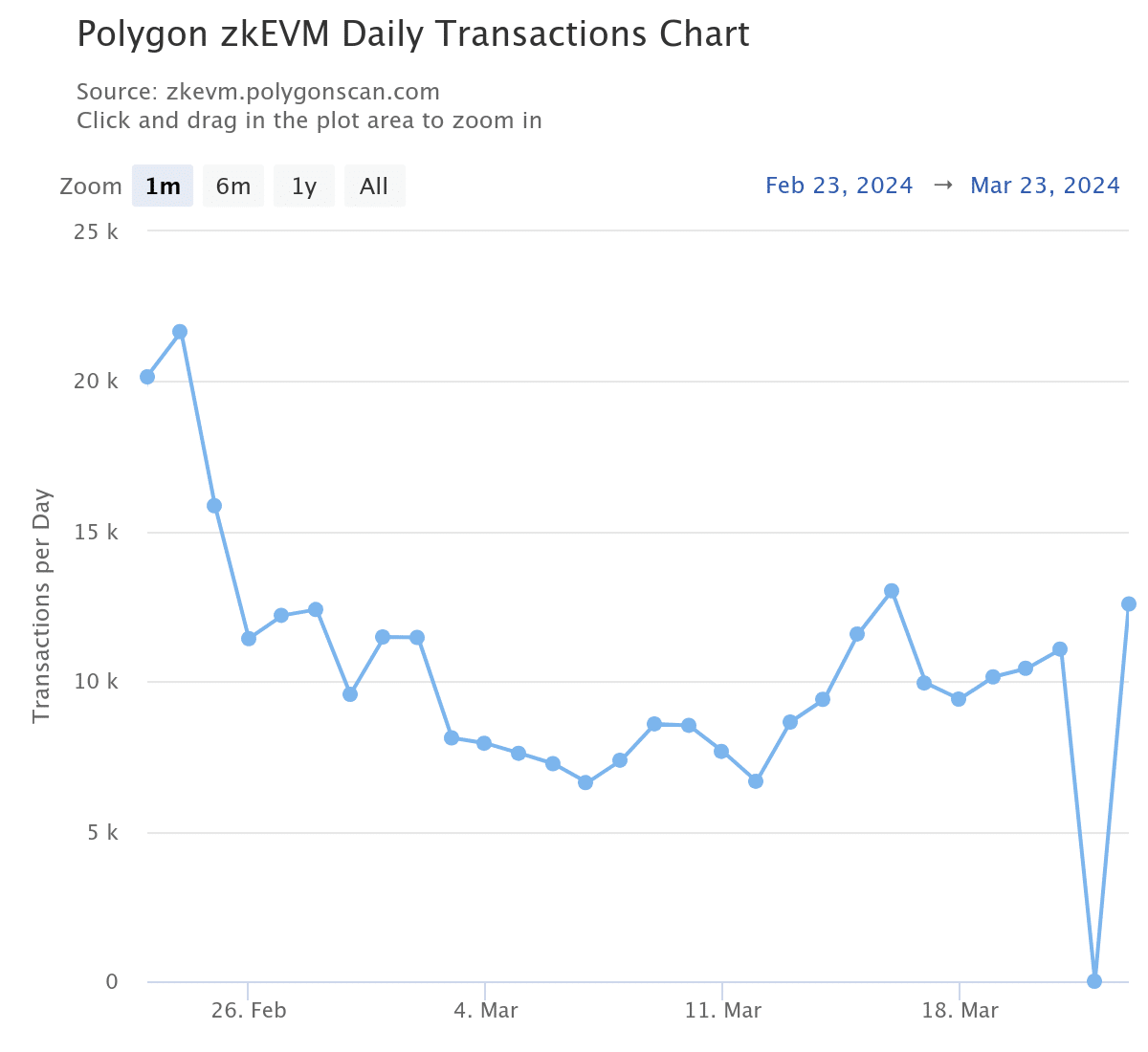

- Each day transactions on Polygon zkEVM bounced again to over 12k on the twenty fourth of March.

