da-kuk

Funding Thesis

Palo Alto Networks(NASDAQ:PANW) has sturdy income development, its web earnings only in the near past turned constructive this yr and its free money stream has a big seasonality. We delved into the dynamics amongst these and what would it not imply for the firm’s development. We discover it may very well be reaching a near-term peak and suggest a maintain.

Firm Overview

Palo Alto Networks (PANW), based in 2005 with headquarters in Santa Clara, CA, is a world cybersecurity supplier that serves enterprises, organizations, service suppliers, and authorities entities from cyber threats. The corporate’s zero belief options concentrate on serving 5 areas, together with Community Safety, Safe Entry Service Edge, Cloud Safety, Safety Operations, and Menace Intelligence and Safety Consulting.

Power

Palo Alto has been round for 18 years, throughout which the cybersecurity trade has gone by way of transformative modifications as a result of technological improvement within the web and cloud computing. It has scored in 13 classes of business companies by Gartner, up from 9 in 2020. However what differentiates it from its rivals is its potential to offer all of the companies in a unified platform. It delivers to shoppers as product, subscription, and help. Whereas in its most up-to-date quarters, the income generated from subscription and help grew a lot sooner than from product alone. The corporate is powerful in offering progressive options to enterprise safety towards cyberattacks. Every categorical service can serve on the granular stage, which makes them simpler in serving clients’ calls for. As a pacesetter within the cybersecurity trade, it has a robust pull with each its clients and its rivals.

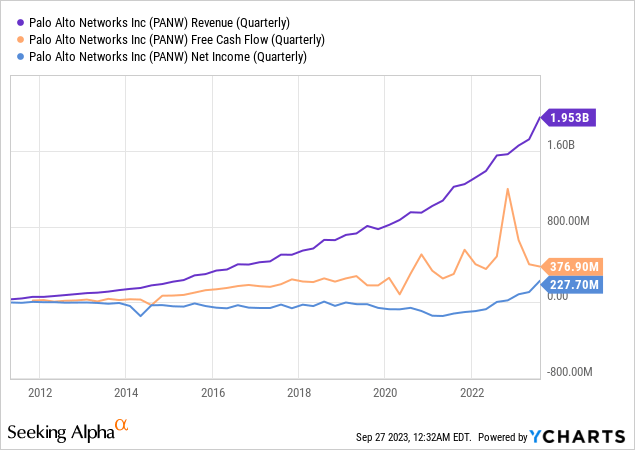

The corporate’s income has nearly doubled each three years because it went IPO. The secular development of its web earnings, after falling to its lowest stage in 2022, is lastly wanting up. In reality, FY 2023 marked the primary time its web earnings has swung to constructive since its IPO. Probably the most noticeable sample of its free money stream, however, is its massive fluctuation since 2020. We join these three within the evaluation beneath to uncover extra connections between them.

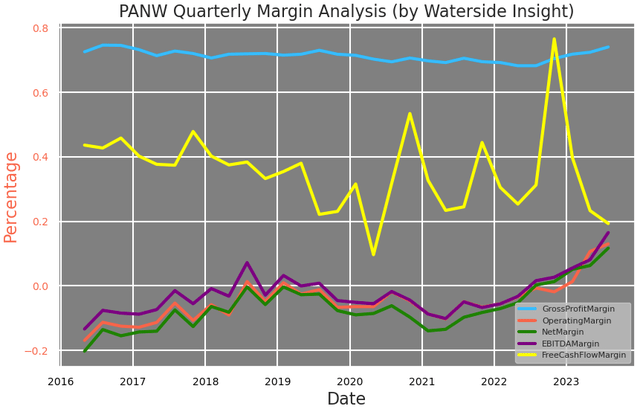

Regular margins since 2015 have had upward momentum, with its web margin and EBITDA margin changing into constructive previously two quarters. And probably the most noticeable was its free money stream margin considerably higher than its common stage previously three years nearly doubling the place it was earlier than the pandemic. Its free money stream began to indicate pronounced seasonality in 2020.

