FatCamera/E+ by way of Getty Photographs

After I have a look at an organization like Peloton (NASDAQ:PTON), I usually marvel at how rapidly a beloved, fashionable firm can flip right into a pariah when it is topic to the whims of client demand. The exercise-bike maker was one of many hottest shares to commerce through the pandemic, however amid this 12 months’s recession and continued normalization of post-COVID life, the corporate has continued to stumble.

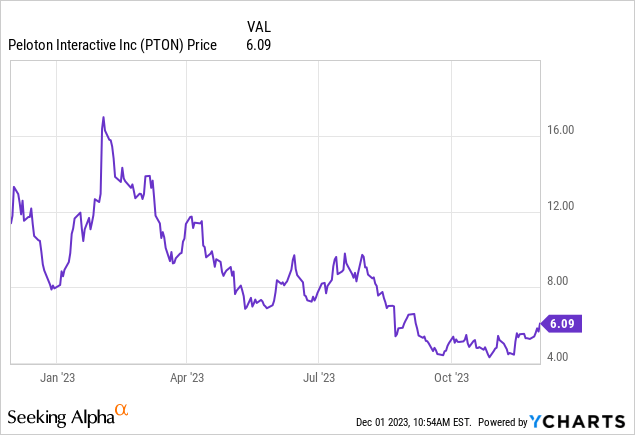

12 months thus far, shares of Peloton have misplaced ~25%, however proceed to be properly over 90% beneath all-time pandemic highs. The inventory has staged a minor restoration over the previous month on little optimistic information (principally in sympathy with the rebound in different development names), however in my opinion, it is a dead-cat bounce that may’t be trusted.

I final wrote a bearish observe on Peloton in September, when the inventory was buying and selling within the mid-$4s. Since then, the inventory has rallied (once more, principally in live performance with different small/mid-cap development names as rate of interest expectations have decreased), regardless of what I view to be a poor fiscal Q1 earnings report that the corporate launched in early November. I stay bearish on Peloton and consider the inventory has additional draw back in 2024.

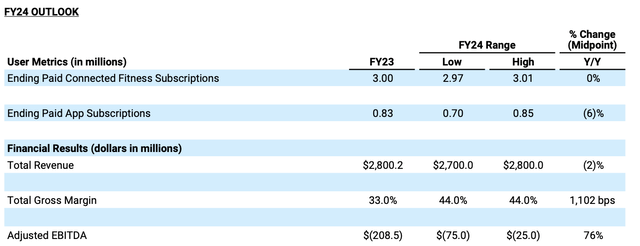

Peloton FY24 outlook (Peloton Q1 shareholder letter)

It is value noting, within the snapshot above, that Peloton’s personal outlook for FY24 (which is the 12 months ending in September 2024 for the corporate) requires a -2% y/y income decline. The one saving grace right here is that it’s anticipating a way more benign loss from an adjusted EBITDA standpoint, pushed primarily by a considerable anticipated improve in gross margins as the corporate raises {hardware} costs to not take losses and mixes extra into subscription income as product gross sales proceed to dwindle. However cost-cutting and smaller losses is barely a concession that the corporate can supply, when the enterprise has exhibited such destructive developments over the previous two years.

As a reminder, listed here are what I view to be the important thing purple flags for Peloton:

- Product remembers and a stained model image- Peloton has suffered a variety of very seen product remembers that, in my opinion, have diminished its premium picture. Rivals like NordicTrack could also be much less flashy, however they’re actually less expensive and do not include current headline baggage.

- Companions are pulling back- Peloton depends on channel companions to spice up its point-of-sale presence and publicity to clients. Within the present leaner macro instances, resellers are hyper-sensitive to decreasing stock ranges to unlock money, which is hurting Peloton’s {hardware} gross sales.

- Can we actually justify that Peloton is cheaper than a gymnasium membership? Let’s ignore the economics of an costly bike or treadmill buy for a second and take into account Peloton’s $89/month bundle which incorporates a normal Bike (not Bike+) rental and a subscription to Peloton App+ (a $24/month worth, and never the complete All-Entry subscription at $44/month). Evidently, there are a lot of gyms within the <$100 class, so Peloton’s solely attraction right here is comfort.

- Unclear substitute cycles- And in a world the place Peloton’s core buyer base isn’t end-consumers however gyms, it is unclear how lengthy Peloton bikes final and if gyms will routinely substitute gear – limiting Peloton’s potential to maintain preserving its income base.

The corporate is engaged on a number of development drivers for FY24, after all – the chief two being leases and a larger give attention to the paid Peloton App expertise. Leases at the moment are roughly one-third of the corporate’s Bike orders – however nonetheless, it isn’t a big enterprise, with the corporate anticipating to finish FY24 with 75k renters, up from 54k on the finish of the newest Q1. At $89/month for probably the most fundamental Peloton Bike mannequin, 75k renters interprets to only ~$80 million in annual income, which is a small fraction of the corporate’s ~$2.8 billion expectation for the 12 months.

All in all, I proceed to see few catalysts that may rescue Peloton from weak gross sales, continued losses, and an already-strained steadiness sheet. Keep warning right here and stay on the sidelines.

