mpruitt/E+ through Getty Pictures

Firm Overview

Opendoor (NASDAQ:OPEN) is the united statesA.’s largest iBuyer, or “on the spot purchaser”, of residential actual property. An iBuyer makes use of proprietary expertise to rapidly worth a house and make an preliminary money supply to a potential promoting home-owner with an accelerated closing timeline if desired.

For these companies, Opendoor prices a service price that’s usually round 5% of the sale worth, which is corresponding to what a house vendor would pay in brokerage charges on a standard dwelling sale. Additionally they earn revenues from closing charges (estimated round 2.5% of gross sales worth) and from the “unfold” or resale margin, which is actually the distinction between Opendoor’s buy worth versus the gross sales worth. Opendoor defines unfold because the “whole low cost to our dwelling valuation at time of supply much less the Opendoor service price of 5%”. An article by Tony Mariotti on iBuyer’s describes the unfold as follows:

The resale margin is the first income for iBuyer’s. Sadly, when the residential actual property market slows and residential costs drop, resale margins lower, impacting profitability.

For sellers, the resale margin is their alternative value. With just one supply from an iBuyer — a single opinion of worth – dwelling sellers miss their probability to draw as many patrons as potential. Basically, by working with an iBuyer, dwelling sellers commerce comfort for worth discovery on the open market.

Does This Enterprise Mannequin Work?

Regardless of rising as an idea within the mid 2010’s (Opendoor itself was based in 2014), the wide consensus is that the enterprise mannequin stays “unproven”. Notably, on-line residential heavyweights Zillow and Redfin each exited the enterprise in 2021 and 2022 respectively whereas collectively reported lots of of hundreds of thousands in losses from their latest iBuyer foray. Because of Zillow and Redfin’s exit, Opendoor and competitor Offerpad (OPAD) are the one remaining important opponents inside the iBuyer area that are nonetheless attempting to make the mannequin “work”, not that they actually have another choices given it’s their solely traces of enterprise.

Testing the mannequin has not come low cost. Opendoor has not had constructive annual web earnings throughout any of their publicly reported fiscal years from 2017 by way of YTD 2023. Opendoor even did not report a constructive web earnings throughout 2020 and 2021 when dwelling costs grew by 11.4% and 18.0% respectively (source).

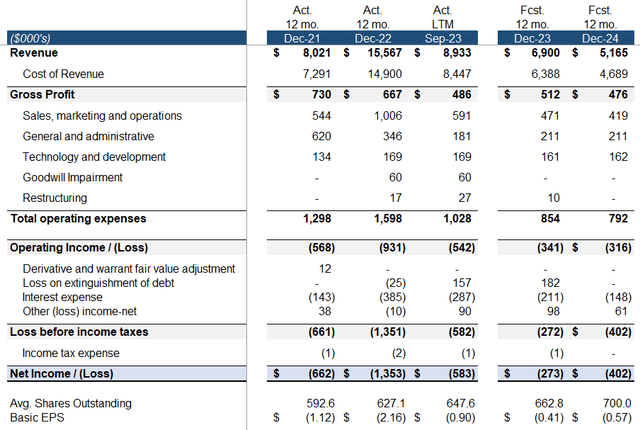

A Assessment of Opendoor’s P&L

Considered one of Opendoor’s main KPIs is “contribution revenue”, which is calculated as proceeds from dwelling gross sales, much less buy worth, much less direct promoting prices (e.g. purchaser commissions), and fewer holding prices (e.g. utilities, taxes, insurance coverage, and so forth.). That is basically the revenue an iBuyer generates earlier than overhead bills, purely from shopping for and promoting houses.

