- The exponential surge led PENDLE holders to lock in positive aspects

- The value rally will be linked to a surge in deposits on father or mother platform Pendle Finance

PENDLE, the native token of decentralized finance (DeFi) protocol Pendle Finance, has emerged as a sizzling commodity on account of an astronomical surge in worth over the previous couple of weeks.

Why PENDLE is within the information?

The altcoin appreciated by almost 5o% over the week, and a whopping 108% in a month’s time, in accordance with CoinMarketCap. For the reason that 12 months started, PENDLE has jumped by greater than 5x in worth, boasting of a $1 billion-plus market capitalization at press time.

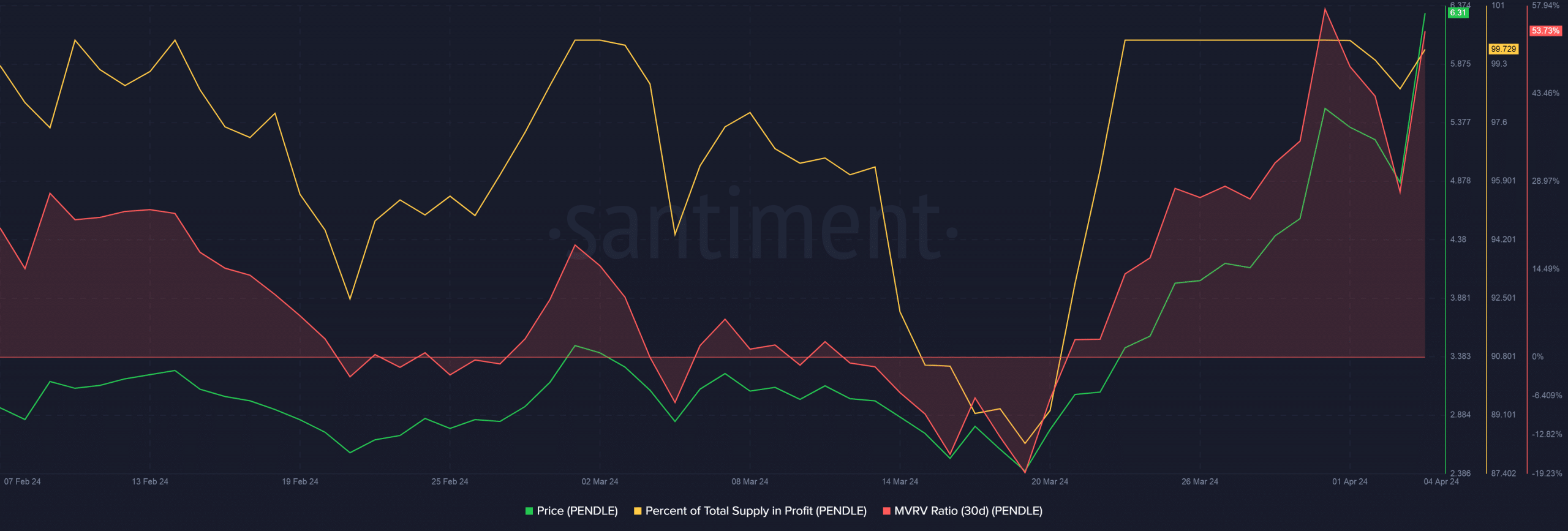

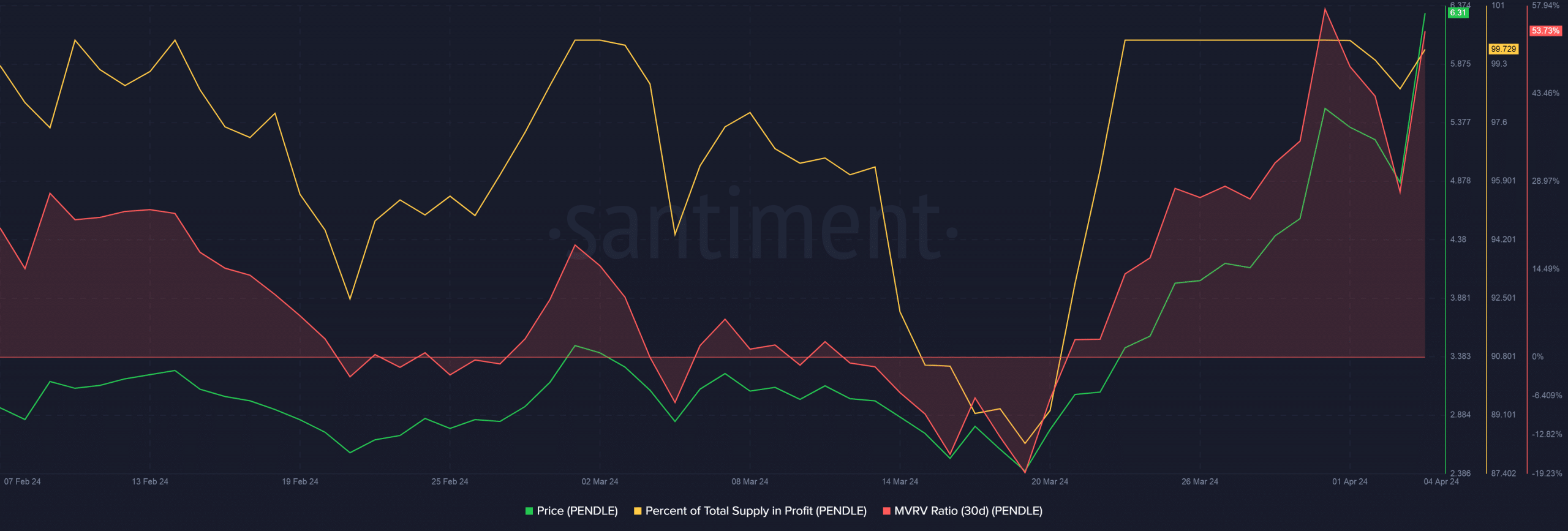

The uptrend led to a pointy uptick within the profitability of coin holders. In actual fact, in accordance with AMBCrypto’s evaluation of Santiment’s information, about 99.73% of PENDLE’s whole provide was in revenue at press time.

Furthermore, a median PENDLE holder can understand a 50% return on their investments, as seen by the 30-day MVRV Ratio.

Supply: Santiment

Moreover, holders are already discovering it exhausting to withstand such temptations. For instance – Based on on-chain monitoring platform Spot on Chain, a dealer was seen shifting an enormous chunk of their PENDLE holdings to cryptocurrency alternate Binance.

