Professional-syanov

Introduction

Caterpillar Inc. (NYSE:CAT) is an industrial conglomerate that leads throughout development, mining, and heavy trade. The corporate has been pretty constant over the previous three a long time regardless of broader trade cyclicality because of conservative monetary practices. Kinda like that outdated out of doors cat that often returns house when the climate is poor.

Predominantly, share buybacks, growing revenue margins, and constant free money stream era have been the drivers of above-market returns through the years. With solely a $140 billion market cap, favorable trade tailwinds, and maintained operational success, I discover it doubtless that CAT will proceed succeeding long run (particularly when in comparison with different conglomerates like 3M (MMM)).

Nevertheless, we are able to additionally contemplate whether or not youthful firms will replicate CAT’s previous success and provide higher development alternatives as they mature. For long-term buyers, this may increasingly play out higher for capital appreciation, however volatility and threat will definitely be increased. Due to this fact, it is going to be essential to pick smaller friends correctly. The choice is small, however two names stand out: Metso Oyj (OTCPK:OUKPY) and Epiroc (OTCPK:EPOKY). With a easy comparative evaluation, buyers can think about conditions the place these main friends might be built-in into the CAT ecosystem and assist the success of the trade, and this success can permit all three names to serve buyers nicely.

Metso Oyj

Metso is a 20-year-old firm, previously joined by paper and pulp processing firm Valmet (OTCPK:VLMTY). Now every going their separate methods, Metso has joined with the almost 100-year-old mining expertise firm, Outotec, previously a part of Outokumpu (OTCPK:OUTKY), considered one of Europe’s major stainless-steel producers. The mixed $10 billion market cap firm presents an in depth vary of main tools and companies for combination, mineral, and steel mining operations.