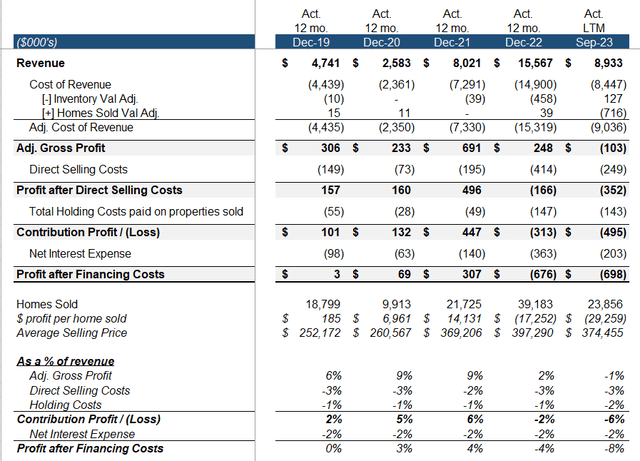

At an absolute minimal an iBuyer should earn a persistently constructive contribution margin in order that the enterprise can scale with quantity and canopy working and overhead bills. I’ve recreated the corporate’s historic contribution earnings within the under desk whereas additionally together with web curiosity expense given Opendoor funds its dwelling stock with asset backed debt.

Compiled by creator

We see that whereas Opendoor had a constructive contribution revenue by way of 2021, margins have been razor skinny and they didn’t cowl the remainder of Opendoor’s working and overhead bills.

Then the iBuyer mannequin utterly fell aside because the federal reserve started quickly elevating rates of interest, leading to greater mortgage charges, dwelling worth declines, and a pronounced drop in current housing sale volumes. Opendoor was pressured to re-sell its housing inventory deeply under buy worth proper as the corporate had ramped up its housing acquisitions. This brings us to the primary deadly flaw of the iBuyer enterprise mannequin.

Why the iBuyer mannequin does not “work” on the macro degree

Even throughout a positive backdrop within the housing market when dwelling costs are appreciating, gross margins are very skinny and extremely correlated with U.S. housing costs.

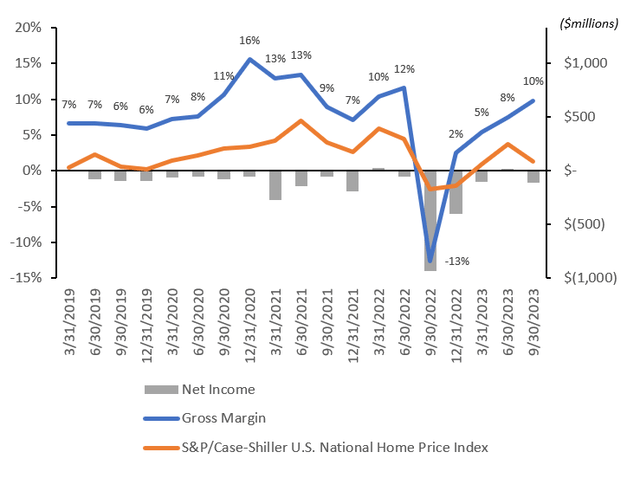

The chart under compares Opendoor’s gross margin and web earnings towards the quarterly change within the S&P/Case-Shiller U.S. Nationwide Residence Worth Index. Regardless of robust gross margins on the again of appreciating dwelling costs by way of 2020 and 2021, Opendoor couldn’t produce a constructive web earnings and at finest approached break-even on an working money circulate foundation (after accounting for the entire stock-based worker compensation). Subsequently the enterprise chugs alongside throughout good occasions, however creates no precise worth for shareholders. Then inevitably when now we have a slight correction in housing costs as witnessed in 2022, the iBuyer sees important losses on their levered housing stock holdings. These losses eat up the corporate’s capital base and additional erodes their potential to show a revenue.

Compiled by creator

Why the iBuyer mannequin does not “work” on the micro degree

Housing cycle apart, why cannot Opendoor flip a revenue throughout a positive backdrop? I consider the reply to this query lies inside a catch-22 like conundrum embedded inside the firm’s unfold.

