grandriver

Permian Assets (NYSE:PR) is an oil and fuel exploration firm solely centered on the Permian Basin. Earlier than I start, let me warn you not to take a look at the value of Permian Assets following oil’s crash in 2020. It reached a low in 2020 of 30 cents. Right now, the corporate trades round $13 per share and has a market cap of $7.33 billion. Don’t be concerned, you would not have been in a position to purchase Permian Assets in 2020…you’ll have had to purchase it in two elements. That is as a result of the corporate Permian Assets was the results of a merger between Centennial Useful resource Improvement and Colgate Power Companions (which was a personal firm) in 2022.

The corporate has many thrilling issues going for it, not the least of which is the truth that it’s purely primarily based within the Permian Basin. For those who’ve learn any variety of my articles, then I’m bullish on the Permian Basin. As I am writing this text Exxon Mobil (XOM) is in talks to doubtlessly purchase Pioneer Pure Assets (PXD), making an enormous transfer into the Permian Basin. And identical to Exxon Mobil, I am bullish as a result of it’s the place firms are focusing the lion’s share of their capital as it’s delivering superior risk-adjusted returns relative to different initiatives round america and the world.

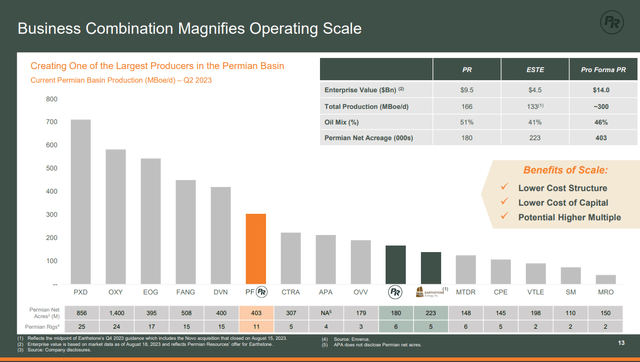

In August 2023, Permian Assets introduced its personal acquisition. Previous to the announcement, Permian Assets held 180,000 internet leasehold acres and one other 40,000 internet royalty acres within the play whereas producing 137,000 barrels of oil per day. They have been already one of many largest publicly traded Permian pure-plays obtainable.

Then, the corporate introduced that they have been buying Earthstone in an all-stock acquisition. The corporate is predicted to shut on the acquisition someday earlier than the tip of the yr. The corporate is creating 1.446 new Permian Assets shares in trade for every Earthstone share. For the reason that information of the acquisition occurred, the inventory has traded comparatively flat.

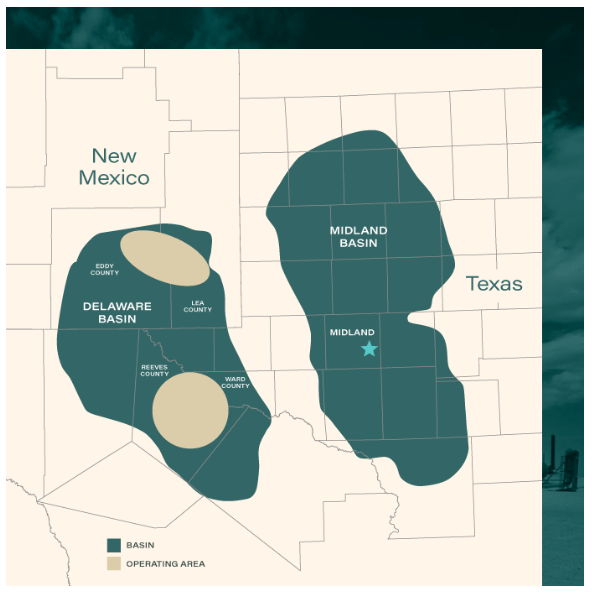

Here’s a have a look at the place the corporate was centered within the Permian Basin earlier than the acquisition. Discover that one of many firm’s heavy focuses is in Lea and Eddy Counties. That’s vital to grasp.

Permian Assets Areas of Operations (Permian Assets Web site)

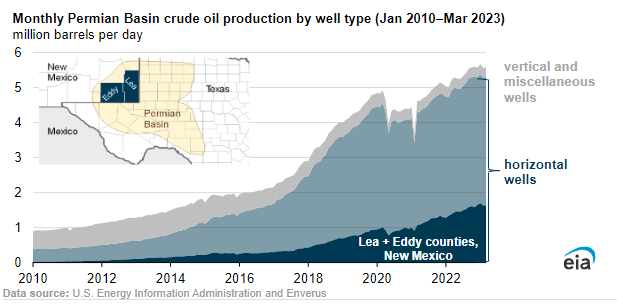

Right here is the EIA’s chart exhibiting the expansion in oil manufacturing from the Permian Basin. There was little or no manufacturing from Lea and Eddy Counties previous to the shale oil/horizontal oil drilling increase however right this moment, it has been one of many massive tales from the Permian Basin, even grabbing the eye of the Power Info Affiliation.

