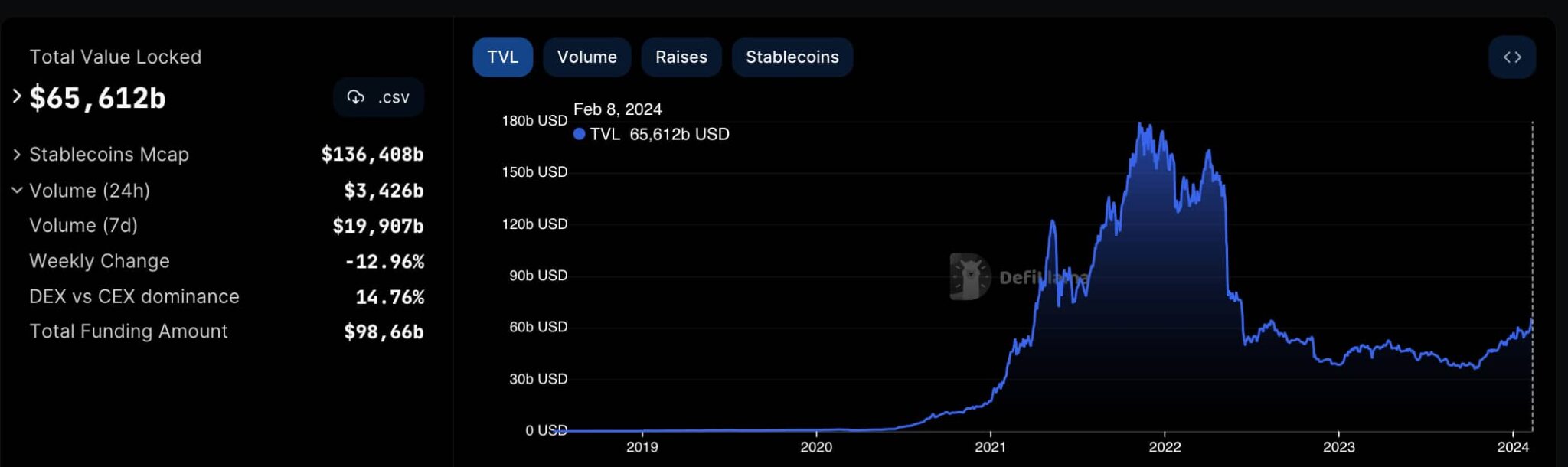

Decentralized finance (DeFi) is on a rally, surpassing $65 billion in complete worth (TVL). This achievement locations DeFi among the many high 5 largest US hedge funds when it comes to property beneath administration (AUM).

On February 9, the entire worth throughout all DeFi protocols reached a multi-year excessive of $65.612 billion. Notably, the final time the decentralized finance sector noticed these numbers in TVL was in June 2022. This metric has at the moment surpassed the $64.658 billion as of August 13, 2022, based on information from DefiLlama.

Curiously, this TVL is accountable for 48% of the stablecoin market cap of $136.408 billion on the time of publication. Within the final 24 hours, decentralized exchanges (DEX) have moved greater than $3.4 billion in quantity, in comparison with a weekly quantity of just about $20 billion.

The entire locked worth measures the variety of non-liquid tokens invested in DeFi protocols. In conventional finance, this is able to be the equal of property beneath administration (AUM), although it isn’t managed by a central entity.

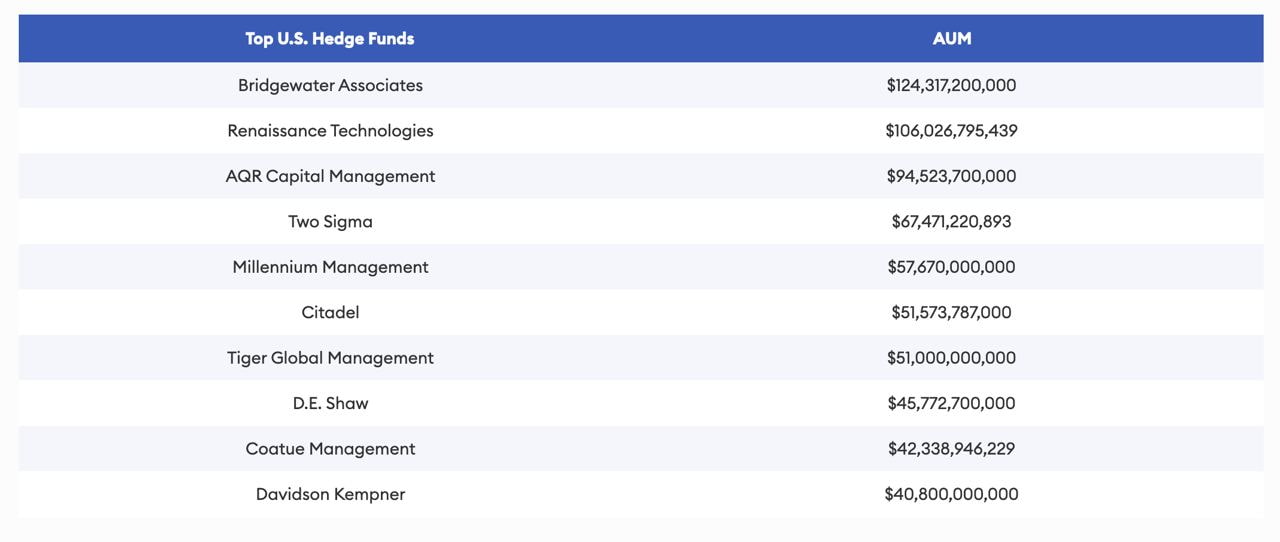

DeFi beats the highest 4 hedge funds in the US

Particularly, such an quantity would place DeFi because the fifth most useful hedge fund in the US.

Two Sigma has the fourth highest property beneath administration within the nation, with $67.471 billion in property beneath administration. Adopted by Millennium Administration, with $57.67, based on a Forbes December 2023 report.

Due to this fact, decentralized finance has change into more and more vital and has succeeded in attracting buyers and capital to the dwelling ecosystem. Regardless of being two totally different measures, they’ll point out capital allocation preferences.

There’s nonetheless a protracted method to go earlier than DeFi achieves additional success and defeats conventional monetary entities.

Even massive monetary names like BlackRock Inc. (NYSE: BLK) flirting with DeFi and Web3. On this context, BlackRock’s current curiosity in tokenization might gas progress, attracting extra capital to the decentralized panorama.

Nonetheless, buyers ought to concentrate on the nonetheless experimental nature of DeFi and make investments cautiously.

Disclaimer: The content material on this website shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.