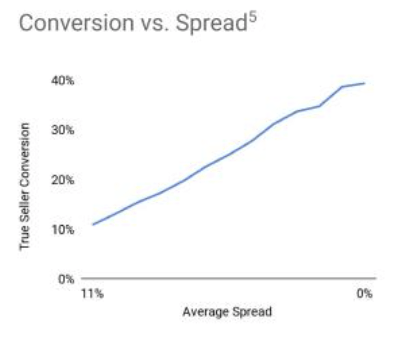

Direct promoting prices, holding prices, and financing prices usually eat 6% to 7% of gross earnings, which exceeds Opendoor’s 5% price, leaving them dependent upon the unfold with a purpose to obtain a constructive contribution margin. And the unfold is inversely correlated with Opendoor’s “conversion”, or the share of house owners who settle for Opendoor’s buy supply. Under is the connection between unfold and conversion per Opendoor’s data.

Opendoor

In consequence, an iBuyer is left with one thing of a conundrum the place they may have a worthwhile contribution margin per property with excessive spreads and low volumes, however with a purpose to scale and canopy overhead, the unfold have to be narrowed and contribution margins should shrink. Is it potential for an iBuyer to stability this trade-off and supply aggressive sufficient bids which permits it to each be worthwhile on round-trip dwelling transactions whereas additionally successful sufficient enterprise to cowl overhead? Whether it is, now we have but to see anybody within the business do it, even in a 12 months when housing costs appreciated by 18%. I consider the market of house owners who’re keen to just accept a significant haircut on their houses (the typical particular person’s largest asset by far) in alternate for the comfort of an on the spot supply is just too restricted.

A Hypothetical Break-even

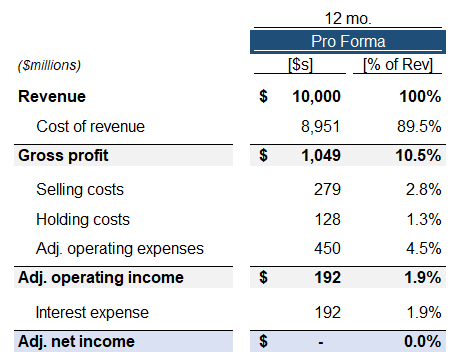

However for the sake of argument, we should always attempt to perceive how Opendoor might no less than break-even in the event that they certainly have been in a position to overcome the inherent challenges posed by the iBuyer mannequin. Administration has commented that they consider the enterprise can function at a break-even adjusted web earnings (including again share primarily based compensation) if they will return to $10 billion in annual revenues.

You already know, for ANI [adjusted net income] breakeven, we count on that to occur at $10 billion regular state income, which means acquisitions are roughly equal to resales. And so at $10 billion with 4% to five% adjusted OpEx, that is what we’re marching in direction of.

Supply: Q3 2023 Earnings Transcript

Primarily based on these feedback, I created the under hypothetical annualized break-even P&L.

Compiled by creator

Two parts of this hypothetical P&L appear to pose a problem. I estimate Opendoor’s LTM adjusted working bills to be ~$460mm, so this P&L would assume that the corporate can ramp operations again up with little in the way in which of extra advertising and marketing, G&A, and so forth.

However extra importantly, it could indicate a ten.5% gross revenue margin. From 2017 by way of LTM 2023, Opendoor’s finest reported annual revenue margin was 9.1% in 2021 in the course of the increase in housing costs whereas the three years previous to 2021 averaged 7.4%. Opendoor has been reporting gross revenue margins of 12% these days on their latest vintages of property gross sales, however this has been achieved by deliberately sustaining a very excessive unfold on very restricted new acquisitions. I’m skeptical with respect to the corporate’s potential to take care of margins at this present degree if acquisitions are ramped again up.

Opendoor is Basically Already Impaired

Now that now we have reviewed the iBuyer enterprise mannequin and the failures of the previous, we will flip to Opendoor’s go-forward prospects. I consider that the corporate has already suffered irreparable injury which might stop it from reaching sustainable profitability even beneath ideally suited circumstances.