EIA Permian Oil Manufacturing Chart (EIA)

Acquisition

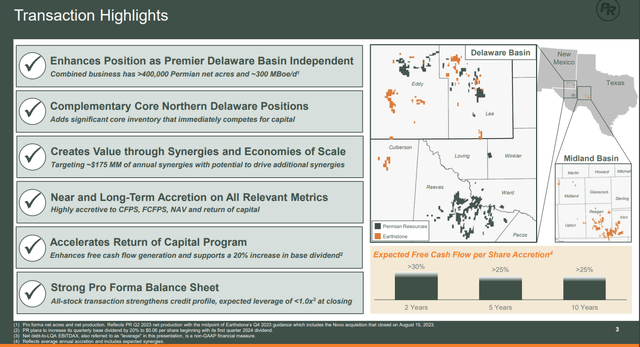

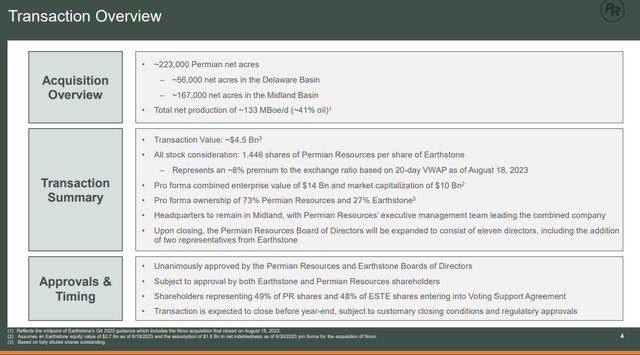

Within the picture beneath, Earthstone acreage is represented within the orange. Simply from guessing, the corporate roughly doubled its footprint (not internet) in Lea and Eddy counties(Northern Delaware). The opposite massive addition was a bit of acreage within the Midland Basin portion of the bigger Permian Basin. All-in-all this elevated Permian Assets acreage to over 400,000 internet acres and greater than doubled manufacturing to 300,000 barrels of oil equal per day.

Earthstone Acquisition Highlights (Firm Presentation)

The headquarters of the corporate is positioned proper within the coronary heart of the Permian in Midland, Texas. The vast majority of the rise in “internet” acres involves the corporate within the Midland Basin because the Earthstone working pursuits within the Northern Delaware have been probably solely a partial curiosity. Nonetheless, the addition of acreage within the Delaware Basin was nonetheless substantial.

Permian Assets Earthstone Transaction Overview (Acquisition Presentation)

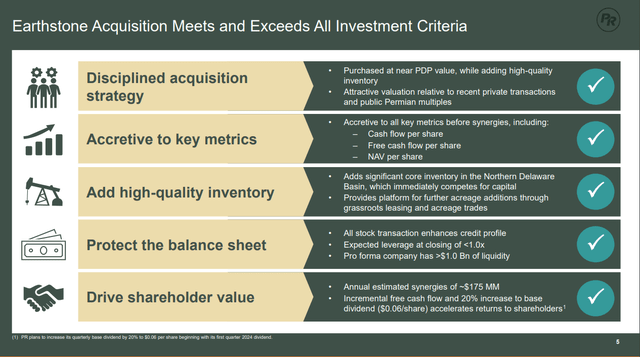

The administration workforce believes the mix of those two firms unleashes the likelihood for higher returns sooner or later. The corporate believes the acquisition, regardless of being funded with share dilution, will probably be accretive to money circulation per share, free money circulation per share, and NAV per share. As an investor, these are what we wish to see from an organization, particularly if it took share dilution to make the acquisition.

Earthstone Acquisition Highlights (Acquisition Presentation)

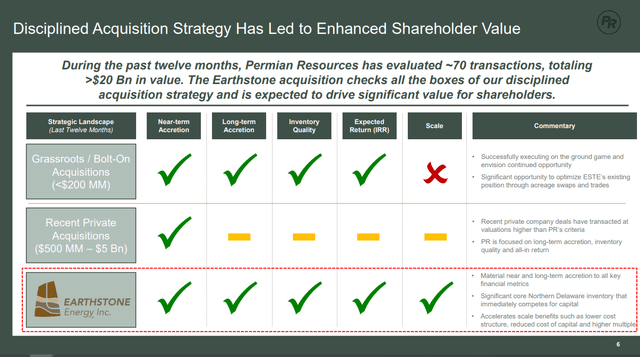

The Permian Assets workforce evaluated many alternative choices to extend shareholder worth and Earthstone was the acquisition that checked the entire containers. Discover that the corporate was centered on buying acreage within the Northern Delaware area as they know that’s the premier acreage within the play. Because the slide says, it “will instantly compete for capital.”

