- BTC despatched to exchanges over the previous week was price over $1 billion

- On the time of writing, the crypto had recovered considerably after dipping beneath $55,000

There was a notable inflow of Bitcoin to exchanges not too long ago. This has coincided with a difficult interval for the world’s largest cryptocurrency, with it being one in every of BTC’s most vital downturns in latest months. For sure, this has had an impression on the crypto’s holders, together with whales.

The truth is, a BTC whale that was inactive for over ten years has now transferred all of its holdings.

Billions of {dollars} of BTC hits exchanges

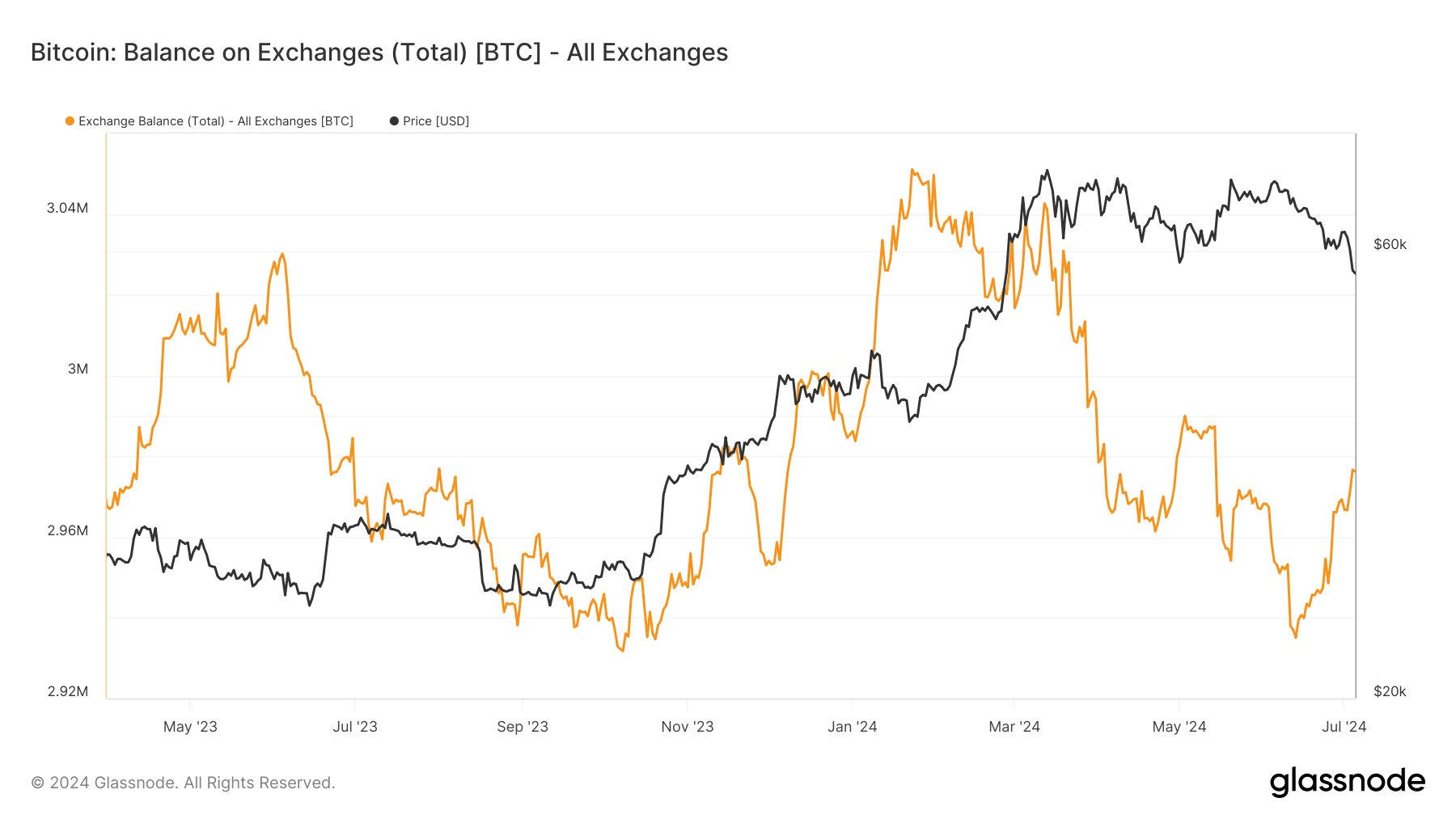

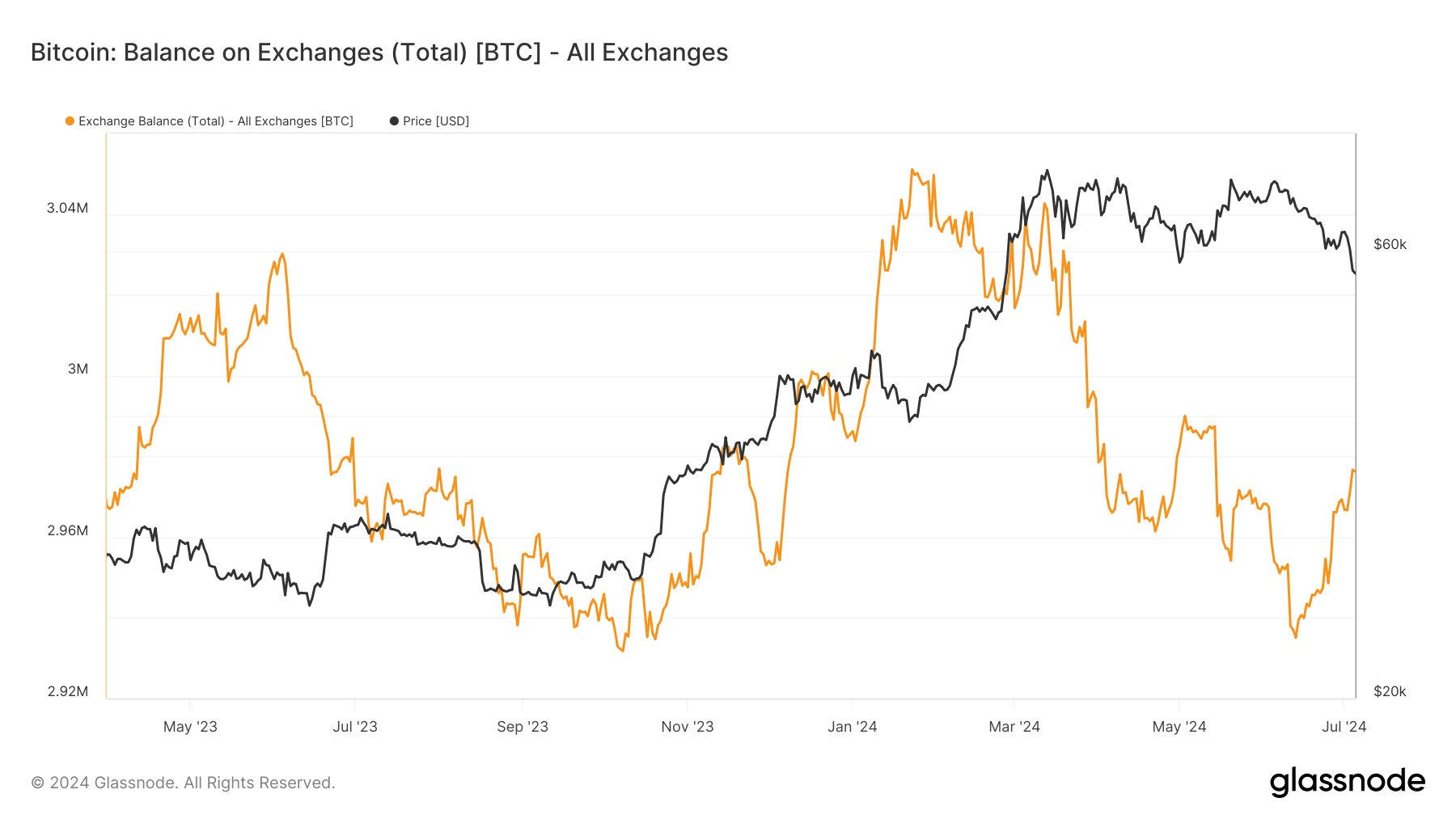

Current knowledge from Glassnode highlighted a major improve within the quantity of Bitcoin being transferred to exchanges.

AMBCrypto’s evaluation of this knowledge revealed that between 1-5 July, greater than 9,500 BTC, valued at roughly $540 million based mostly on present costs, moved into exchanges.

Supply: Glassnode

Increasing the timeframe to the previous week revealed a fair bigger switch, with over 21,000 BTC moved — Equal to greater than $1 billion in worth. This surge in change inflows may point out a preparation for promoting, probably placing downward strain on Bitcoin costs within the brief time period.

Decade-old Bitcoin pockets reawakens

That’s not all, with Lookonchain detecting a major motion involving a pockets that had been dormant for over a decade.

