Overview

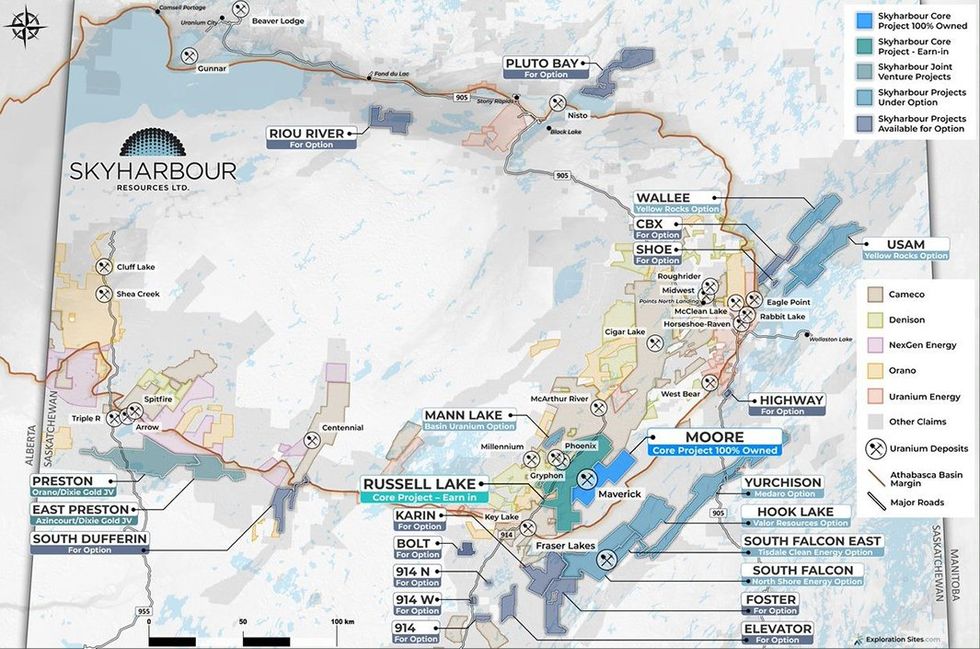

Skyharbour Assets (TSXV:SYH, OTCQX:SYHBF, Frankfurt:SC1P) is a mineral exploration firm that holds an intensive portfolio of uranium and thorium initiatives in Canada’s Athabasca Basin. The corporate is well-positioned to learn from bettering uranium market fundamentals with over 523,000 hectares of land comprising a complete of 25 initiatives.

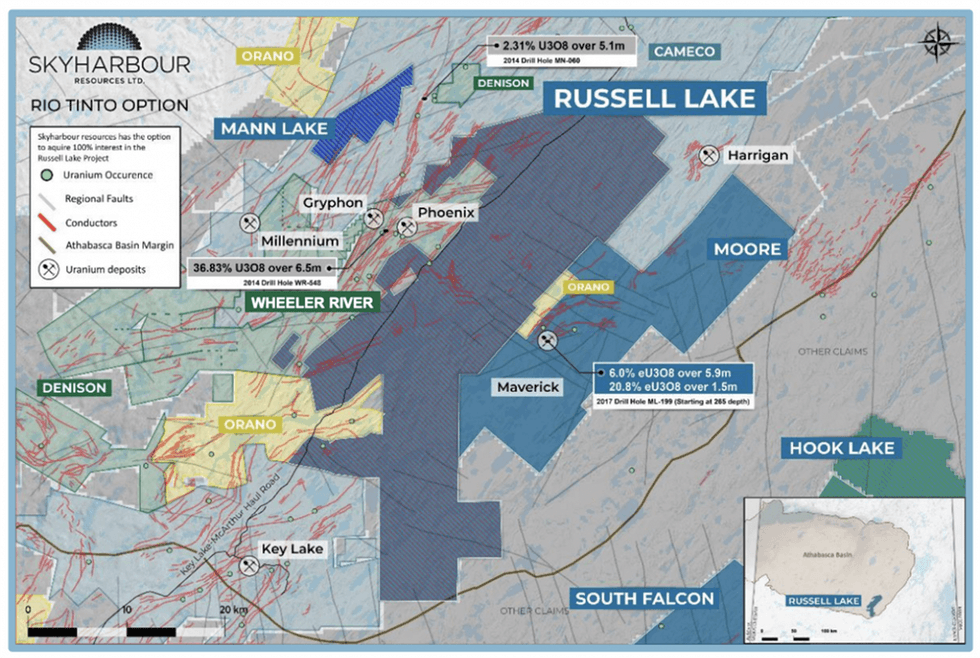

The corporate not too long ago optioned from Rio Tinto, now a big strategic shareholder of the corporate, an preliminary 51-percent curiosity and as much as a 100-percent curiosity within the Russell Lake Uranium undertaking positioned within the central core of the Jap Athabasca Basin of northern Saskatchewan. The massive, advanced-stage uranium exploration property totalling 73,294 hectares, hosts historic high-grade drill intercepts over a big property space with sturdy exploration upside potential.

