- DOT appeared unable to interrupt via the important thing $7 resistance

- Ichimoku Cloud and its alignment with the double-top sample signaled additional declines

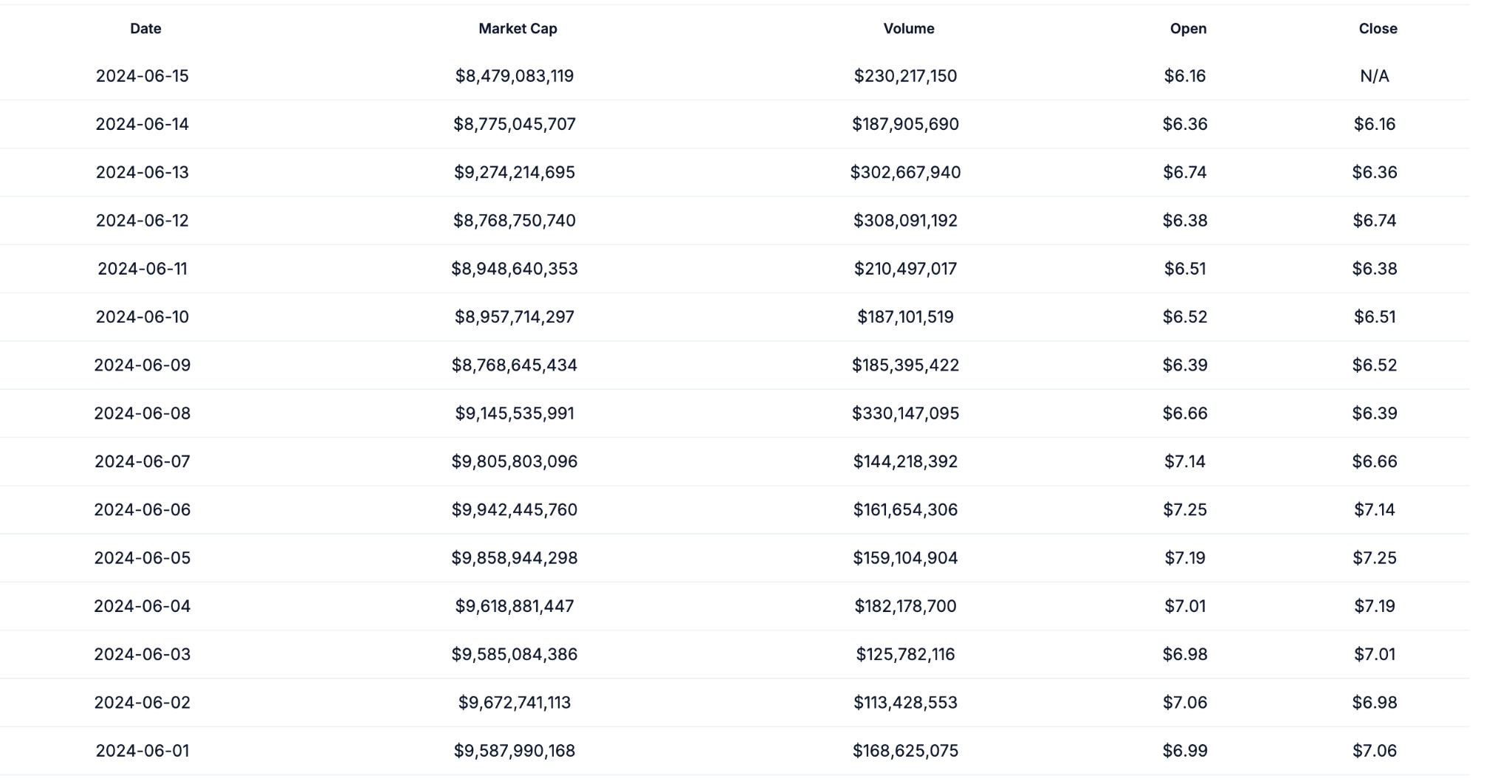

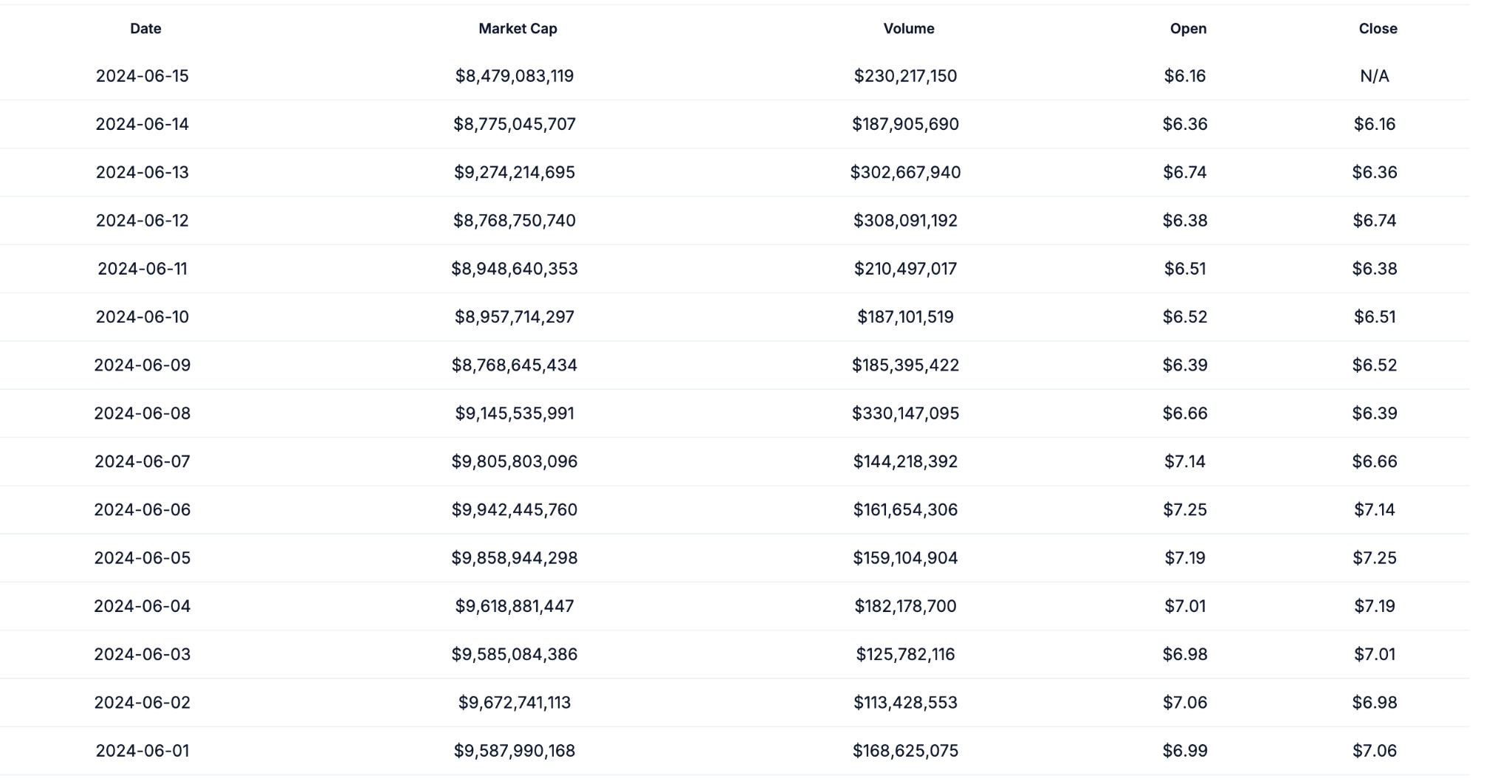

Polkadot (DOT) is grappling with intense stress from the market’s bears after failing to breach the important thing resistance stage of $7. The truth is, over the past 14 days, DOT’s worth has fluctuated between a excessive of $7.25 and a low of $6.16 on the charts.

Supply: CoinGecko

Regardless of repeated makes an attempt to breach its speedy resistance stage, DOT appeared to retreat to its press time stage of $6.2, elevating buyers’ considerations about additional declines.

