wellesenterprises

Article Thesis

Oracle Company (NYSE:ORCL) has introduced its most up-to-date quarterly earnings outcomes on Monday, and the market reacted very negatively to those outcomes on Tuesday, with shares slumping by greater than 10%. Contemplating the truth that the corporate outperformed revenue estimates, that looks as if an overreaction. With an inexpensive valuation, Oracle seems to be strong however not like a cut price immediately.

What Occurred?

Oracle Company reported its second-quarter earnings outcomes on Monday following the market’s shut. The headline numbers will be seen right here:

Looking for Alpha

We see that revenues missed estimates barely, by rather less than 1%. That is not nice, however not a catastrophe, both. The income development price of 5% was strong and simply shy of the 6% that was anticipated. On the similar time, Oracle beat estimates for its earnings per share barely — by round 1% as nicely.

So all in all, one may have imagined that there can be a small share worth response — revenues have been marginally decrease than anticipated, whereas earnings have been marginally greater than anticipated. Nonetheless, the market reacted very harshly to those outcomes, sending Oracle decrease by 11% on the time of writing. It’s value noting that Oracle remains to be up by slightly greater than 20% up to now this 12 months, thus it is not like the corporate has slumped to a brand new 52-week low. However, a share worth drop of greater than 10%, which destroyed greater than $30 billion of market capitalization, looks as if an overreaction to me, contemplating the gorgeous small income miss of simply round $100 million.

Oracle: Strong Execution

Oracle Company shouldn’t be among the many highest-growth tech firms and has been trailing Meta Platforms (META), Alphabet (GOOG)(GOOGL), Amazon (AMZN), and many others. with regards to rising its enterprise over time. That is not stunning, as Oracle is lively in a slower-growth market that’s extra mature, in comparison with the markets these higher-growth tech giants are lively in.

However, Oracle has generated strong enterprise development previously, by way of a mix of natural investments and M&A, which incorporates the latest acquisition of healthcare participant Cerner:

Within the above chart, we see that revenues have accelerated lately, following a little bit of a plateau section between 2012 and 2020 the place income development has been uneven and reasonably sluggish, on common. The income development acceleration lately is partially attributable to M&A, primarily the Cerner takeover, however Oracle additionally benefitted from the truth that it has been increasing its cloud choices which have pushed natural income development. We can also see that Oracle had skilled phases of weak development earlier than, e.g. between 2002 and 2006, earlier than issues improved within the following years.

Throughout the latest quarter, Oracle’s fiscal Q2, the corporate noticed its cloud enterprise develop properly:

– Total cloud income totaled $4.8 billion, just about in step with estimates, which was up by a pleasant 25% in US {Dollars} and which was up by 24% in fixed currencies, Oracle thus skilled a small tailwind from forex price actions in comparison with the earlier 12 months’s quarter. Complete cloud revenues now make up near 40% of Oracle’s whole revenues, with that ratio climbing repeatedly.

– Cloud development was, in flip, pushed by a hefty enhance in Oracle’s Cloud Infrastructure enterprise. Whereas this unit generates round $1.6 billion in gross sales and thus contributes solely round one-third of Oracle’s whole cloud revenues, the Cloud Infrastructure enterprise is rising at a really excessive price: Throughout the latest quarter, revenues on this section have been up by 52% in comparison with the earlier 12 months’s quarter.

Over time, the expansion price will decelerate for each the general cloud enterprise and the Cloud Infrastructure enterprise, as no entity can develop at a 20%+ price without end. However within the foreseeable future, the cloud enterprise ought to stay a pleasant development driver for Oracle, particularly since this higher-growth enterprise unit turns into extra essential when it comes to total income contribution. That is mirrored within the development estimates for Oracle within the coming years, as we are able to see within the following desk:

Oracle’s forecasted income development (Looking for Alpha)

Whereas there is no such thing as a assure that analysts are appropriate with their estimates, their forecasts can provide us a strong base case state of affairs, I consider. Previously, Oracle has crushed estimates extra typically than it missed them, thus there’s a little bit of a historical past of analysts underestimating Oracle’s development (there have been 11 income beats and 5 income misses during the last 4 years). Precise revenues may thus are available greater than what’s mirrored within the above desk, however even a sequence of estimate hits would make for a pleasant efficiency. Income development is forecasted at 7% this 12 months, which is strong, however analysts are additionally seeing income development accelerating over the next three years, with the (anticipated) year-over-year development price enhancing yearly by way of 2027. This may be defined by the rising contribution of Oracle’s higher-growth cloud enterprise, whereas the continued integration and scaling of Cerner additionally performs a job within the improved development outlook.