The 100-percent-owned co-flagship Moore Lake Undertaking, acquired from Denison Mines in 2016 – now a big strategic shareholder of the corporate – is positioned 15 kilometers east of Denison’s Wheeler River undertaking, 39 kilometers south of Cameco’s McArthur River uranium mine, and adjoining to the Russell Lake Undertaking. Moore is an advanced-stage uranium exploration property with high-grade uranium mineralization on the Maverick Zone, together with spotlight drill outcomes of 6 % U3O8 over 5.9 meters together with 20.8 % U3O8 over 1.5 meters. Skyharbour not too long ago accomplished a 9,600m inaugural drill program at Russell Lake, intersecting important uranium mineralization in most holes. Given the success of the inaugural drill program, Skyharbour is planning a winter drill program consisting of 5,000m in ten to 12 drill holes with all targets being street accessible and close to the exploration camp.

Along with providing buyers publicity to high-grade uranium discovery potential at its main initiatives, Skyharbour leverages its properties by the prospect generator mannequin, with companion firms funding exploration and growth at its earlier stage or secondary property. It’s a cost-effective mannequin that facilitates massive exploration applications with out substantial fairness dilution.

In September 2021, Skyharbour introduced the preliminary set of diamond drill outcomes from its 2021 summer time diamond drilling program at its 100-percent-owned, 35,705-hectare Moore Uranium Undertaking. The summer time/fall 2021 program included 6,598 meters in 19 holes and returned highlights of two.54 % U3O8 over 6 meters together with 6.80 % U3O8 over 2 meters within the basement rocks at Maverick East Zone in addition to 0.54 % U3O8 over 19.5 meters together with 4 meters of two.07 % U3O8. Skyharbour drilled greater than 2,400 meters in seven drill holes throughout the 2022 spring drilling marketing campaign which examined new targets, together with Grid Nineteen and Viper, together with a gap drilled on the Maverick East zone.