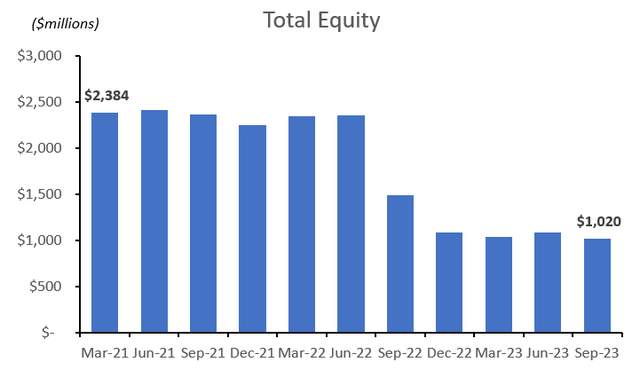

The capital base has been decimated

Opendoor’s losses have considerably impaired its enterprise. Throughout Q1 2021, Opendoor raised $886 million by way of a inventory sale and used these proceeds to begin ramping up their stock acquisitions. Since then, Opendoor’s web losses have resulted in a 57% decline in shareholder fairness, reducing the stability from $2.3 billion at Q3 2021 to $1.0 billion as of Q3 2023.

Compiled by creator

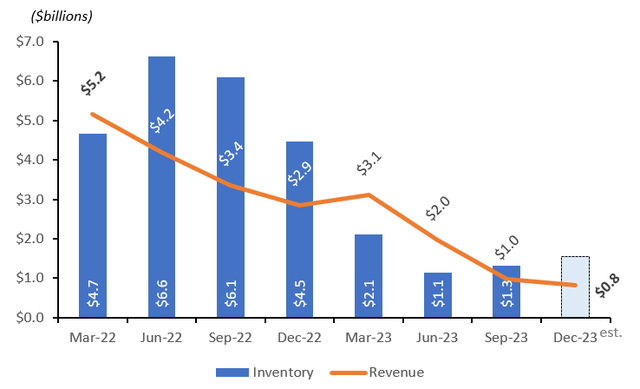

This autumn 2023 steering

Administration has guided for between $800 to $850 million in This autumn revenues, which might be a brand new latest quarterly low. That is clearly a far cry from the run-rate wanted to attain $10 billion in annualized revenues. Primarily based on this top-line, the typical sell-side This autumn GAAP earnings per share estimate at present stands at $(0.22).

Compiled by creator

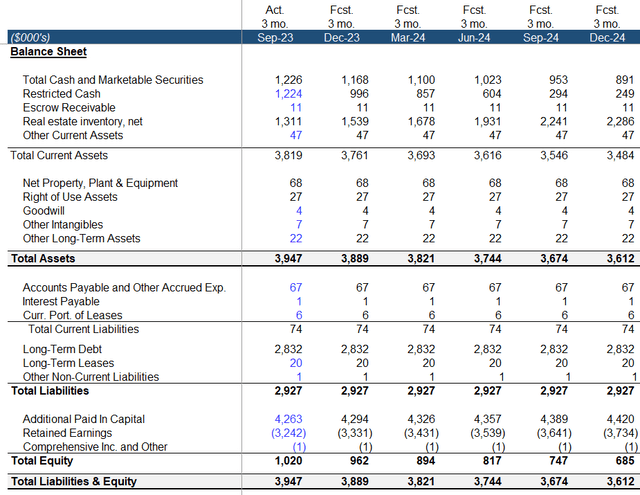

The chart above additionally highlights Opendoor’s declining stability of houses inside their stock, which stood at $1.3 billion as of Q3 2023. If the corporate is to get again to $10 billion in annual revenues, they might want to resume a ramp-up in property acquisitions and start turning over the upper degree of stock.