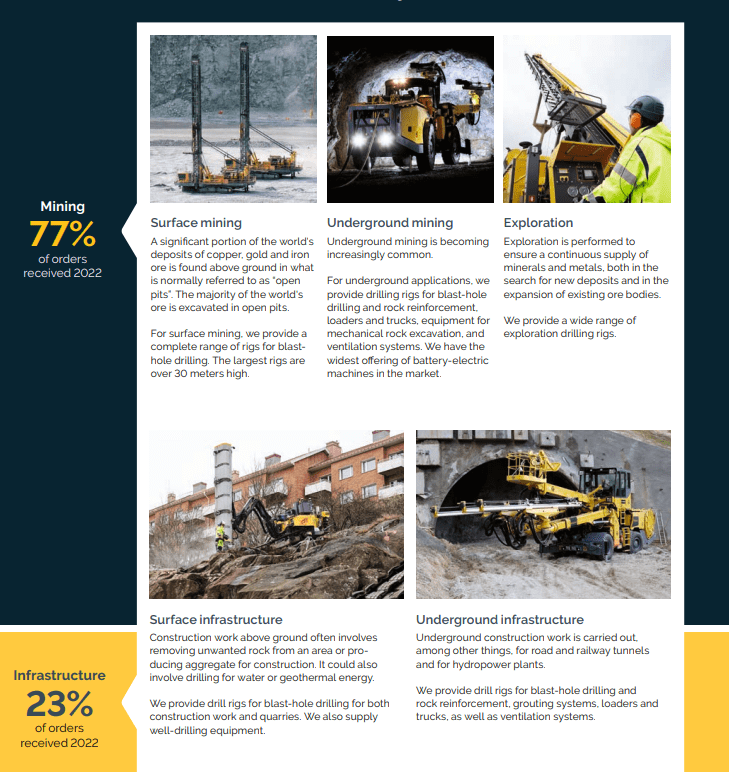

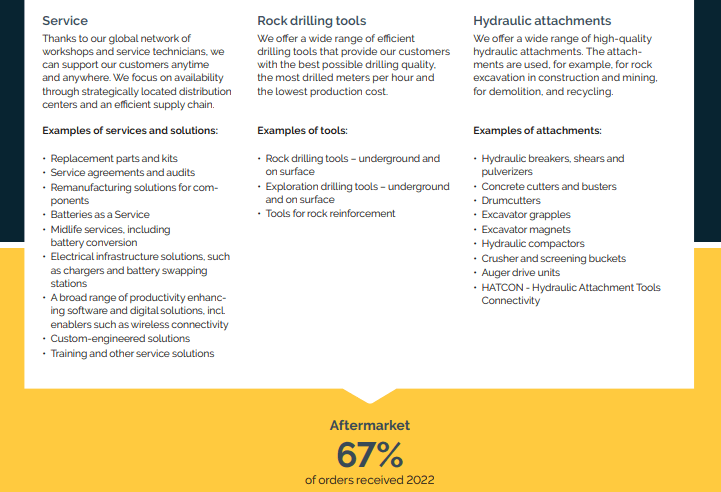

Epiroc AB

The opposite $20 billion peer, Epiroc, has over 150 years of expertise within the design and manufacture of development, mining, and industrial equipment and attachments (with most centered on drilling and blasting), however was not too long ago spun off from their former dad or mum, the economic options large Atlas Copco (OTCPK:ATLKY). Some could initially imagine {that a} spin-off firm is an underperformer (particularly from a top-tier firm equivalent to Atlas), however as the info exhibits, Epiroc holds its weight or extra.

Fast Monetary Summaries

Whereas Epiroc and Metso have traded equally since their IPOs over the previous 5 years, they haven’t traded in step with CAT. Nevertheless, they do provide aggressive monetary options of decrease leverage and equally excessive earnings development. I imagine that whereas these smaller friends face some points in the mean time, which can be mentioned, the overall theme is that their monetary efficiency signifies that they are going to have a long-lasting impression on their industries and may survive for generations identical to CAT. As I dive deeper into the three names, I imagine this theme will develop into clear.

| Firm |

Complete Return 1 Yr (%) |

Complete Return 3 Yr (%) |

5-yr Common Internet Revenue Margin (%) |

3-Yr EPS Progress (Diluted CAGR %) |

Leverage Ratio (Internet Debt / EBITDA TTM) |

P/E (TTM) |

|

CAT |

55 |

70 |

10.5 |

28.9 |

2.0x |

16.9 |

|

Epiroc |

35 |

35 |

15.3 |

21.8 |

0.4x |

25.0 |

|

Metso |

45 |

35 |

6.4 |

26.5 |

0.8x |

14.6 |

The Broader Image

Earlier than we even contemplate an funding, or including shares, to considered one of these friends, we should first contemplate the results of cyclicality on the mining and development industries. Bull markets provide great return prospects, however financial slowdowns might be damaging. Each investor should contemplate their very own targets and circumstances, as there’s by no means a single proper reply to investing. Due to this fact, I’ll start by addressing the market to get an concept of the long-term alternative that’s out there for the mining and development trade.

