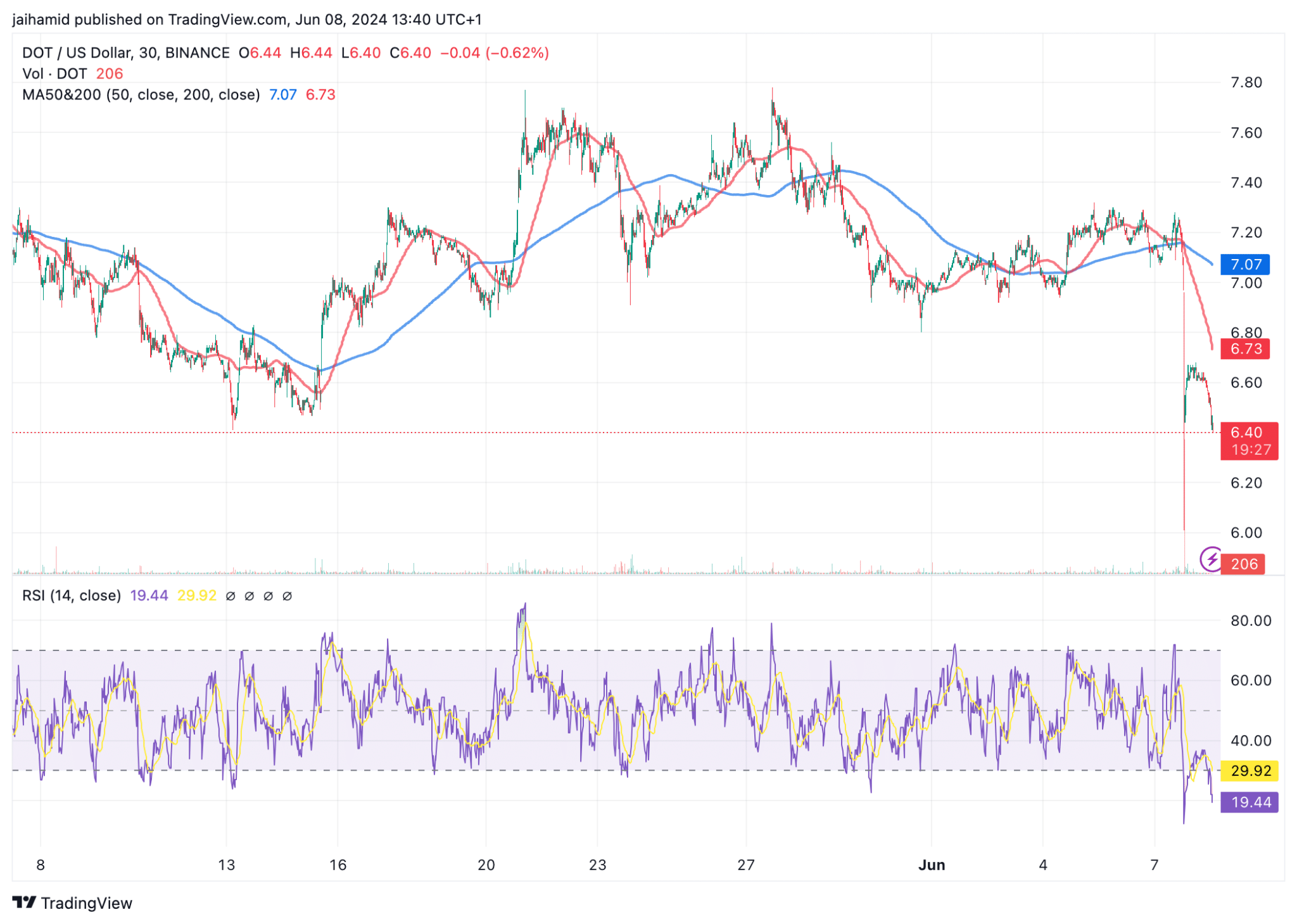

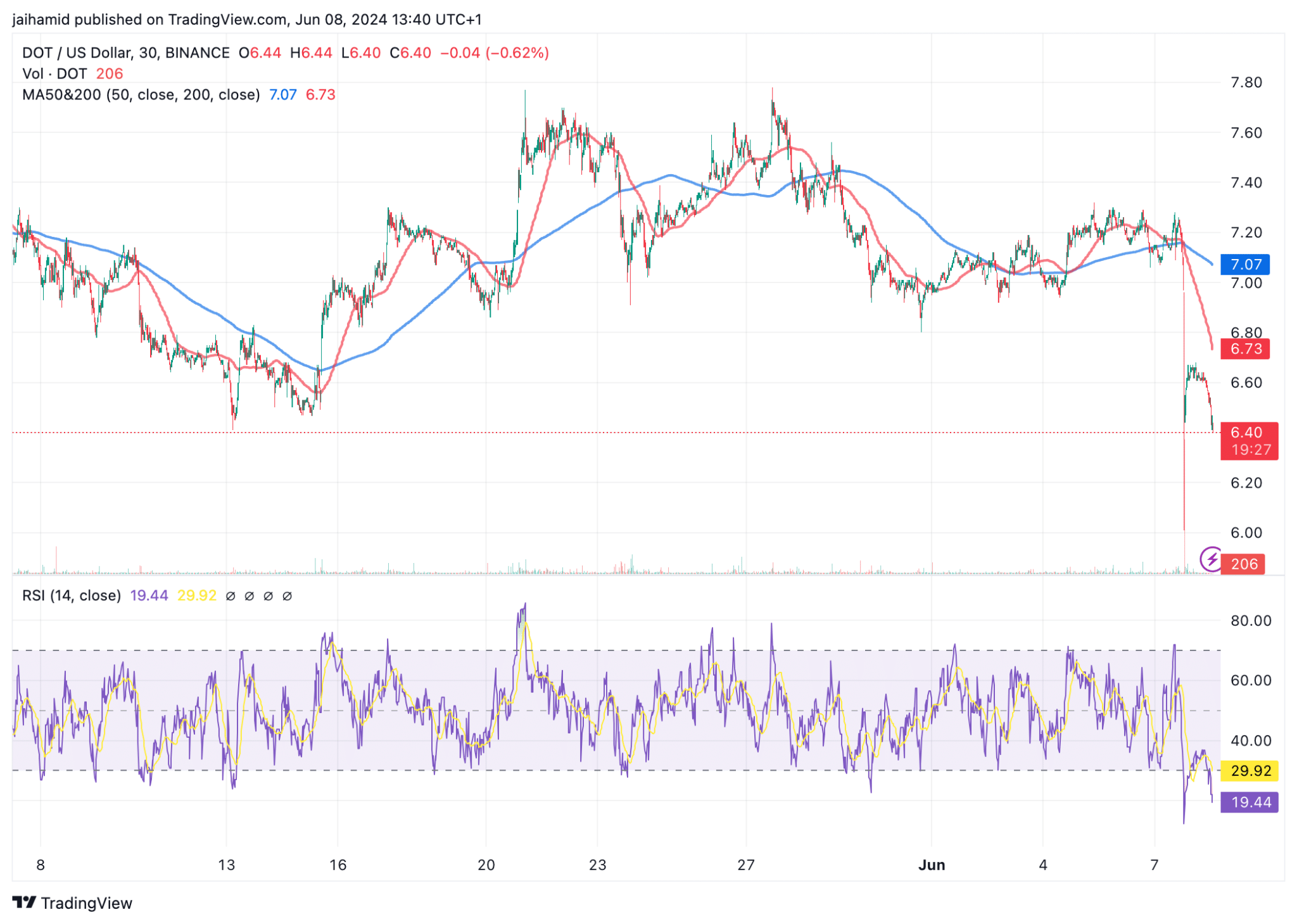

- DOT continued to pattern beneath the 200-period shifting common.

