The Polkadot (DOT) value reached a excessive of $5.90 this week however has retraced barely since.

The lower took DOT under the $5.50 horizontal resistance space, above which a breakout had beforehand occurred.

Polkadot Falls After Rejection

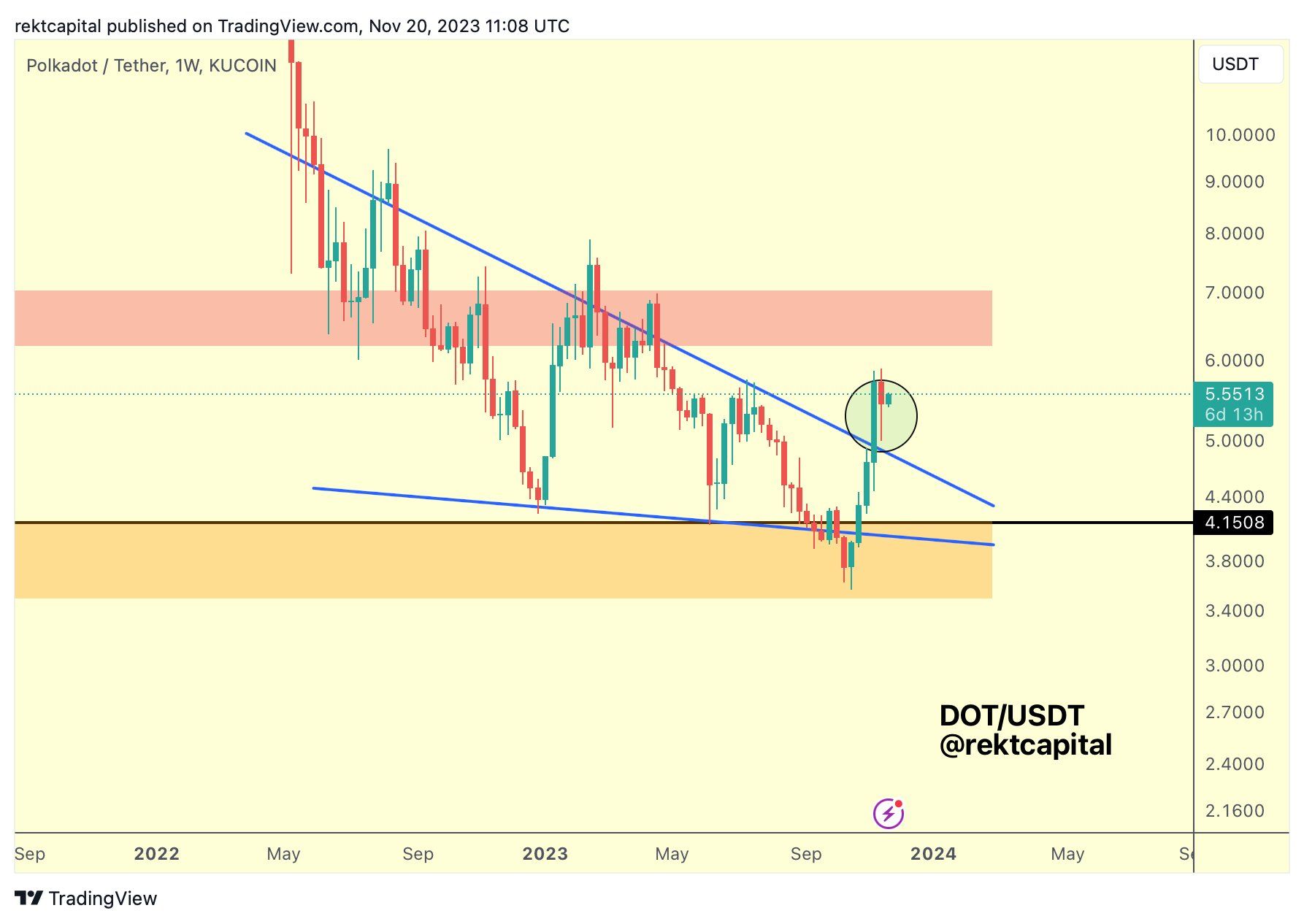

Analyzing the weekly timeframe for DOT exhibits that the value decreased under a descending resistance pattern line since February, hitting a low of $3.56 in October.

This decline led to a decisive breach of the essential horizontal help. The realm has beforehand had a constant degree because the begin of the 12 months.

Nevertheless, a constructive shift has occurred in 4 weeks following the low. In October, the Polkadot value broke free from the descending resistance pattern line, reaching a peak of $5.90 final week, marking its highest worth in 200 days.

Whereas this improve seemingly triggered a breakout above the important thing resistance space, DOT fell under it shortly afterward. This created a bearish candlestick (purple icon).

Merchants continuously make the most of the Relative Power Index (RSI) as a momentum gauge to evaluate market situations, serving to them decide optimum instances for getting or promoting by figuring out overbought or oversold belongings.

An RSI studying above 50, mixed with an upward pattern, indicators a positive place for the bulls. A studying under 50 signifies the alternative.

The RSI is on an upward trajectory and stands above the 50 threshold.

Learn Extra: What Is Polkadot (DOT)?

What Are Analysts Saying?

Cryptocurrency merchants and analysts on X are predominantly bullish on the DOT value pattern.

Rekt Capital famous the identical descending resistance pattern line breakout, stating that:

Seems just like the retest was profitable Now it’s all in regards to the follow-through from right here Typically, any dips into the highest of the sample even in December would nonetheless be macro bullish

Crypto Tony had a bullish short-term view because the value held above the $5.50 horizontal space. Nevertheless, it’s unclear if the latest lower within the space has modified his outlook to a extra unfavourable one.

Learn Extra: How To Stake Polkadot (DOT)

DOT Worth Prediction: Is This the Starting of a Reversal?

Technical analysts make the most of the Elliott Wave concept to acknowledge repetitive, long-term value patterns and acquire insights into investor psychology, aiding in figuring out pattern instructions.

Based on the present Elliott wave depend, the Polkadot value has accomplished a five-wave downward motion (white) since reaching its all-time excessive in November.

If this evaluation is correct, it suggests the start of a brand new motion in the wrong way. Whether or not this signifies the beginning of a bullish pattern reversal or an upward correction stays unsure. However, each situations anticipate a considerable improve within the DOT value.

The weekly RSI exhibits a bullish divergence because the starting of the 12 months (inexperienced line), offering extra help for the continuing upward momentum. Such divergence usually happens at pattern bottoms, a precursor to bullish pattern reversals.

The importance of this bullish divergence is accentuated by its alignment with the restoration of the $4.40 space and the completion of a five-wave downward motion.

Within the occasion of a continued improve within the altcoin’s worth, the subsequent resistance degree is predicted at $10. The realm would symbolize a considerable 110% improve from the present value.

Nevertheless, regardless of the bullish DOT value prediction, failure to reclaim the $5.50 horizontal resistance space can set off a 15% drop to the closest horizontal help at $4.40.

For BeInCrypto’s newest crypto market evaluation, click on right here.

Disclaimer

In step with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections.