Overview

Pan Asia Metals (ASX: PAM) is the one publicly traded battery metals firm with superior lithium initiatives in South-East Asia, strategically situated in Thailand – the most important car producer within the area. With Asia accounting for greater than half of the worldwide annual car manufacturing, PAM is uniquely positioned to capitalize on the hovering demand for battery minerals within the area. PAM’s dedication to producing progressive, high-value merchandise with a minimal carbon footprint makes us an excellent associate for assembly our wants in each battery chemical compounds and sustainable power. PAM can also be a revered native firm, with a technique targeted on creating an built-in provide chain to cost-effectively ship related and in-demand merchandise to the Li-ion battery market. PAM is quickly advancing its Reung Kiet lithium challenge by way of pre-feasibility research and plans to develop its international lithium useful resource sustainably by way of the Kata Thong challenge, additionally situated in Thailand, and different potential low-cost initiatives globally.

The transfer towards a inexperienced financial system is in full swing as automakers and world governments shift focus to electrical autos (EVs) and different clear applied sciences in a world push to realize carbon-reduction targets. Asia is on the forefront of this transition, each when it comes to adoption and alternatives, and the ASEAN nations to the south are following go well with with Vietnam, Thailand, Indonesia, and Malaysia positioning to draw battery and EV producers.

EV adoption in mature Asian markets ranged between 1.2 p.c and 16.1 p.c in 2021, however rising markets are additionally making strides. Thailand topped emerging market adoption at 0.7 percent in 2021. Governments are ramping up EV and emissions laws, together with China, South Korea, and Japan. Thailand’s 3030 EV Policy goals to succeed in 30 p.c of home EV car manufacturing by 2030. Miners inside the area are poised for vital development as Asia embraces clear expertise with a give attention to creating a home provide chain of battery metals.

Pan Asia Metals’ lithium and tungsten belongings in Thailand are presently the one superior lithium initiatives in Southeast Asia, creating a singular worth proposition for low-cost operation and a big alternative to value-add its manufacturing. Pan Asia Metals is presently the one lithium explorer in Southeast Asia. The corporate is led by an skilled administration crew with direct expertise in and a deep understanding of the geopolitical atmosphere in Southeast Asia.

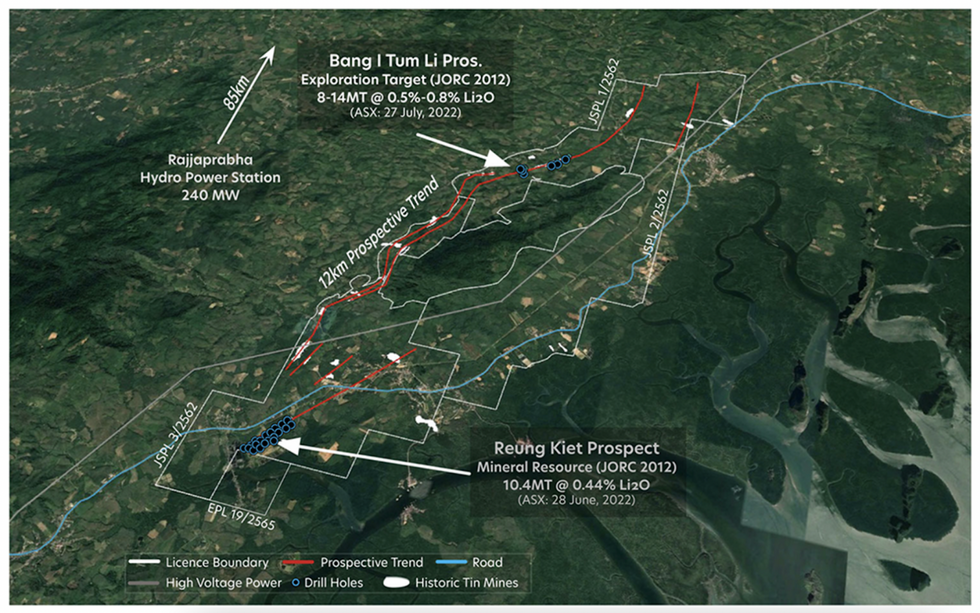

The corporate operates three initiatives in Thailand, with 100% possession in every. The Reung Kiet Lithium Undertaking (RKLP), the corporate’s flagship asset, contains the aptly named Reung Kiet Prospect (RK) and the Bang I Tum (BIT) prospect. RK comprises a JORC-compliant 10.4 million tonnes of lithium oxide at 0.44 p.c, and PAM is finishing the drill program for a useful resource improve in each tonnes and JORC class. The corporate is about to begin drilling at BIT, which has a drill-supported JORC-compliant 8 to 14 million tonnes of 0.5-0.8 p.c lithium oxide. Latest ore sorting of RK samples noticed an improve within the feed to 1 p.c lithium oxide while eradicating over 60 p.c of the waste materials. Latest rock chip assays at BIT elevated the goal space of mineralization by over 200 p.c with 44 of the 64-rock chip and channel samples averaging 1.56 p.c lithium oxide and over 70 p.c of those >1.0 p.c lithium oxide and over 25 p.c >2.0 p.c lithium oxide.