- Regardless of the market’s ‘Excessive Worry’ sentiment, a dramatic 138.77% surge in buying and selling quantity indicated rising dealer curiosity.

Polkadot [DOT] has established itself with a horrible efficiency this 12 months, even amid market rallies and ETF hype.

The world’s eighteenth-largest cryptocurrency has steadily decreased, with little or no indicators of revival. However what if there’s some gentle on the finish of the tunnel?

From a technical perspective, the 50-period shifting common (blue line) and the 200-period shifting common (pink line) present crossover durations.

Supply: TradingView

Nonetheless, regardless of these crossovers, the worth has been unable to maintain any bullish momentum, trending beneath the 200-period shifting common for prolonged durations, indicative of a bearish pattern.

The Relative Energy Index (RSI) sat round 19 at press time, effectively into the oversold territory.

This urged that DOT has been closely bought off, doubtlessly oversold, which typically precedes a value correction or reversal if consumers step again in seeing worth at cheaper price ranges.

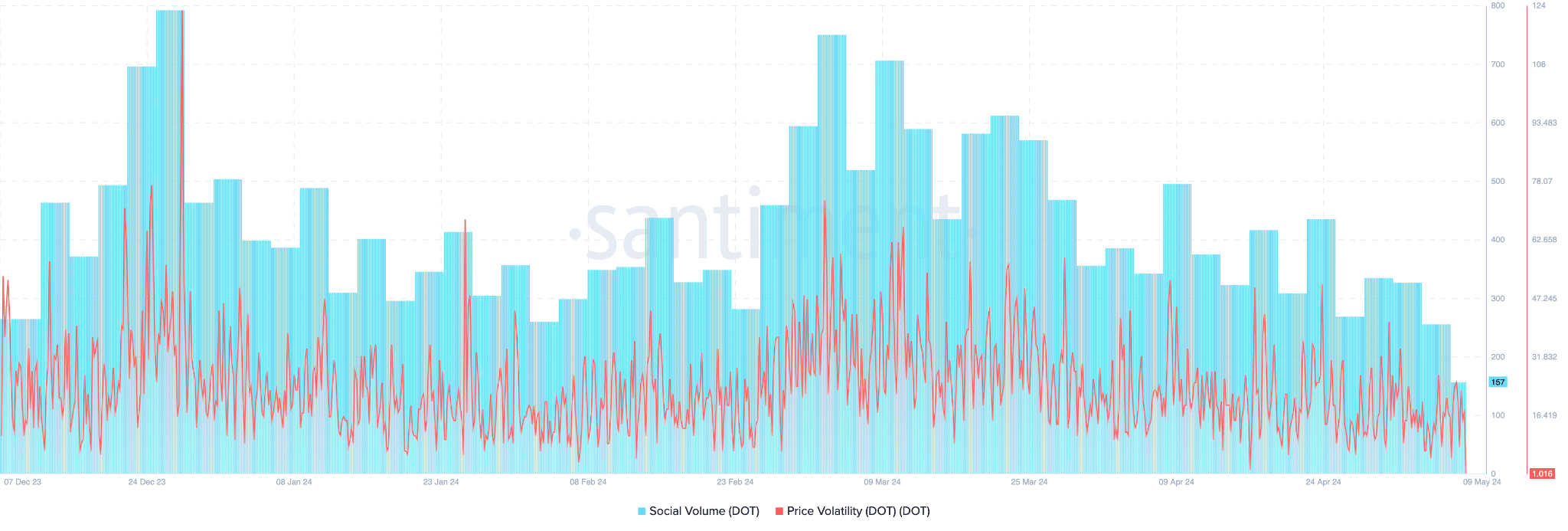

Supply: Santiment

DOT’s social quantity has steadily declined over the previous two months, coinciding with persistent value decreases.

