- Peter Schiff criticized MicroStrategy’s inventory regardless of it reaching an all-time excessive.

- MicroStrategy’s Bitcoin portfolio’s market worth boosted to over $40 billion, regardless of volatility.

Peter Schiff, a distinguished crypto critic, has as soon as once more focused Michael Saylor’s agency, MicroStrategy.

In a latest submit, Schiff issued a stark warning about MicroStrategy’s inventory (MSTR), which has just lately reached an all-time excessive following the corporate’s bold plan to remodel it right into a trillion-dollar Bitcoin [BTC] financial institution.

This marks one other occasion of Schiff’s ongoing skepticism towards companies deeply invested in cryptocurrency, particularly BTC.

On the twenty second of October, he posted on X (previously Twitter), saying,

“$MSTR has obtained to be essentially the most overvalued inventory within the MSCI World Index. When it lastly crashes, that’s gonna be the actual massacre!”

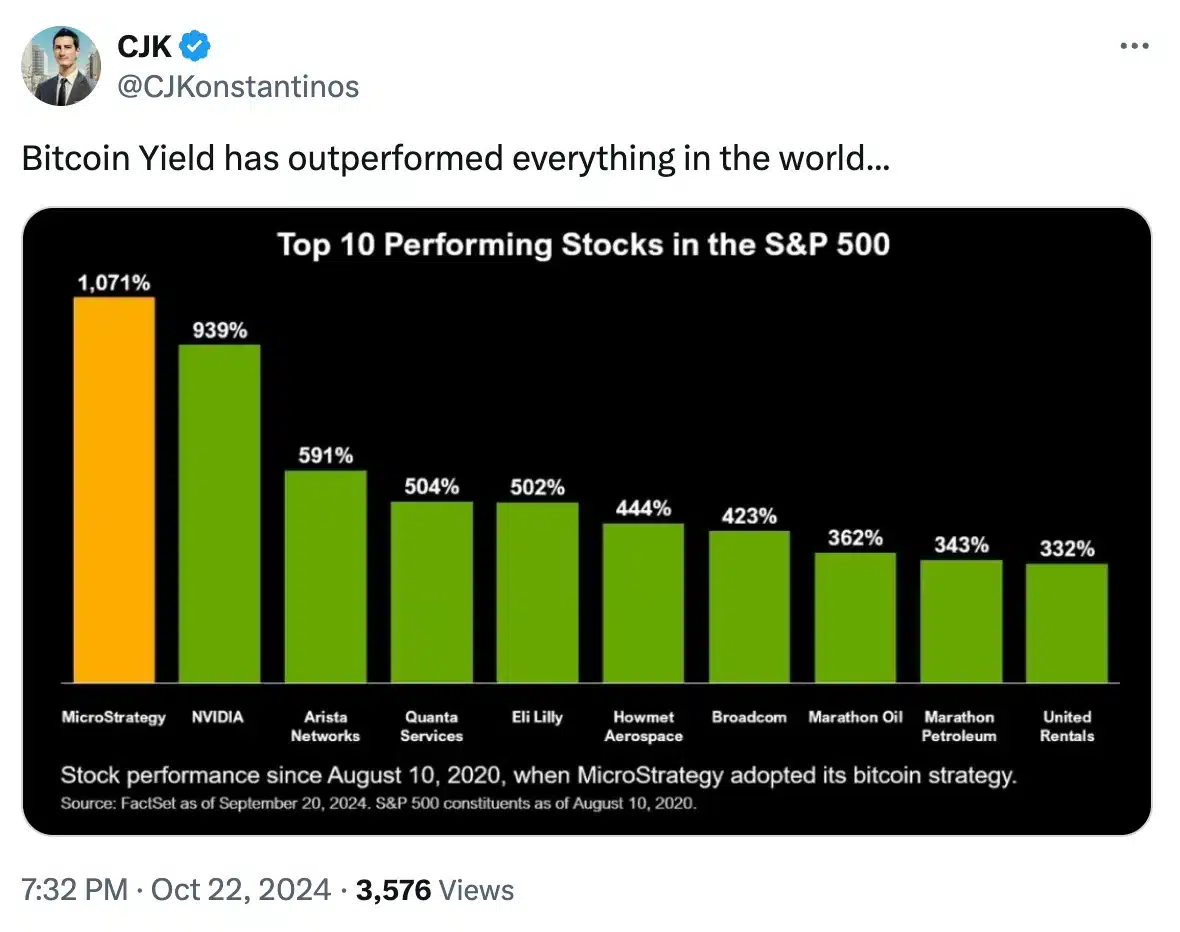

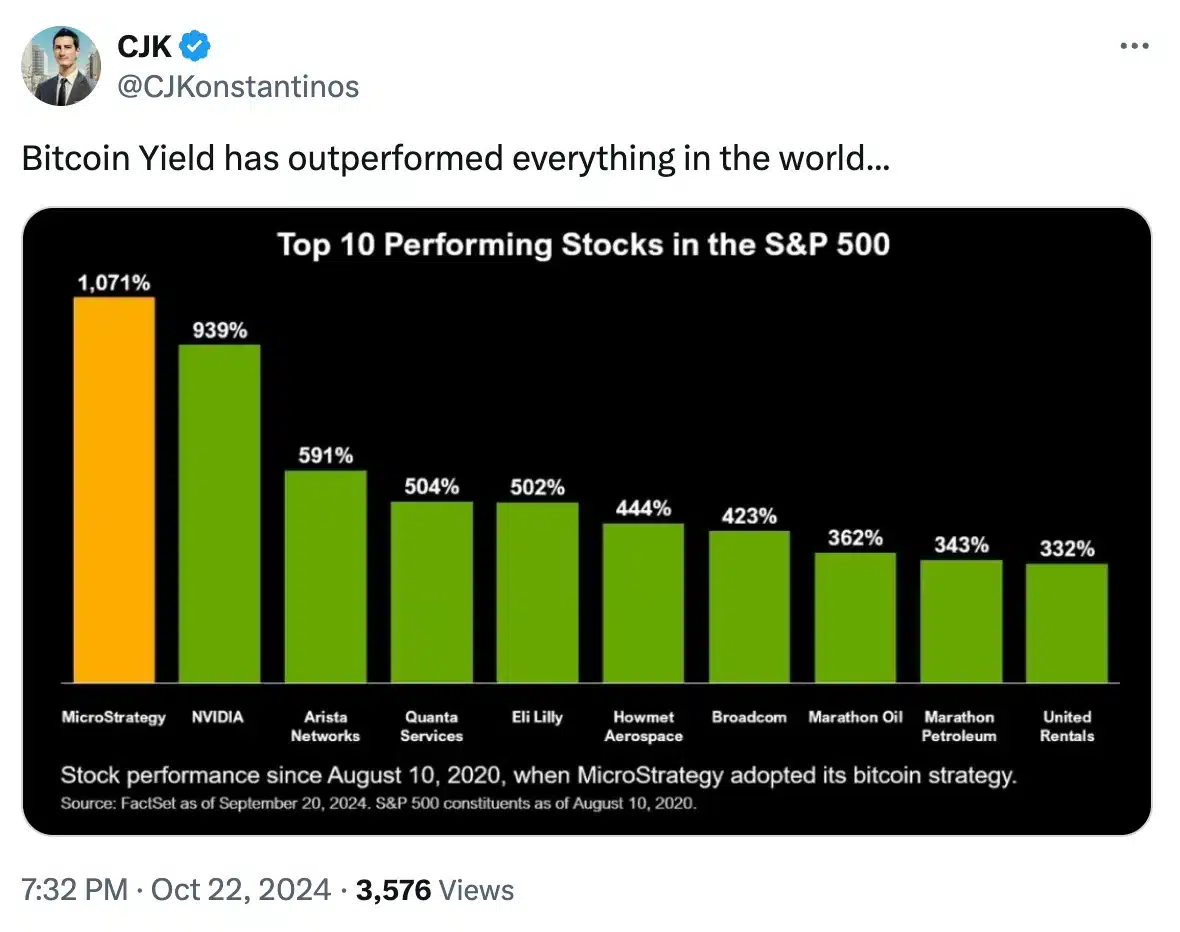

Nevertheless, the warning was largely taken with a grain of salt as highlighted by CJ Konstantinos, in his latest submit the place he stated,

Supply: CJK/X

Nevertheless, Schiff pressed on together with his argument, asserting his factors and claiming,

“Bitcoin doesn’t have a yield. You may promote it to generate capital features, you’ll be able to write calls in opposition to it to generate earnings, however Bitcoin itself has no yield. Worse, in the event you personal it in an ETF you pay custody charges.”

Why is Schiff in opposition to Bitcoin?

Schiff, a longtime advocate of gold and vocal opponent of cryptocurrencies, has persistently voiced his skepticism towards Bitcoin.

