Jarmo Piironen

Introduction

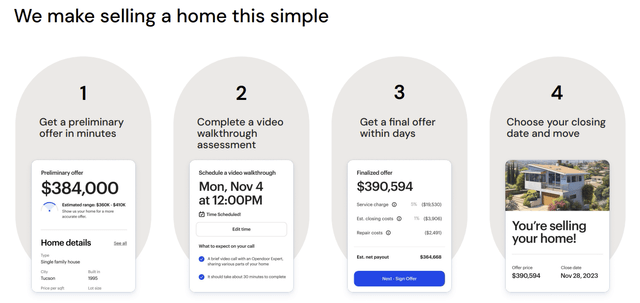

Opendoor (NASDAQ:OPEN) is the main iBuying firm that gives an ecommerce-like expertise for getting and promoting houses. The corporate goals to simplify and streamline what could possibly be probably the most annoying, time-consuming, and costly stage in most individuals’s lives: shifting from one residence to a different.

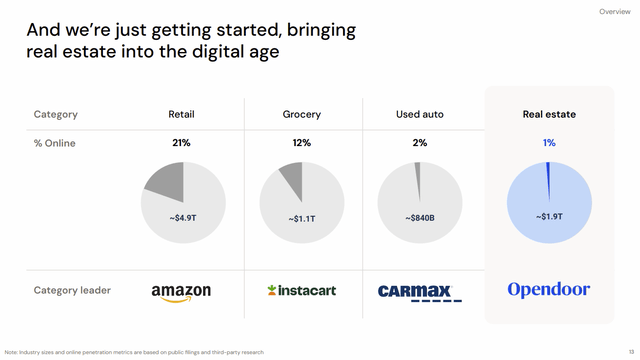

Opendoor FY2023 November Investor Presentation

The previous 12 months or so has been a very robust time for Opendoor as rising rates of interest, spiking mortgage charges, and the housing market reset put great stress on Opendoor’s residence stock and profitability.

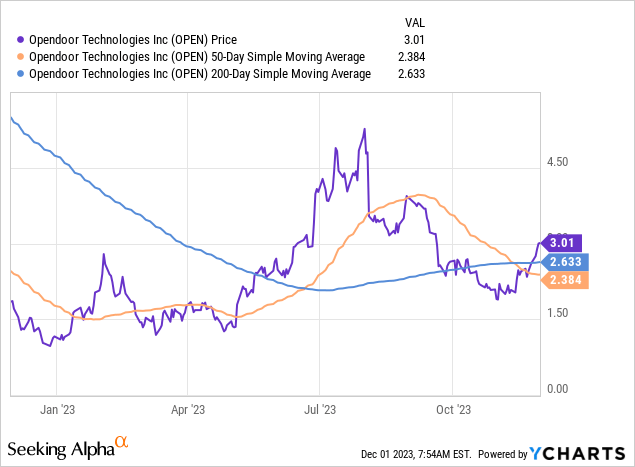

It is no shock why the inventory has been extremely unstable this 12 months, swinging from as little as $1 to as excessive as $5. As we speak, the inventory is caught smack within the center at $3 a share.

The place does it go from right here?

Powerful to say.

However one factor’s for certain: Opendoor is well-positioned to rescale its enterprise in 2024.

Development

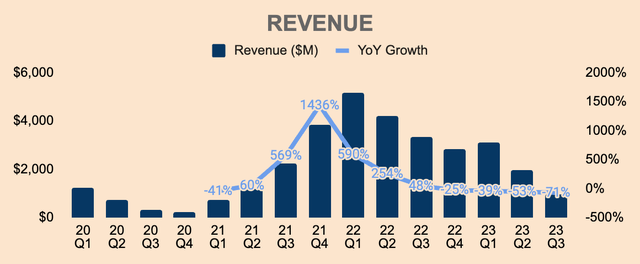

Opendoor’s topline was in step with administration’s steering of $950M to $1B however fell wanting analyst expectations by $30M. In Q3, Income was $980M, down 71% YoY and 50% QoQ, as a result of decrease gross sales volumes and decrease residence costs, which was down 8% YoY.

Creator’s Evaluation

As you possibly can see, Opendoor utterly erased all the expansion it loved in the course of the early days of the pandemic, again when the housing market was firing on all cylinders as a result of ultra-low rates of interest.

However as you all know, the Fed hiked rates of interest at a document tempo, inflicting mortgage charges to spike as effectively. Consequently, transaction quantity dried up as residence patrons stayed on the sidelines.