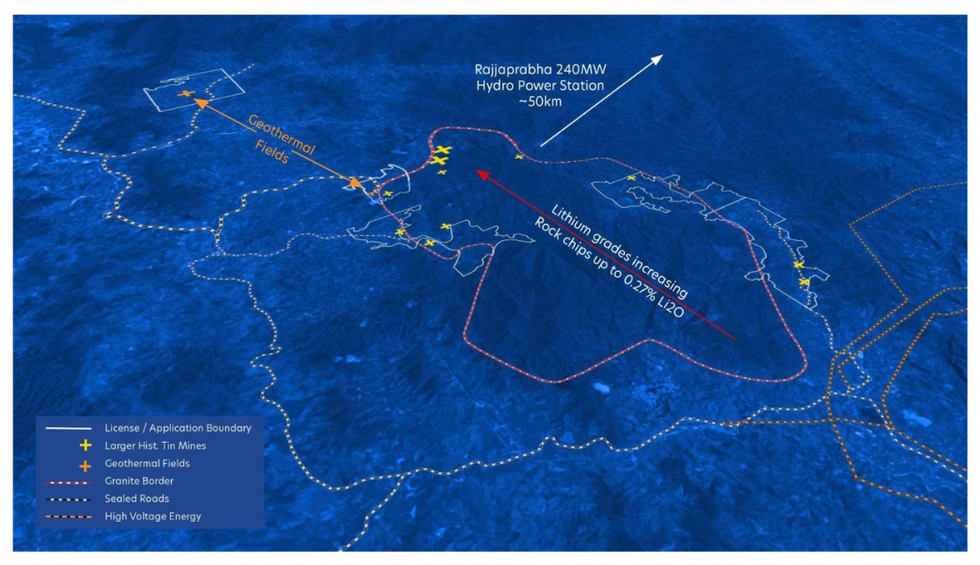

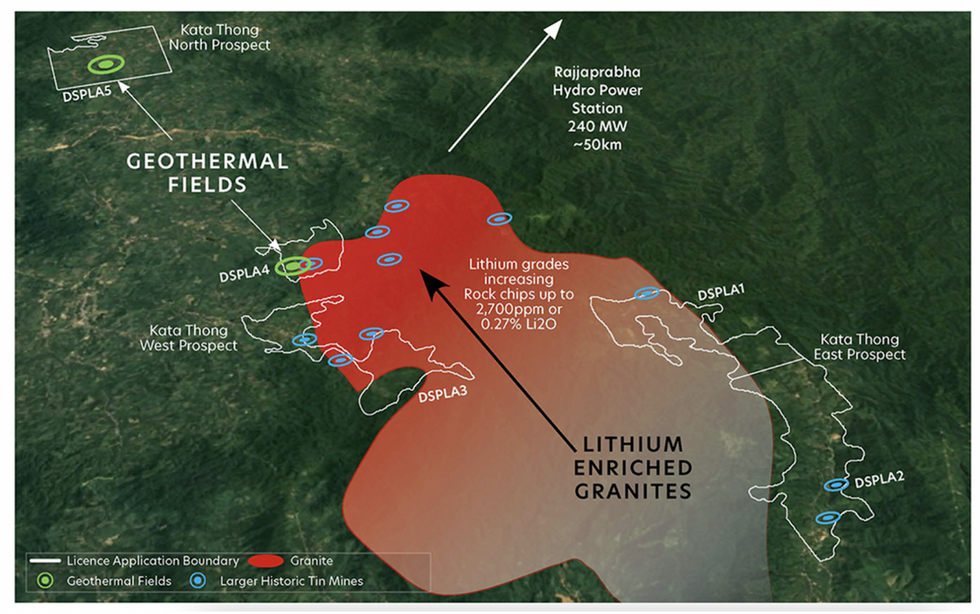

The secondary Kata Thong lithium challenge is Pan Asia Steel’s second challenge which comprises 5 software areas with a mix of historic onerous rock tin mines and geothermal fields, that are believed to be wealthy in lithium. The world has produced rock chip assays as much as 0.27 p.c lithium. Pan Asia Metals’ third asset, Khao Quickly, comprises tungsten deposits, a metallic crucial to industrial exercise.

A strategic aim of Pan Asia Metals is to ‘transfer past the mine gate’ by including extra worth that extends by way of the availability chain. The corporate plans to not solely discover and develop belongings however may also tackle processing and refinement to create a last product that’s prepared for manufacturing lithium-ion batteries. This strategic focus allows the corporate to supply extra speedy worth by delivering a high-grade product fairly than uncooked lithium.

