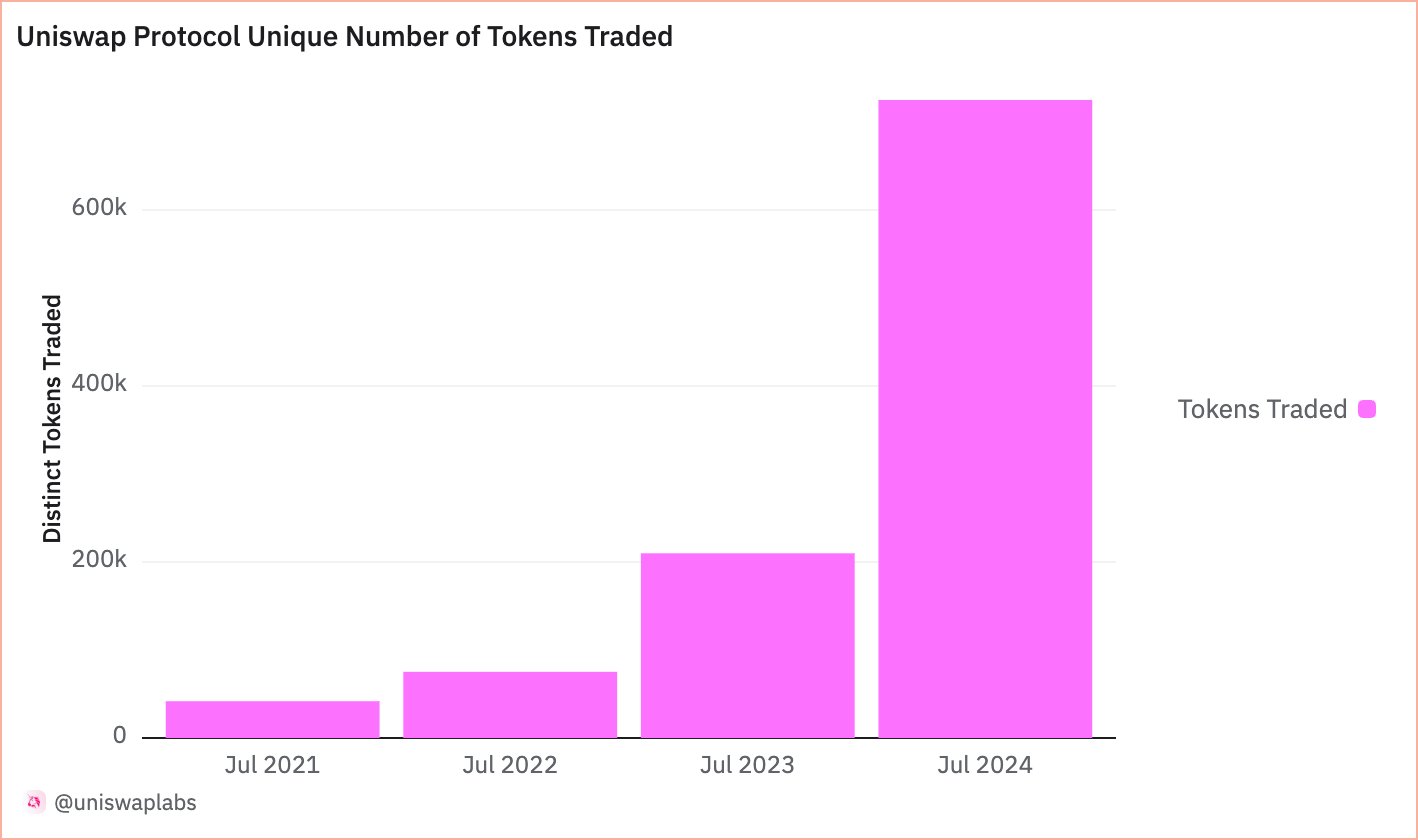

- In line with knowledge from Dune Analytics, Uniswap data the best variety of distinctive tokens exchanged in a yr, with 725,000 in 2024.

- Uniswap recorded 209,000 distinctive tokens exchanged in 2023, 75,000 in 2022 and 41,000 in 2021.

The biggest decentralized change (DEX) by buying and selling quantity Uniswap (UNI) has reached a historic milestone with 725,000 distinctive tokens exchanged to date in 2024. In line with the details This determine, compiled by Dune Analytics, greater than triples the 209,000 distinctive tokens exchanged in 2023 and represents roughly 10 instances the 75,000 registered in 2022.

Supply: dune.com

Our overview of different metrics, resembling the entire variety of wallets generated, additionally confirmed unimaginable development, from 3 million in Could 2023 to 7.2 million in Could 2024. This represents a 140% enhance in comparison with the comparability yr.

When it comes to cumulative buying and selling quantity, Uniswap surpassed $2 trillion on April 5 and in addition emerged as the biggest DEX in keeping with Whole Worth Locked (TVL) with $5.31 billion. This greater than doubled the almost $2 billion recorded by PancakeSwap, securing the second place. Surprisingly, this comes amid Uniswap Labs’ charge hike from 0.15% to 0.25%. After the implementation of the brand new buying and selling price, $661,000 was netted on the finish of Could.

In line with consultants, these figures are anticipated to double or triple following the adoption of spot Ethereum Change Traded Funds (ETFs). It may be recalled that the decentralized change’s buying and selling quantity rose to a whopping $5.5 billion when the Ether ETF hype peaked in late Could. At the moment, the entire quantity of DEXes was $11.2 billion. Our analysis additionally discovered that the buying and selling quantity recorded by Uniswap was larger than that of any blockchain on which Uniswap operates.

Uniswap vs. SEC Authorized Showdowns

Just lately, Uniswap acquired a Wells Discover from the US Securities and Change Fee (SEC) concerning potential violations of US securities legal guidelines. Like us earlier than reportedUniswap responded with a 43-page file explaining the the explanation why the Fee shouldn’t carry authorized expenses in opposition to them. In a press release issued by Uniswap’s Chief Authorized Officer, Marvin Ammori, and offered of CNF, virtually the entire SEC’s allegations are primarily based on false assumptions.

The SEC’s total case rests on the false assumption that each one tokens are securities. Tokens are basically merely a file format for worth. The SEC basically must unilaterally change the definitions of change, brokerage, and funding contracts to attempt to seize what we do.

In explaining the small print of the discover, Uniswap CEO Hayden Adam disclosed that the SEC outlined three key points on the coronary heart of the dispute. The primary has to do with whether or not Uniswap’s interface is a dealer. The second targeted on UNI’s securities standing, whereas the third highlighted transparency and the absence of a contractual relationship between Uniswap and token holders.

In any case, crypto analyst Ali Martinez predicts that UNI may attain $10 quickly. On the time of writing, UNI was buying and selling at $8.3, after rising 2% within the final 24 hours.