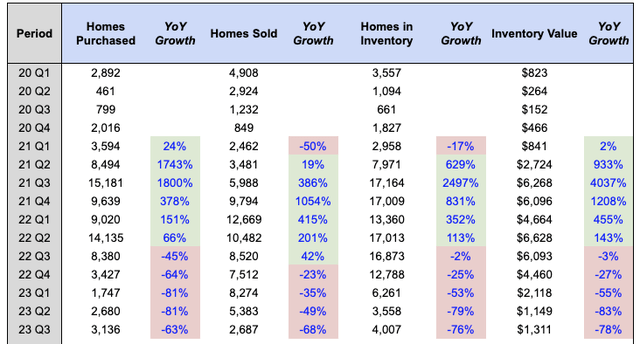

Clogged with excessive stock, Opendoor slowed down its tempo of residence acquisition by embedding increased spreads into its gives. As such, Properties Bought declined steadily in 2022 as the corporate targeted on unloading the houses it acquired at peak costs — aka the previous guide.

Nevertheless, Opendoor has begun to ramp up acquisitions over the previous few quarters because the housing market stabilizes. Q3 Properties Bought — though down 63% YoY — elevated 17% sequentially to three,136, regardless of common new listings being down 8%. This is because of elevated financial savings from improved price construction and pricing accuracy, which Opendoor passes to prospects within the type of decrease spreads, driving increased conversions within the course of.

In our enterprise, there’s an inverse relationship between unfold and vendor conversion, which means the extra we scale back unfold, the upper our vendor conversion is. Larger conversion leads to extra residence acquisitions and, in flip, extra residence gross sales.

Creator’s Evaluation

Shifting ahead, Properties Bought ought to enhance over the following few quarters as Opendoor continues to extend distribution by way of its channel companions. In keeping with administration, acquisitions from these low-cost distribution channels elevated by 33% in comparison with Q2 this 12 months and 76% in comparison with Q1 this 12 months.

These partnerships increase model consciousness in addition to market attain, which ought to enhance conversion at minimal price, and in the end drive progress for Opendoor.

- Its unique partnership with Zillow (Z) — the most important on-line actual property firm — is now dwell in 45 markets.

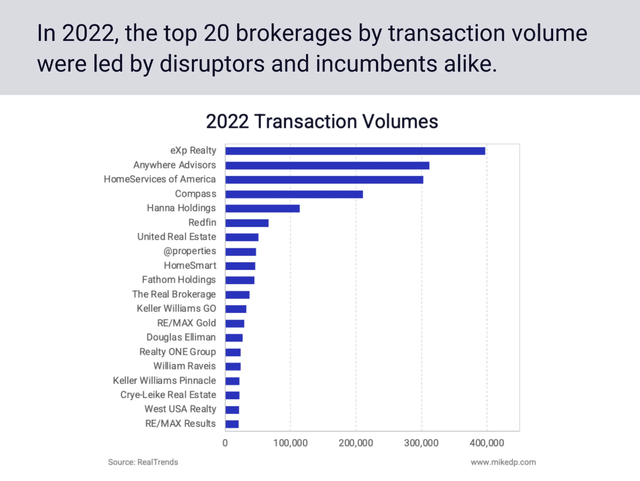

- In October, Opendoor additionally landed a brand new partnership with eXp Realty — the most important unbiased actual property firm on this planet. As you possibly can see under, eXp Realty is the most important dealer by transaction quantity.

MikeDP

Alternatively, Properties Bought continued to drop sequentially as Q2 marked a 2-year low by way of Properties in Stock. As such, Opendoor solely offered 2,687 houses in Q3, down 68% YoY. Furthermore, Q3 (and This fall) is a seasonally sluggish quarter within the housing market.

Nevertheless, as Opendoor rebuilds its stock within the subsequent few quarters, we are able to anticipate extra Properties Bought within the coming quarters, particularly in the course of the hotter seasons (Q1 and Q2).

Sure, uncertainty looms over the housing market. It continues to be unstable.

However in occasions like this, Opendoor shines.

In turbulent occasions, prospects seek for pace, transparency, and certainty — options which are nonexistent in conventional methods of shopping for and promoting houses.

That is why Opendoor continues to realize market share.

We’ve been displaying all through the course of the 12 months that we’re gaining share. And we’re gaining share towards a declining market. And I believe that is proof of the worth prop and what we’re placing into the marketplace for prospects and our focus is constant to take action.

(CEO Carrie Wheeler — Opendoor FY2023 Q3 Earnings Name)

Profitability

Whereas progress has been muted (for now), profitability is wanting higher with every passing quarter.

