RHJ

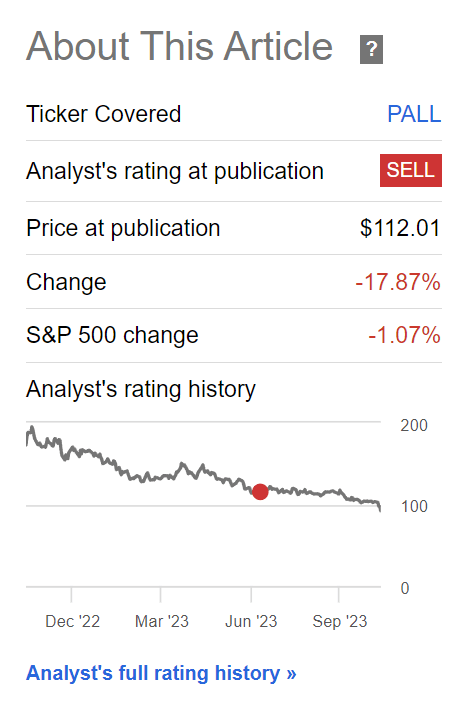

A number of months in the past, I penned a bearish article on the abrdn Bodily Palladium Shares ETF (NYSEARCA:PALL), as I felt demand for palladium in automotive purposes is getting into a terminal decline part. Since my article, the PALL ETF has declined by 18%, because the market seems to agree with my evaluation (Determine 1).

Determine 1 – PALL has declined by 18% (In search of Alpha)

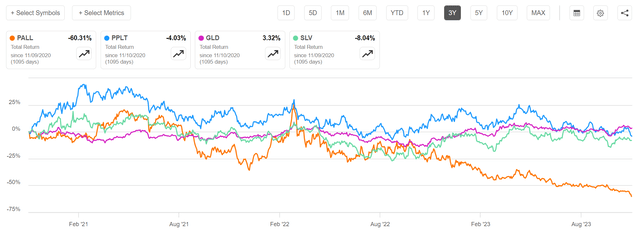

In reality, palladium has been the worst performing valuable steel previously few years as speculators exit the steel mostly related to gasoline catalytic converters (Determine 2).

Determine 2 – PALL has massively underperformed different valuable metals (In search of Alpha)

With the share value of PALL declining by greater than 40% year-to-date, is there a risk of a imply reversion commerce?

Transient Fund Overview

The abrdn Bodily Palladium Shares ETF is a straightforward to perceive fund; the PALL ETF points shares to buyers and makes use of the proceeds to purchase bodily palladium bars which are held in vaults in Zurich and London. The PALL ETF is comparatively small, with solely $177 million in belongings and prices a 0.6% expense ratio.