Oracle’s earnings per share are anticipated to whole slightly greater than $5.50 this 12 months, with that quantity seen rising to greater than $7.60 by early 2027 (when Oracle’s fiscal 12 months ends), which might symbolize a development price of round 11% over the following three years. That does not make Oracle an ultra-high-growth firm, however it could be very strong, I consider.

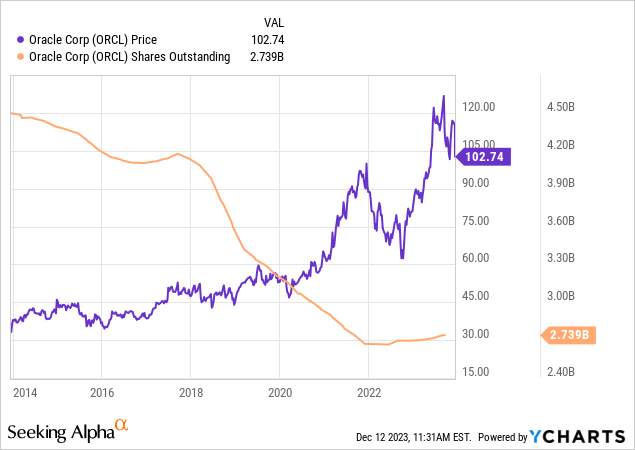

Earnings development within the coming years needs to be potential due to a mix of rising revenues and buybacks, as Oracle is a tech firm with a historical past of decreasing its share rely at a hefty tempo:

Over the past decade, the share rely has dropped by round 1.8 billion, due to huge buyback spending. It’s value noting that Oracle points a major variety of shares per 12 months, which is why the buybacks aren’t as efficient as they was once, and which explains why the share rely has elevated barely during the last 12 months. Nonetheless, in the long term, the share rely has declined significantly, and I anticipate that the corporate will proceed to decrease its share rely at a significant tempo within the coming years.

Is Oracle A Good Funding?

I’m fairly certain that Oracle is a greater funding immediately, in comparison with yesterday, because the outlook hasn’t actually modified whereas the share worth has declined by double-digits. That being mentioned, Oracle is not essentially an excellent worth immediately. Primarily based on present earnings per share estimates, Oracle now trades for round 18-19x this 12 months’s anticipated web earnings, which isn’t particularly costly in absolute phrases, however which additionally is not particularly low-cost. The ten-year median earnings a number of for Oracle stands at 19x proper now, in response to YChart’s information, thus we are able to say that Oracle is buying and selling just about in step with the historic common. This implies that proper now could be neither an particularly good time to purchase Oracle, neither is it an particularly unhealthy time to purchase a place within the inventory. Whereas Oracle was slightly expensive earlier than the latest worth drop, with an earnings a number of of greater than 20, it seems to be pretty priced proper now.

Ideally, traders purchase shares of firms when these shares are buying and selling nicely under truthful worth, as that makes for the perfect risk-reward setup. That is not the case right here, nonetheless, which is why I will not give Oracle a purchase ranking proper now. Oracle was a greater worth one 12 months in the past, for instance, when shares have been buying and selling at $80 as a substitute of barely above $100.

Takeaway

Oracle had a strong quarter, however the market did not just like the report in any respect. Oracle’s 11% share worth droop has corrected the inventory’s latest overvaluation, and shares now commerce at a very reasonable valuation, I consider.

The expansion outlook is strong due to an interesting development price within the cloud enterprise, however traders however should not see Oracle as a high-growth firm. At a high-teens earnings a number of, Oracle is a strong “Maintain”, I consider, whereas ready for a greater entry level may make sense for individuals who wish to enter or increase a place.