Pan Asia Metals is situated close to the most important manufacturing hub in Southeast Asia. Three of the highest Asian auto producers are inside Thailand and accessible by all modes of transport. Extra industrial facilities are close by in Malaysia and Singapore. The proximity of those producers permits Pan Asia Metals to additional cut back its prices and carbon footprint. Thailand is a low-cost atmosphere with a complicated industrial financial system, creating quite a few alternatives for price financial savings.

A crew of skilled managers and explorers leads the corporate towards its targets of creating and refining crucial minerals for manufacturing. Along with instantly relevant expertise within the mining trade, management members additionally deeply perceive the native enterprise atmosphere providing confidence in its capability to completely capitalize on its belongings.

Firm Highlights

- Pan Asia Metals is an exploration and growth firm with belongings in Southeast Asia specializing in the crucial minerals mandatory for clear power transformation.

- Past creating extremely prolific deposits, the corporate needs to maneuver past the mine gate by refining and processing a high-grade product prepared for cathode manufacturing.

- Pan Asia Metals operates three 100-percent-owned initiatives in Thailand focusing on lithium and tungsten deposits.

- The Reung Kiet flagship challenge has a JORC-compliant useful resource estimate of 10.4 million tonnes of lithium at 0.44 p.c, with a useful resource enlargement due quickly.

- Pan Asia Metals operates two extra belongings with vital onerous rock lithium and tungsten deposits for future growth.

- An skilled managed crew with a deep understanding of the Southeast Asian market and the mining trade leads the corporate in direction of totally creating its belongings.

- The corporate executed a non-binding memorandum of understanding with VinES Vitality Options Joint Inventory Firm for the analysis of a standalone lithium conversion facility in Vietnam for an preliminary annual capability of 20-25,000tpa of lithium carbonate and / or lithium hydroxide.

- Pan Asian Metals found new pegmatite zones on the Bang I Tum Lithium Prospect situated about eight kilometers north of the Reung Kiet Lithium Prospect in southern Thailand.

Key Initiatives

Reung Kiet Lithium Undertaking

The corporate’s flagship Reung Kiet lithium asset is close to Phuket, Thailand, and has entry to important infrastructure that may reduce growth prices and supply a number of transportation choices. The asset was an open pit tin mine as much as the Nineteen Eighties and has acquired no fashionable lithium exploration previous to Pan Asia Metals’ acquisition. The corporate is presently drilling exploration targets to increase recognized lithium deposits.

Undertaking Highlights:

- Important Lithium Deposits: The asset has an current JORC-compliant mineral useful resource estimate of 10.4 million tonnes of lithium at 0.44 p.c, with a useful resource enlargement to be introduced quickly. An extra exploration goal has drill-supported outlined estimates of 8 to 14 million tonnes of lithium at 0.5 to 0.8 p.c.

- Proximity to Very important Infrastructure: The asset is close to vital transportation methods and has entry to energy. Out there infrastructure contains:

- The 240-megawatt Rajjaprabha Hydro Energy Station

- Phet Kasem Street or Freeway 4 (certainly one of Thailand’s 4 major highways)

- Phuket Worldwide Airport

- Important port infrastructure, together with Phuket, Ranong Surat Thani

- Encouraging Drill Assays: A not too long ago accomplished drill marketing campaign produced encouraging outcomes that point out the blue-sky potential of the asset. Assays embody:

- RKDD002 – 15.6 meters at 0.82 p.c lithium from 55 meters, together with 9 meters at 1 p.c lithium.

- RKDD009 – 30.2 meters at 0.69 p.c lithium from 37.3 meters, together with 6 meters at 1.08 p.c lithium from 38.5 meters and 4.5 meters at 1.44 p.c.

- RKDD027 – 10.6 meters at 1.24 p.c lithium from 28.3 meters

Kata Thong Lithium Undertaking

Pan Asia Metals’ Kata Thong challenge comprises the right geologic formation indicative of wealthy lithium deposits. The lithium-rich Kata Khwama granite formation is a 20-kilometer-long strike as much as 10 kilometers huge and has produced rock-chip assays as much as 0.27 p.c lithium.

Undertaking Highlights:

- Positioned for a Zero Carbon Footprint: The ESG score of an asset is important when producing supplies for the clear power trade. The Kata Thong asset is close to the 240-megawatt Rajjaprabha Hydro Energy Station, permitting the corporate to leverage clear power in its operations.

- Geologic Surveys Indicative of Lithium: There are three distinct mineralization veins inside the challenge’s space, every with the potential to comprise onerous rock lithium. These formations are:

- Pegmatite dyke and vein swarms also can comprise lithium-tantalum-niobium mineralization.

- Muscovite and tourmaline-muscovite alteration containing excessive background ranges of lithium.