He has steadily argued that BTC is a speculative asset missing the intrinsic worth present in conventional investments like gold.

This has made him a distinguished determine within the ongoing debate between Bitcoin proponents and people who consider in conventional finance.

Then again, MicroStrategy’s strategic pivot towards BTC has confirmed to be extremely profitable.

Over the previous 4 years, the corporate has seen its market worth skyrocket from $1.5 billion to over $40 billion. This development is basically credited to Michael Saylor’s daring resolution to take a position closely in Bitcoin.

This transfer has positioned MicroStrategy as a significant Bitcoin participant, controlling 252,220 BTC.

Schiff takes a jab at Saylor

Throughout a latest dialogue in regards to the BTC seized from the Silk Street market, Peter Schiff humorously focused Michael Saylor.

Schiff quipped that Saylor ought to contemplate borrowing the $4.3 billion value of Bitcoin from the federal government to additional bolster MicroStrategy’s already large BTC holdings.

This sarcastic comment highlights Schiff’s ongoing criticism of Saylor’s aggressive Bitcoin technique, whereas subtly mocking the corporate’s deep dedication to increasing its cryptocurrency property.

Amidst such talks, MicroStrategy’s inventory worth skilled a modest 0.30% enhance, reaching $219.70. This displays regular investor confidence within the firm’s BTC-focused technique.

Supply: Google Finance

Then again, Bitcoin noticed a slight dip of 0.93% over the previous 24 hours, with its worth settling at $66,947.37, at press time, as per CoinMarketCap.