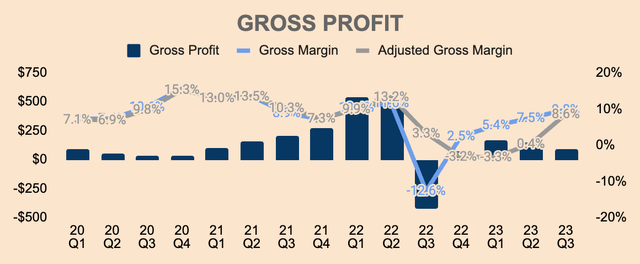

GAAP Gross Revenue improved from $(425)M final 12 months to $96M this most up-to-date quarter. Alternatively, GAAP Gross Margin improved from (12.6)% final 12 months to 9.8% in Q3.

This seems to be nice however ignore GAAP metrics for now, since Opendoor made a big Stock Valuation Adjustment in Q3 final 12 months, as a result of housing correction.

As an alternative, it is higher to have a look at Adjusted Gross Revenue, which aligns the timing of Stock Valuation Changes recorded beneath GAAP to the interval during which the house is offered.

Encouragingly, Adjusted Gross Margin improved YoY and QoQ to eight.6%, as a result of residence value stabilization and better spreads embedded in Opendoor’s gives.

Creator’s Evaluation

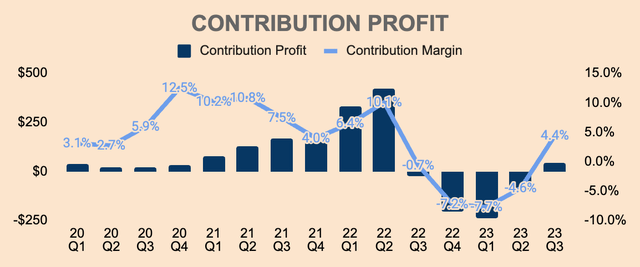

We see an identical development with Contribution Revenue.

Q3 Contribution Revenue, which accounts for direct promoting prices and holding prices, was $43M, representing a Contribution Margin of 4.4%. This additionally exceeded administration’s steering of three.2% to 4%, as a result of sturdy efficiency of their new guide of houses and lower-than-expected gross sales from the previous guide.

Creator’s Evaluation

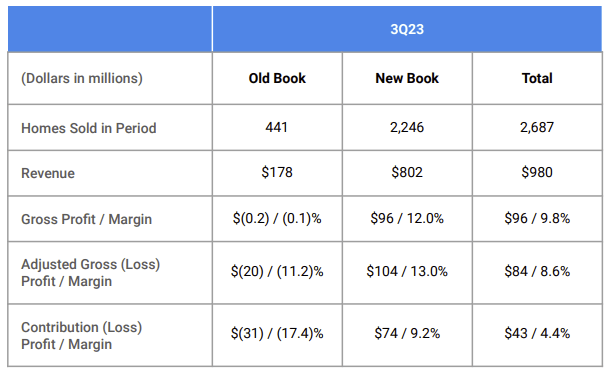

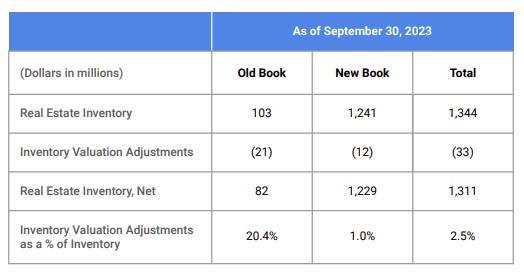

As you possibly can see, the upper combine of latest guide to previous guide defined the outperformance in Opendoor’s Contribution Margin.

- Previous guide: offered 441 houses at a Contribution Margin of (17.4)%

- New guide: offered 2,246 houses at a Contribution Margin of 9.2%

As of the tip of Q3, Opendoor has lower than 150 previous guide houses not in resale contract, which implies minimal margin stress from the previous guide shifting ahead. In different phrases, anticipate Contribution Margin to enhance from right here because the higher-margin new guide of stock makes up nearly all of Income.

Opendoor FY2023 Q3 Shareholder Letter

Regardless, Contribution Margin lastly turned optimistic after being damaging for a full 12 months — nice information for buyers.

It is not again to the place administration would have preferred — their annual Contribution Margin goal vary is 5% to 7% — but it surely’s getting there.