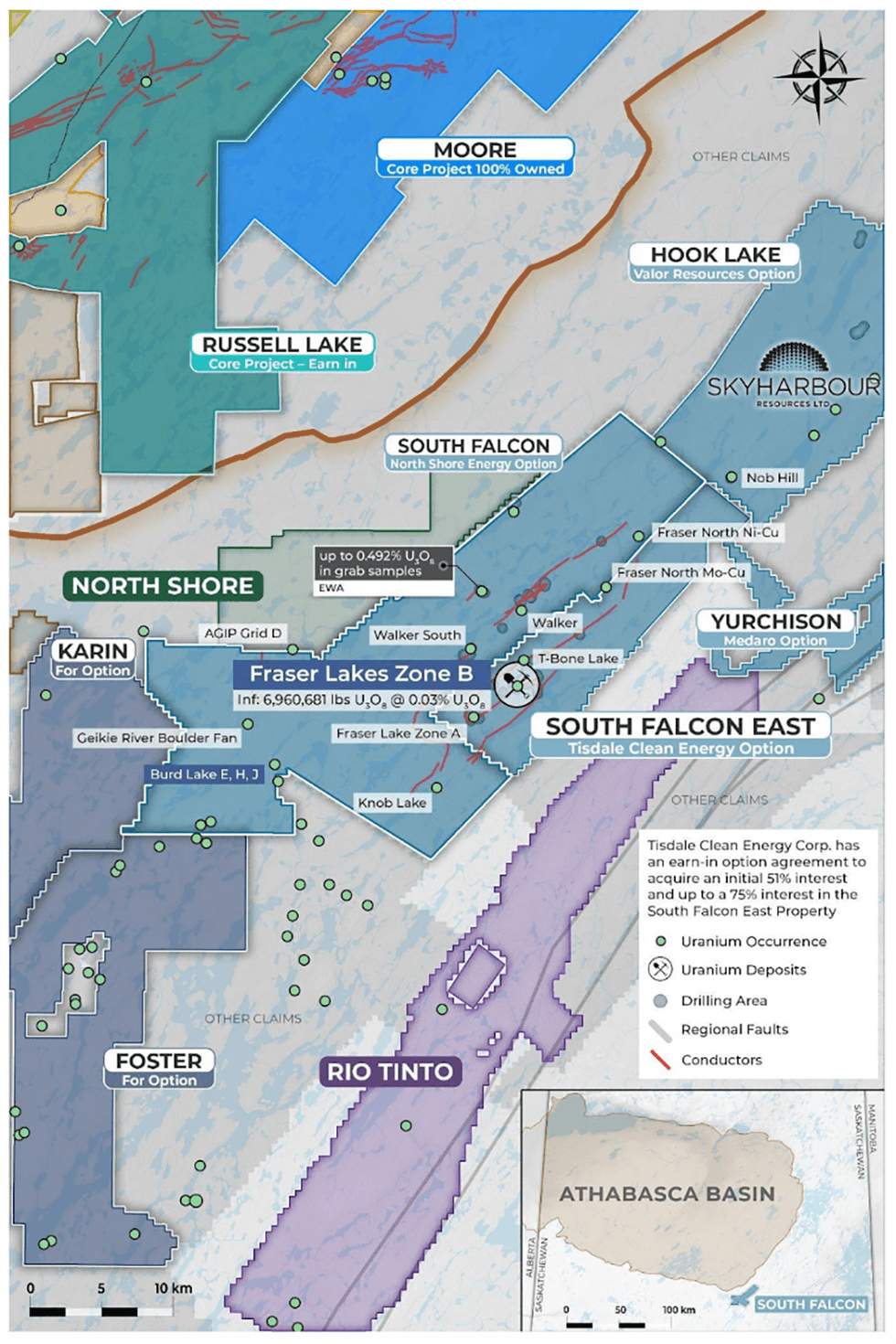

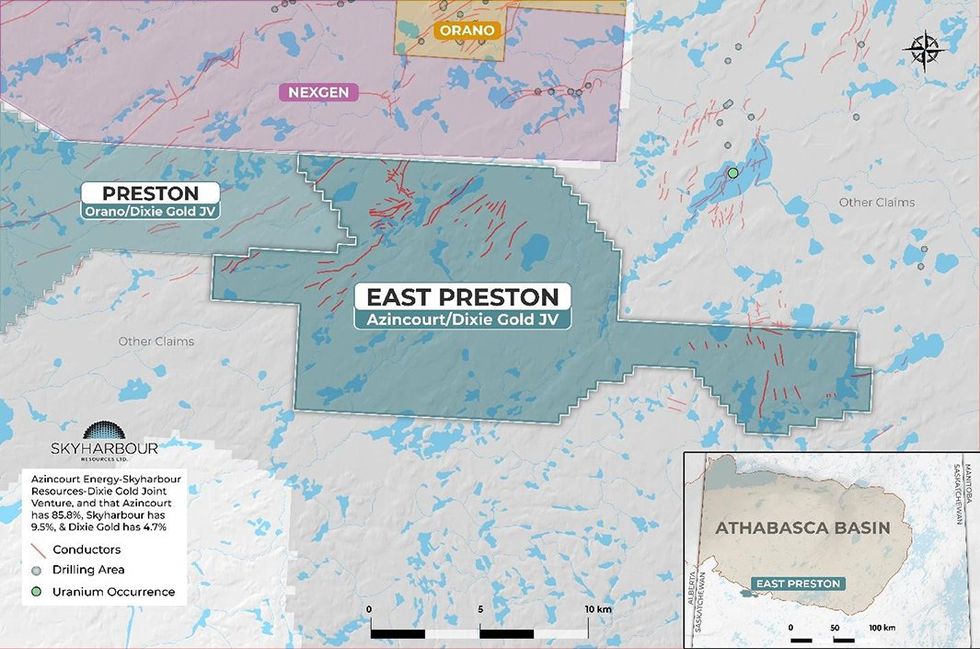

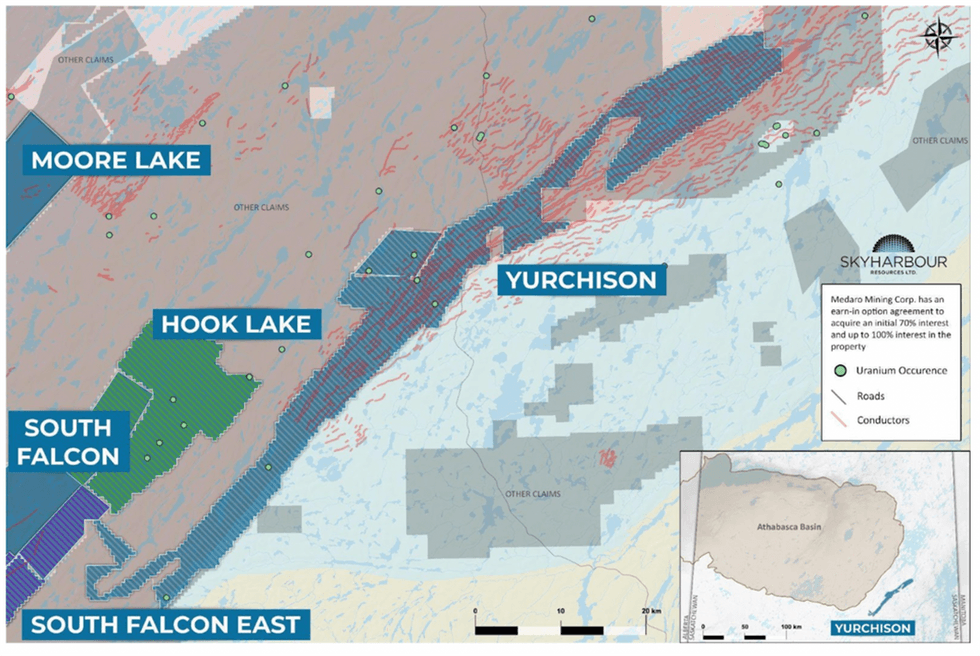

The corporate at present has joint ventures with trade chief Orano Canada Inc. and Azincourt Vitality on the Preston and East Preston initiatives, respectively, whereby Orano and Azincourt earned majority pursuits within the initiatives by exploration expenditures, money funds and share issuances. Skyharbour additionally has six lively earn-in possibility companions, together with with ASX-listed Valor Assets on the Hook Lake Uranium Project; CSE-listed Basin Uranium on the Mann Lake Uranium Project; CSE-listed Medaro Mining on the Yurchison Project; Yellow Rocks Vitality, a personal Australian entity, on the Wallee and Usam Island Projects; North Shore Uranium on the Falcon Project; and CSE-listed Tisdale Clear Vitality on the South Falcon East Project, which is host to the Fraser Lakes Zone B Uranium and Thorium Deposit (NI 43-101 inferred useful resource totalling 7 Mlbs of U3O8 at 0.03 % and 5.3 Mlbs of ThO2 at 0.02 %).

In mixture, Skyharbour has now signed earn-in possibility agreements with companions that complete greater than $37 million in partner-funded exploration expenditures, over $28 million price of shares being issued and over $19 million in potential money funds coming into Skyharbour, assuming that these companion firms full their total earn-ins on the respective initiatives.

In 2023, Skyharbour made a number of acquisitions that introduced its complete land packages to 523,097 ha (1,292,600 acres) throughout 25 initiatives., representing one of many largest undertaking portfolios within the Athabasca Basin. These current acquisitions included: the Freeway Undertaking (1,184 hectares), CBX Undertaking (1,761 hectares), Shoe Undertaking (609 hectares), Snow Undertaking (212 hectares), Elevator Undertaking (9,294 hectares), 914 Undertaking (2,129 hectares), 914N Undertaking (450 hectares), Karin Undertaking (18,383 hectares), and the South Dufferin Undertaking (13,205 hectares). Skyharbour additional acquired by staking seven new potential uranium exploration claims in Northern Saskatchewan, which embrace the CBX undertaking comprising 5 new contiguous claims totalling 6,804 hectares, the Karin undertaking (5,882 hectares) and the 914W undertaking (1,260 hectares). The latest staking included the Bolt Property, which can present further floor to possibility or joint-venture out to new companion firms as part of our prospect generator enterprise

Skyharbour’s world-class administration and geological staff brings years of experience in uranium exploration, vitality industries, company finance and capital markets. The corporate is well-positioned to capitalize on the uranium market’s resurgence with sturdy potential for useful resource progress and new discoveries at its undertaking base. Skyharbour’s aim is to maximise shareholder worth by new mineral discoveries, dedicated long-term partnerships, and the development of exploration initiatives in geopolitically favorable jurisdictions.

Firm Highlights

- Skyharbour holds one of many largest undertaking portfolios throughout the Athabasca Basin with greater than 523,097 hectares of land bundle throughout 25 initiatives.

- The co-flagship Moore Uranium undertaking is an advanced-stage uranium exploration property within the jap Athabasca Basin close to current infrastructure with recognized high-grade uranium mineralization and important discovery potential; high-grade drill outcomes embrace 21 % triuranium octoxide (U3O8) over 1.5 meters with 6 % U3O8 over 6 meters.

