Mailson Pignata

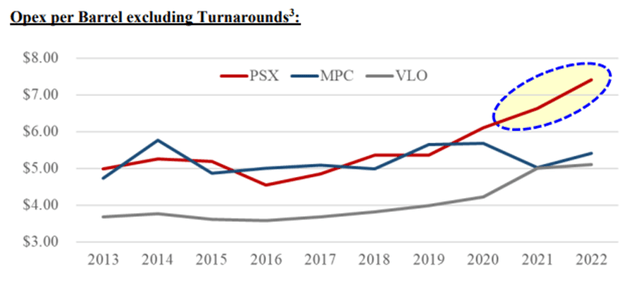

Phillips 66 (NYSE:PSX) has seen a strong run up in share value because of the exercise spurred on by the activist investor Elliott Funding Administration. In a letter to the board, Elliott implied that PSX’s refining belongings may be run extra successfully to drive prices out of the enterprise. Elliott straight sited the rising hole in working prices per barrel between PSX and friends Marathon and Valero.

The inventory noticed a 5% leap on the day of this announcement, including to the 40% value appreciation because it bottomed in July of 2023. After a formidable run, does PSX have what it takes to observe via on its guarantees to shareholders and drive the share value larger?

This evaluation will present that PSX does actually have a run method to market beating returns in 2024. That is attributed to sturdy value discount efforts, startup of the Rodeo Renewed facility, and the secure efficiency of its midstream enterprise.

This sturdy operational efficiency will likely be transformed to shareholder returns as PSX executes on its aim of returning $13-$15 billion by the top of 2024. I undertaking 2024 will see a 7% enhance within the dividend whereas additionally returning at the very least $3 billion to shareholders within the type of share repurchases.

Driving Out Price

Elliott Administration’s key level in advocating for change at PSX was an working value that was 50% on a per barrel foundation. For firms that produce thousands and thousands of barrels per day this will result in important loss in earnings. The letter references 2022 information, so PSX has 9 months of recorded efficiency within the books to gauge progress on this space.

Elliott’s Letter to the Board of PSX

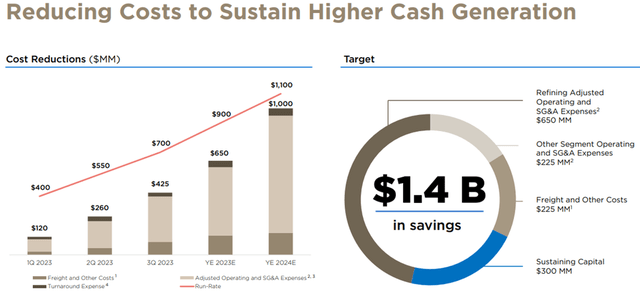

PSX has been capable of notice financial savings of $650 million over the course of 2023 with one other $350 being realized by the top of 2024. The complete yr impact of those financial savings is estimated to drive roughly $1.1 billion of prices out of the enterprise on an annual foundation.

At its present fee of manufacturing, PSX generates roughly 715 million barrels of product per yr. This value financial savings equates to a price discount of roughly $1.50/barrel. This may deliver the 2024 exit OPEX/barrel all the way down to the vary of $6.00/barrel. Reductions in sustaining capital are projected to extract one other $300 million in financial savings to drive PSX within the neighborhood of $5.60/barrel. Whereas this is able to nonetheless make PSX the very best value producer within the trade, it is going to not be such a ridiculous outlier from the pack.

Elliott believes that if administration can attain its EBITDA objectives of $9 billion in EBITDA by 2025, the corporate will likely be value $205/share. This may be a 55% enhance from immediately’s share value of $133.24/share. Whereas there are some skeptics if PSX can obtain these objectives, notably given the challenges in CPChem (extra on that later), enhancements in its refinery place will generate a significant enhance in shareholder worth.

From Q3 exit, PSX expects to avoid wasting $675 million yearly between now and 2024 exit. Utilizing the identical valuation metrics (10% FCF) as Elliott Administration, this is able to add $6.75 billion to the valuation of PSX, leading to roughly 11.5% enhance within the share value.

PSX January Investor Slides

Returns by the Numbers

Elliott’s letter to the PSX board focuses on the profitability of the refinery phase. This is sensible as this phase generates almost 60% of its revenue. Nevertheless, it largely reductions the efficiency of its different two segments, Midstream and Advertising that generate the remaining 40%. Each of those teams are considerably much less cyclical and supply a dependable earnings base.

In Q3, PSX revised its dedication to shareholders and raised the bar on shareholder returns. The corporate initially guided to return between $10-$12 billion over a time interval stretching from mid-2022 to yr finish 2024. Now that we’re on the midpoint of that program, PSX raised the steerage to between $13 and $15 billion, a large enhance.

In my earlier evaluation of PSX in March of 2023, I projected that the corporate would seemingly exceed the $12 billion mark even with refinery margins falling from file 2022 efficiency. Now virtually a full yr later, and $6.7 billion into this system lets dive into what shareholders can anticipate.