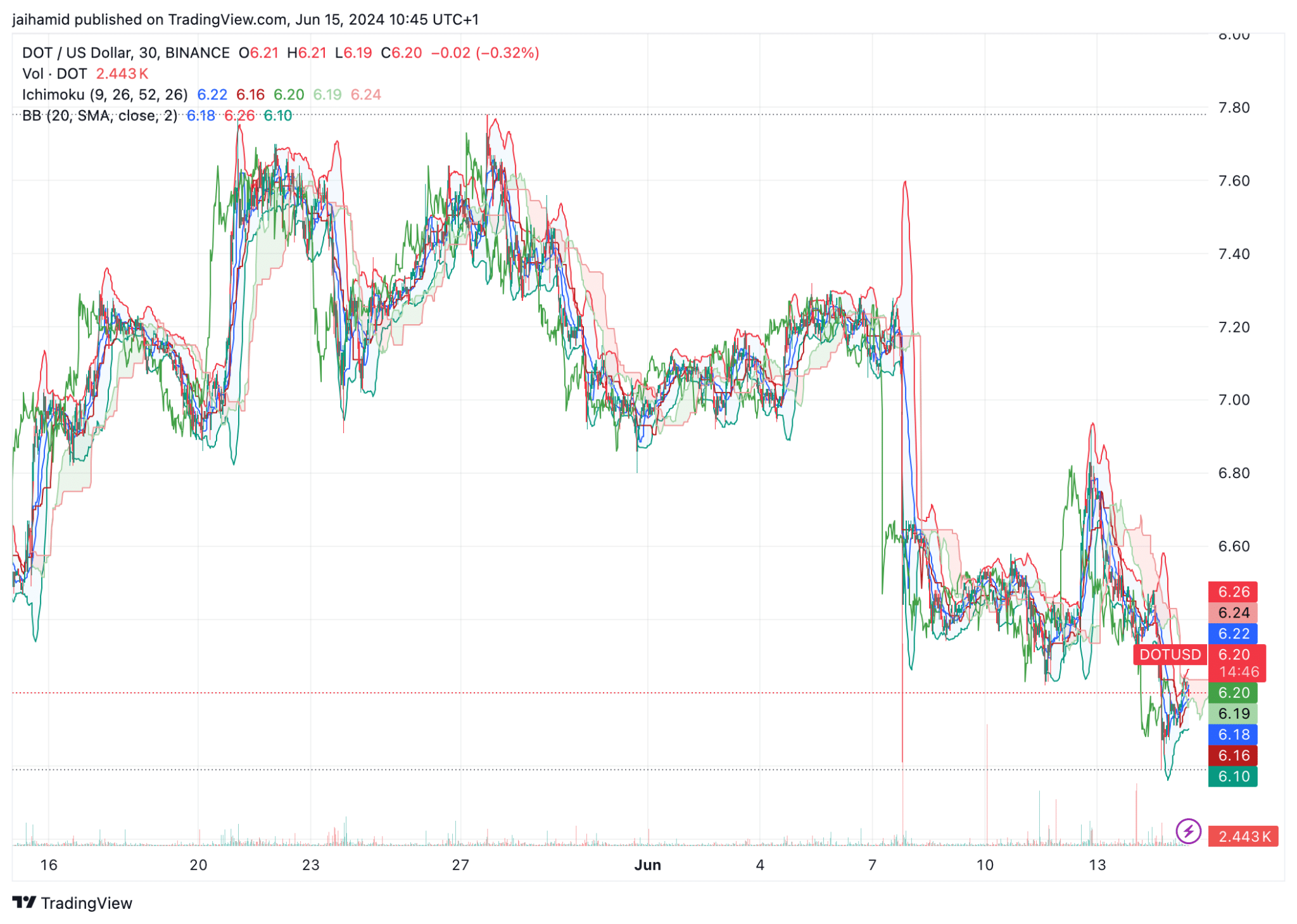

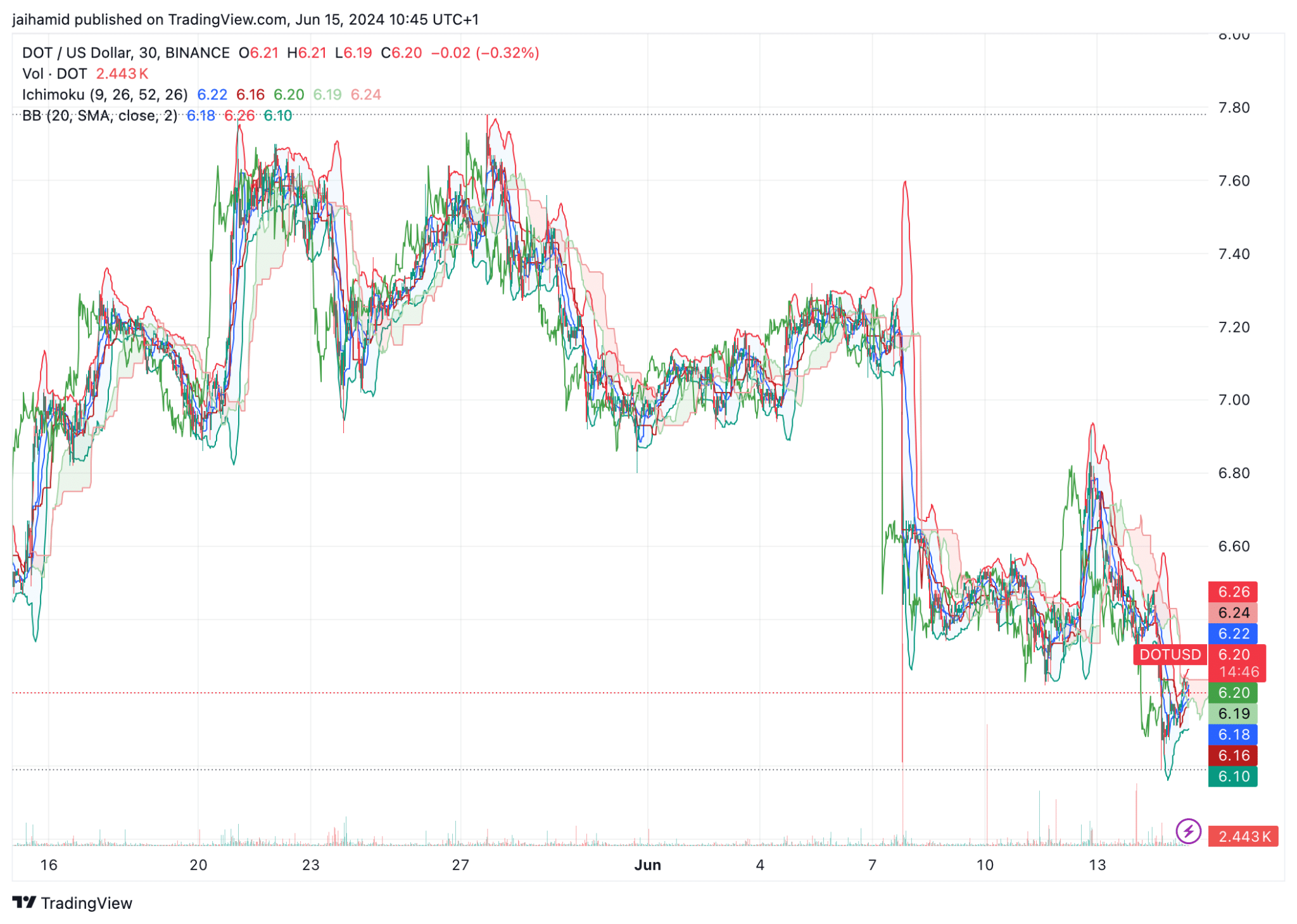

Right here, it’s price mentioning that DOT’s worth was under the Ichimoku Cloud too – An indication of a bearish pattern. The conversion line (blue) and the baseline (purple) gave the impression to be above the worth too, reinforcing the bears’ place.

Supply: DOT/USD, TradingView

On the time of writing, the worth was additionally close to the decrease band of the Bollinger Bands, indicating that DOT could also be doubtlessly oversold within the quick time period. If shopping for stress returns, this might result in a short lived rebound or consolidation on the charts.

The shifting averages have been trending south too, and the worth was under these strains – Indicating additional declines.

The consolidation zone round $6.20 is vital. The short-term forecast is that if DOT holds this stage, it could type a base for northbound motion, notably if it may possibly push above $6.30, which could act as a minor resistance.

Conversely, failing to take care of the $6.20-level may see DOT testing decrease helps, presumably round $6.16 or extending to $6.00, if the bearish stress intensifies.