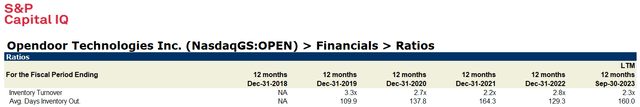

Administration has commented that their normalized stock turnover is between 3.0x to three.5x, nevertheless the corporate has by no means carried out higher than 3.3x yearly since 2019 and averaged round 2.7x per 12 months. And once more, quicker turns of stock would imply narrower spreads and decrease margins.

S&P Cap IQ

A conservative stock turnover of two.8x would indicate that Opendoor must construct stock again to ~$3.3 billion from Q3 2023’s $1.3 billion stability with a purpose to method $10 billion in annualized revenues.

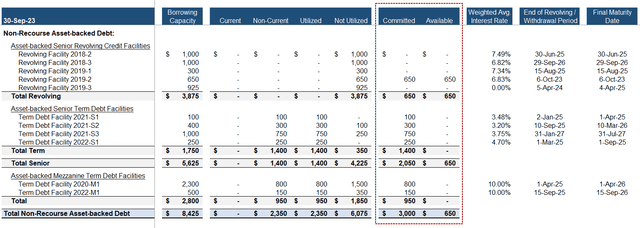

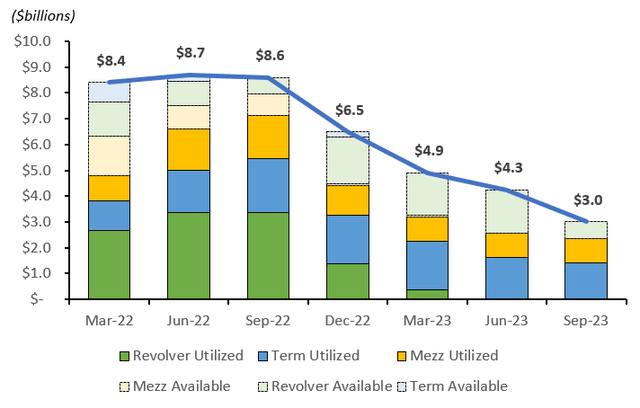

I consider that capital constraints will restrict Opendoor’s potential to rebuild stock

Whereas administration referred to billions in “borrowing capability” on their newest earnings name, that is largely debt which has already been funded. Moreover, their monetary filings word that not the entire introduced borrowing capability is “dedicated”.

Borrowing capability quantities beneath non-recourse asset-backed debt as mirrored within the desk above are in some instances not totally dedicated and any borrowings above the dedicated quantities are topic to the relevant lender’s discretion.

Supply: Q3 2023 SEC Filing

Opendoor’s collectors have actively moved to scale back their publicity to the corporate. KKR led Opendoor’s October 2021 mezzanine refinancing which on the time was heralded as a part of a “$9 billion debt war chest“. KKR retained a portion of the mezzanine debt inside the BDC, FS KKR Capital Corp (FSK). Throughout their This autumn 2022 earnings name, they particular talked about Opendoor whereas discussing their holdings “which have been impacted by credit score performance-related points” and the steps they’d taken to attenuate publicity.

I would additionally prefer to touch upon one other funding, Open Door. The corporate is an internet actual property platform, facilitating the acquisition and sale of single-family houses. In October of 2021, we led an funding in a $2.2 billion asset-secured mezzanine debt facility, which has since been diminished to $1 billion by way of a mix of undrawn dedication quantity cancellations and debt repayments at par plus the associated prepayment premiums which has meaningfully diminished our publicity.

Supply: This autumn 2022 Earnings Transcript

Additionally telling is a change in language between Opendoor’s Q2 2022’s 10-Q and Q3 2022’s regarding debt and financing preparations.

Q2 2022:

Our enterprise is capital intensive and sustaining enough liquidity and capital sources is required as we proceed to scale and accumulate extra stock. Whereas there could be no assurance that these tendencies will proceed, now we have noticed elevated availability and engagement for this lending product throughout quite a lot of monetary establishments and now we have been in a position to enhance phrases and improve our borrowing capability in recent times. We actively handle {our relationships} with a number of monetary establishments and search to optimize period, flexibility, effectivity and value of funds.