By yr finish, PSX is on monitor to generate $7.7 billion in internet revenue, a wholesome discount from $11 billion in 2022. This isn’t solely shocking as crack spreads have declined after a file yr. Nevertheless, the corporate is constant its efforts on value management and tasks to comprehend one other $350 million in value financial savings throughout 2024. Moreover, the Rodeo Renewed undertaking is slated to come back on-line within the first quarter and contribute $700 million of EBITDA for the corporate.

I’ve additionally modeled in additional refinery margin decline for conservatism. In my base case state of affairs, refinery margins fall 20% from 2023 ranges. I additionally mannequin Rodeo Renewed as not contributing to the underside line for added conservatism. To spherical out bills, the corporate tasks to spend $2.2 billion in CAPEX throughout 2024. All advised, PSX stands to generate $7 billion in money in the course of the yr.

| 2024e | |

| 2023 Internet Revenue | $7.7B |

| Price Financial savings | $0.35B |

| Rodeo Renewed Startup | $0B |

| CPChem Startups | $0.1B |

| Modifications in Refinery Margins | ($0.75B) |

| Depreciation | $2.0B |

| CAPEX | ($2.2B) |

| Internet Money Era | $7.2B |

Now that we established a conservative earnings profile for 2024, it’s potential to research how that money is distributed to shareholders. The desk under exhibits that PSX can nonetheless ship $5 billion in 2024 again to shareholders and nonetheless generate a constructive internet money place for the corporate.

| 2024e | |

| Internet Money Era | $7.2B |

| Dividend Price | ($2.0B) |

| Debt Reimbursement | ($1.1B) |

| Share Repurchases | ($3.0B) |

| Internet Money Steadiness | $1.1B |

Underneath these projections, assuming $800 million in share repurchases in This autumn of 2023, PSX will ship $13 billion again to shareholders as a base case state of affairs with $1.1 billion of margin remaining within the evaluation.

Reaching the High

To succeed in or exceed the highest finish of the guided returns, PSX might want to see secure or rising crack spreads. Administration has projected for a comparatively secure provide and demand outlook for the subsequent three years. The at present scheduled capability additions and retirements seems to be pretty balanced with a slight skew to the undersupplied aspect of the size.

I believe as we take a look at capability development, there was about 1.5 million barrels a day of internet capability added in 2023. That compares to world demand development of two.2 million, 2.3 million barrels a day. As we take a look at 2024, we have one other, name it, internet 1.4 million barrels a day of capability being added. And as you take a look at the IEA, EIA and OPEC, demand expectations are fairly broad for subsequent yr, between 1 million barrels a day and a couple of million barrels a day.

However as we take a look at 2025, 2026, the capability development is comparatively modest and we do have a continuation of rationalization that is occurring Lyondell, Houston. We have got Grangemouth, UK, lately introduced. Japanese refinery shutting down as properly. So solely about 1 million barrels a day of development in 2025, 2026. So, not an awesome quantity of capability coming into the market.

If refining margins are flat this can re-inject $1.3 billion again into the money circulation mannequin that may be deployed for extra share repurchases. This may simply drive PSX into the middle-to-top finish vary of its projected shareholder return program. Any profit from Rodeo Renewed (which I anticipate to contribute at the very least $500 million) will drive PSX to the highest of their vary and presumably past.

A 7% enhance within the Dividend

PSX has been a trustworthy steward of its dividend. In March of this yr, CEO Mark Lasher gave a really promising outlook for a way the corporate intends to deal with the dividend.

And we had a hiatus from share repurchases throughout COVID. We persistently grew our dividend all through COVID, so we did not again off our dividend. We — that is the promise we make. And we are likely to view our dividend as an irrevocable promise. And so we’re cautious about rising that dividend. However on the tempo of share repurchases we’re making immediately, we see that incremental dividend money being pretty constant. So we’ll enhance the dividend per share over time. However as we repurchase shares, take these off the desk. That will likely be a constant quantity at about proper at $2 billion a yr. And so that is the near-term shareholder return dedication that we made

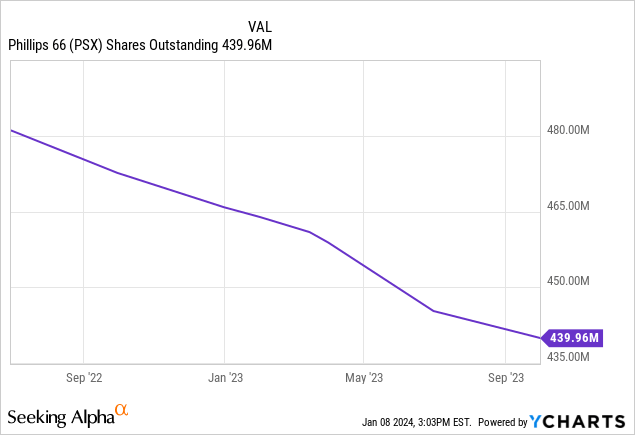

Utilizing the framework of a continuing dividend value permits the corporate to drive dividend development via share retirement. This helps longtime shareholders to comprehend each appreciation and revenue.