PANW: Quarterly Margin (Calculated and Charted by Waterside Perception with knowledge from firm)

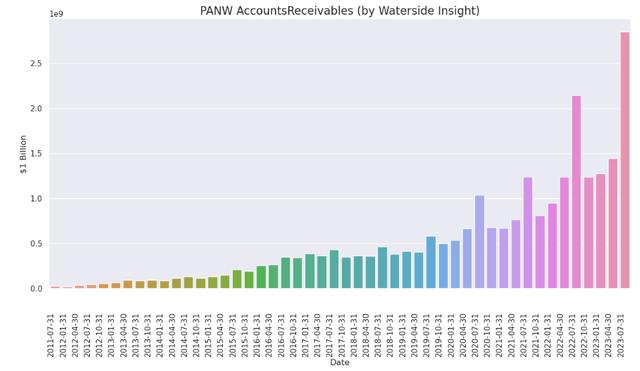

The supply to is working money stream has a robust issue from its extra pronounced seasonality from its accounts receivables. The quarter ending in July of every calendar yr, which is the final month of its fiscal yr has the best worth for the FY. That specific quarter used to not be that distinguished from the remainder of the quarters in the identical FY, however since 2018, the distinction has noticeably elevated. Within the FY that simply ended, FY This autumn is sort of doubling the earlier three quarters’ common. The corporate defined that it’s largely because of end-customers’ December 31 fiscal year-end or year-beginning funds planning, August being the seasonally gentle month in gross sales, and as a result of inner gross sales compensation plan.

PANW: Accounts Receivables (Calculated and Charted by Waterside Perception with knowledge from firm)

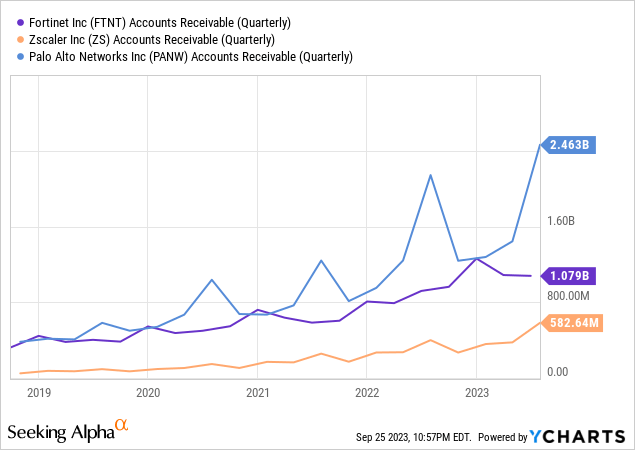

If it is because of its clients’ enterprise planning and administration, there needs to be a basic pattern occurring inside the trade, no less than to a point. However once we examine Palo Alto Networks’ accounts receivables with its rivals comparable to Torinet and Zscaler, we did not discover such important seasonality. We consider it’s largely because of PANW’s personal gross sales compensation plan that features annual quotas and fee fee accelerators for acquiring the gross sales contracts on the finish of the FY.

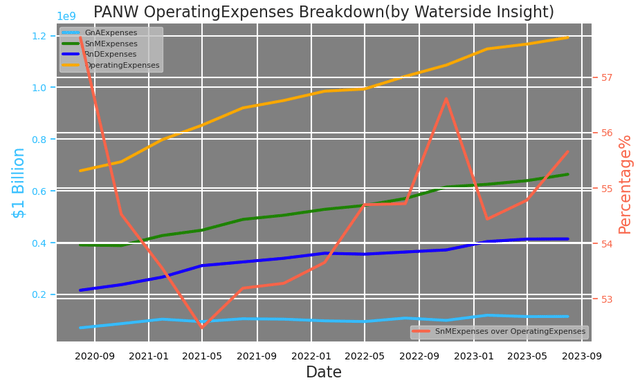

These contract prices which are recoverable and incremental to acquiring buyer gross sales contracts are systematically deferred on the premise of how the contractual items or companies are being delivered to the purchasers. Such deferred contract prices are included within the gross sales and advertising and marketing bills. Certainly, a breakdown of its working bills exhibits that Palo Alto Networks spends the least in administration, and maintains sturdy spending on R&D, whereas having gross sales and advertising and marketing bills as the most important element, accounting for greater than half of it. And this ratio has been rising in 2021. up from 52% to round 56%, after falling in 2020. Though it isn’t a big enhance, it exhibits that the more and more stronger seasonality can also be related to contract acquisition prices.

