Knowledge tracked by 21.co exhibits $1.08 billion in Treasury notes has been tokenized by way of public blockchains.

The tally has risen practically 10-fold since January 2023 amid elevated rates of interest worldwide.

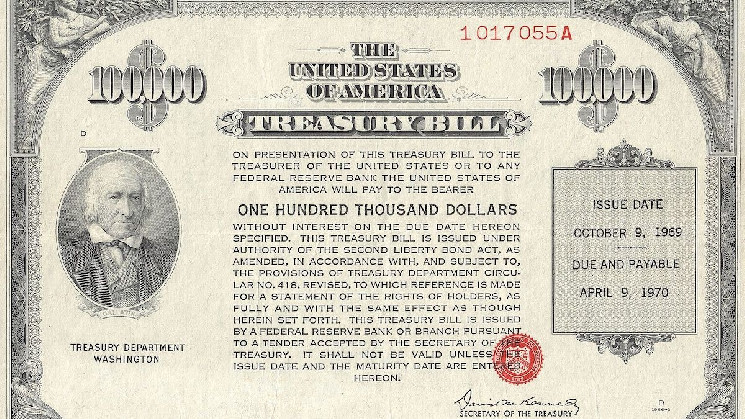

The marketplace for tokenized U.S. Treasury debt is booming.

The market worth of Treasury notes tokenized by way of public blockchains like Ethereum, Polygon, Valanche, Stellar and others has crossed above $1 billion for the primary time, information tracked by Tom Wan, an analyst at crypto agency 21.co, present.

Tokenized Treasuries are digital representations of U.S. authorities bonds that may be traded as tokens on the blockchain. The market worth has risen practically 10-fold since January final yr and 18% since conventional finance large BlackRock introduced Etheruem-based tokenized fund BUIDL on March 20.

As of writing, BUILD is the second-largest such fund, with a tokenized worth of $245 million, trailing solely Franklin Templeton’s Franklin OnChain U.S. Authorities Cash Fund (FOBXX) – one share of which is represented by the BENJI token – which led the pack with $360.2 million in deposits.

“Simply occurred, $1B Complete Tokenized U.S. Treasuries on Public Blockchains. Blackrock’s BUIDL elevated by 400% from 40M to 240M provide in every week,” Wan posted on X. “OndoFinance is now the biggest holder of BUIDL, holding 38% of the full provide. Now Ondo’s OUSG is totally backed by BUIDL.”

The fast rise in Treasury yields up to now two years has fueled demand for his or her tokenized variations. The ten-year yield, the so-called risk-free price, has risen to 4.22% from 1.69% since March 2022, denting the attraction of lending and borrowing the dollar-pegged stablecoins within the decentralized finance market.

Investing in tokenized Treasuries can assist crypto buyers diversify their portfolio, permitting them to settle transactions on any given day.

“The great thing about tokenization, [is] you possibly can settle the transaction 24/7,” Wan mentioned.