Based on an October 30 announcement, decentralized crypto change PancakeSwap now has portfolio administration performance. The function has been added in collaboration with the decentralized finance (DeFi) protocol Bril Finance.

The brand new function permits PancakeSwap customers to deposit tokens into single-asset vaults by way of the change’s person interface. As soon as the tokens are deposited, they go right into a liquidity provision algorithm with computerized rebalancing. The PancakeSwap and Bril improvement groups declare that this method permits customers to earn greater risk-adjusted returns in comparison with different strategies.

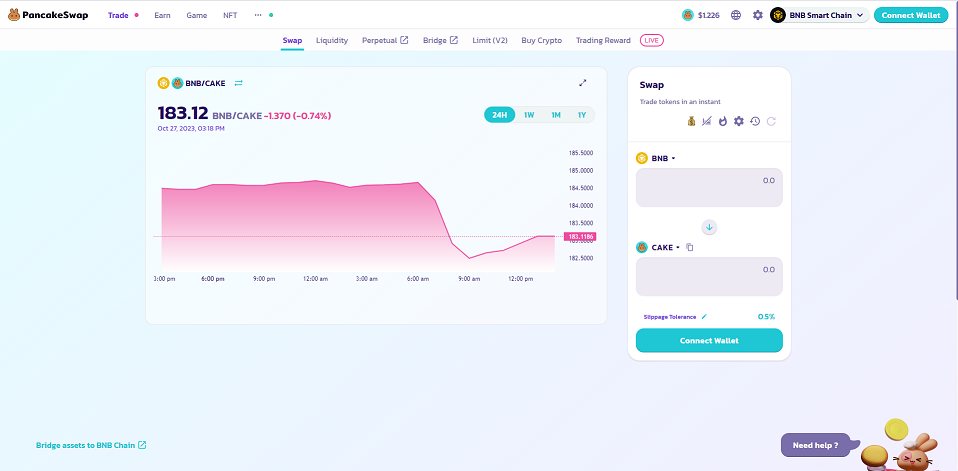

PancakeSwap UI. Supply: PannenkoekSwap.

Based on the announcement, customers can deposit tokens resembling Tether (USDT), Bitcoin BEP 2 (BTC), BNB (BNB) and Ether (ETH). The groups declare that the protocol has already delivered an inner charge of return (IRR) of greater than 24% in assessments. IRR is a metric that measures the compound annual development charge for a mission.

Extra rewards within the change’s governance token, CAKE, may also be offered to customers for the primary 4 weeks after the function’s launch. At launch, PancakeSwap would be the solely interface providing customers entry to Bril’s portfolio administration system, the announcement stated.

PancakeSwap “Head Chef” (CEO) Mochi claimed that the brand new integration will assist make the change a significant hub for DeFi, stating:

“We purpose to grow to be a hub for all DeFi and integrations like this, permitting us to grow to be a one-stop store for portfolio administration. Because of Bril’s automated expertise and its integration with PancakeSwap, PancakeSwap customers can benefit from the core options and functionalities they’re already accustomed to and seamlessly monetize their belongings in a hands-off method.”

Associated: UAE dirham stablecoin DRAM is launched on Uniswap, PancakeSwap

PancakeSwap is the second largest absolutely decentralized crypto change by way of each day quantity, in line with knowledge from DeFi Llama. In Could, it launched a pancake-themed sport referred to as “Pancake Protectors.” In September, it built-in Transak as a supplier for making fiat-to-crypto funds.