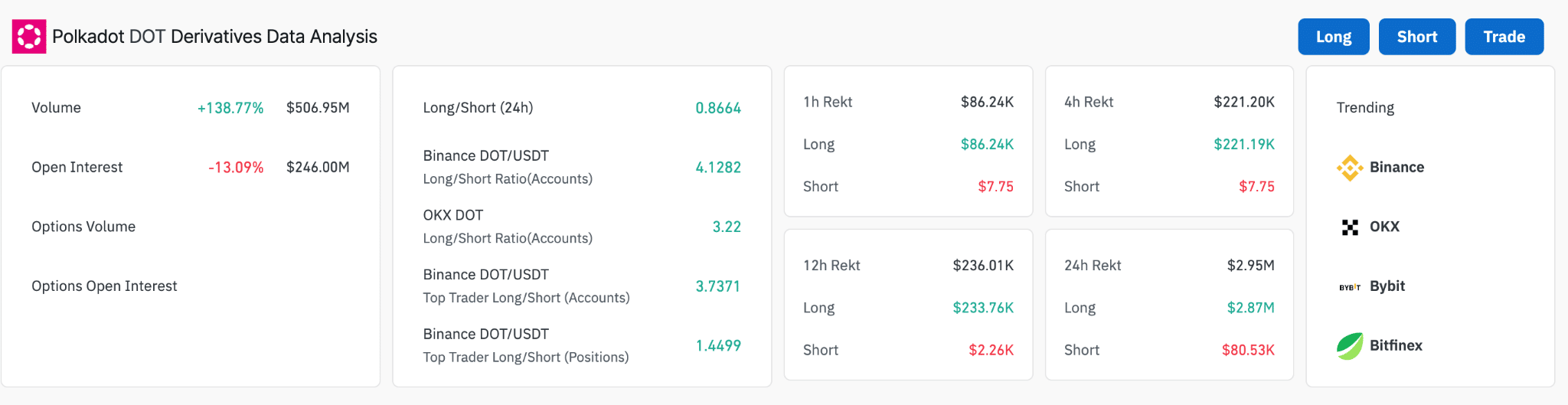

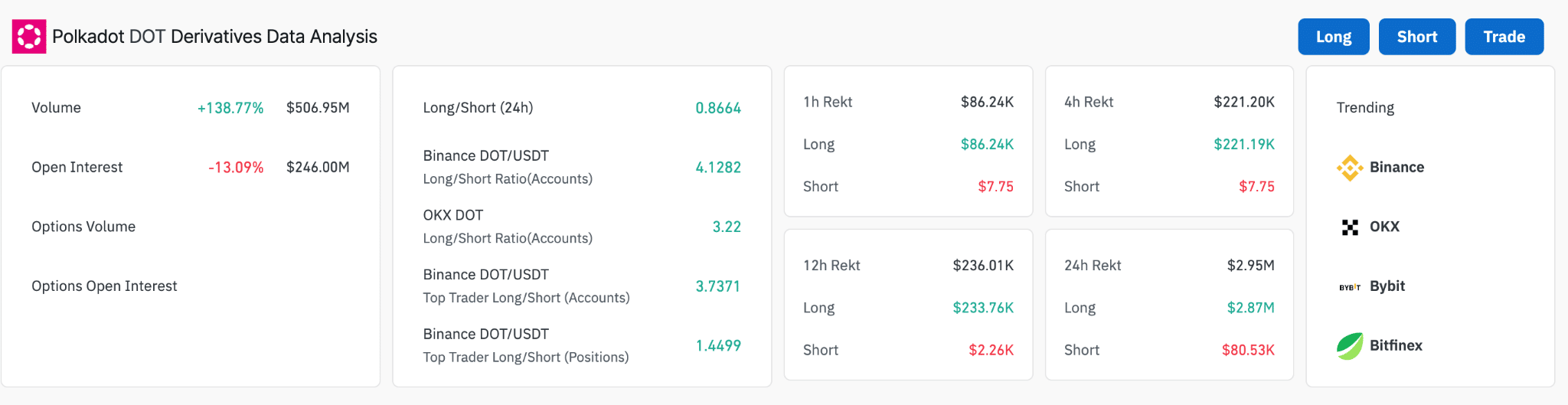

Nonetheless, DOT’s derivatives knowledge look intriguing in the meanwhile. They point out that there may be a silver lining to the bearish momentum.