The investor transferred 200k tokens, value $1.25 million at press time, on Thursday. Simply 4 days previous to this transaction, they deposited 162k tokens, value $919k. Each the transfers had been made when PENDLE hit its peak.

Apparently, they purchased these tokens in 2022-23, when PENDLE’s worth was $0.147. The whale nonetheless has 200k of PENDLE left of their pockets, suggesting expectations of additional worth positive aspects.

Pendle Finance sees spike in TVL

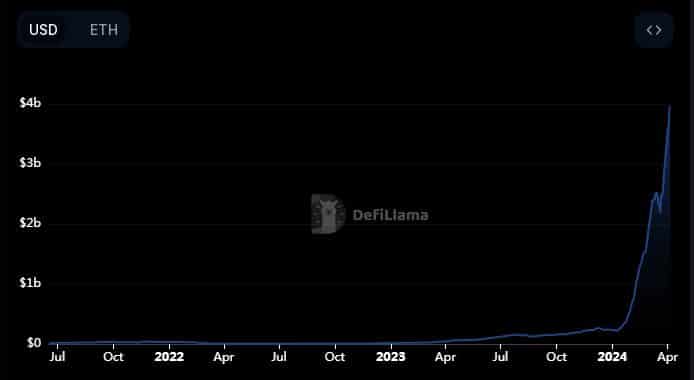

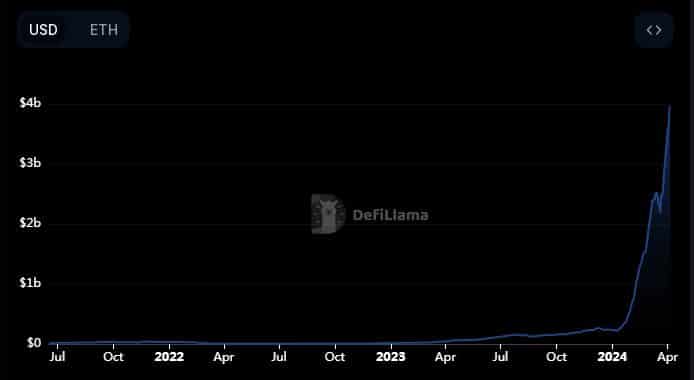

PENDLE is the governance token of Pendle Finance, a singular platform that enables customers to commerce and worth tokenized yield property. The rally will be linked to a surge in deposits on the platform, which was nearing $4 billion at press time.

Supply: DeFiLlama

A more in-depth look by AMBCrypto revealed that the current TVL increase was on account of giant infusion of USDe, a so-called artificial stablecoin by Ethena Labs. The asset gave the impression to be providing a 37% annual share yield at press time, encouraging customers to deposit them to Pendle and increase their earnings.