MTStock Studio

Introduction

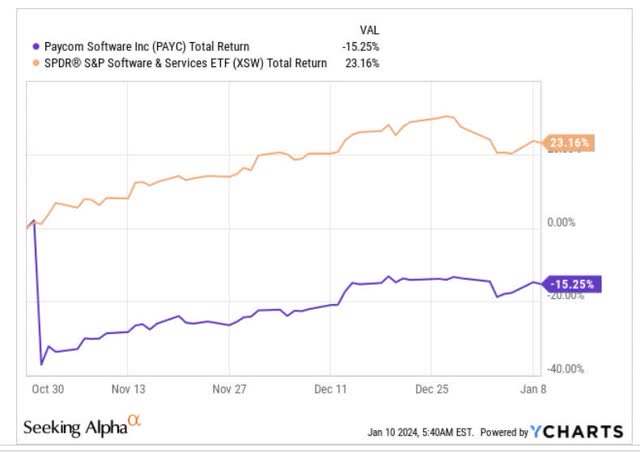

The inventory of Paycom Software program (NYSE:PAYC), a specialist in offering cloud-based HCM (human capital administration) options, has confronted a difficult few months; while different software program and repair entities have managed to ship returns of over 20% on common, PAYC has floundered, shedding -15% of its worth over the previous couple of months.

YCharts

Beti Cannibalization Considerations

A lot of the weak spot within the share value has been pushed by issues surrounding the influence of Beti on PAYC’s personal income prospects.

For the uninitiated, Beti is an automatic providing of PAYC that finetunes the general payroll course of, by enabling workers to work on their very own payroll with no blemishes. The software program abets workers of PAYC’s shoppers by figuring out and correcting the myriad of payroll-related errors earlier than submission. Mockingly, the efficient troubleshooting capabilities of Beti within the pre-submission part has ended up wiping out a superb chunk of billable corrections and unscheduled payroll runs which have historically served as a superb supply of service income for PAYC.

PAYC doubtless has lower than 37000 shoppers throughout the globe, and administration famous that near two-thirds of their shopper base have now adopted Beti. Within the coming durations, one may also see PAYC’s shoppers within the Canadian and Mexican markets undertake Beti with better fervor.

Within the short-term, this cannibalization is definitely not superb as a result of PAYC was a enterprise that was delivering topline CAGR of 26% over the previous three years. Nonetheless, now, PAYC administration believes that these latest developments the place they concentrate on engendering better long-term worth for his or her shoppers, might shift the corporate’s income profile to that of a 10-12% progress entity.

Look At The Greater Image

Given the drastic shift within the income profile, the share value has understandably come beneath stress, however we’d urge buyers to have a look at the larger image.

Below legacy payroll techniques provided by rivals, there could be a number of to-and-fro discussions between the workers and HR, which prevents the latter from specializing in higher-end initiatives and damaging productiveness. As extra potential shoppers notice the value-add and financial savings offered by the Beti resolution, it might be affordable to recommend that what PAYC loses out by the use of service-related billables, it makes up when it comes to greater volumes from a fair bigger shopper base, who will more and more see this resolution because the HCM trade benchmark.

Buyers additionally want to notice that PAYC is at present not witnessing any reducing momentum when it comes to new brand gross sales or go-to-market momentum; if something, that continues to be sturdy.

PAYC administration has additionally described this part as “transitory”, and as soon as the corporate will get its foot within the door with recent shoppers, it is going to even be higher positioned to cross-sell extra of its non-payroll purposes which is one thing that may tackle better prominence within the coming years.

The opposite key level to notice is that PAYC, has in latest durations, pivoted in direction of focusing extra on buying bigger shoppers, or these with an worker power of greater than 10,000 workers. Their latest enlargement in Canada and Mexico must also give them a helpful pool of bigger diversified multinationals. Notice that PAYC additionally has a brand new enterprise gross sales operate that’s solely specializing in shoppers with greater than 25,000 workers.

Don’t neglect that principally this can be a enterprise that expenses shoppers on a “per worker” foundation, and thus, when bigger shoppers come on board, the massive worker power related to these shoppers will naturally filter by to strong enterprise volumes.

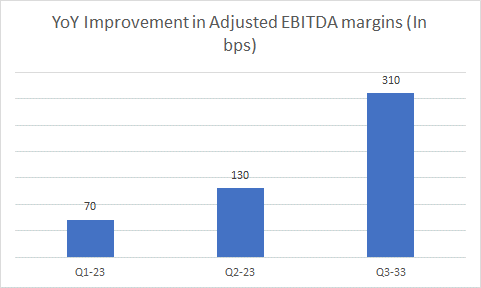

Lastly, it is also price contemplating that while the topline could also be slowing, it isn’t as if the margins have gone to the canine. In reality, fairly the alternative; over the past three quarters, the annual development with the group-adjusted EBITDA margins has solely continued to increase sequentially.

Quarterly Press Launch

After witnessing such sturdy traction within the margins in 2023, PAYC could not see the identical stage of enlargement in 2024, however primarily based on consensus estimates for FY24, one continues to be looking at flattish EBITDA margins, which is nothing to be scoffed at.