PANW: Working Bills Breakdown (Calculated and Charted by Waterside Perception with knowledge from firm)

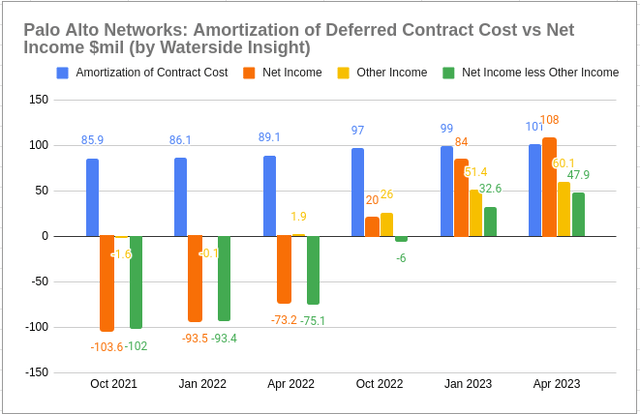

The gross sales commissions are largely associated to preliminary contracts greater than renewals. The amortization of those contract prices is unfold over a interval of 5 years, taking into account contract size, know-how life, and different quantitative and qualitative elements. By evaluating the deferred contract prices and its web earnings, which has simply turned constructive this yr sustainably, it seems that Palo Alto Networks’ fee incentivization {dollars} have gone far in boosting the web earnings because it has turned from unfavourable $103 million within the quarter ending in October 2021 to constructive $108 million within the quarter ending in April 2023. It is a large turnaround. However as we glance slightly additional, its web earnings has been a notable contribution from different earnings, which is generally comprised of curiosity earnings from its funding portfolio. Different earnings was once not materials 5 quarters in the past, however now it’s nearly half of its web earnings. With out different earnings, this turnaround remains to be sturdy however is way much less in worth. We’ll get into what different earnings is generally from later.

PANW: Deferred Contract Prices vs Web Earnings (Calculated and Charted by Waterside Perception with knowledge from firm)

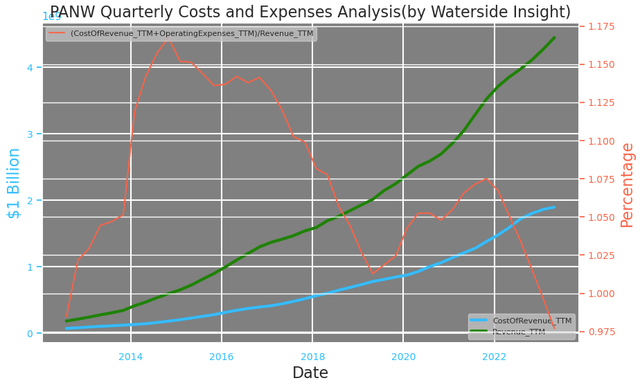

We consider one other deciding issue to its constructive web earnings is healthier management of its prices of income and working bills. Given the truth that its price of income and working bills as an entire are decrease than its income for the primary time previously eight years, there are causes to consider this constructive turnaround may very well be sustainable if such a pattern continues. However given the best way contract prices are deferred, might there be a rebound of bills going ahead to drive this up? In spite of everything, this stage is the bottom it has been since its IPO.

PANW: Prices and Bills (Calculated and Charted by Waterside Perception with knowledge from firm)

To summarize, there may be an natural development momentum in Palo Alto Networks’ gross sales development, regardless that it’s drastically stimulated by the sale fee plans. Nonetheless, the magnitude of such development will not be as sturdy because it seems if merely judging by its web earnings and earnings numbers alone. And we’ll look additional into the funding portfolio that provides rise to its Different Earnings beneath.

Weak spot/Dangers

With such a robust operational money stream, one could be stunned to see Palo Alto Networks’ 0.78x present ratio, round 50% cash-to-debt ratio, and what’s extra, a story change-in-working-capital ratio.

PANW: Money Ratios (Calculated and Charted by Waterside Perception with knowledge from firm)

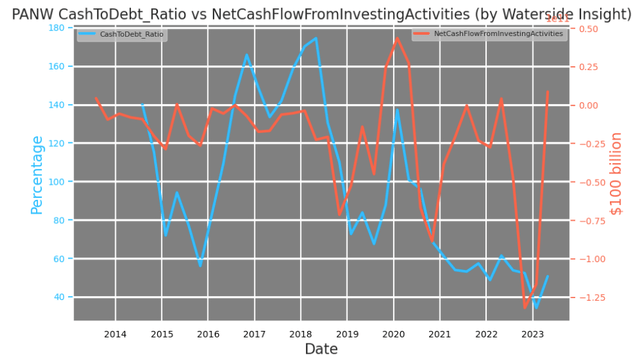

With its quadruple free money stream on a TTM foundation, the place did its money go? Whereas its money ratio was declining, its money stream from investing actions has gone up nearly by 3x in a yr.