Supply: Coinglass

First, there’s a dramatic improve in buying and selling quantity, up 138.77% to $506.95 million, suggesting a surge in dealer curiosity or speculative exercise. And liquidity appears to have slowed down over the previous week, too.

There’s nonetheless a prevailing bearish sentiment among the many merchants.

The ‘rekt’ knowledge tells a narrative of current market circumstances being unfavorable to many merchants, significantly these holding lengthy positions, given the disproportionate quantity of lengthy liquidations in comparison with shorts.

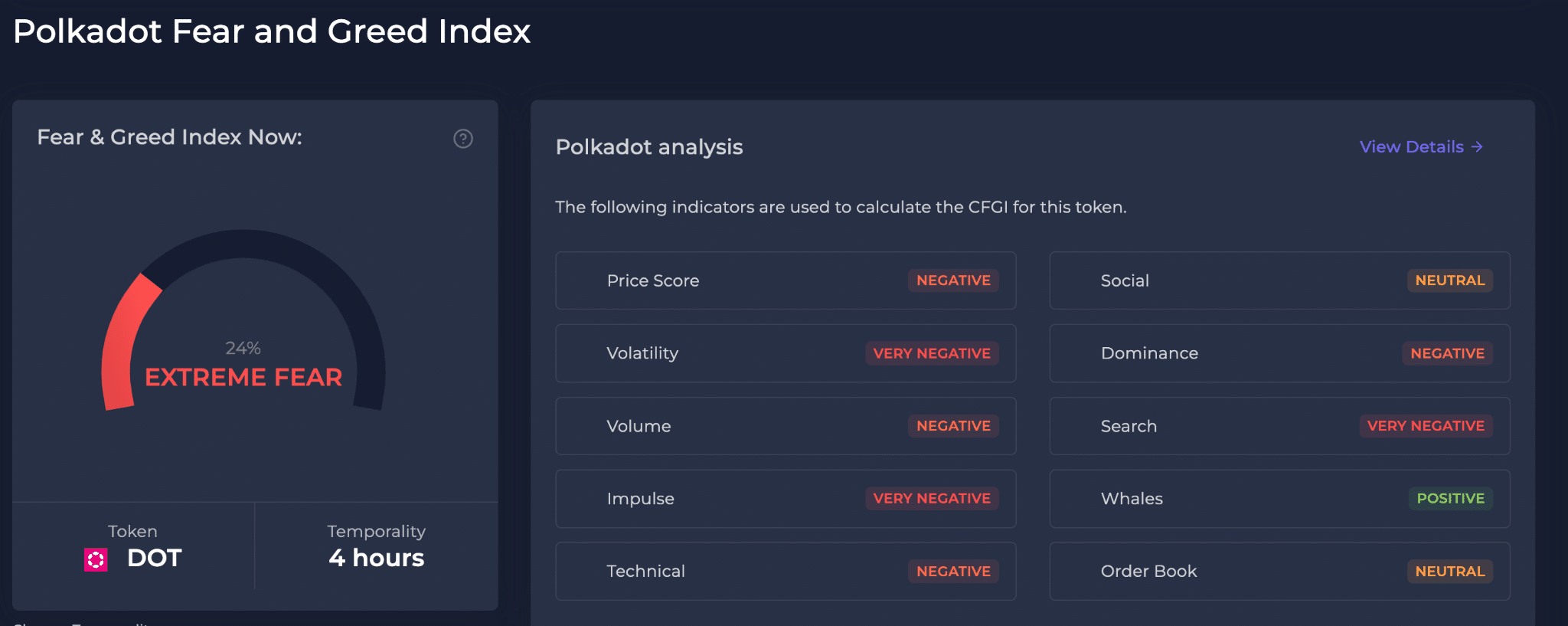