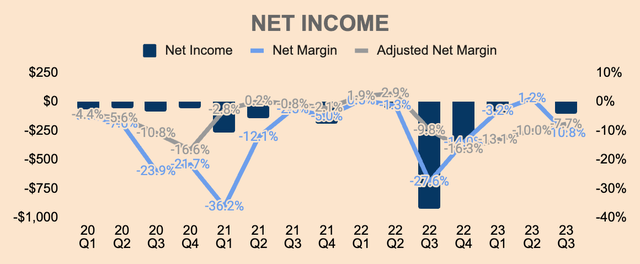

When it comes to the underside line, Q3 GAAP Internet Earnings was $(106)M, which is a (10.8)% GAAP Internet Margin. Once more GAAP metrics are usually not very helpful since they embrace one-time objects resembling Acquire on Extinguishment of Debt, and it doesn’t align the timing of Stock Valuation Changes to the interval during which the houses are offered.

As such, it’s higher to have a look at Adjusted Internet Earnings, which was $(75)M, representing a (7.7)% Adjusted Internet Margin. As you possibly can see, it’s getting higher by the quarter.

Creator’s Evaluation

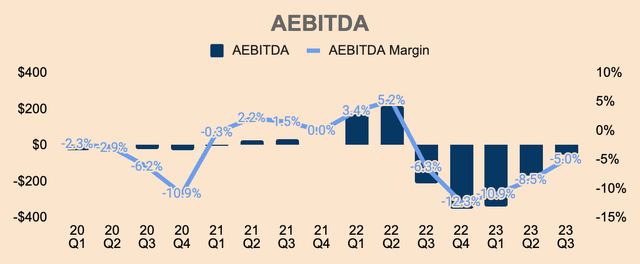

The identical goes for Adjusted EBITDA, which was $(49)M in Q3, forward of administration’s steering of $(70)M to $(60)M, as a result of stronger-than-expected Contribution Margin in addition to working leverage.

Creator’s Evaluation

As you possibly can inform, profitability metrics throughout the board are bettering as Opendoor continues to dump its lower-margin previous guide of stock and promote extra of its higher-margin recent stock.

By This fall, nearly all the previous guide must be offered, which clears the best way for Opendoor to return to Adjusted Internet Earnings profitability. As well as, the housing market is stabilizing and the corporate is continuing cautiously with ongoing price self-discipline, so issues ought to solely get higher from right here.

That mentioned, Opendoor continues to be severely unprofitable — and the one option to obtain profitability is to rescale its enterprise to cowl its massive mounted prices.

Well being

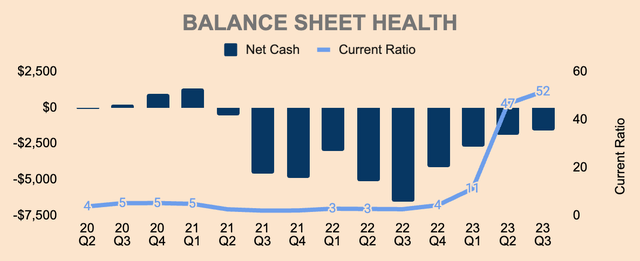

Turning to the stability sheet, Opendoor has $1.2B of Money and Brief-term Investments with $2.9B of Whole Debt, inserting its Internet Money place at about $(1.7)B.

As proven under, Internet Money has been bettering over the previous few quarters as the corporate delevers its stability sheet and slows down the tempo of residence acquisitions. Nevertheless, as the corporate scales, I anticipate Internet Money to drop as Opendoor faucets into the capital markets to fund residence purchases.

Creator’s Evaluation

Opendoor’s stock scenario is wanting higher as effectively. As of Q3, Opendoor holds 4,007 Properties in Stock value $1.3B, of which lower than 150 houses got here from the previous guide, value about $82M. The previous guide now represents about 6% of the online stock stability, down from 22% in Q2.

Opendoor FY2023 Q3 Shareholder Letter

It is also value noting that as of Q3, 12% of Opendoor’s houses had been listed in the marketplace for greater than 120 days — if not for the previous guide, that determine would have been 8%. Regardless, Opendoor’s turnover fee is significantly better than the broader market’s 15%, which is a testomony to Opendoor’s worth proposition and pace of execution.