PANW: Money-to-Debt Ratio vs Money from Investmenting (Calculated and Charted by Waterside Perception with knowledge from firm)

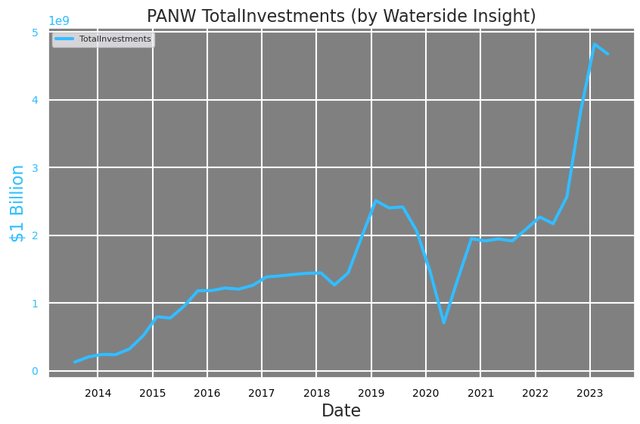

And certainly, its complete funding has shot as much as double the place it was in mid-2022.

PANW: Whole Investments (Calculated and Charted by Waterside Perception with knowledge from firm)

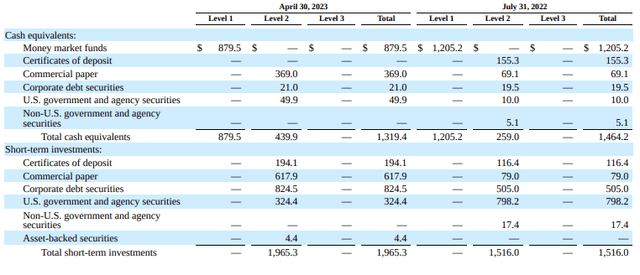

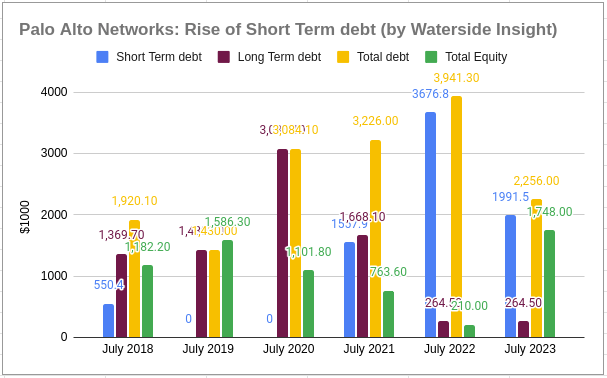

If we have a look at the composition of its funding, its short-term funding has a focus in company bonds and US company debt.

PANW: Money and Brief-Time period Funding (Firm 10Q of April 2023)

Whereas its long-term investments are largely tied up in US company bonds. The corporate is undoubtedly bullish on US company bond markets. It even talked about increased rate of interest was a think about reaching increased funding earnings in its newest 10Q.

PANW: Lengthy-Time period Investments (Firm 10Q of April 2023)

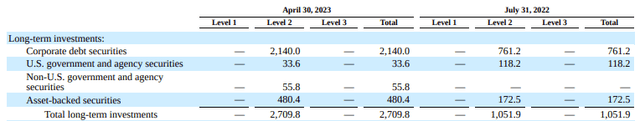

Within the meantime, its debt utilization has switched to be dominated by short-term debt. It lowered its long-term debt whereas rising nearly the precise quantity of short-term debt. Its debt-to-equity at 3.2x and debt-to-EBITDA ratio at 4.67x are very excessive in comparison with different software program corporations. Actually, this can be a dramatic enchancment in comparison with the debt-to-equity ratio of 18.84x in This autumn FY2022. However it’s largely because of increased complete fairness reasonably than crushing down the debt. Though this ratio is within the ballpark with what it was in 2021 and 2020, the distinction is again in ’20 and ’21, it had a better long-term debt with minuscule short-term debt. This ratio might be increased than about 98% of the businesses within the software program trade. With extra of the obligations being pulled ahead, this isn’t useful for its future money stream, which is prone to underperform because of this.

PANW: Rise of Shor-Time period Debt (Calculated and Charted by Waterside Perception with knowledge from firm)

It nearly appears like Palo Alto Networks is leveraging its current sturdy working money stream to fund its funding portfolio. It may very well be a bullish wager on the company bond market or it’s a measure to shore up its potential to meet the short-term debt obligations with out impacting its free money stream as a lot. The company bonds market might present a better yield as a fixed-income portfolio.

Alternatives, Challenges, and Competitions

Palo Alto Networks’ willingness to make use of acquisitions to strengthen its potential has been as sturdy as ever. It has used 17 acquisitions totaling about $4 billion spending to type its Cortex and Prisma Cloud enterprise. The corporate exhibits its concentrate on delivering built-in natural development by way of M&As and partnerships with a number of legendary start-ups Over and once more, the corporate has proven its potential to combine these acquisitions to reinforce or complement its personal product functionality.