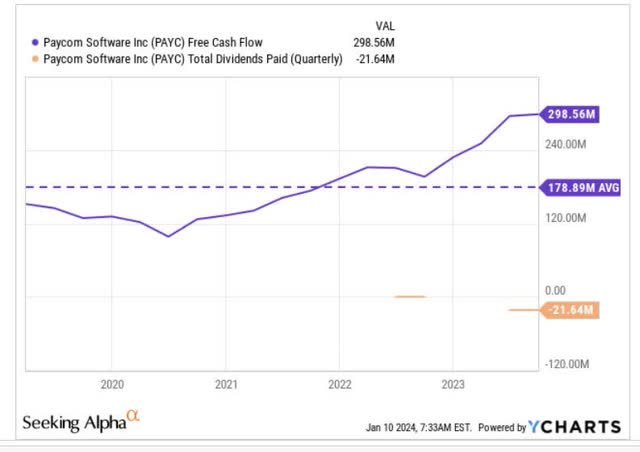

A steady EBITDA regime additionally lays the inspiration for better conversion on the FCF stage which continues to development up encouragingly on a TTM foundation and is at present 66% greater than the 5-year common.

YCharts

The strong FCF era panorama solely lends additional assist to PAYC’s latest emergence as a dividend payer, the place it has been spending round $22m in money per quarter by the use of dividends. Given the numerous magnitude of the dividend protection by the FCF (at present at round 13.5x), we don’t see any dangers to a reduce in dividends in gentle of a slowing topline.

Closing Ideas

We additionally assume the Paycom inventory could also be price taking a look at as a result of the risk-reward on the charts is now in a a lot better place.

The primary chart highlights how PAYC’s inventory is positioned relative to different tech choices. Throughout a lot of the post-pandemic period, it was tough to make a case to tech-focused buyers to rotate into Paycom given how elevated the relative power ratio had regarded.

Nonetheless, this 12 months, we’ve not solely seen some mean-reversion, however a big drop effectively under the mid-point to the decrease half of the desk. With the relative power ratio now buying and selling a superb 44% off the mid-point of the long-term vary, we predict PAYC may benefit from some rotational curiosity.

StockCharts

Then if we pivot to PAYC’s personal weekly imprints over the past 2-2.5 years, its fairly clear that the inventory has been trending decrease within the form of a descending channel. Throughout the sell-off in October/November final 12 months, word that the inventory hit the decrease boundary of the channel, and rapidly recoiled from there within the following weeks.

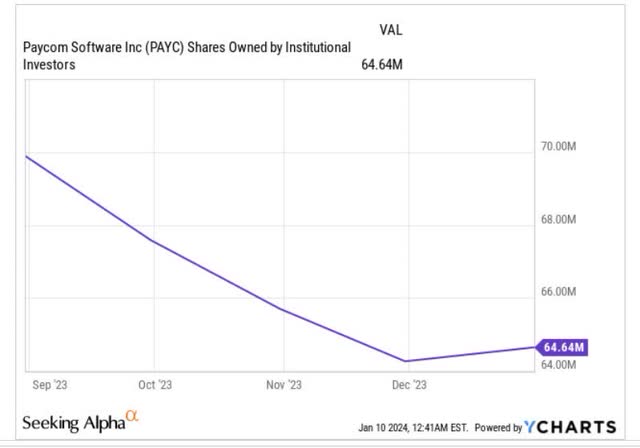

What’s additionally barely encouraging to notice is that after 4 straight months of lowering their possession stake within the PAYC counter, the sensible cash cohort just lately upped their stake within the firm.

YCharts

All in all, given the place the share value is at present perched (~$200 ranges) throughout the descending channel, and given the place the 2 boundaries are (~$320 and ~$125) we predict the risk-reward seems to be fairly tasty for an extended place.

Investing

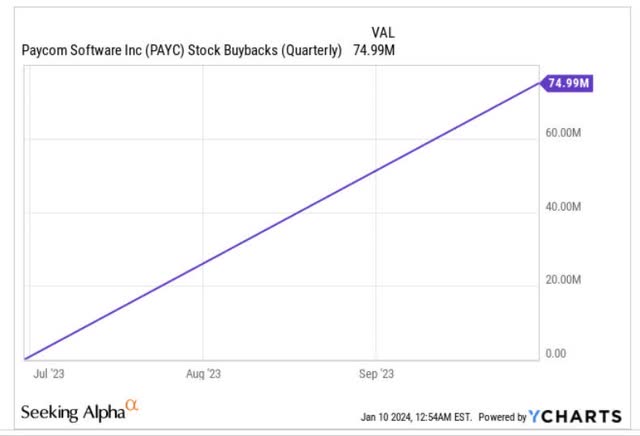

We additionally assume the share value might get further assist from an elevated pickup in buyback spend which has solely continued to enhance on a sequential foundation. Paycom’s ongoing $1.1bn share buyback will expire in seven months, and inside that plan, they nonetheless have round $1bn that has but for use.

YCharts

Lastly, additionally think about that the inventory affords wonderful worth now. Over the past 5 years, the inventory’s rolling ahead P/E common has been round 54x, however now you possibly can choose it up at a whopping 60% low cost.

YCharts