audioundwerbung

Be aware:

I’ve coated Plug Energy Inc. (PLUG) beforehand, so traders ought to view this as an replace to my earlier articles on the corporate.

Liquidity Crunch And Going-Concern Warning

In early November, Plug Energy reported one other set of abysmal quarterly outcomes with income lacking consensus expectations by a mile and consolidated gross margin deteriorating to new multi-year lows.

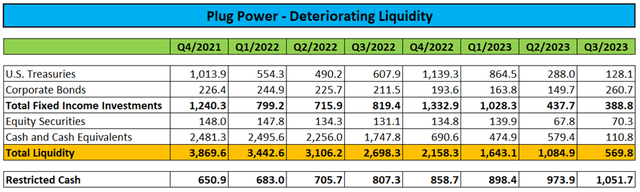

The poisonous mixture of huge losses from operations and elevated capital expenditures in addition to the continued requirement to offer substantial money collateral for sale-and-leaseback transactions has resulted within the firm’s liquidity deteriorating by an eye-watering $3.3 billion for the reason that starting of 2022.

Regulatory Filings

On the finish of Q3, out there liquidity was all the way down to roughly $570 million. With out elevating further capital, Plug Energy would possibly run out of obtainable funds later this quarter.

In reality, the difficulty required administration to incorporate a going concern warning within the firm’s quarterly report on type 10-Q.

Analysts Shedding Religion

In current weeks, a lot of Tier 1 funding banks have downgraded the inventory together with Morgan Stanley and Citigroup resulting from issues concerning the corporate’s ongoing execution points and substantial, near-term liquidity wants.

Following Plug Powers Q3 report, Roth MKM analyst Craig Irwin stated the corporate’s rapid capital wants at “sizably above $500 million” similar to Citigroup’s Vikram Bagri.

Much like many sell-side analysts, I made a decision to not give administration the advantage of the doubt and downgraded the corporate’s shares to “Promote” in November after years of conserving a “Maintain” score on the inventory.

Strict Draft Tips For Inexperienced Hydrogen Manufacturing Tax Credit

Including insult to damage, the U.S. Treasury’s just lately revealed draft guidelines for claiming inexperienced hydrogen manufacturing tax credit revealed a lot stricter than initially anticipated necessities final week.

In reality, tips for calculating lifecycle emissions at the moment are set to incorporate a number of the most controversial guidelines across the utilization of zero-carbon electrical energy: additionality, geographical correlation, and hourly matching.

- Additionality requires inexperienced hydrogen being produced from new renewable vitality initiatives.

- Geographical correlation requires the supply of renewable vitality to be near the inexperienced hydrogen manufacturing facility.

- Hourly matching or temporal correlation pertains to how regularly producers must show that their electrolysers have been powered by 100% renewable vitality (often hourly, weekly, month-to-month or yearly) and due to this fact to what extent they’ll use grid electrical energy at occasions when renewable vitality sources aren’t out there, after which ship the identical quantity of renewable vitality again to the grid at a later date.

If finalized within the proposed type, the rules would supply a extreme blow to the corporate’s formidable inexperienced hydrogen manufacturing and electrolyzer gross sales plans.

Close to-Time period Financing Choices

Nonetheless with the corporate’s first inexperienced hydrogen plant in Georgia now already twelve months not on time amid a near-doubling of capital expenditures and remaining liquidity depleting quick, administration should safe further financing as quickly as potential.

In line with statements made within the Q3 shareholder letter, the corporate is pursuing a lot of financing options:

- Company debt financing.

- Undertaking financing and plant fairness partnerships.

- A mortgage assure by the U.S. Division of Vitality (“DOE”).

Please observe that at this level, Plug Energy solely carries roughly $200 million in long-term debt with the overwhelming majority comprised of the corporate’s 3.75% convertible notes maturing on June 1, 2025.

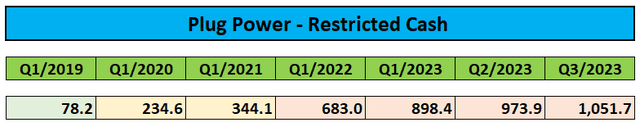

Nonetheless, the 10-Q lists roughly $1 billion in lease and finance obligations largely associated to sale-and-leaseback transactions of apparatus leased to materials dealing with prospects that are nearly totally collateralized by restricted money and safety deposits (emphasis added by writer):

Restricted Money

In reference to sure of the above famous sale/leaseback agreements, money of $539.4 million (…) was required to be restricted as safety as of September 30, 2023 (…), which restricted money will likely be launched over the lease time period. As of September 30, 2023 (…), the Firm additionally had sure letters of credit score backed by safety deposits totaling $426.9 million (…), of which $396.2 million (…) are safety for the above famous sale/leaseback agreements, and $30.7 million (…) are customs associated letters of credit score.