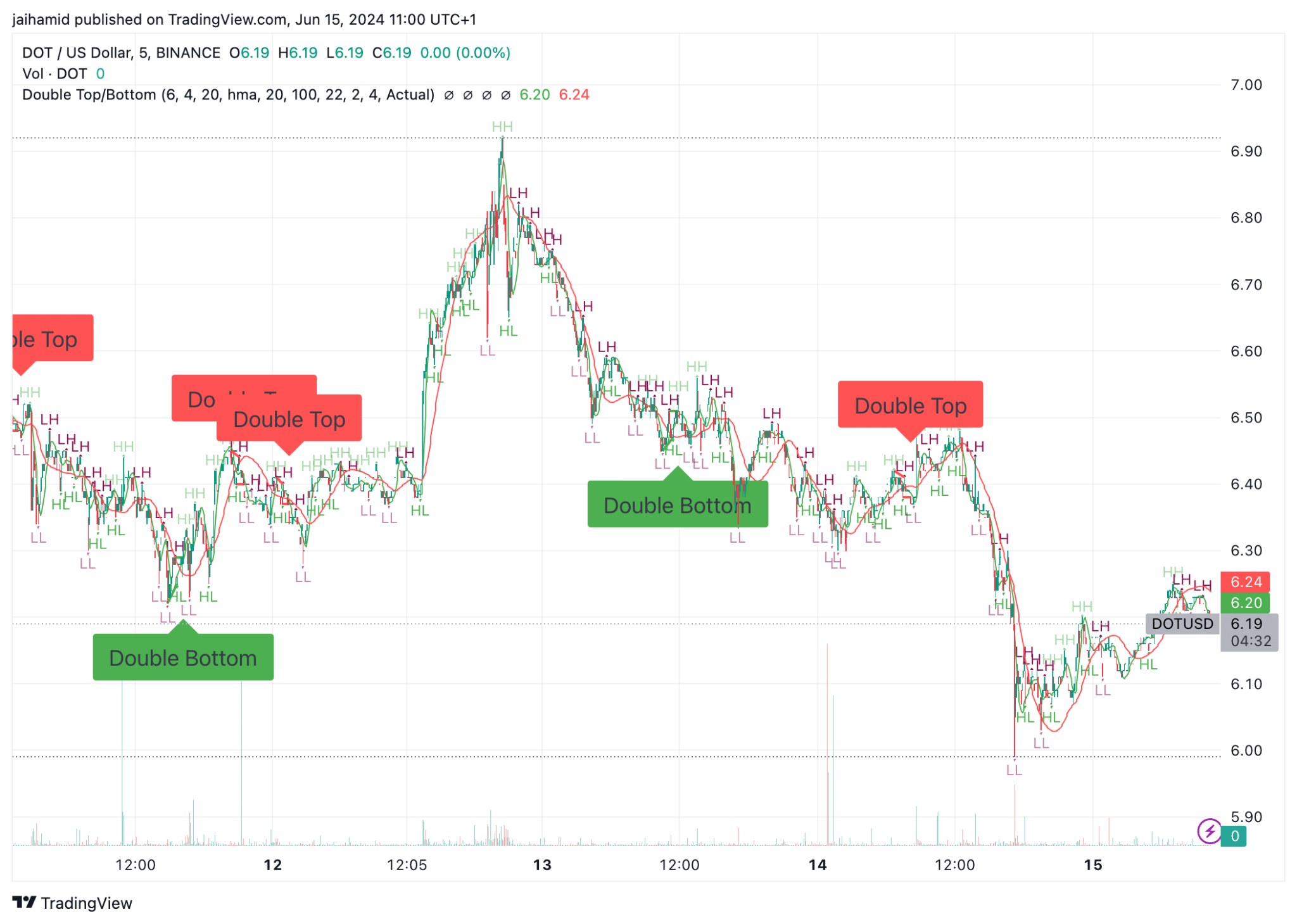

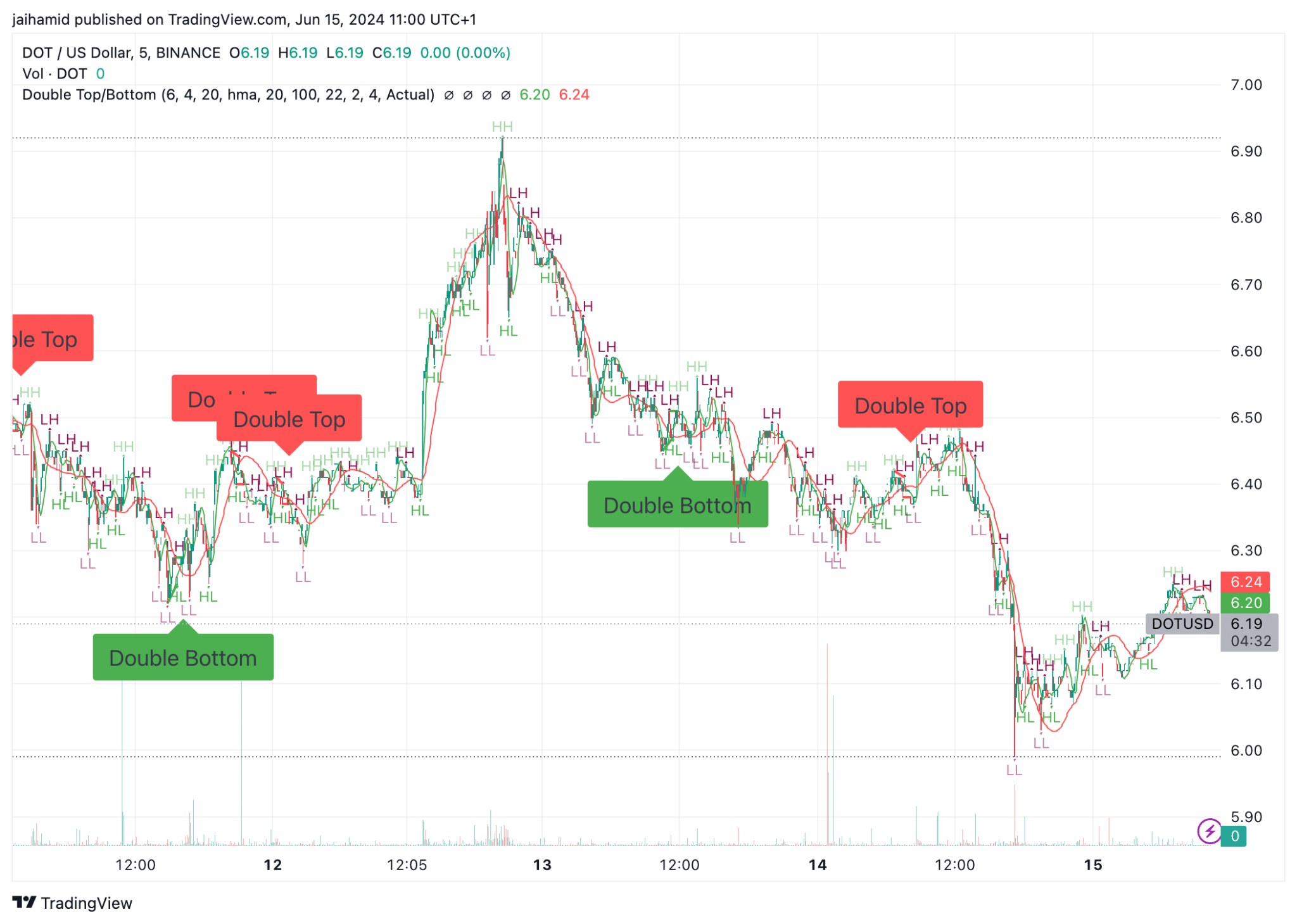

Supply: TradingView

Within the aforementioned chart, the double-top sample is seen across the $6.60-level, the place the worth examined this level twice earlier than declining every time. Right here, double tops are usually thought of bearish reversal patterns, indicating that the worth would proceed to fall after failing to interrupt via the resistance.

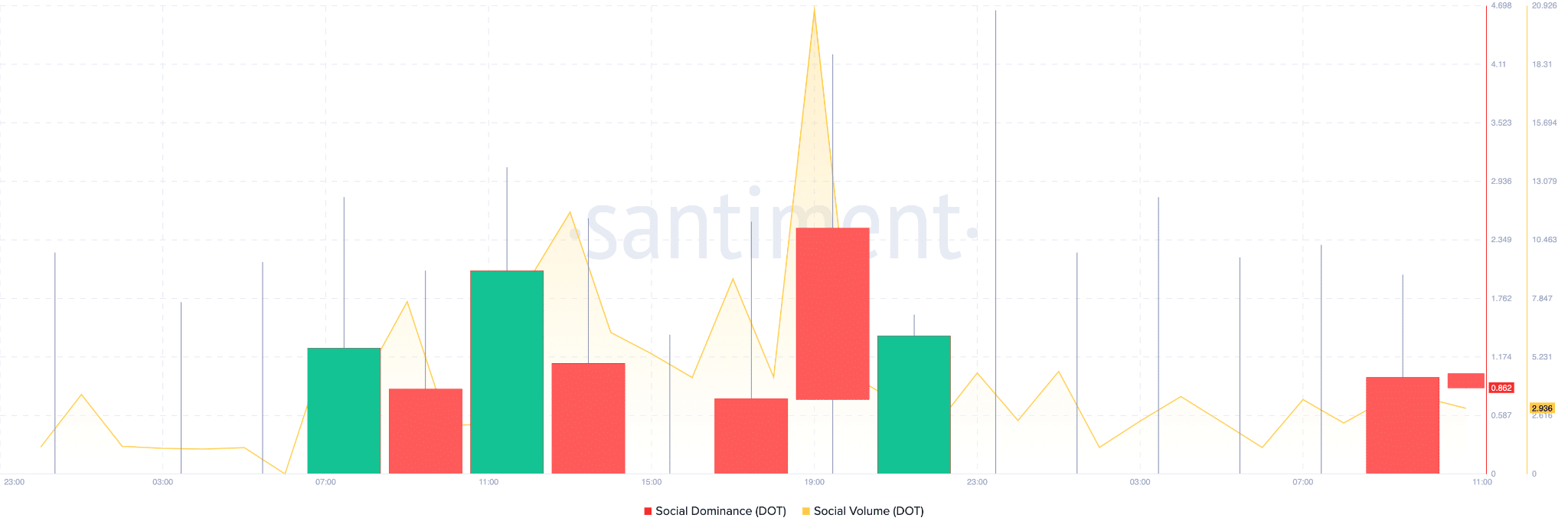

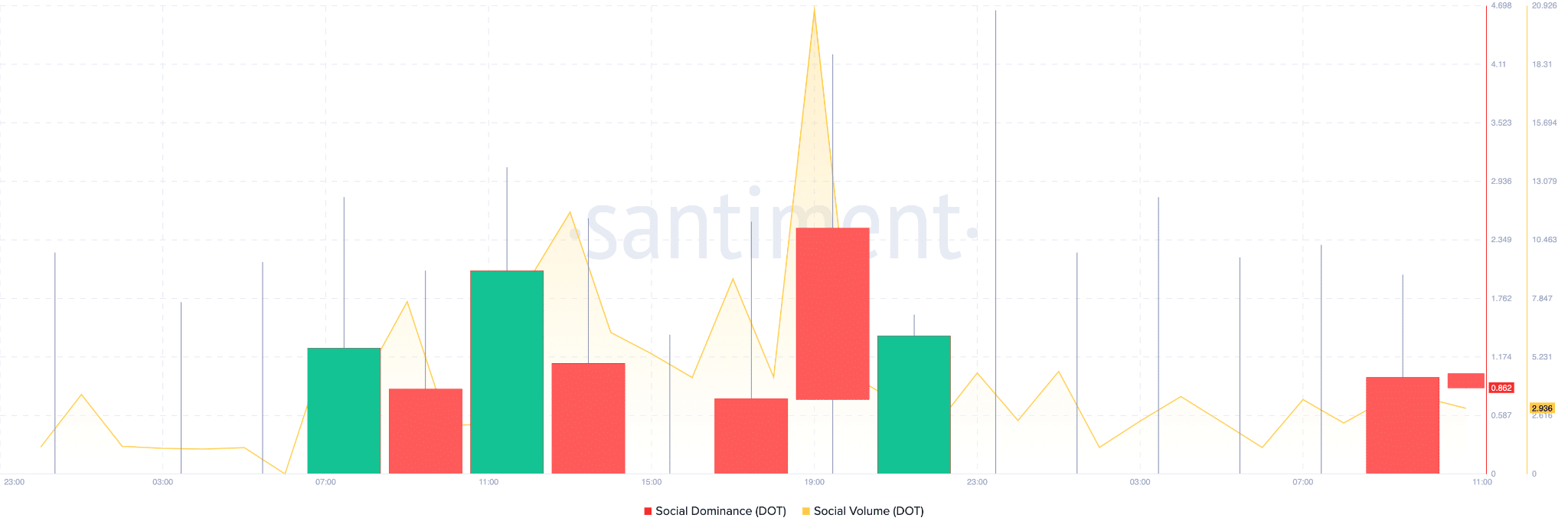

Supply: Santiment

Apparently, DOT’s social quantity and dominance lately recorded pretty modest spikes on the charts. The alignment of excessive social quantity and sustained social dominance can usually precede volatility in worth as extra merchants and buyers take note of DOT and doubtlessly act on the data circulated.