Supply: Q2 2022 SEC Filing

Q3 2022:

Our enterprise is capital intensive and sustaining enough liquidity and capital sources is required as we proceed to scale and accumulate extra stock. We intend to actively handle {our relationships} with a number of monetary establishments and search to optimize period, flexibility, effectivity and value of funds, however there could be no assurance that we will get hold of adequate capital for our enterprise or to take action on acceptable monetary and different phrases.

Supply: Q3 2022 SEC Filing

Opendoor’s Q3 2023 10-Q notes that they’d $1.4 billion in time period mortgage commitments and $950 million in mezzanine commitments, which might indicate that these amenities are totally funded except collectors agree to permit additional capability. This would go away solely $650 million in out there revolver commitments.

Compiled by creator

Under is an extra have a look at Opendoor’s declining debt stability and dedicated availability over time because the warfare chest hit its peak.

Compiled by creator

One cause current collectors could also be reluctant to approve extra commitments is the truth that these legacy commitments carry under market charges. Throughout late 2022, Opendoor briefly carried the mortgage facility “Time period Debt Facility 2022-S2” which carried a median rate of interest of 8.48% versus a median rate of interest of ~3.5% on their 2021 amenities. In the event that they do get hold of new commitments, I consider it could be secure to imagine they’d come at a lot greater rates of interest which is an extra blow to the iBuyer mannequin and begs the query if the proliferation of all the business wasn’t simply one other offspring of ZIRP financial coverage.

Other than the $650mm in out there debt commitments, Opendoor’s different current capital out there for stock purchases is $1.2 billion price of restricted money on the stability sheet, although it’s troublesome to say what portion of this could possibly be allotted to stock at any cut-off date. As the corporate notes, they’ve particular advance charges and sometimes want to hold some quantity of restricted money towards their debt balances.

We could also be required to maintain quantities in restricted money accounts to collateralize our asset-backed time period debt amenities if the property borrowing base is inadequate to fulfill the borrowing base necessities.

Supply: Q3 2023 SEC Filing

If we assume Opendoor can use 90% of their restricted money plus the $650mm dedicated debt availability, then we’d get to a possible stock stability of $3.0 billion, which doubtless wouldn’t be sufficient to attain $10 billion in annualized revenues.

Opendoor doesn’t seem to have a simple resolution on the capital entrance. It is going to be essential to watch how a lot debt availability they disclose over the approaching quarters and in the event that they get hold of new financing at greater rates of interest. And it is price remembering that we’re speaking about merely attempting to attain a break-even adjusted web earnings, a lot much less a break-even GAAP web earnings or outcomes which would supply an acceptable threat adjusted return to shareholders.

Projections for 2024

Transferring to the 12 months forward, we should always not count on a robust rebound in gross sales proper out of the gate in 2024. Opendoor acquired 2,680 properties in Q2 2023, 3,136 properties in Q3 2023 and has guided for an extra 3,000 properties in This autumn 2023. That is the pipeline which might be transformed into income in Q1 and Q2 of 2024 and would indicate ~$1 billion in quarterly revenues. Under are my projections for fiscal 12 months 2024.

Compiled by creator

My projections would indicate $(0.57) cents in earnings per share in 2024. For what it is price, the typical promote aspect estimate is much more bearish and at present stands at ~$(0.72).

Opendoor’s implied annual money losses can be lower than my projected $(402)mm web earnings because of the firm’s sizable quantity of inventory primarily based compensation which is a non-cash expense. Over the subsequent 5 quarters, I count on ~$(335)mm in destructive money flows from operations.

If Opendoor does certainly incur a lack of this magnitude in 2024, the capital place would additional tighten significantly. Under is an illustrative stability sheet projection.