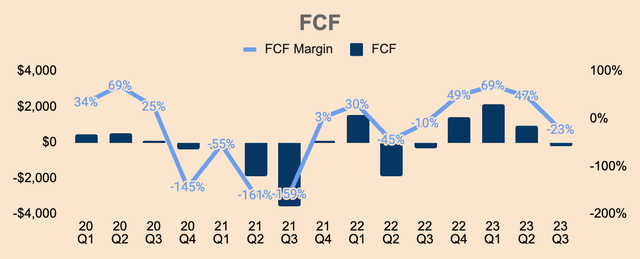

When it comes to money stream, Opendoor had Free Money Circulation of $(227)M, which is a (23)% FCF Margin. This damaging money stream is anticipated since Opendoor was a web purchaser of houses in Q3 — within the final three quarters, Opendoor was a web vendor of houses, thus the optimistic FCF in these quarters. Shifting ahead, I anticipate Opendoor to be a web purchaser of houses within the subsequent few quarters as the corporate rescales.

Creator’s Evaluation

Outlook

This is what buyers can anticipate in This fall. I’ve included administration’s midpoint steering right here:

- Income of ~$825M, which is down 71% YoY and 16% QoQ. The drop in Income sequentially is because of 1) decrease market clearance charges within the winter months, 2) excessive mortgage charges of 8%, and three) decrease anticipated home-level checklist costs, in all probability to clear the previous guide of stock.

- Contribution Revenue of ~$20M, implying a 2.4% Contribution Margin, which is barely down from Q3’s 4.4%, however nonetheless an enchancment from final 12 months’s (7.2)%. The lower in Contribution Margin QoQ is because of 1) decrease residence costs and a couple of) stress from the lower-margin previous guide.

- Adjusted EBITDA of ~$(100)M, implying a (12.1)% Adjusted EBITDA Margin, which is decrease than Q3’s 5.0%, probably as a result of decrease Income and Contribution Revenue.

As well as, administration expects residence purchases of about 3,000 in This fall, which is flat QoQ. Alternatively, administration expects to speed up residence acquisition in 2024 as the corporate reduces spreads, grows partnership channels, and will increase advertising spend.

Extra importantly, the whole disposal of its previous guide and the gradual rescaling of its enterprise ought to put Opendoor in an excellent place to succeed in Adjusted Internet Earnings profitability.

We anticipate to return to optimistic Adjusted Internet Earnings at regular state annual income of $10 billion, or roughly 2,200 acquisitions and resales per thirty days, on the increased finish of our annual contribution margin goal vary of 5% to 7%.

(Opendoor FY2023 Q3 Shareholder Letter)

Scaling the enterprise is critical to attain profitability — and I imagine Opendoor has what it takes to get there. This is why:

- Opendoor did it in 2022, producing greater than $15B of Income.

- Opendoor’s rising partnership with distribution companions ought to enhance model consciousness and speed up progress.

- The residential actual property market is a $1.9T business, which signifies that Opendoor solely has lower than 1% market share — the expansion potential is monumental.

- Extra importantly, Opendoor has a confirmed monitor document of capturing over 4% market share in a number of markets.

- Since 2019, Opendoor has quadrupled its serviceable addressable market through market and buybox growth, to $600B+. Assuming only a 3% market share inside its buybox — which is greater than cheap — Opendoor ought to generate no less than $18B of Income. At that time, Opendoor must be worthwhile.

Opendoor FY2023 November Investor Presentation

It will not be simple by any means.

However given the truth that 99% of residential actual property transactions are nonetheless taking place offline, given the truth that Opendoor has a far superior worth proposition over conventional actual property brokers, and given the truth that Opendoor runs a digital monopoly within the iBuying area, I imagine Opendoor is effectively positioned to realize vital market share within the largest business on this planet.

Valuation

Over the previous few weeks, Opendoor inventory blasted previous three main resistance ranges, specifically:

- Horizontal resistance at $2.80

- The 50-day SMA

- The 200-day SMA

With that in thoughts, the first development is now up for Opendoor inventory, which may level to extra upside for the inventory.

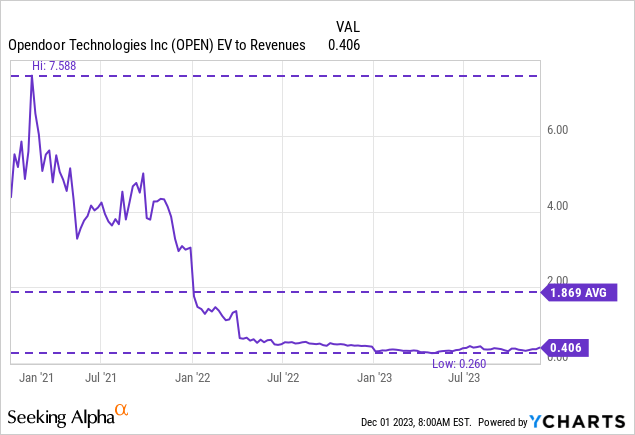

That mentioned, Opendoor trades at depressed valuations, at solely 0.4x EV to Income, considerably under its highs of seven.6x and its common of 1.9x.