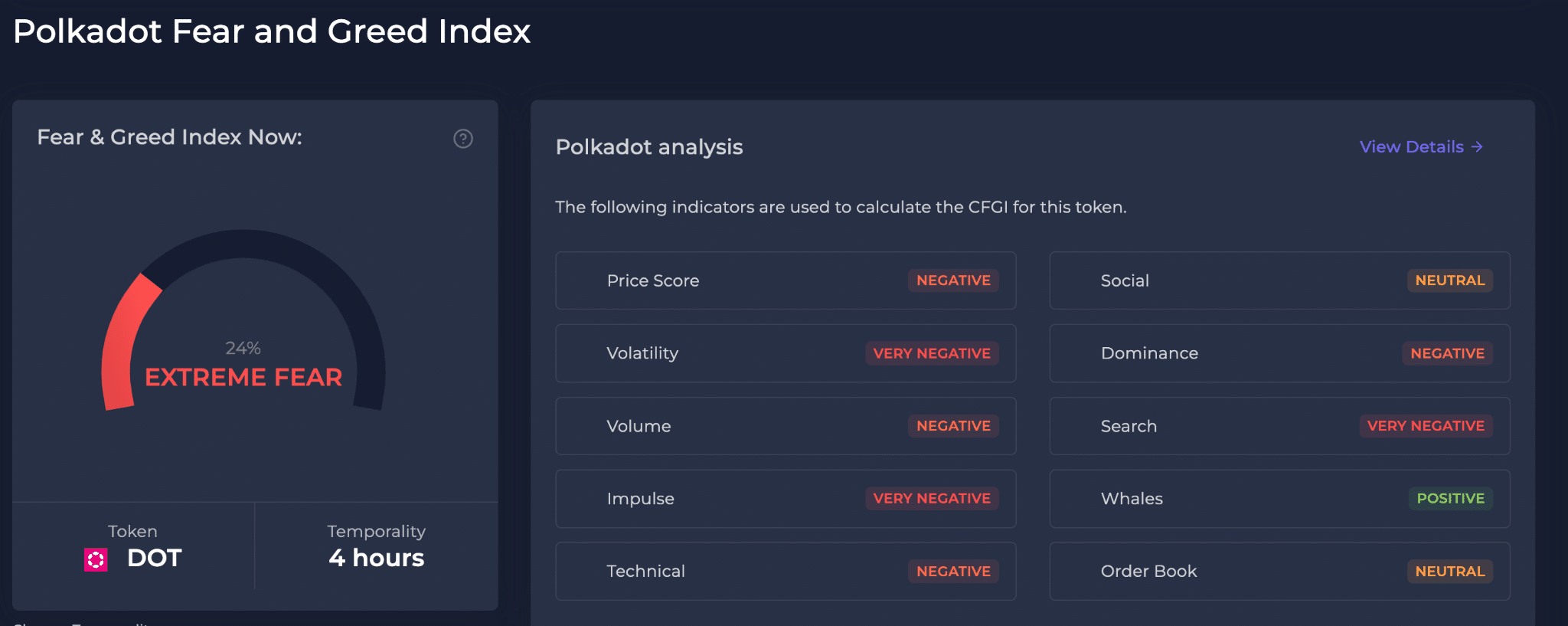

Supply: CFGI

Learn Polkadot’s [DOT] Value Prediction 2024-25

The Polkadot Worry and Greed Index is 24%, signaling “Excessive Worry” amongst buyers.

This sentiment is pushed by a mix of things, together with unfavorable perceptions on value stability and excessive volatility, which recommend that the market is cautious of additional declines and uncertainty in value actions.

![Polkadot [DOT] remains at the mercy of bears – But there’s a silver lining](https://wearecryptonians.com/wp-content/uploads/2024/06/dot-jai-fi-1000x600.jpg)