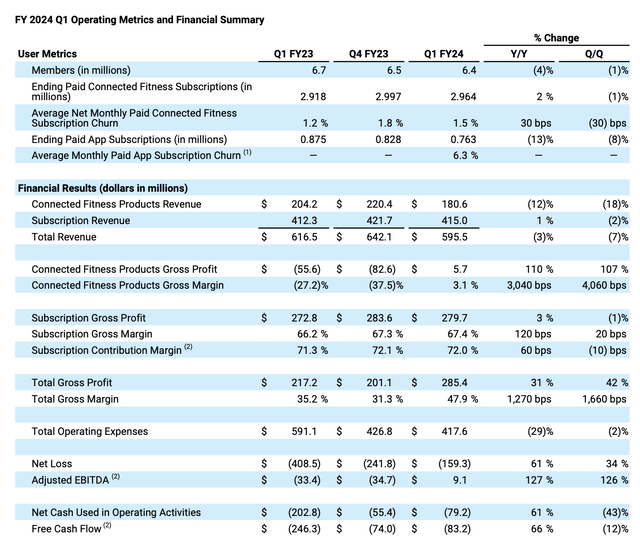

Q1 obtain

Let’s now undergo Peloton’s newest Q1 (September quarter) ends in larger element. The Q1 earnings abstract is proven beneath:

Peloton Q1 outcomes (Peloton Q1 shareholder letter)

Income declined 3% y/y to $595.5 million, roughly in-line with Road expectations of $600.3 million (-2% y/y). {Hardware}/merchandise income declined 12% y/y to $180.6 million, whereas subscription income was flat at 1% y/y to $415.0 million – now representing greater than two-thirds of the corporate’s income. In fact, that blend does are likely to tilt in fiscal Q2, as the vacation season weighs extra closely towards {hardware} gross sales.

Be aware that is not essentially optimistic from a profitability standpoint. Peloton’s {hardware} merchandise barely make any cash (and actually, they used to lose cash). As seen within the chart above, merchandise gross margin was solely 3.1%, although that is 30 factors higher than a 27% loss within the year-ago Q1. Complete gross margins shifted up by 1270bps to 47.9% within the quarter, pushed by the enhance in {hardware} profitability plus the a lot heavier subscription income combine within the quarter – which I view to be the foremost optimistic for the quarter.

Nonetheless, developments within the subscription enterprise are regarding. Churn continued to be excessive, with paid health subscriptions persevering with to say no by 33k paid subscribers to 2.964 million, after shedding 30k subscribers within the earlier This autumn. In the meantime, subscribers for the Peloton App – which the corporate simply launched on a standalone foundation in Might of this 12 months – dwindled sharply, shedding 65k paid members within the quarter to 763k. Within the firm’s shareholder letter, CEO Barry McCarthy wrote that within the App enterprise, “we have been much less profitable at partaking and retaining free customers and changing them to paying memberships than we anticipated.”

The corporate’s technique for fixing this, as famous within the shareholder letter, is:

We did two issues in response. First, we shifted our advertising spend to give attention to our paid App. That shift labored properly and is driving the next mixture of premium priced App+ subscribers than we have been anticipating. Second, we redoubled our efforts to take away onboarding friction in our App to help new customers to find their first Peloton courses. This will likely be a long run work in course of.”

The corporate’s Q2 outlook requires complete paid Related Health subscribers to rise again to a 2.97-2.98 million vary, however for paid app subscriptions to fall to 660-680k subscribers. Larger than anticipated churn is anticipated as many subscribers who joined the Peloton App earlier than it modified its pricing tiers in Might 2023 are going to lose entry to legacy content material inside the quarter. General, there’s not a lot hope for development within the subscription enterprise – regardless of this income stream now being the spine of Peloton’s total enterprise in addition to its profitability.

The excellent news is that much less sharp losses on {hardware} have helped Peloton’s adjusted EBITDA swing to a slight optimistic, and at no cost money circulation burn within the quarter to cut back -67% y/y to a lack of $83 million within the quarter. Nonetheless, we regularly fear about Peloton’s liquidity.

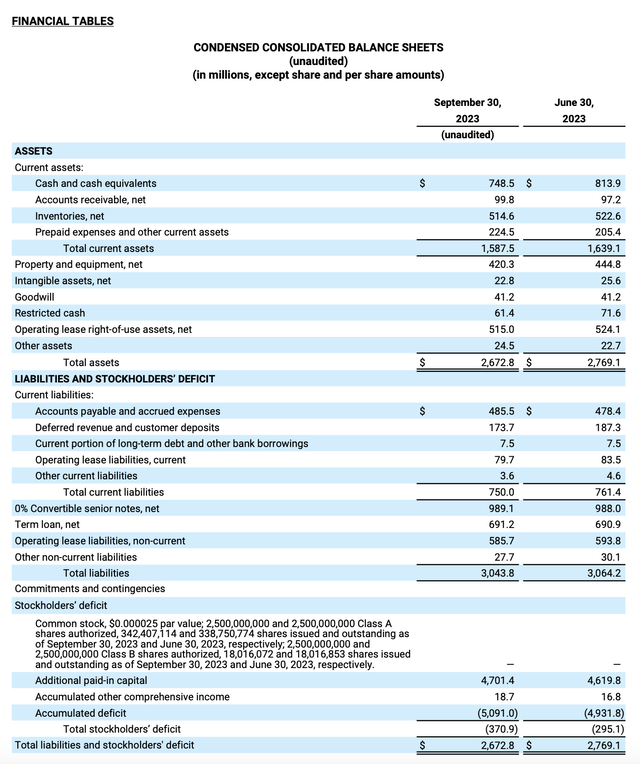

Peloton Q1 steadiness sheet (Peloton Q1 shareholder letter)

As proven above, on the finish of Q1 Peloton had solely $748.5 million of money remaining on its steadiness sheet – and that is greater than offset by $1.69 billion of debt.

Key takeaways

Peloton has arrested its development declines and is hoping to return to slight development within the second half of FY24, however can it do that when A) {hardware} gross sales are weak, owing largely to a retraction in client spending and B) subscription retention has trended so poorly over the previous 12 months? And with restricted liquidity on its steadiness sheet and a mounting load of debt, Peloton has restricted time to handle these points earlier than it will get crunched.

For my part, this isn’t the proper inventory to financial institution on.