- Easy quartz-cassiterite-wolframite veins

- 5 Particular Prospect License Purposes (SPLA): The corporate has 5 SPLAs from the Phang Nga Province in Southern Thailand and as soon as accepted, shall be prepared for exploration and growth.

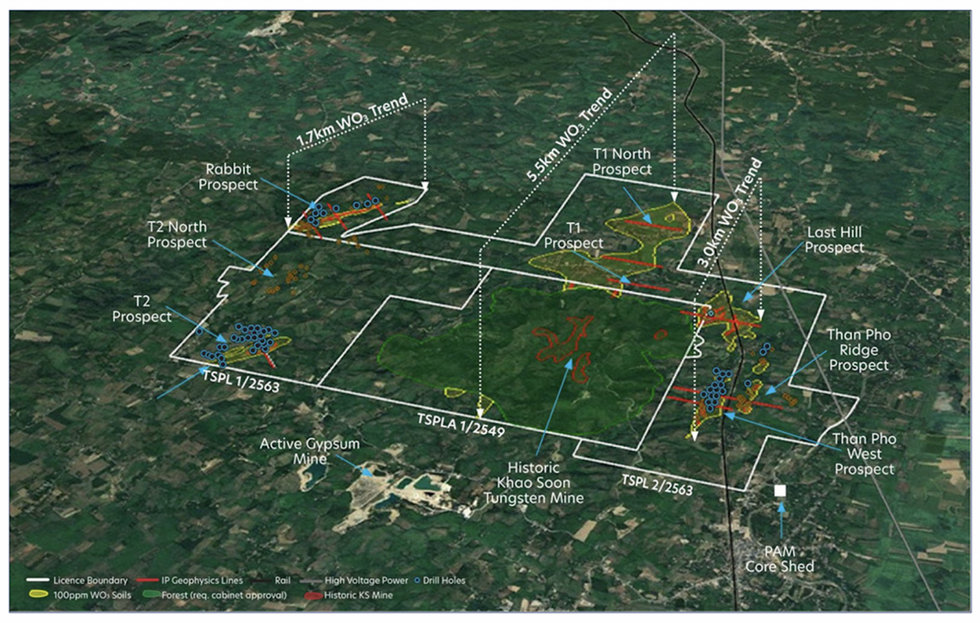

Khao Quickly Tungsten Undertaking

The corporate’s Khao Quickly Tungsten asset has an current JORC 2012 Drill Supported estimate of 15 to 29 million tonnes of 0.2 to 0.4 p.c tungsten trioxide. As well as, the mine is a previous producing mine that ceased manufacturing in 1979, creating the chance to use fashionable exploration and mining methods.

Undertaking Highlights:

- A Whole of 41 Diamond Drill Holes: Profitable drilling campaigns drilled 41 holes totaling 3,513 meters and produced the 15 to 29 million tonnes useful resource estimate, indicating the asset’s potential.

- Promising Drill Intersections: Accomplished drilling campaigns produced a number of promising intersections; among the prime intersections had been:

- KSDD001 – 51.5 meters at 0.50 p.c tungsten trioxide from 0 meters, together with 12.8 meters at 1.07 p.c tungsten trioxide from 14.8 meters.

- KSDD021 – 14.55 meters at 0.47 p.c tungsten trioxide from 0 meters, together with 7.3 meters at 0.62 p.c tungsten trioxide from 0 meters.

- KSDD024: 13.1 meters at 0.51 p.c tungsten trioxide from the floor, together with 4.6 meters at 0.97 p.c tungsten trioxide from 8.5 meters.

Administration Crew

Paul Lock – Chairman and Managing Director

Paul Lock has devoted his consideration to the exploration of mineral assets in Southeast Asia since 2013. He has a background in challenge finance, leveraged finance and company advisory. Lock is a commodities dealer with Marubeni and a derivatives dealer with Rothschild.

David Interest – Technical Director and Chief Geologist

David Interest is an Financial Geologist with greater than 30 years of expertise. He has labored in a wide range of geological terrains throughout Asia, Australia, Argentina, USA, and Africa. Interest is skilled in all aspects of the minerals challenge cycle.

David Docherty – Non-Government Director

David Docherty’s involvement within the useful resource sector started in London in 1965, and he has been concerned within the Thai useful resource sector since 1987. He was the managing director of Mining Finance Corp in 1969. Docherty is a founding member of the crew who found Chatree.

Supriya Sen – Non-Government Director

Supriya Sen is a former senior advisor at McKinsey, a number one strategic consultancy agency. She has a background in banking, with greater than 30 years of expertise at companies comparable to GE Capital, World Financial institution, Asian Improvement Financial institution and Citibank. Sen is a strategic advisor targeted on monetary inclusion, innovation and expertise transformation, sustainability, and inexperienced infrastructure finance sectors.