patpitchaya

Opera Restricted (NASDAQ:OPRA) traders have been teetering on the sting over the previous few months since I downgraded OPRA to a Promote/Underperform score in July 2023 to the chagrin of the overly-optimistic OPRA Bulls (OPRA is down virtually 45% since my July replace). I up to date traders that the blended shelf providing by the corporate should not be understated, as OPRA surged to its high in the identical month. I then upgraded OPRA to a Maintain/Impartial score in September 2023, anticipating that the downward momentum may proceed, however the threat/reward had turned extra balanced. Even that improve proved too early, as OPRA fell one other 11% since then, underperforming the S&P 500 (SP500) considerably, because the market posted a 7% uptick.

Consequently, late OPRA traders who chased its unsustainable upside have doubtless realized an costly lesson. Given OPRA’s current developments and Opera’s third-quarter or FQ3 earnings release since my final replace, I consider it is an acceptable time to assist traders determine whether or not to return to the battered inventory.

Curiously, OPRA posted a double-beat on income and adjusted EPS in FQ3, suggesting that the corporate has continued to execute properly. In search of Alpha’s Quant “A+” earnings revisions grade corroborates my remark. It additionally led to an preliminary surge in OPRA in late October 2023, however the upward restoration confronted a stumbling block on the $13 degree as sellers returned. Consequently, I consider traders had been doubtless involved about whether or not the very best days in its unbelievable progress part might be over.

Administration supplied a better-than-expected steering for This fall and FY23. Consequently, analysts’ estimates have additionally been upgraded, anticipating Opera to publish income progress of 16.6% in This fall. Whereas Wall Avenue initiatives full-year income progress of 19.7% for FY23, it is clear that Opera’s surging run may finish.

Regardless of that, Opera continues to be assigned a best-in-class “A+” progress grade by In search of Alpha’s Quant, additional bolstered by a sexy “B+” valuation grade. In different phrases, I consider it is potential that OPRA might be bottoming out, as administration highlighted a number of alternatives in 2024 that might pan out.

Accordingly, Opera is engaged on enhancing its monetization drivers to enhance ARPU additional. Administration up to date that it skilled an growing share of “Western customers” in its lively consumer base, which monetized extra attractively. Consequently, the corporate posted an 11% QoQ progress in ARPU, “reaching a brand new excessive of $1.31.”

Moreover, Opera additionally sees its area of interest deal with gaming customers taking part in out properly in Q3, notching a “10% sequential enhance to 26M MAUs in the course of the third quarter.” Consequently, it helped enhance its GX-based ARPU to an annualized $3 price, sustaining its progress inflection in GX. Opera introduced to traders that its GX efforts are nonetheless nascent, reaching a penetration price of simply 7%. Consequently, it sees a considerable alternative on this section, predicated on its AI and gaming experience, coupled with the advance in its promoting progress drivers.

Opera has proved its mettle within the browser market, however its smaller scale. Consequently, I consider the corporate has supplied adequate confidence to proceed to scale profitably. Subsequently, it ought to undergird its capability to proceed enhancing working leverage and develop a sustainable long-term community impact moat, which Google (GOOGL) (GOOG) has exploited to change into a core market chief.

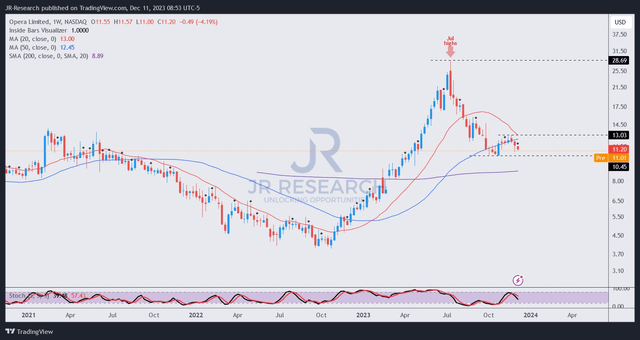

OPRA value chart (weekly) (TradingView)

As seen above, OPRA dip patrons have tried to assist its consolidation on the $11 degree. Nonetheless, the upward momentum failed on the $13 degree because the post-earnings restoration dissipated.

Regardless of that, I see constructive value motion so long as OPRA’s $11 degree is not decisively damaged down by intense promoting strain. Subsequently, I assessed that the danger/reward profile has improved, with the $11 degree as a important assist zone so as to add extra aggressively if re-tested efficiently.

Score: Improve to Purchase.

Vital notice: Traders are reminded to do their due diligence and never depend on the data supplied as monetary recommendation. Please at all times apply unbiased pondering and notice that the score is just not supposed to time a selected entry/exit on the level of writing until in any other case specified.

We Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a important hole in our view? Noticed one thing essential that we did not? Agree or disagree? Remark under with the purpose of serving to everybody locally to be taught higher!