- Skyharbour not too long ago acquired the 73,294-hectare Russell Lake Uranium Undertaking from Rio Tinto, which is a potential exploration property strategically located between the corporate’s Moore Uranium undertaking (to the east), Denison Mines’ Wheeler River undertaking (to the west), and between Cameco’s Key Lake and McArthur River Tasks within the jap portion of the Athabasca Basin.

- Skyharbour additionally has a 100% curiosity within the Falcon Uranium Undertaking, which accommodates an NI 43-101 inferred useful resource totalling 7 million kilos (Mlbs) of U3O8 at 0.03 %, and 5.3 Mlbs of thorium dioxide at 0.023 %.

- Three way partnership with Orano Canada on the Preston undertaking: Orano has earned a 51 % curiosity within the undertaking by spending C$4.8 million in exploration prices and making money funds totalling C$100,000.

- One other three way partnership was accomplished with Azincourt Vitality on the East Preston Uranium Undertaking. Azincourt earned a 70-percent curiosity by spending C$2.5 million on exploration, a money fee of C$500,000 and issuing 4.5 million shares.

- Skyharbour has six lively earn-in possibility agreements with Valor Assets, Basin Uranium, Medaro Mining, Yellow Rocks Vitality, Tisdale Clear Vitality and North Shore Vitality on the Hook Lake, Mann Lake, Yurchison, Wallee & Usam, South Falcon East and Falcon initiatives, respectively.

- Skyharbour has a notable shareholder base together with Denison Mines Corp (TSX: DML; NYSE:DNN), Rio Tinto (ASX:RIO) Sprott Uranium Miners ETF (URNM), International X Uranium ETF (URA), Horizons International Uranium Index ETF (HURA), Sprott Junior Uranium Miners ETF (URNJ), and important insider possession.

- Led by a robust administration and geological staff with observe file of success

- Skyharbour will proceed to execute its prospect generator mannequin by buying initiatives at enticing valuations and forming joint ventures to advance secondary initiatives.

Key Tasks

Uranium Tasks – Saskatchewan

Skyharbour Assets has a dominant uranium property portfolio of over 523,000 hectares within the Athabasca Basin in Saskatchewan, Canada, totalling 25 top-tier exploration initiatives. These embrace the co-flagship Moore Lake and Russell Lake initiatives, Falcon, South Falcon East, Preston, East Preston, Mann Lake, Hook Lake, Yurchison, Wallee, Usam Island, South Dufferin, Pluto Bay, Riou River, Foster River, Freeway, Karin, 914, 914N, Elevator, 914W, Shoe, CBX,and BoltProjects.

Russell Lake

The Russell Lake Undertaking is a big, advanced-stage uranium exploration property totalling 73,294 hectares strategically positioned between Cameco’s Key Lake and McArthur River Tasks and adjoining Denison’s Wheeler River Undertaking to the west and Skyharbour’s Moore Uranium Undertaking to the east. Freeway 914, which providers the McArthur River mine, runs by the western extent of the property and significantly enhances accessibility. Equally, a high-voltage powerline is located alongside Freeway 914. Skyharbour’s acquisition of Russell Lake creates a big, practically contiguous block of extremely potential uranium claims totalling 108,999 hectares between the Russell Lake and the Moore uranium initiatives.

In November 2023, Skyharbour introduced the intersection of serious uranium mineralization on the not too long ago accomplished inaugural drill program at Russell Lake, with plans for a further 4,000 meters – 5,000 meters winter drill program set to begin. A complete of 9,595 meters of drilling in nineteen holes was drilled in three phases throughout 2023. The primary part of drilling consisted of a complete of three,662 meters in eight accomplished holes on the Grayling Zone, whereas a further 4 holes totaling 2,730 meters had been drilled within the Fox Lake Path Zone throughout the second part. The not too long ago accomplished third part of drilling was comprised of three,203 meters in seven holes on further targets on the Grayling Zone.

In January 2024, Skyharbour introduced plans of a 5,000 metre diamond drilling program to include ten to 12 holes over the subsequent a number of months at Russell with mobilization and graduation throughout the subsequent few weeks.

Moore Lake

Skyharbour owns 100% of the 35,705-hectare co-flagship Moore Uranium undertaking positioned 42 kilometers northeast of the Key Lake mill, roughly 15 kilometers east of Denison’s Wheeler River undertaking, and 39 kilometers south of Cameco’s McArthur River mine.

Unconformity-hosted uranium mineralization was found on the property on the Maverick Zone within the early 2000s at comparatively shallow depths. Skyharbour has carried out a number of drill applications with a number of holes intersecting high-grade uranium mineralization over the 4.7-kilometer-long Maverick hall.