Earthstone Acquisition Checks the Bins (Acquisition Presentation)

Working Money Flows

The corporate’s document of money flows is about to dramatically change, nevertheless, it’s nonetheless useful to take a look at their prior money flows to see if the administration workforce has operated effectively. In 2018, earlier than the businesses have been mixed, the corporate was creating unfavorable free money circulation as they have been ramping up manufacturing with extra alternatives to deploy capital than capital obtainable.

We will see that following the plunge in oil in 2020, the corporate’s money flows continued on their upward trajectory. I’d anticipate these development charges to proceed into the foreseeable future.

Permian Assets Money Flows

| $ tens of millions | 2018 | 2019 | 2020 | 2021 | 2022 | TTM 2023 |

| Working Money Circulate | 670 | 564 | 171 | 526 | 1,372 | 1,803 |

| CapEx | (1,217) | (968) | (328) | (327) | (784) | (1,378) |

| Free Money Circulate | (547) | (404) | (157) | 199 | 588 | 425 |

Earthstone was a bit of behind Permian Assets in its development trajectory. Whereas Permian Useful resource started outspending working money circulation in 2018, Earthstone did not start to do the identical till 2021-22.

Earthstone Money Flows

| $ tens of millions | 2018 | 2019 | 2020 | 2021 | 2022 | TTM 2023 |

| Working Money Circulate | 102 | 126 | 131 | 230 | 1,018 | 1,158 |

| CapEx | (183) | (205) | (88) | (427) | (2,018) | (1,235) |

| Free Money Circulate | (81) | (79) | 43 | (197) | (1,000) | (77) |

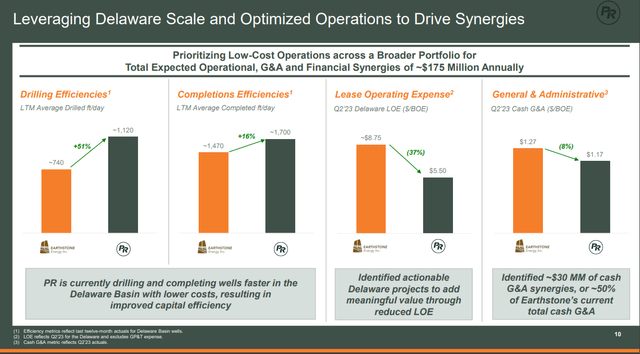

The mixed firm hopes to save lots of $175 million yearly by means of synergies. You possibly can see right here that in keeping with these metrics, Permian Assets has been the extra environment friendly operator. Naturally, as Permian Assets transfers this information into financial savings for Earthstone operations, it ought to spell higher returns for traders.

Permian Assets Optimize Operations (Acquisition Presentation)

Steadiness Sheet

The corporate has maintained a robust self-discipline with its stability sheet. Within the acquisition, Permian Assets assumes all debt of Earthstone, which is able to change the desk beneath. Nevertheless, this provides you an image of how the corporate has managed its stability sheet with strict self-discipline, even within the face of unfavorable free money circulation throughout 2018 and 2019.

| $ tens of millions | 2018 | 2019 | 2020 | 2021 | 2022 | Q2 2023 |

| Property | 4,260 | 4,688 | 3,827 | 3,805 | 8,493 | 8,926 |

| Debt | 1,016 | 1,418 | 1,223 | 1,054 | 2,836 | 3,000 |

| Debt-to-Asset Ratio | .24 | .30 | .32 | .27 | .33 | .34 |

The mixed firm’s stability sheet could have a debt-to-asset ratio of roughly .35, holding in step with Permian Assets’ debt-to-asset ratio previous to the acquisition.

Shares Excellent

For those who select to put money into Permian Assets, perceive that they’ve actively used share dilution as one of many instruments of their software belt to develop the corporate. This can be a double-edged sword. If the corporate deploys the capital with self-discipline, then it is a positive technique. However generally the market doesn’t look favorably on this technique.

