Jeremy Poland

Pioneer Assets (NYSE:PXD) is rumored to be acquired by Exxon Mobil (XOM). However this ignores the lengthy historical past of Exxon Mobil in making acquisitions. I had beforehand talked about that Exxon Mobil tends to promote high-cost manufacturing right into a market like this, whereas others like Chevron (CVX) write off properties and dump them at market bottoms. That process is unlikely to alter simply because rumors have began, until there’s a cause not at the moment recognized for the deal.

Pioneer has a few of the finest acreage within the business and has lengthy produced glorious outcomes due to that acreage location. However this isn’t a shock that might trigger a choice to buy the corporate at a time when oil costs are comparatively excessive. This has been recognized for a while. So a proposal might have been made again in 2020 or 2021 by a financially robust firm like Exxon Mobil.

Within the present fiscal 12 months, you’ve a number of purchases that have been made already. Chevron acquired PDC Power again in May 2023, when the dialogue for the acquisition was carried out at significantly decrease oil costs. Moreover, when you examine again on the inventory value on the time, the acquisition was carried out for a comparatively small premium.

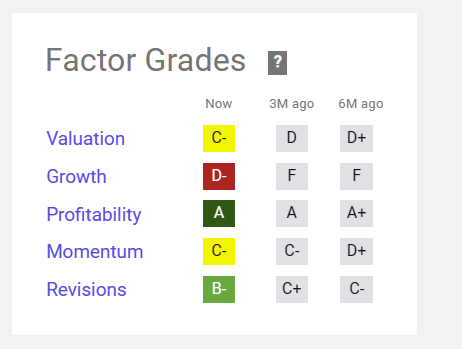

Pioneer Pure Assets Quant System Valuation Measures October 6, 2023 (Searching for Alpha Web site October 6, 2023)

Pioneer Pure Assets already has a good valuation. One would usually assume an acquisition would happen when the Valuation is an A or perhaps a B. Somebody who would buy an oil and gasoline firm with the valuation proven above is much extra more likely to be from outdoors the business with out the expertise to buy a cut price. As an alternative, they only “need in on the motion”. That type of merger typically comes again to hang-out the corporate later.

Different Bargains

The business is loaded with bargains proper now. Diamondback Power (FANG) has a decrease price-earnings ratio. The acreage is each bit nearly as good.

Diamondback Power Quant System Valuation (Searching for Alpha Web site October 6, 2023)

Regardless of the lower cost earnings ratio, the Quant System on the web site doesn’t give this firm a superior grade. That ought to inform traders that issues have been cheaper earlier, and certainly there have been plenty of purchases and acquisitions made all through the business when costs have been cheaper.

Trade insider will purchase when the valuation grade is greater. Speculative cash with out business expertise will typically purchase throughout market tops or frankly anytime insiders as a bunch don’t see a cut price.

Baytex Power

Baytex Power (BTE) for example announced the acquisition of Ranger Oil (ROCC) again in March 2023 when oil costs have been considerably decrease than they have been now. That implies that negotiations and unbiased evaluations occurred at a time when the market was far much less optimistic concerning the business outlook than now.

The controlling entity was Juniper Capital advisors as the most important shareholder of Ranger Oil. So why would Juniper (somebody with appreciable expertise) promote? The reply is that the corporate bought its curiosity close to the market backside for about $10 per share. When the corporate offered to Baytex, the deal was price about $44 per share. Subsequently, Juniper made an excellent revenue over about 3 years, whereas Baytex bought a far improved scenario at an excellent time within the oil and gasoline business cycle for a relative cut price.

This was a win-win for each firms, and Baytex will doubtless construct on that win.

Present Trade Situations

Oil costs should not in a positive place for business insiders to make giant purchases with out some unknown cause that insiders would doubtless know however wouldn’t be obvious to the general public. Moreover, when Exxon Mobil made the offer to purchase Denbury (DEN) that provide got here “out of the blue” as is typical for Exxon Mobil.