As of each September 30, 2023 and December 31, 2022, the Firm had $76.7 million held in escrow associated to the development of sure hydrogen crops.

With that being stated, let’s look into the corporate’s choices in additional element:

1. Company Debt Financing

On the convention name, CFO Paul Middleton pointed to “expressions of provides” from monetary establishments for “ABL-like amenities” and “restricted money advance amenities“.

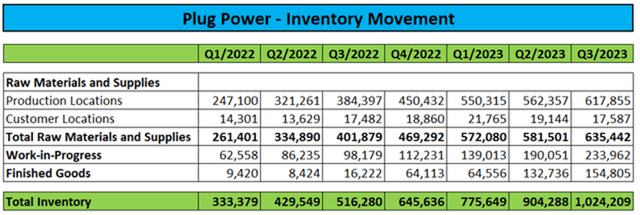

Certainly, asset-backed lending could possibly be an choice, significantly when contemplating the corporate’s seemingly ever-increasing stock ranges:

Regulatory Filings

Nonetheless, potential lenders are prone to wrestle with appraising the liquidation worth of the corporate’s stock, significantly on the subject of work-in-progress or completed items however even uncooked supplies and provides could possibly be a problem with the corporate solely serving a small area of interest within the materials dealing with tools market with a reasonably restricted variety of prospects.

Given this concern, any potential stock financing would probably be nicely under the usual 50% charge.

Leveraging Plug Energy’s restricted money is likely to be a extra viable choice as the corporate has already executed on a similar transaction up to now albeit at a a lot smaller scale with the mortgage being repaid from releases of the corporate’s restricted money over the time period of the underlying sale-and-leaseback transactions.

Regulatory Filings

Nonetheless, along with inserting a lien on principally all the firm’s property, the lender required the corporate “to take care of always minimal unencumbered money and money equivalents equal or larger than the then excellent principal steadiness” of the credit score facility thus just about eliminating any residual threat whereas charging a whopping 12% rate of interest in a really low curiosity setting.

Contemplating the present curiosity setting, Plug Energy would probably should pay rates of interest north of 15% for the same facility at the moment, significantly as the corporate would not be capable to adjust to onerous covenants just like the one mentioned above.

2. Undertaking Financing / Plant Fairness Partnerships

Fairly frankly, with the corporate having delayed its inexperienced hydrogen plant roadmap a number of occasions already and Plug Energy’s very first facility in Georgia nonetheless not being operational, this doesn’t look like a viable short-term choice.

As well as, promoting fairness in inexperienced hydrogen crops not anticipated to come back on-line earlier than 2025 would not look possible both, significantly not in case the above-discussed draft tips being finalized with out main modifications.

Not less than for my part, the corporate must present proof that their crops are certainly working on the proposed scale and producing returns consistent with administration’s projections earlier than potential traders would possibly think about stepping in.

Nonetheless, with out significant manufacturing tax credit, a number of the crops presently beneath development would possibly see additional delays or will not even be accomplished.

In line with a current news article, and not using a $1.5 billion mortgage assure dedication by the Division of Vitality, Plug Energy will not spend further cash on its New York inexperienced hydrogen plant right now.

3. DOE Title XVII Mortgage Assure

In line with CFO Paul Middleton on the Q3 convention name, the corporate hopes to safe conditional approval for a $1.5 billion DOE Title XVII loan guarantee “that will fund our inexperienced crops (…) from development part onwards” by the top of the yr with funding anticipated in late Q1 or early Q2/2024.

Nonetheless, this is able to be nicely behind previously-communicated expectations. Furthermore, a time-frame of simply three months between the DOE’s conditional dedication and funding appears overly formidable once more.

For instance, Eos Vitality Enterprises, Inc. (EOSE) obtained an roughly $400 million conditional dedication from the DOE in late August with funding not anticipated earlier than Q2/2024 regardless of the corporate’s zinc battery plant growth challenge showing far much less advanced relative to Plug Energy’s formidable inexperienced hydrogen facility ramp-up plans.

Bear in mind additionally that this is able to be project-based financing which might’t be utilized for protecting outsized working losses from the corporate’s ailing materials dealing with enterprise.

Different Choices – Fairness or Fairness-Linked Securities

With the financing choices outlined by administration both not viable, prohibitively costly or just taking too lengthy to materialize, Plug Energy will probably should resort to elevating further fairness or issuing convertible debt.

1. Fairness

Even with the share value close to multi-year lows, the corporate’s market capitalization stays round $3 billion, nonetheless greater than ample to pursue an fairness providing.