The corporate accomplished a 2,467-meter spring 2022 diamond drill program consisting of seven drill holes. Skyharbour continues to discover and delineate new zones of uranium mineralization on the high-grade Moore Undertaking, with plans to proceed drilling in 2023/24 along side drilling at Russell Lake. An NI 43-101 Mineral useful resource estimate is at present being carried out on the undertaking and is ready to be launched in early 2024. ISkyharbour not too long ago introduced a second part of drilling consisting of three,000 metres at its high-grade Moore Undertaking upon completion of the drilling at Russell Lake. Skyharbour plans to hold out infill and growth drilling on the high-grade Maverick Hall in addition to to check a number of regional targets together with the Grid Nineteen goal space. This second part of drilling will complete 3,000 metres in eight to 10 drill holes.

Falcon

Skyharbour’s 100-percent-owned Falcon (beforehand Method Lake) uranium undertaking spans 42,908 hectares masking 11 claims, roughly 50 kilometers east of the Key Lake mine. Uranium mineralization found so far at Falcon is shallow and is hosted in two geological settings, with the southern half internet hosting basic Athabasca-style basement mineralization related to well-developed EM conductors which embrace EWA and Walker targets. Skyharbour has an possibility settlement with North Shore Vitality Metals, which gives North Shore an earn-in possibility to accumulate an preliminary 80 % curiosity and as much as a 100% curiosity within the Falcon property. North Shore plans to conduct a drilling program on the property in Q1 of 2024.

South Falcon East

The South Falcon East Undertaking is a uranium undertaking within the southeast Athabasca Basin and represents a portion of Skyharbour’s bigger Falcon Undertaking. The undertaking covers roughly 12,234 hectares and lies 18 kilometers outdoors the Athabasca Basin, roughly 55 kilometers east of the Key Lake Mine. Drilling so far on all the Falcon Level Undertaking space totals over 22,000 meters in additional than 110 holes. Greater than $15 million has been invested in exploration consisting of airborne and floor geophysics, multi-phased diamond drill campaigns, detailed geochemical sampling and surveys, and ground-based prospecting, culminating in an intensive geological database for the undertaking space.

In 2022, the corporate entered into an possibility settlement offering Tisdale Vitality Corp an earn-in possibility to accumulate an preliminary 51 % curiosity and as much as a 75 % curiosity within the South Falcon East Property. Tisdale is planning an intensive preliminary drill program to begin in early 2024, which can consist of roughly 2,000 meters of drilling. The precedence might be to substantiate and develop the prevailing mineralization related to the Fraser Lakes Zone B uranium deposit. Infill drilling will affirm the presence and continuity of current mineralization in preparation for an up to date useful resource estimate and mannequin sooner or later.

Preston

The Preston undertaking is a big 49,635-hectare land place strategically positioned to the south of and proximal to NexGen Vitality’s Rook 1 undertaking, which is host to the high-grade Arrow deposit, in addition to proximal to Fission Uranium’s (TSX:FCU) Patterson Lake South (PLS) undertaking, which hosts high-grade Triple R deposit. Uranium mineralization within the Patterson Lake space bears a variety of similarities to the high-grade uranium deposits within the Jap a part of the Athabasca Basin, like these on the Cigar Lake and McArthur River mines. The mineralization happens in structurally disrupted and strongly clay-altered, generally graphitic pelites and metapelites with slim felsic segregations/pegmatites. Orano is planning a drill program to be carried out in early 2024 on the undertaking.

East Preston

The East Preston undertaking is a big 20,674-hectare land place that the corporate advances by its prospect generator mannequin.

Skyharbour signed an possibility settlement with Azincourt Vitality (TSXV:AAZ) in 2017 to possibility 70 % of a portion of the East Preston undertaking. In 2021, Azincourt earned its curiosity within the undertaking by finishing C$2.5 million in staged exploration expenditures and making a complete of C$1 million in money funds over the earlier 4 years, in addition to issuing a complete of 9.5 million widespread shares of Azincourt divided evenly between Skyharbour and Dixie Gold.

In March 2023, Azincourt announced the completion of its 2023 winter diamond drilling program. This system consisted of three,066 meters in 13 holes, with a precedence of evaluating alteration zones and elevated uranium recognized within the winter of 2022 with a deal with the G, Ok, H and Q Zones. Evaluation of the outcomes reveals uranium enrichment throughout the beforehand recognized clay alteration zones alongside the Ok and H goal zones. Uranium enrichment is recognized as uranium (U) values and a uranium/thorium ratio (U/Th) above what would usually be anticipated within the given rock kind or space.