The “leaking” of data {that a} deal is supposedly about to happen has led to this:

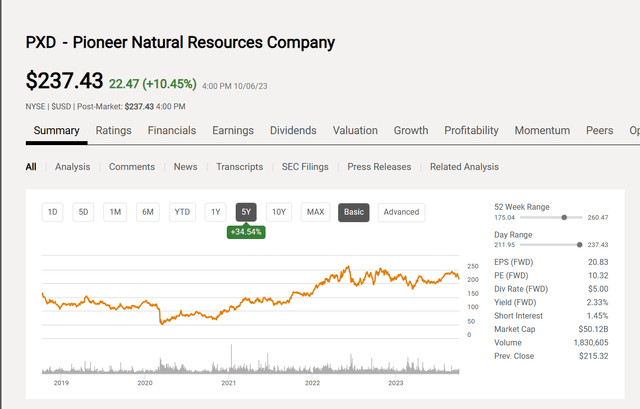

Pioneer Assets Inventory Worth Historical past And Key Valuation Measures (Searching for Alpha Web site October 6, 2023)

The Pioneer widespread inventory value proven above is already up 10% in an period when the market has lengthy demanded no or little or no premium in a takeover bid for the business for fairly a while. That value appreciation alone might kill the deal (for all intents and functions) until an acquirer needs to pay money. However Exxon Mobil has lengthy acquired firms for inventory (see the details of the Denbury acquisition).

When Exxon Mobil Did Pay A Premium

There was a time when Exxon Mobil Paid a premium (XOM). The Interoil acquisition involves thoughts.

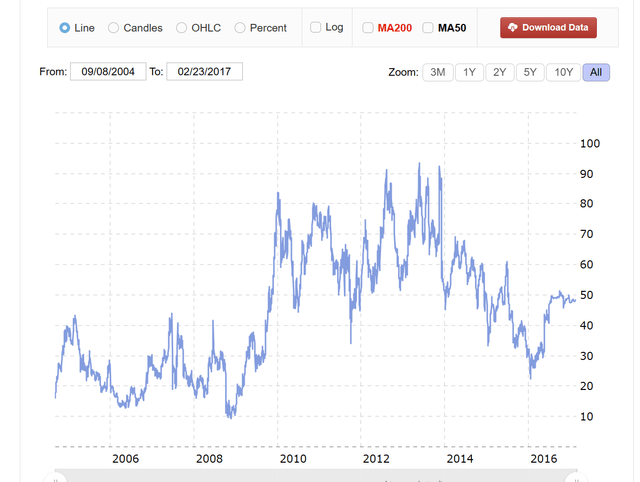

Interoil Widespread Inventory Worth Historical past (www.macrotrends. web October 6, 2023)

As shown above, Exxon Mobil did pay a premium when it offered $45 a share. However the inventory was down significantly from its highs near $90 a share when the provide was made. Exxon Mobil paid fairly a bit much less for the corporate simply by ready.

Conclusion

What’s proven above is much extra typical of profitable and skilled insiders. They are going to pay what the market considers high greenback in the event that they see no different affordable technique on the time and the acquisition causes are compelling sufficient. That continues to be to be seen.

However on this case, Exxon Mobil is a recognized cut price hunter. For shareholders, that’s often known as good administration. Denbury was acquired after it got here out of chapter and had shed an entire lot of debt. The corporate was doubtless so much cheaper simply due to that.

The Permian has plenty of bargains that I observe, with price-earnings ratios as low-cost as 2. Even so, the quant system clearly reveals that for the business, there have been higher instances than the present time to buy bargains. For these two causes alone, Pioneer is unlikely to be acquired now.

That’s not the identical as stating it is not going to occur. What it’s saying is that if it does occur, it isn’t a typical transaction. Subsequently, I might keep on the sidelines.

There are plenty of good firms promoting traditionally cheaply within the oil and gasoline enterprise. However there isn’t any cause to simply rush in at a time like this. Buyers can do effectively at present costs if they’re keen to attend for that return to traditionally regular pricing. Nonetheless, business insiders are able to profiting from bargains that may vanish shortly. There’s each indication that the bargains that existed since 2020 have gotten scarce.

A lot of the patrons’ market that I cowl exists amongst unnatural sellers and speculators that hoped to make a killing within the 2015-2020 interval however have been disillusioned. They now wish to “dump and run” which normally supplies much better alternatives than buying public firms. Therefore, I’ve plenty of articles of those non-public entities promoting for 3 instances EBITDA or much less.

All of those issues make Pioneer a comparatively costly acquisition proposal. The end result weighs in opposition to the rumors now floating round. If it does occur, it might be as a result of an inside purchaser like Exxon Mobil sees a much better future forward for the acquisition that the corporate didn’t see prior to now, for causes the market is not going to know. That, to me, appears like a tall order as a result of insiders normally don’t act that manner.