Authored by Jonathan Newman via The Mises Institute,

Paul Krugman can’t work out why everybody is so bummed about the economy. From his perspective, we must always all be leaping for pleasure, praising Joe Biden, and publicly signing fifty-year commitments to vote Democrat.

Official statistics present that “unemployment continues to be close to a 50-year low, but inflation has been falling quick.”

However the ignorant lots merely gained’t get with the image.

Krugman admits “surveys of client sentiment and political polls proceed to point out that Individuals have a really detrimental view of the Biden economic system.”

He concludes that it’s partisanship and media bias driving a wedge between client sentiment and financial actuality. He discovered a research that exhibits that 30 p.c of the disparity will be defined by Republicans who’re doing superb economically however are simply mad that Biden is stumbling and mumbling across the White Home.

Krugman Is Incorrect

I believe Krugman is mailing (faxing?) this one in. I’m not satisfied that client sentiment is simply now being disproportionately affected by offended Republicans, particularly contemplating all of the dramatic financial modifications which have shaken customers over the previous few years.

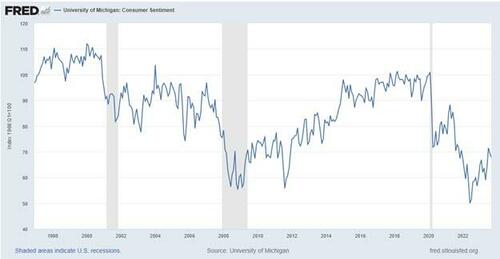

The measure Krugman is taking a look at is the College of Michigan Index of Client Sentiment.

Determine 1: College of Michigan: Client sentiment index

Supply: “University of Michigan: Consumer Sentiment (UMCSENT),” FRED, Federal Reserve Financial institution of St. Louis, final up to date October 1, 2023. Information from Surveys of Consumers, College of Michigan, final up to date November 2023.

The index relies on survey responses to questions like “Would you say that you’re higher off or worse off financially than you had been a yr in the past?,” “Do you suppose that through the subsequent twelve months we’ll have good instances financially, or unhealthy instances, or what?,” and “Do you suppose now is an effective or unhealthy time for folks to purchase main home items (like furnishings and massive home equipment)?”

It’s Affordability, Not Partisanship

I appeared on the developments within the solutions to every of those questions and located that the final query is the one whose reply has worsened most importantly for the reason that 2020 disaster.

Determine 2: Elements of client sentiment index

Supply: Information from Surveys of Consumers, College of Michigan, final up to date November 2023. Creator’s visualization of information.

The yellow line within the chart tracks the responses to the query of whether or not now is an effective time to purchase main home items. The pink and purple strains monitor respondents’ view of the trajectory of the general economic system over the subsequent twelve months and 5 years, respectively. The blue line exhibits the households’ analysis of their monetary state of affairs in comparison with a yr in the past, and the inexperienced line exhibits their expectations of their monetary state of affairs one yr from now. (Observe that on this chart, increased values correspond to worse sentiment.)

It is a drawback for Krugman’s thesis, as a result of pessimism primarily based on political partisanship would almost certainly be channeled via the survey questions in regards to the trajectory of the economic system as a complete, not the one about shopping for a fridge.

Whereas all of the elements have worsened since 2019, you’ll discover that the biggest swing has to do with affording furnishings, home equipment, and different main home items. Pre-2020, most respondents mentioned that it was a very good time to purchase main home items, however post-2020, most are saying that it’s a unhealthy time.

Why Is It More durable to Afford Client Durables These Days?

Why would folks say that? Nicely, costs for client durables and bank card charges have each elevated dramatically since 2020.

Determine 3: Client Value Index (client durables) and bank card rates of interest

Supply: “Commercial Bank Interest Rate on Credit Card Plans, All Accounts (TERMCBCCALLNS)” and “Consumer Price Index for All Urban Consumers: Durables in U.S. City Average (CUSR0000SAD),” FRED, Federal Reserve Financial institution of St. Louis, final up to date August 1, 2023, and October 1, 2023. CPI knowledge from the Consumer Price Index, US Bureau of Labor Statistics, final up to date October 1, 2023; rate of interest knowledge from Consumer Credit, Federal Reserve Statistical Launch G.19 (Board of Governors of the Federal Reserve System).

Rates of interest on bank cards have elevated together with all different rates of interest because the Fed has tried to cope with unpopular worth inflation. This goes to point out that every thing has a price—you can’t print and spend your means via a disaster with out penalties. It’s a hallmark of Keynesian considering (of which Krugman is a real believer) to suppose in any other case.

Commenting on this function of Keynesian coverage, Ludwig von Mises mentioned, “We’re destined to spend a long time paying for the simple cash orgy of some years.”

Conclusion: Customers Are Justifiably Involved in regards to the Future

Past client durables, nonetheless, there are many causes to be cautious of the long run. Client sentiment is way more sophisticated than which social gathering is within the White Home and even the unemployment fee plus worth inflation.

Customers have seen declining quality in each items and companies, lengthy wait instances for merchandise, a smattering of bank failures, and unstable inventory markets. Coverage uncertainty from each the federal authorities and the Fed additionally impacts client expectations. Customers have run via their financial savings (which had been nominally boosted by stimulus checks) and have added trillions of {dollars} in debt since 2020. Bank card delinquency charges have spiked as much as 2007–8 ranges.

It is a way more believable clarification for why client sentiment general doesn’t match Krugman’s “surreally good” sentiment. It’s Krugman’s partisanship, not customers’, that explains the divergence of views.

Loading…