Hook Lake (North Falcon Level)

Hook Lake (North Falcon Level) undertaking consists of 16 contiguous mineral claims totaling 25,847 hectares. The property has seen intensive historic work, which advantageously permits for fast-tracked exploration. Uranium mineralization found so far on the Hook Lake Undertaking is shallow and is characterised by structurally managed mineralization on the Hook Lake, West Method and Nob Hill goal zones. The first Hook Lake goal space on the property’s north finish has returned high-grade uranium seize samples of as much as 68 % U3O8 in large pitchblende veining at floor degree.

Valor Assets accomplished the interpretation of airborne gravity gradiometry survey information on the Hook Lake uranium undertaking in Could-June 2022, which outlined 11 new targets. Valor has plans to proceed exploring and drilling Hook Lake in 2024.

Mann Lake

The three,473-hectare Mann Lake Uranium Undertaking is positioned within the jap Athabasca Basin in northern Saskatchewan. It’s strategically positioned 25 kilometers southwest of the McArthur River Mine, the biggest high-grade uranium deposit on the earth, and 15 kilometers to the northeast alongside strike of Cameco’s Millennium uranium deposit. In October 2021, the corporate entered into an possibility settlement with Basin Uranium, which gives them an earn-in possibility to accumulate as much as a 75 % curiosity within the Mann Lake uranium undertaking.

Basin Uranium Corp. introduced the intersection of serious mineralization from the three-hole part 2 drill program on the Mann Lake undertaking. A complete of 6,279 meters of diamond drilling was accomplished on the Mann Lake property throughout the 2022 season.

Yurchison Undertaking

The Yurchison Undertaking consists of 13 claims totalling 57,407 hectares within the Wollaston Area of northern Saskatchewan. This contiguous set of claims covers an intensive bundle of Wollaston Supergroup metasediments in an space recognized for its base steel potential. The northeastern half of the undertaking falls throughout the Courtenay Lake-Cairns Lake fold belt, which accommodates quite a few lead-zinc-silver showings whereas the rest is alongside pattern to the north-northeast of the Janice Lake copper deposit and quite a few different base steel showings within the “Wollaston Copperbelt”.

In 2022, Skyharbour’s companion firm Medaro Mining commenced an airborne geophysical survey at its Yurchison uranium property. Helicopter-borne aeromagnetic, horizontal gradiometric, radiometric, and VLF-EM surveys lined a complete of seven,117 line kilometers at 50-meter line spacing.

South Dufferin

Skyharbour Assets acquired 100% of the South Dufferin Uranium undertaking in 2023 from Denison Mines Corp. The South Dufferin Undertaking contains 13,205 hectares over 10 claims within the Athabasca Basin, which is host to the highest-grade uranium deposits on the earth and is constantly ranked as a prime mining jurisdiction by the Fraser Institute.

Different initiatives

- Riou River – 18,227 hectares alongside the Riou River throughout the Athabasca Basin

- Pluto Bay – 27,918 hectares northeast of Black Lake internet hosting quite a few uranium showings and several other EM conductors east of the regional Black Lake Fault

- Wallee – 20,765 hectares, roughly 35 kilometers northeast of Cameco’s Eagle Level deposit, quite a few untested EM conductors coinciding with important magnetic and/or gravity lows within the Wollaston Area

- Usam Island – 42,186 hectares, roughly 21 kilometers northeast of Cameco’s Eagle Level deposit, accommodates quite a few EM conductors located alongside important magnetic lows of the Wollaston Area

- Foster River – 26,857 hectares, southwest and adjoining Skyharbour’s Falcon Level South undertaking, quite a few uranium showings as much as 1.25 % U3O8

- Freeway Undertaking – 1,184 hectares property with freeway 905 operating by the claims, between Michael Lake and Wollaston Lake

- CBX – 8,777 ha property roughly 6.5 km to 25 km north to northeast of the Eagle Level uranium mine, masking the northern shore of Wollaston Lake together with elements of Crafty Bay

- Shoe – 609 ha property positioned roughly 10 to 25 km alongside strike to the northeast of the at present idled Eagle Level uranium mine (Cameco’s Rabbit Lake Operation)

- Karin – 24,265 ha property roughly 21 km to 33 km east of Freeway 914 and 20 km southeast of Cameco’s Key Lake operation

- Elevator – 9,294 ha property located 15 km east of Freeway 914

- 914 – 2,178 ha property located 1 km east of Freeway 914

- Bolt – Consists of two contiguous claims 100% owned by Skyharbour totalling 4,726.35 hectares and is positioned roughly 7 kilometers west of Freeway 914 and about 32 kilometers southwest of Cameco’s Key Lake Operation