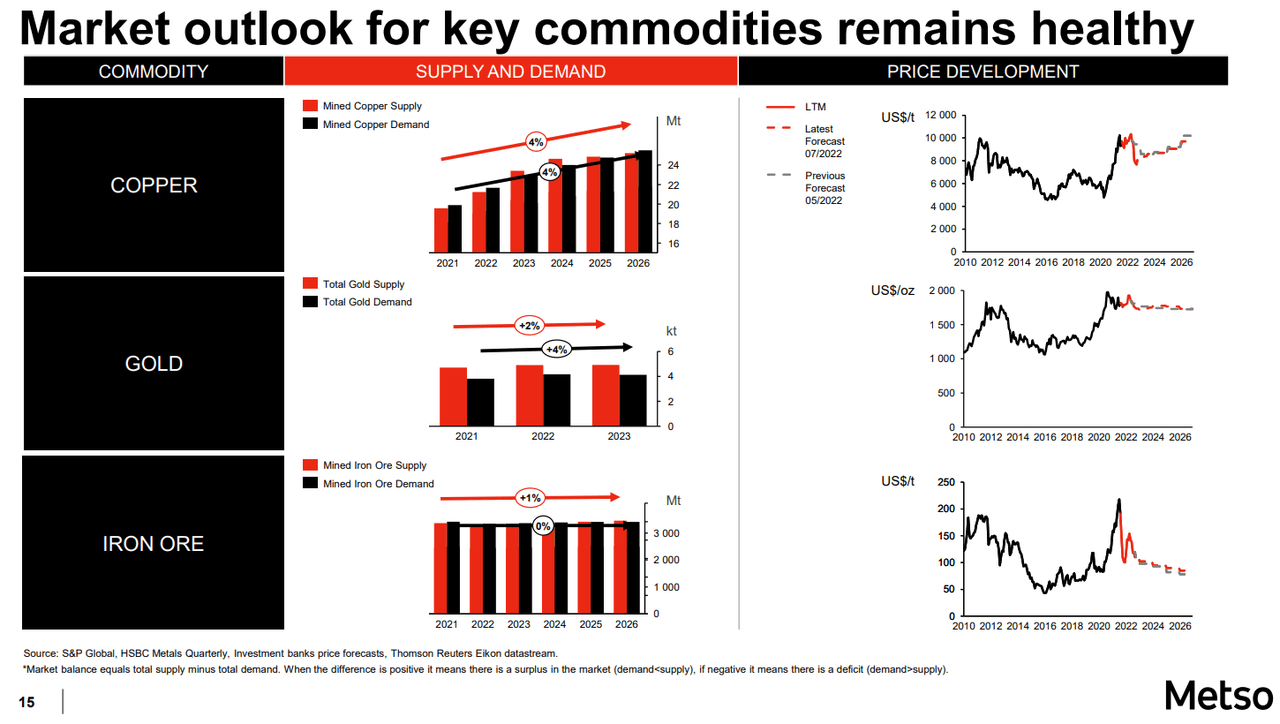

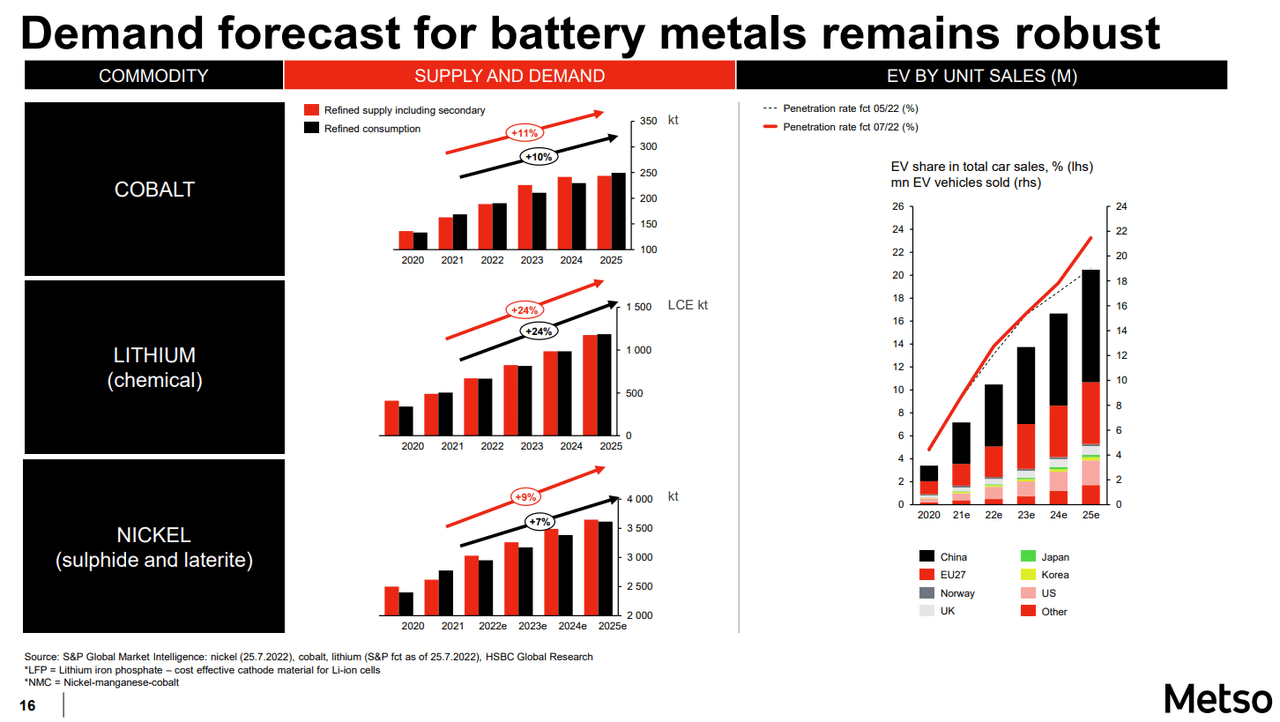

With 2023 almost over, many buyers could have missed the swift cycle that occurred within the commodities market. Rising rates of interest and an unbelievable slowdown in demand triggered materials costs to plummet in 2022, however product costs have rebounded as inflation stays sticky, recession dangers ease, and the world continues to industrialize. Value isn’t every thing, and there’s additionally good information that means demand is predicted to outpace provide, permitting costs to stay favorable for the trade. This results in elevated funding in high-quality instruments and companies from our three friends. Additionally, there’s continued proof for vital market development from commodities for the renewable power trade equivalent to cobalt, lithium, and nickel.