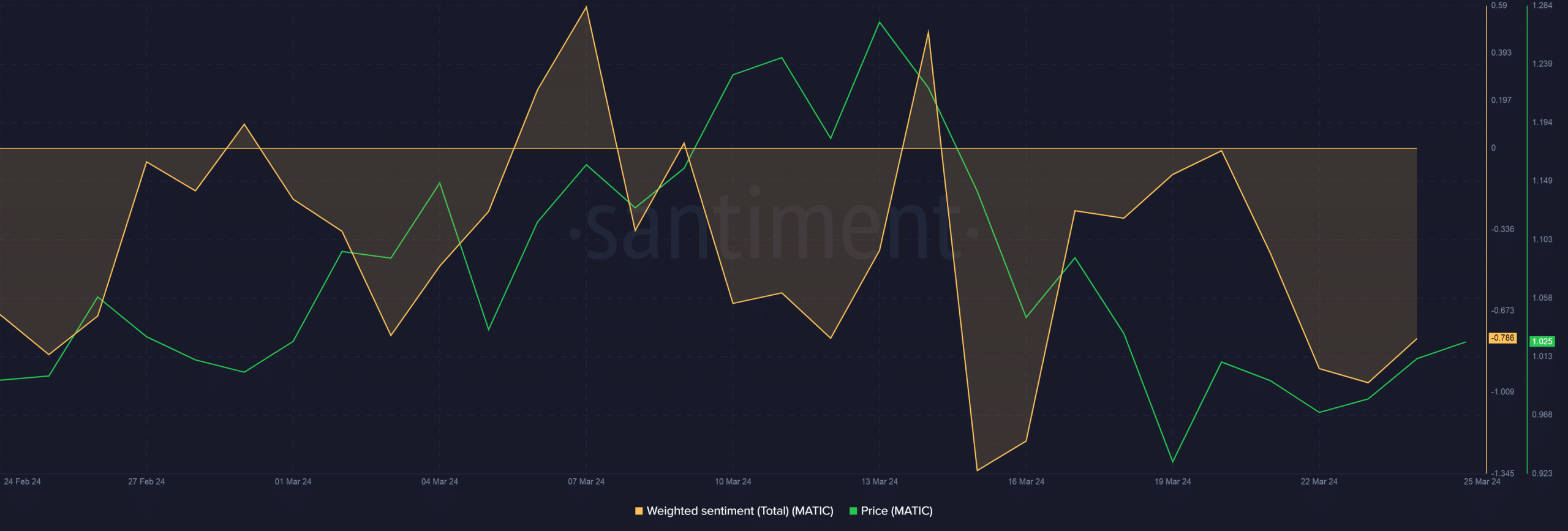

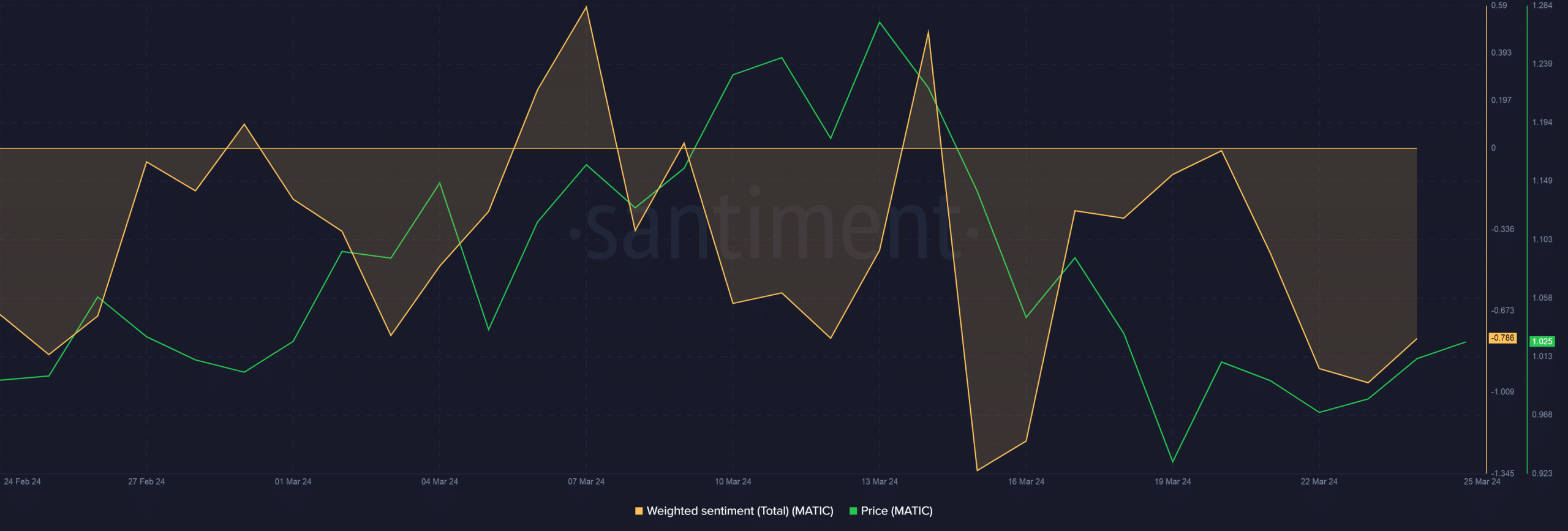

- MATIC gained some constructive momentum on zkEVM’s decision.

Polygon [MATIC] zkEVM resumed operations after builders mounted the bug that left the zero-knowledge (zk) rollup non-operational for a lot of the twenty third of March.

Again to normalcy

In response to the replace supplied by Polygon Labs, an emergency state was activated, permitting builders to rapidly examine and resolve the issue.

After the repair, layer-1 (L1) settlement on Polygon zkEVM resumed like earlier than. The emergency state was deactivated after the repair was issued.

Polygon Labs — which spearheads the event and progress of the broader Polygon ecosystem — promised an in depth autopsy of your entire episode early subsequent week.

It reiterated that the difficulty was restricted to only Polygon zkEVM and didn’t affect Polygon proof-of-stake (PoS) chain, or every other chains within the ecosystem.

The zk rollup skilled a big downtime attributable to a problem with its blockchain sequencer.

For the uninitiated, a sequencer lies on the coronary heart of L2 operations, batching transactions collectively earlier than delivery them to the Ethereum base layer for ultimate settlement.

The bug halted block manufacturing, thereby disrupting the stream of transactions altogether.

Nonetheless, newest knowledge scanned by AMBCrypto indicated that normalcy has returned to the community.

Each day transactions on the scaling resolution bounced again to over 12k on the twenty fourth of March, in response to Polygon zkEVM Explorer.

Supply: Polygon zkEVM Explorer

Polygon zkEVM’s stall comes following outages in different main good contracts chains currently.

Final month, Solana’s [SOL] and Avalanche [AVAX] suffered community paralysis, rendering the 2 unusable for a substantial interval.

How did MATIC reply?

In the meantime, the ecosystem’s native token, MATIC, gained some constructive momentum on zkEVM’s decision, rising 3.75% within the final 24 hours, per CoinMarketCap.

Learn Polygon’s [MATIC] Worth Prediction 2024-25

Nonetheless, traders remained pessimistic, as mirrored by the adverse Weighted Sentiment indicator.

Supply: Santiment

The asset misplaced 5% of its worth prior to now week, consistent with the broader market pattern. Its month-to-month efficiency, nonetheless, paled compared to different main cryptos with related attraction.