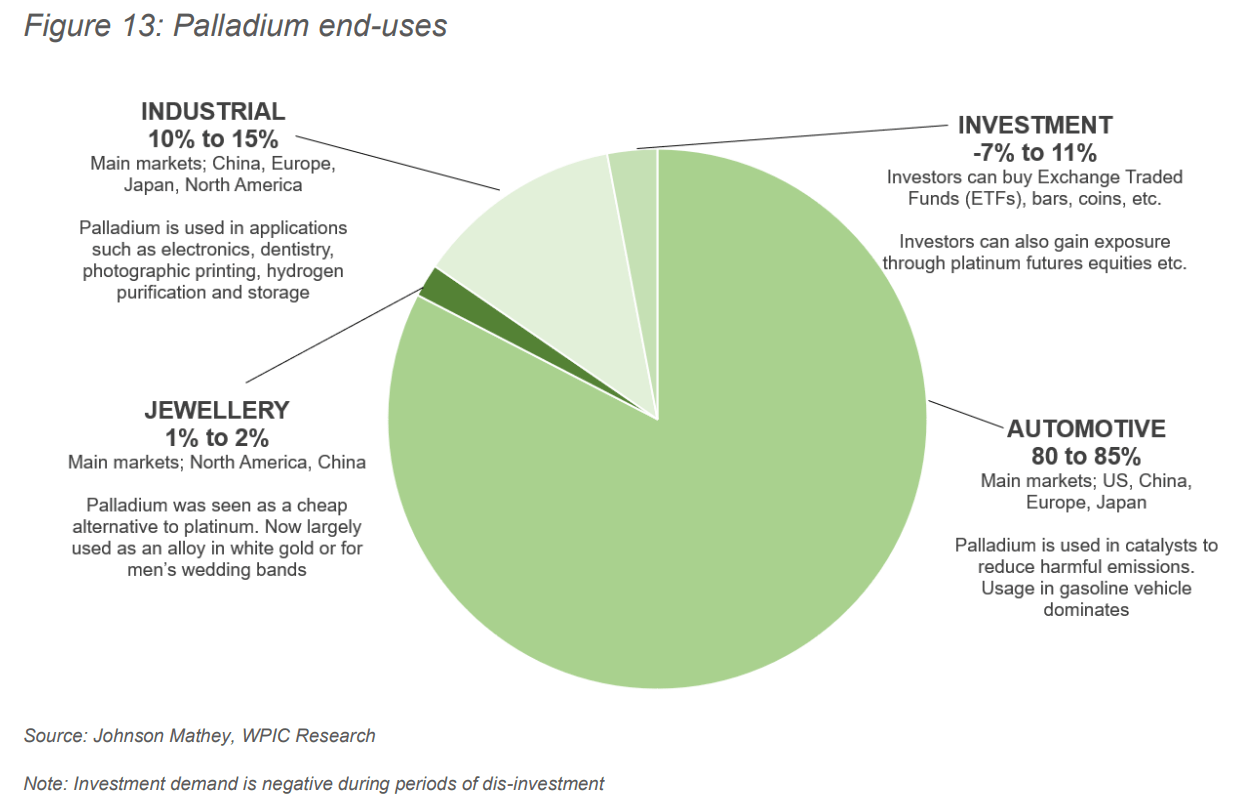

As I wrote in my prior article, the end-use of palladium is usually automotive purposes (i.e. catalytic converters), as that makes up 80-85% of demand (Determine 3).

Determine 3 – Automotive purposes make up 80-85% of end-use (Sprott Asset Administration)

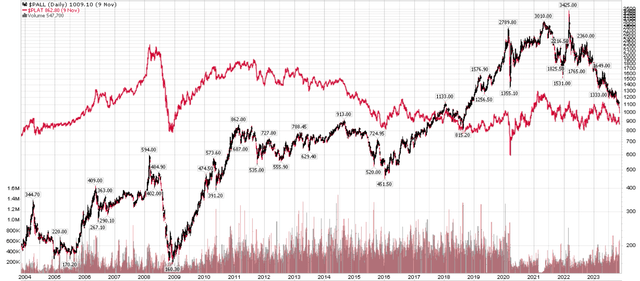

Palladium loved an incredible growth within the 2010s on account of tightening emission requirements and technological advances that allowed palladium to be substituted for platinum at a 1:1 ratio. Mixed with the bodily rarity of palladium (palladium is 15 times rarer in nature in comparison with platinum), this allowed palladium costs to skyrocket, outperforming that of Platinum (Determine 4).

Determine 4 – Palladium costs outperformed platinum within the 2010s (Creator created with value chart from stockcharts.com)