That stated, elevating between $500 million and $1 billion in an underwritten providing could be very tough, significantly as potential Tier 1 underwriters are prone to cross on the providing this time given the corporate’s monitor report and ongoing, elevated execution threat.

Establishing an “At-The-Market Fairness Distribution Settlement” or “ATM-Settlement” much like Nikola Company (NKLA) or FuelCell Vitality, Inc. (FCEL) appears like a extra viable choice however the firm’s means to boost a ample quantity of funds in due time from promoting numerous shares into the open market will largely depend upon buying and selling quantity.

Nonetheless, with market individuals’ threat urge for food on the rise and the refill considerably from current multi-year lows, the corporate ought to critically think about working with main funding banks to ascertain a large-scale ATM facility.

2. Convertible Debt

Whereas actually an choice, a large-scale convertible notes providing would even be prone to put main stress on the share value as evidenced by the sell-off in Rivian Automotive, Inc.’s (RIVN) frequent shares in reference to the corporate’s 1.5 billion inexperienced convertible notes offering in early October.

As many convertible debt consumers are inclined to make use of delta-neutral convertible arbitrage methods which require establishing a corresponding brief place within the underlying shares, the inventory value would very probably take one other come across announcement.

As well as, given the dismal state of the corporate’s operations, phrases are prone to be ugly.

Plug Energy may additionally pursue an strategy much like Nikola Company by issuing debt to specialised hedge funds which might be convertible into frequent shares at a reduction to prevailing market costs on the lender’s choice.

Because of this, the lender could be incentivized to ascertain a brief place within the firm’s frequent shares and subsequently concern a conversion discover to cowl the place with discounted shares issued by the corporate.

Much like the above-discussed ATM-Settlement, any such financing would probably lead to ongoing stress on the corporate’s shares as convertible noteholders maximize their earnings by shorting as many frequent shares as potential.

3. Convertible Most popular Inventory

Issuing convertible most popular inventory could be similar to promoting convertible debt to a specialised lender with the slight distinction that most popular fairness is rating decrease within the firm’s capital construction and repayments are sometimes required on a month-to-month foundation.

Month-to-month installments are often made in newly issued frequent shares with most popular fairness holders accordingly incentivized to ascertain a brief place within the firm’s frequent shares forward of those dates.

The corporate has issued convertible most popular inventory up to now, albeit at a lot smaller scale.

Different Choices – Factoring

Much like Bloom Vitality Company (BE), Plug Energy may enter into factoring agreements with monetary establishments and promote an eligible a part of its receivables frequently. Nonetheless, with a relatively modest accounts receivable steadiness of $163.2 million on the finish of Q3, proceeds from potential factoring agreements could be inadequate to cowl the corporate’s short-term financing wants.

Backside Line

In my opinion, I don’t anticipate Plug Energy to enter into asset-backed lending amenities resulting from prohibitive phrases together with the probably requirement to collateralize considerably all the firm’s property.

Getting access to challenge financing or promoting stakes in a few of Plug Energy’s yet-to-be-constructed inexperienced hydrogen crops is not a viable near-term choice both as potential lenders/consumers are prone to require proof of the corporate’s know-how working on the proposed scale and generate returns at the least consistent with administration’s projections.

Whereas a large DOE mortgage assure will surely be nice information for the faltering build-out of the corporate’s inexperienced hydrogen capability, Plug Energy could be precluded from using these funds for protecting outsized losses from operations within the core materials dealing with enterprise.

As well as, funding of a DOE-backed mortgage is just not prone to occur inside the time-frame projected by administration.

With remaining liquidity depleting rapidly, Plug Energy will probably should revert to issuing equity-linked securities or outright promoting new fairness.

At this level, I might anticipate the corporate to make the most of a near-term funding strategy similar to Nikola Company with a mix of open market share gross sales and convertible debt issuances.

Given the corporate’s low debt ranges and a lot of viable near-term financing choices, I don’t anticipate Plug Energy to file for chapter anytime quickly however near-term survival will probably come on the expense of huge dilution for present shareholders.

Contemplating the dismal state of the corporate’s operations and the excessive probability of considerable, near-term dilution, traders ought to promote present positions and look forward to administration to stabilize the ailing firm and at last begin executing on its guarantees.

Danger Components

With the U.S. inventory market again close to all-time highs amid expectations of decrease rates of interest subsequent yr, threat urge for food amongst traders has elevated exponentially in current weeks thus benefiting extremely speculative shares like Plug Energy.

Within the present setting, even minor information may present further gasoline to the restoration rally within the crushed down shares, not too communicate of actual catalysts like a large-scale DOE mortgage assure dedication.

Ought to administration achieve securing ample near-term financing with out main dilution, the inventory would probably get an additional increase.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.