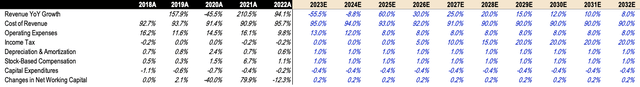

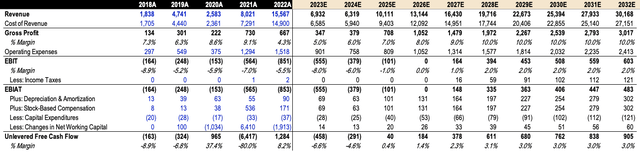

In my earlier article, I used to be too aggressive with my progress assumptions. As such I’m decreasing my Income estimates for Opendoor. Listed here are the important thing assumptions driving my DCF mannequin:

- Income: I adopted analyst estimates for the primary three years and steadily dropped progress charges to eight% by 2032. Because of this, I anticipate FY2032 Income to be $30B, down from my earlier estimate of $46B. The explanation for this downward revision is my expectation that administration will scale the corporate at a slower, extra manageable, and extra worthwhile tempo.

- FCF Margin: Administration mentioned that Adjusted Internet Earnings is one of the best proxy for Working Money Circulation, they usually talked about that the corporate will probably be Adjusted Internet Earnings worthwhile once they hit $10B of Income — I anticipate this to occur in 2025. In the long run, I anticipate a steady-state FCF Margin of three%.

Creator’s Evaluation

Listed here are the projections:

Creator’s Evaluation

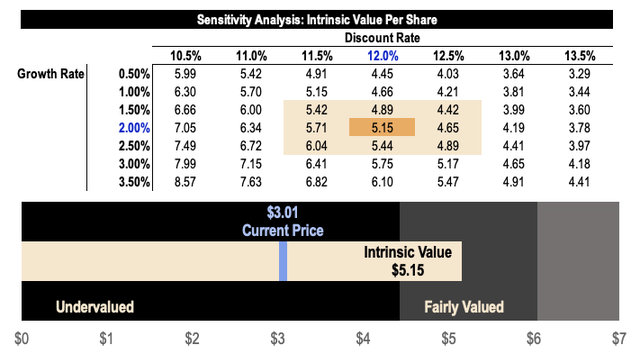

Based mostly on a reduction fee of 12.0% and a perpetual progress fee of two.5%, I get an intrinsic worth estimate of $5.15 for Opendoor, which is lowered from my earlier estimate of $7.88, solely as a result of decrease Income estimates.

That mentioned, that is considerably increased than the typical analyst value goal of $2.29. My value goal additionally represents an upside potential of 71%, primarily based on the present value of $3.01.

Creator’s Evaluation

Dangers

Larger for Longer

As talked about by administration, mortgage charges reached 8% in October, the best stage in over 20 years. This might imply extra owners on the sidelines as they look ahead to rates of interest to return down.

Rates of interest may stay elevated for longer — or worse, go increased — which not solely reduces housing affordability but additionally will increase Opendoor’s price of capital.

One other Housing Crash

One other housing correction may delay Opendoor’s progress and profitability ambitions. Sentiment may flip damaging as soon as once more as buyers dump actual estate-related shares.

Thesis

In my earlier article, I wrote my funding thesis on Opendoor:

Opendoor operates as a digital monopoly within the iBuying enterprise and with lower than 1% market share within the large residential actual property business, Opendoor has a lengthy progress runway forward as the corporate builds an end-to-end platform for individuals to purchase and promote houses with simplicity and certainty.

Nothing has modified with my thesis.

Moreover, numerous positives might be taken from Opendoor’s Q3 outcomes. This contains:

- the return to optimistic Contribution Margin

- bettering profitability

- shrinking previous guide of houses

- increasing recent stock

Opendoor shouldn’t be out of the woods but — the macro setting stays shaky.

Nevertheless, Opendoor is leaner and meaner than ever earlier than, and with a disciplined strategy in the direction of progress, Opendoor is well-positioned to rescale its enterprise and ultimately obtain sustained profitability.

And with lower than 1% on-line penetration, Opendoor is now preying on the remaining 99% of residential actual property that’s left undigitized.