Restricted Mine Provide Is A Blessing And A Curse

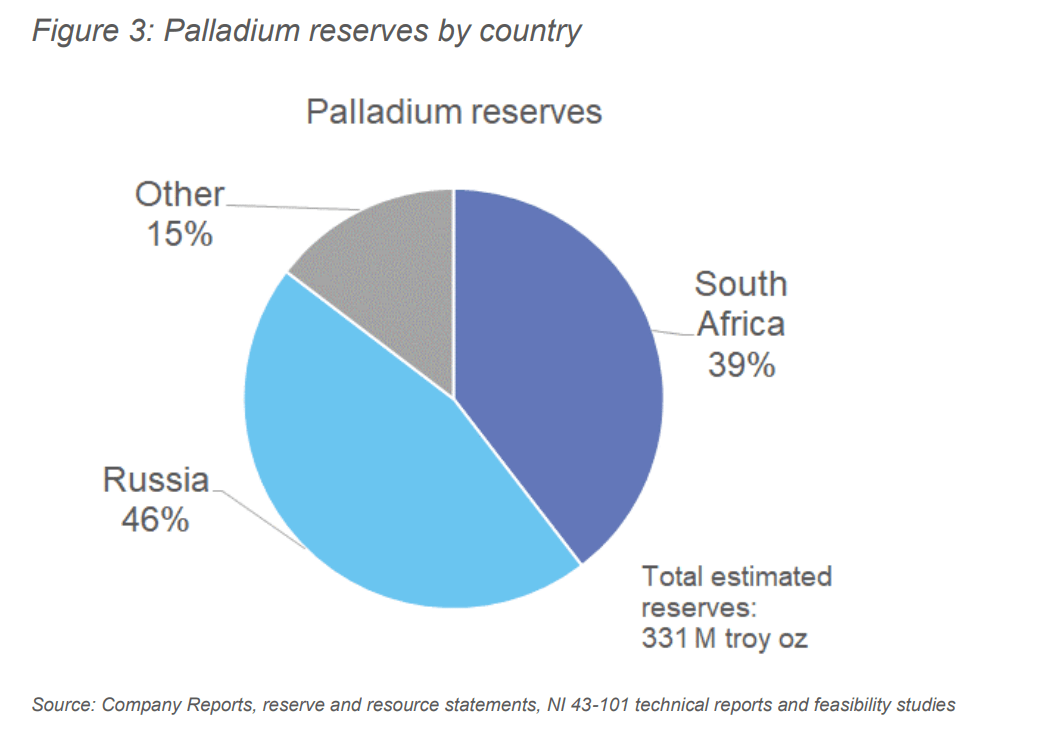

One main motive palladium loved such a big growth within the 2010s was as a result of palladium is a really small market, with Russia and South Africa controlling 46% and 39% of worldwide reserves respectively (Determine 5).

Determine 5 – Palladium is a small market (Sprott Asset Administration)

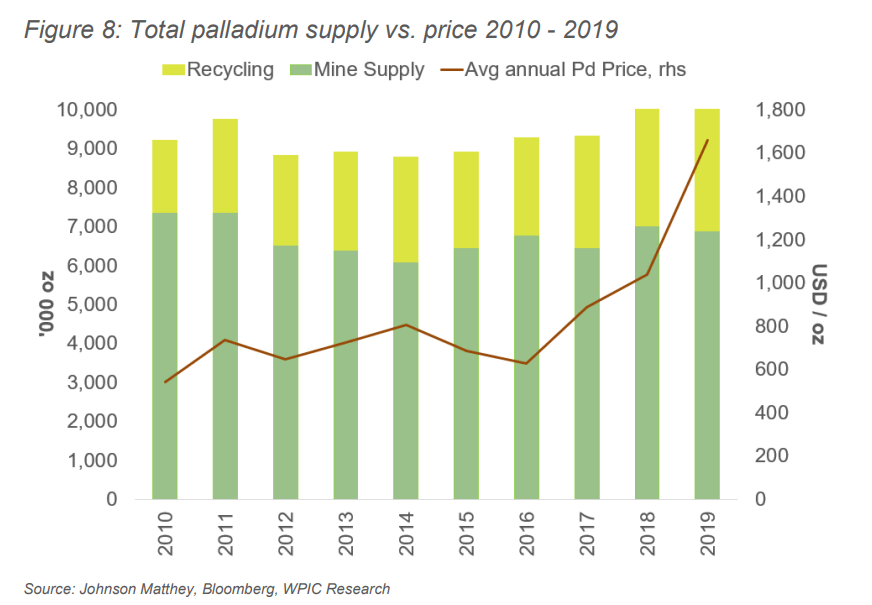

Moreover, palladium is often produced as a byproduct from mining different metals like silver and copper. So even when costs surged within the 2010s, there was little supply-side response, as miners weren’t going to develop copper mines to supply extra palladium (Determine 6).

Determine 6 – Palladium provide is price-inelastic (Sprott Asset Administration)

This byproduct dynamic was a blessing when demand exceeded provide, as there are few devoted palladium deposits and mines, so costs squeezed increased as emission requirements tightened, requiring extra palladium content material per car.

For context, every catalytic convert incorporates 2-7 grams of palladium, or a number of hundred {dollars} value. In comparison with the full price of a passenger car, the worth of contained palladium is simply a rounding error and therefore demand from the automotive trade was comparatively value inelastic.