PSX has spent a median of $950 million in share repurchases per quarter so far in 2023. As of the top of Q3 it has retired almost 25 million shares and is on monitor to retire an extra 7.5 million in This autumn for a complete of 32.5 million shares. The financial savings from these retired shares will likely be reallocated again to the prevailing shares to drive the dividend value again as much as $2 billion a yr or $500 million quarterly.

This equates to a 7.9% enhance within the dividend if taken precisely to the $2 billion mark. I consider traders will see a quarterly dividend elevate to roughly $1.13/share for 2024.

Alternatives for Extra Worth Creation

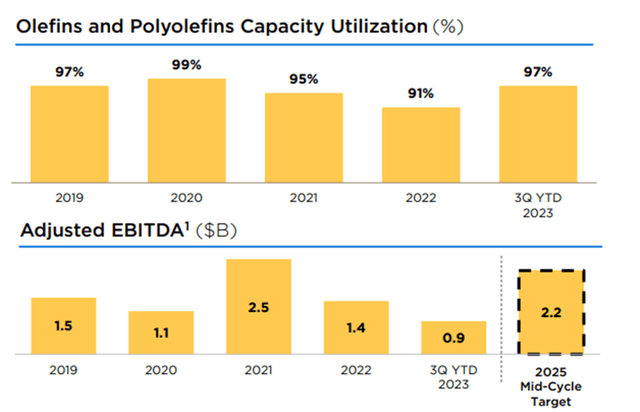

Past closing the hole in refining working prices, Elliott Administration additionally recognized the chance to monetize non-core belongings to spice up the capital return program for PSX. Elliott has aligned with many Searching for Alpha readers in that PSX ought to promote is CPChem stake as it’s a very giant capital funding for PSX with little or no revenue to indicate for it. The annual internet revenue creation from this phase is at present within the vary of $600-$800 million yearly.

Since sale of this group would solely barely detract from your complete enterprise’s incomes potential, this looks like an apparent supply to reap capital. Sadly, right now, PSX’s administration appears content material to play the long game with CPChem.

However CPChem is properly positioned to endure these sorts of circumstances. They’ve a powerful aggressive place. 95% of their feedstock is advantaged. And they also’ve been capable of run flat out and create good bottom-of-the-cycle worth, virtually $1 billion of EBITDA again to us on the backside of the cycle is a fairly good story. However we see fundamentals proceed to enhance. It’ll be a perform, although, of what is going on on within the world financial system.

And so we proceed to be bullish in the long run round CPChem, round their worth chain, however the final end result goes to be pushed by world economics.

It is truthful to be skeptical on the prospects of CPChem. Administration expects a mid-cycle goal of $2.2 billion in EBITDA if the trade can obtain “mid-cycle” margins by that point. With two multi-billion greenback cracker crops underneath development to begin operations in 2026, it calls into query the return of invested capital from these tasks.

PSX January Investor Slides

I hate to be close to sighted, however I worry it is a tall job for one administration staff to appropriately handle enterprise in refinery, retail, midstream, and a JV chemical substances unit. It is onerous to be good at every little thing. Due to this fact, on this premise, I’d be in favor of promoting the CPChem unit for redeployment of capital.

Dangers

The obvious danger can be a decline in crack spreads resulting in a speedy decline in refinery profitability. The oil and gasoline trade is infamous for being cyclical and traders don’t need to be caught on the flawed aspect of the cycle. My evaluation baked in an total 20% discount in refinery margins and decreased revenue development to offer some conservatism. On this base case, PSX continues to be capable of meet the minimal of $13 billion in returns it has promised to shareholders.

A further danger can be an additional delay with the Rodeo Renewed undertaking. Since that is largely a regulation play, the general route of the undertaking might be modified with the stroke of the pen. There’s the potential for margin compression on this sector as a number of renewable tasks are coming into the market.

If each of those situations pan out concurrently, I consider ample margin exists to ship the bottom case of shareholder returns as value financial savings in each the refinery and midstream segments can mitigate most of those losses.

Abstract

On this article I analyzed the affect of PSX’s value discount program in addition to the cumulative affect of its shareholder return program. I reviewed how enhancements within the refinery enterprise might generate an 11.5% enhance in share value utilizing a FCF based mostly analysis.

I additionally introduced a base case projection that permits PSX to succeed in its minimal threshold to return $13 billion to shareholders by the top of 2024 assuming a 20% compression in refinery margins. If refinery margins are maintained, the highest finish of the return steerage of $15 billion may be achieved.

I consider affected person traders will likely be rewarded with a hefty 7% dividend elevate in 2024 in addition to important share appreciation because the cumulative results of value reductions and share repurchases are realized. I proceed to fee PSX as a purchase underneath $135/share.