If my math is appropriate, the brand new firm could have roughly 722 million shares excellent after the Earthstone acquisition clears.

| tens of millions | 2018 | 2019 | 2020 | 2021 | 2022* | Q2 2023 |

| Shares Excellent | 267 | 277 | 277 | 310 | 558 | 569 |

*Merger between Colgate and Centennial accomplished

Permian Assets Relative Scale

Permian Assets is presently valued at lower than $10 billion and the mixed firm at right this moment’s share costs could have a valuation that also falls proper at $10 billion. Examine this to the businesses like Devon Power, which have a market cap of almost $28 billion. Granted, Devon Power has different performs that it’s concerned in, however the Permian is Devon Power’s most important focus simply as it’s for a lot of E&P firms nowadays. One can see how Permian Assets has the potential to shortly scale to the scale of Devon Power (DVN).

Permian Assets Relative Footprint within the Permian Basin (Acquisition Presentation)

Valuation

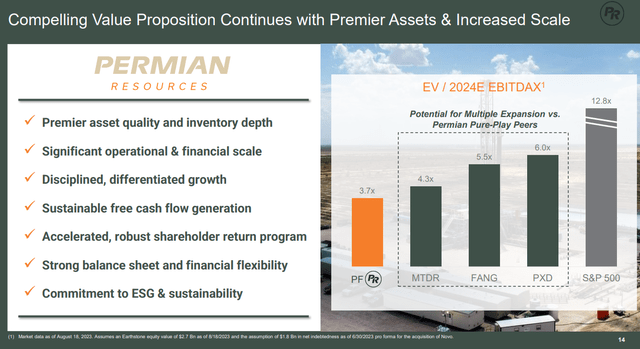

The corporate is presently undervalued relative to a few of its friends. And now with Pioneer getting acquired by Exxon Mobil at a premium, it stands to purpose that we’ll start to see Permian Assets obtain larger multiples.

Permian Assets Relative Valuation (Acquisition Presentation)

Dangers

Permian Assets is on strong footing. They’ve one of many higher stability sheets within the trade and have an enviable place staked out within the Northern Delaware Basin the place a number of the finest charges of return within the Permian Basin are discovered. However as with all funding, there are nonetheless dangers concerned.

First, there may be all the time a threat that the merger does not undergo. On condition that they have been in a position to announce their acquisition previous to Exxon’s acquisition, they probably acquired a greater deal buying Earthstone (NYSE:ESTE) than they’d have in any other case. This can be a credit score to the Permian Assets administration workforce and their foresight. Nevertheless, if the acquisition does not undergo, then they may probably need to pay a better value in the event that they have been to pursue the Earthstone acquisition additional.

Second, oil costs might decline. Nevertheless, I do not see that being a giant threat. I’ve spoken about vitality demand in earlier articles, and it reveals no signal of reducing, even with the large government-funded push in direction of electrical autos. And if you do the maths, relying on the place you reside, electrical autos hardly ever justify the added value to buy. Because the transition in direction of electrical autos continues, it can take longer than all of us anticipate.

Third, regulatory threat within the oil and fuel trade is on the entrance of everybody’s thoughts. It’s holding many individuals away from the undervalued oil trade, however I don’t see this as a giant threat within the close to time period. I’d say that an individual must be leveraged/invested within the Permian Basin for not less than the following 5 to six years. The regulatory dangers could be reevaluated then.

Fourth, as I already identified, share dilution may even be a threat when investing in Permian Assets.

Conclusion

Permian Assets is a robust purchase in the mean time. I presently don’t maintain any investments within the oil and fuel sector, regardless that that is what I cowl principally. Nevertheless, if I used to be going to put money into one firm, it might be Permian Assets. Throughout the board, they’ve developed a observe document as an organization that understands the need to focus totally on the charges of return on capital invested.

I did not cowl it on this article, however the administration workforce at Permian Assets is younger. Regardless of being younger, you possibly can witness that the selections being made, present a maturity past their years. And if they continue to be an unbiased firm, this administration workforce could ship some critical alpha to your portfolio throughout their careers. The very best investments occur by figuring out and investing within the folks, and never simply the initiatives themselves. In any case, the capital initiatives are created/discovered by the folks.

Moreover, with the latest acquisition of Pioneer Assets by Exxon Mobil undoubtedly makes Permian Assets a takeover goal sooner or later. There is no telling when that would occur, however with round 400,000 acres within the Permian Basin, it might add scale to any current main or mid-major oil firm. The administration workforce at Permian Assets is targeted on driving worth and so if the suitable alternative introduced itself, I am positive the administration at Permian Assets would capitalize on it. However once more, this might occur subsequent yr, or it might occur 10 years from now.

Regardless, traders are sitting on one of many bigger gamers within the Permian which is able to proceed to pay out higher and higher dividends as their money flows from the play proceed to mature.

As soon as once more, presently, Permian Assets is a robust purchase.