Nonetheless, the identical byproduct dynamic can flip right into a curse when demand is lower than provide, as we have now seen lately as electrical automobiles substitute inner combustion engines on the street. Miners targeted on producing copper and silver as their main output merely don’t care sufficient about palladium byproduct credit to decelerate manufacturing when there may be extra provide of palladium.

EVs More and more Gaining Market Share; Will Surpass ICE In Late 2020s

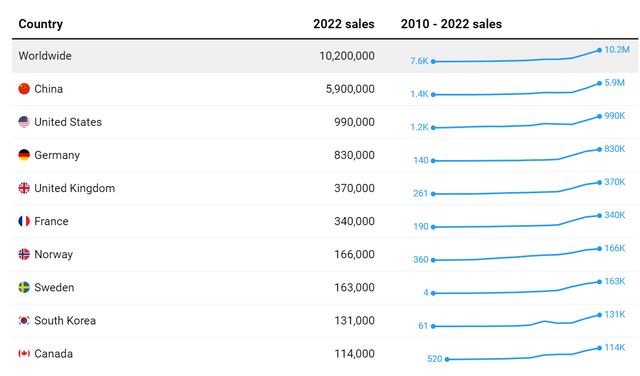

My bearish thesis on palladium could be very easy to grasp. Globally, about 70 million passenger automobiles are bought yearly. Electrical automobiles have gone from nil to over 10 million models in 2022, taking roughly 14% market share (Determine 7).

Determine 7 – EVs accounted for over 10 million car gross sales in 2022 (aljazeera.com)

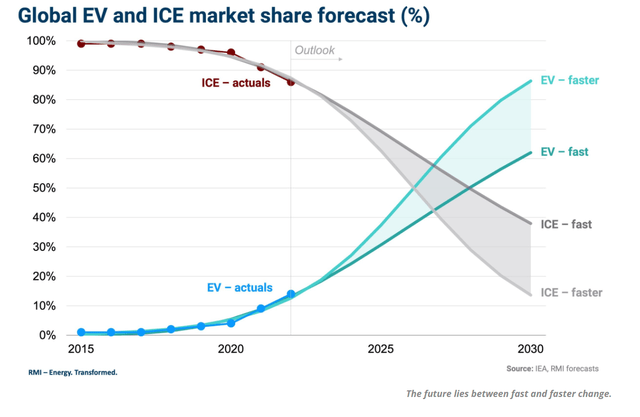

Thus far in 2023, EV gross sales are on pace to develop 40% YoY and lots of analysts anticipate EV gross sales to surpass ICE powered automobiles within the subsequent few years (Determine 8).

Determine 8 – EVs is anticipated to exceed ICE automobiles in late 2020s (cleantechnica.com)

With collapsing demand for palladium in catalytic converters, it’s no shock that the worth of palladium and PALL have been in freefall.

UAW Strike Might Have Been The Trigger Of Newest Plunge

Within the brief time period, the current 7 week strike by the United Auto Employees (“UAW”) union might have exacerbated weak market dynamics and precipitated the worth of palladium to plunge. In keeping with some trade estimates, the strike impacted car manufacturing by ~43,000 per week, so the prolonged 7-week strike may have stopped manufacturing of ~250,000-300,000 automobiles in whole between the three detroit automakers.

With the strike now resolved, we should always see manufacturing traces restart and demand for inputs like palladium normalize. So I might not be stunned if the worth of palladium finds some near-term stability.

Nonetheless, the long-term decline in palladium demand is inevitable, so I might urge holders of the PALL ETF to make use of any rallies to exit.

Conclusion

The abrdn Bodily Palladium Shares ETF offers pure publicity to the worth of palladium. As a result of exponential progress of EVs, my outlook for palladium is adverse.

Within the short-term, the current UAW strike may have negatively impacted gasoline car manufacturing, so I might not be stunned if palladium costs stabilize as placing staff return to work. Nonetheless, trying long-term, EVs are set to overhaul inner combustion engines within the subsequent few years, resulting in considerably decrease demand for palladium in catalytic converters.

Since palladium is often a byproduct of different metals’ manufacturing, decrease costs won’t immediate any provide response from the miners. What was a blessing when costs had been rising on account of demand exceeding provide will flip right into a curse for palladium buyers within the coming years as provide exceeds demand.

I keep my promote ranking on PALL.