This pockets not too long ago transferred all of its contents, totaling 1,004.5 BTC. The evaluation indicated that these cash had been acquired in 2014 at a mean worth of $735 every, valuing the whole holdings at roughly $738,000 on the time of acquisition. Given the present market worth of Bitcoin, these cash are actually valued at round $57 million.

This substantial improve in worth highlights the numerous appreciation of BTC through the years. Additionally, it highlighted the potential impression such massive, surprising transactions may have on market dynamics.

Extra BTC actions

This week, a number of vital Bitcoin transactions have occurred which are influencing market dynamics. Mt. Gox carried out a check transaction involving over 1,000 BTCs as a part of their preparation for deliberate payouts to collectors.

Along with this, the defunct change moved greater than 42,000 BTC, valued at over $2 billion, from wallets that had been inactive for over a decade.

Moreover, the German authorities has additionally moved over 4,000 BTC to exchanges. These large-scale actions from vital and beforehand dormant holders have contributed to extend liquidity on the promote facet of the market.

Moreover, such actions can result in heightened sell-side strain. This will impression its worth by driving it south because of the sudden hike in accessible provide in the marketplace.

Bitcoin struggles to rebound

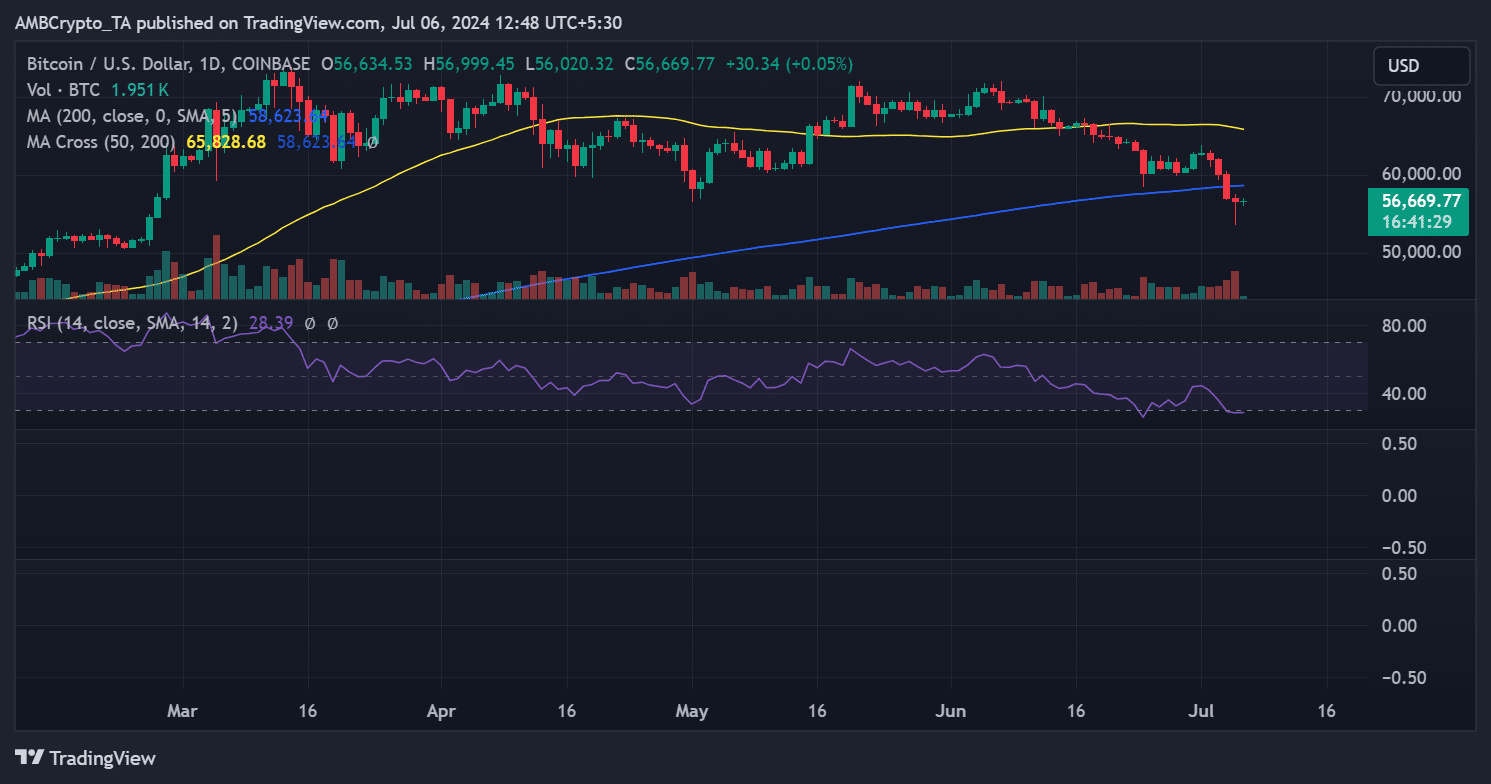

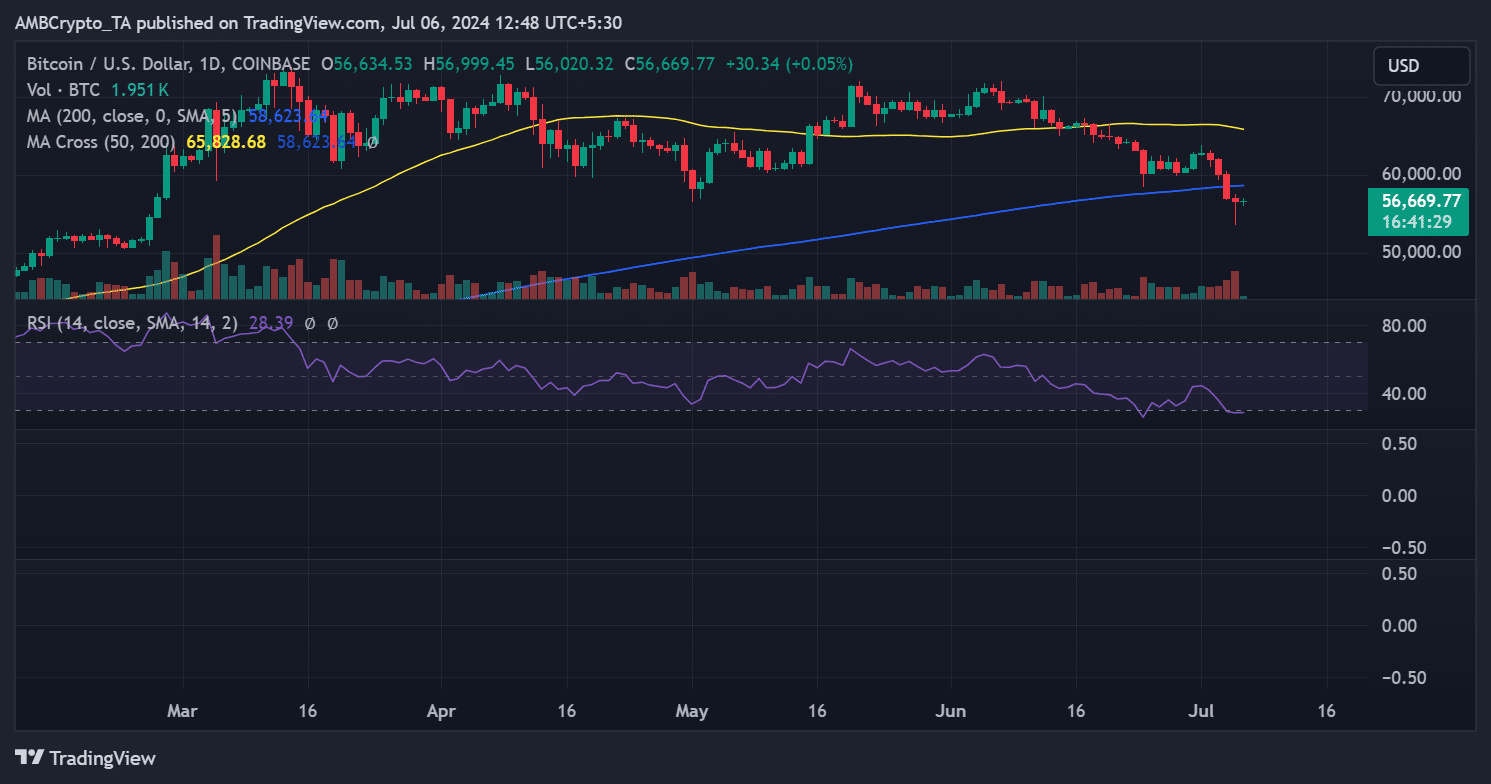

Based on AMBCrypto’s evaluation of Bitcoin on the every day timeframe, BTC gave the impression to be nonetheless struggling to stabilize amid its ongoing decline. The identical was highlighted by the positioning of its RSI and Shifting Averages.

Supply: TradingView

– Learn Bitcoin (BTC) Worth Prediction 2024-25

On the time of writing, the cryptocurrency was buying and selling at round $56,600, fluctuating between minor features and losses.