Compiled by creator

If losses proceed, shareholder fairness would additional decline whereas unrestricted money can be consumed. This might rapidly change into problematic given Opendoor’s excellent $502 million in (busted) convertible notes which mature in August 2026.

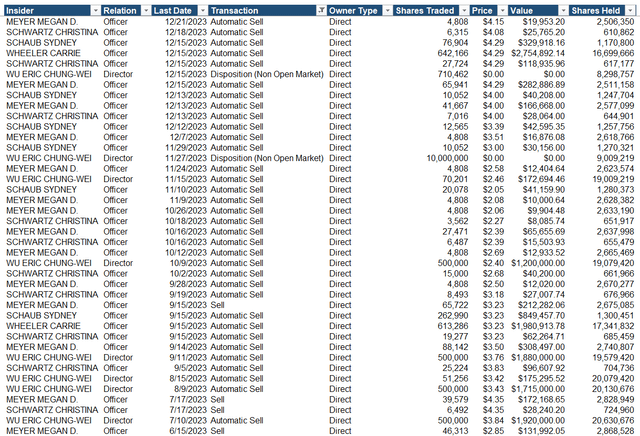

Ongoing Dilution and Insider Gross sales

Outdoors of working losses, one other issue which weighs on Opendoor’s share worth is ongoing dilutive share primarily based compensation (SBC) and insider gross sales. A comparatively excessive quantity of SBC has change into routine at youthful unprofitable tech corporations. It’s a non-cash expense that helps protect liquidity whereas additionally flattering adjusted earnings metrics.

Whereas 2021 was distorted by Opendoor’s entry into public markets, quarterly SBC usually accounts for greater than 10% of quarterly gross earnings. YTD 2023 SBC by way of Q3 totals $94 million, amounting to greater than 20% of YTD gross earnings of $415 million. Dilution has change into much more pronounced as Opendoor’s share worth has declined, with whole shares excellent having elevated by greater than 1.5% over every of the previous two quarters. Moreover, this compensation is usually monetized and offered into the open market by insiders.

NASDAQ

In response to NASDAQ’s data, insiders disposed of greater than 26 million shares throughout 2023 (representing practically 4% of the present shares excellent) whereas having accomplished no open market purchases over the previous two years (the tip of the information set). Opendoor co-founder and former CEO, Eric Wu’s, latest Form 4 exhibits his remaining shares owned to be 18.3 million as of 11/27/23, down practically 50% in 1.5 years from 35.6 million shares as of 5/17/22. Mr. Wu announced his resignation from his place at Opendoor and from the board on December 14th and seems to be formally exiting the corporate.

Concluding Abstract and Worth Goal

I consider Opendoor is caught between a rock and a tough place and that the door is quickly closing. If the corporate continues to generate quarterly money losses, I consider it’s going to finally change into bancrupt.

With a purpose to return to money profitability, they have to at a minimal improve run-rate quarterly revenues by greater than 2.5x from ~$900 million to $2.5 billion. This might be no simple feat as current dwelling gross sales volumes stay depressed. Opendoor would want to ramp up advertising and marketing (improve opex), deploy greater than $1 billion in stability sheet money (scale back curiosity earnings), improve funded debt (improve curiosity expense), and scale back their bid-offer spreads (scale back gross revenue), all of which can weigh on profitability within the near-term.

In gentle of those challenges and the uncertainty on if the corporate can ever maintain profitability, I consider that Opendoor’s frequent shares ought to commerce at a reduction to tangible ebook worth per share, which at present stands at $1.51 as of Q3 2023, as certainly it did from September 2022 by way of April 2023 the place it traded at a median P/TBV of 0.84x in the course of the interval.

I mission that in 12 months, Opendoor’s Q3 2024 tangible ebook worth per share might be additional diminished to ~$1.00 by way of a mix of losses and continued SBC dilution. Subsequently, my worth goal per share stands at $1.00 and would indicate 77% in draw back from at this time’s worth of ~$4.50 per share.