- 914N – 450 ha property located 5 km east of Freeway 914

- 914W – 1,260 ha roughly 48 km southwest of Cameco’s Key Lake Operation

Administration Crew

Jordan Trimble – Director, President and CEO

Jordan Trimble is an entrepreneur and has labored within the useful resource trade in varied roles with quite a few firms specializing in administration, company finance and technique, shareholder communications, deal structuring and capital elevating. Earlier to Skyharbour, he was the company growth supervisor for Bayfield Ventures, a gold firm with initiatives in Ontario, which New Gold efficiently acquired in 2014. All through his profession, Trimble has based and helped handle a number of private and non-private firms and has been instrumental in elevating substantial capital for mining firms together with his intensive community of institutional and retail buyers. He’s a frequent speaker at useful resource and mining conferences globally and has appeared on varied media shops, together with BNN and the Monetary Submit. Trimble holds a Bachelor of Science from the College of British Columbia. He’s a CFA constitution holder and served a full time period as a director of the CFA Society Vancouver.

James Pettit – Director and Chairman of the Board

Jim Pettit is at present serving as a director on the boards of a number of public useful resource firms. He presents over 30 years of expertise throughout the trade specializing in finance, company governance, administration and compliance. Pettit specializes within the early-stage growth of personal and public firms. His background over the previous 30 years has been centered totally on the useful resource sector and he was beforehand chairman and CEO of Bayfield Ventures, which was bought to New Gold in 2014.

Dr. Andrew Ramcharan – Senior Vice-president of Company Growth

Dr. Andrew Ramcharan has an intensive background in company growth, mining and exploration, undertaking analysis, and funding banking spanning over twenty years. Beforehand, as supervisor of company growth for IAMGOLD, Ramcharan was concerned in elevating greater than $600 million in fairness financings and labored on undertaking acquisitions totalling over $800 million. Previous to that, he was at SRK Consulting for a number of years and labored with uranium firms together with SXR Uranium One, Ur-Vitality and UraMin, which ultimately bought for $2.5 billion in 2007 to Areva.

David Cates – Director

David Cates is a director of Skyharbour. He’s the president and CEO of Denison Mines (TSX: DML) and Uranium Participation Corp (TSX:U). Previous to being appointed the president and CEO place, Cates served as Denison’s vice-president finance, tax and chief monetary officer. As chief monetary officer, Cates performed a key position within the firm’s mergers and acquisitions actions – main the acquisition of Rockgate Capital Corp. and Worldwide Enexco Ltd. Cates joined Denison in 2008 and held the place of director, taxation previous to his appointment as chief monetary officer. Previous to becoming a member of the corporate, Cates held positions at Kinross Gold Corp. and PwC LLP with a deal with the useful resource trade.

Paul Matysek – Advisory Board

Paul Matysek is a strategic advisor for Skyharbour and is a mining entrepreneur, skilled geochemist and geologist with over 35 years of expertise within the mining trade. He was the founder, president and CEO of Vitality Metals Company, a premier uranium firm that traded on the New York and Toronto Inventory Exchanges. Matysek led EMC as one of many fastest-growing Canadian firms in recent times, rising its market capitalization from $10 million in 2004 to roughly $1.8 billion when it was acquired by a bigger uranium producer, Uranium One Inc., in 2007. In December 2017, Matysek was concerned within the sale of Lithium X Vitality Corp. for $265 million to NextView New Vitality. Matysek was the president and CEO of Goldrock Mines Corp. which on June seventh, 2016 introduced it had entered right into a definitive settlement to be acquired by Fortuna Silver Mines (NYSE:FSM, TSX:FVI) for $129 million on a fully-diluted in-the-money foundation. Beforehand, Matysek was the president and CEO of Lithium One Inc., which developed a high-quality lithium undertaking in northern Argentina. In July 2012, Lithium One and Galaxy Assets merged with a $112 million plan to create a totally built-in lithium firm. Previous to Lithium One, Matysek was the president and CEO of Potash One the place he was the architect of the $434 million pleasant takeover of Potash One by Ok+S Ag, which closed in early 2011.

Joseph Gallucci – Director

Joseph Gallucci is a senior capital markets govt and company director with over 20 years of expertise in funding banking and fairness analysis. His profession centered on mining, base metals, valuable metals and bulk commodities on a world scale. He’s at present the managing director and head of funding banking at Laurentian Financial institution Securities. the place he oversees the funding banking follow in entirety.

His profession has spanned varied corporations together with BMO Capital Markets, GMP Securities, Dundee Securities, and he was a founding principal of Eight Capital the place he led their mining funding banking staff.