Beneath the floor, there are effervescent actions by way of incoming acquisitions by way of M&As and partnerships and ongoing spun-offs from former staff. The graph beneath exhibits a few of its notable alumni-founded start-ups.

Palo Alto Networks Alumni Spin-offs (Palo Alto Networks Alumni Spin-offs (rakgarg@substack))

Subsequently, to remain forward of the curve, the corporate is savvy in utilizing each home-grown and acquisitions to make technological advances and keep aggressive.

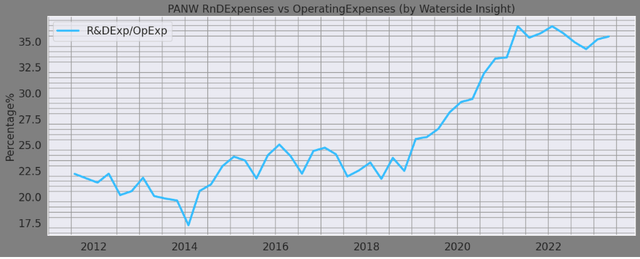

PANW: R&D Bills share of Working Bills (Calculated and Charted by Waterside Perception with knowledge from firm)

And with this a lot funding sitting on bonds as we alluded to earlier, the corporate is probably going bidding time to scoop up worthwhile corporations when shares dump. It might doubtlessly liquidate a few of its fixed-income investments to make one other acquisition. The areas wherein it should attempt to purchase a technological edge almost certainly contain AI and deep studying, which at the moment have purposes in community safety and superior risk prevention. The latter is the place Palo Alto Networks continually must defend by iterating and enhancing, given more and more refined cyberattacks from at house and abroad. Ought to a bargaining deal emerge, it should wish to take the prospect. Nonetheless, we do not suppose the corporate will be capable of pull a big deal with out first bringing down its short-term debt profile first.

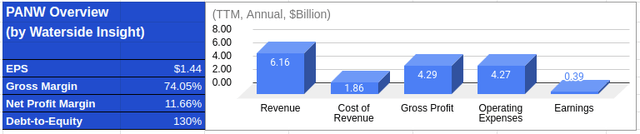

Monetary Overview

PANW: Monetary Overview (Calculated and Charted by Waterside Perception with knowledge from firm)

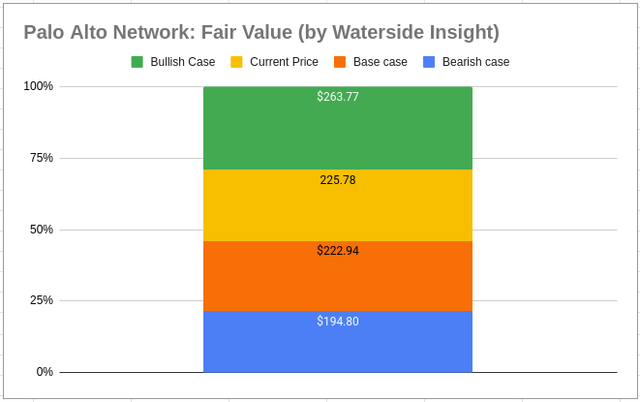

Valuation

In abstract, Palo Alto Community’s enterprise has a profile of excessive development, sturdy money stream, decrease earnings, and blended with excessive debt/leverage. Primarily based on all our evaluation above, we use our proprietary fashions to evaluate its truthful worth with a ten-year projection forward. We assumed a 7.01% price of fairness and a ten.7% of WACC. In our base case, the corporate has sturdy development in FY2023 however is adopted by a dip within the subsequent, with its long-term development regular; it’s priced at $220.94. Within the bullish case, it continues to generate considerably excessive money stream even accounting for the debt obligation, so its near-term development turns into stronger than the bottom case; it’s valued at $263.77 Within the bearish case, debt cost erosion to the money stream compounded by slower gross sales tempo, its near-term development reverting again to the historic norm; it was priced at $194.8. The present market worth is sort of proper on the base case situation.

PANW: Honest Worth (Calculated and Charted by Waterside Perception with knowledge from firm)

Conclusion

In abstract, we give full credit score to Palo Alto Networks’ natural topline development underneath energetic acquisition efforts. Nonetheless, its debt profile will show to be a constraint for its near-term development acceleration whereas its funding portfolio may very well be a vulnerability throughout monetary market swings. The gross sales acquisition prices are at the moment sustainable however it’s a price that’s laborious to chop down. We see its worth to be truthful for the time being and suggest a maintain.