With their big array of kit and companies, CAT is the primary beneficiary of any mining and development spending worldwide. And, since Metso and Epiroc are extra premium/high-end and leading edge, they are going to profit from these more healthy trade dynamics. In actual fact, there are a lot of examples of latest mining tasks around the globe which have already introduced the assist of the three friends, together with:

-

ioneer (IONR) has partnered with CAT for autonomous haulage programs for his or her Rhyolite Ridge lithium borate mining undertaking in Nevada.

-

Epiroc’s sale of over 23 mining autos will permit Glencore’s (OTCPK:GLNCY) Onaping Depths mine to be one of many first all-electric mines on the planet.

-

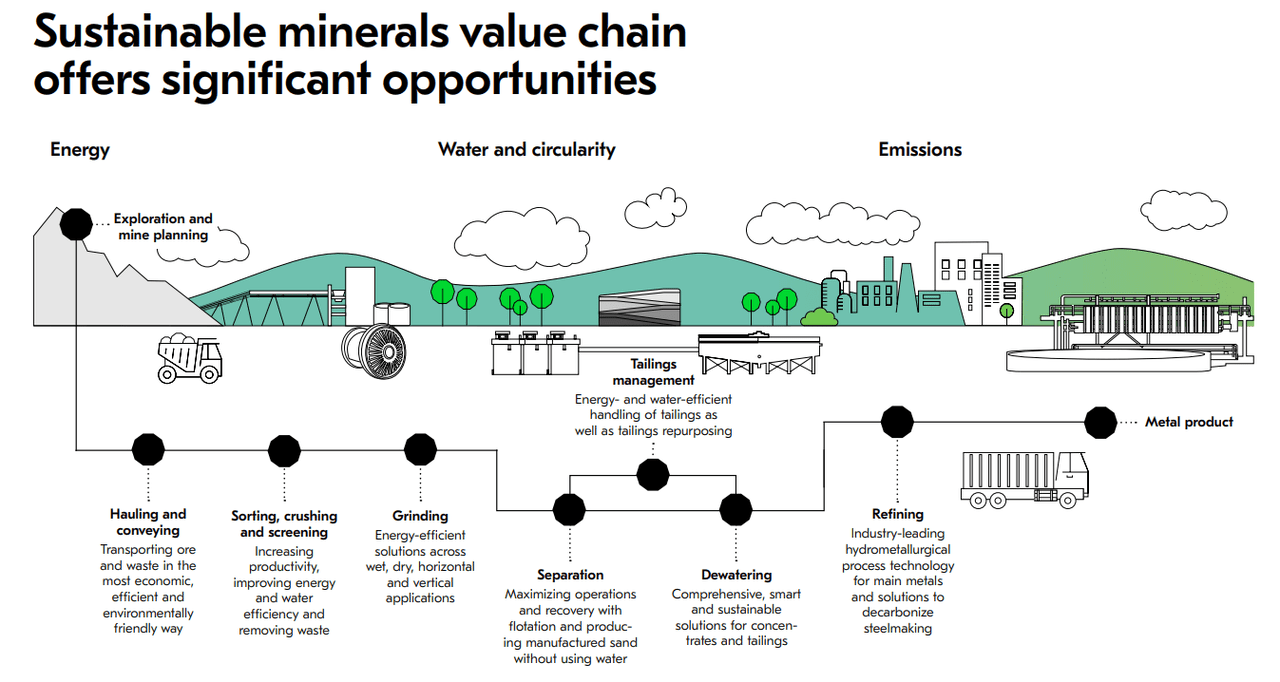

Metso is a serious accomplice of Rio Tinto (RIO) of their drive to develop sustainable smelting solutions.

Metso Investor Presentation

Metso Investor Presentation

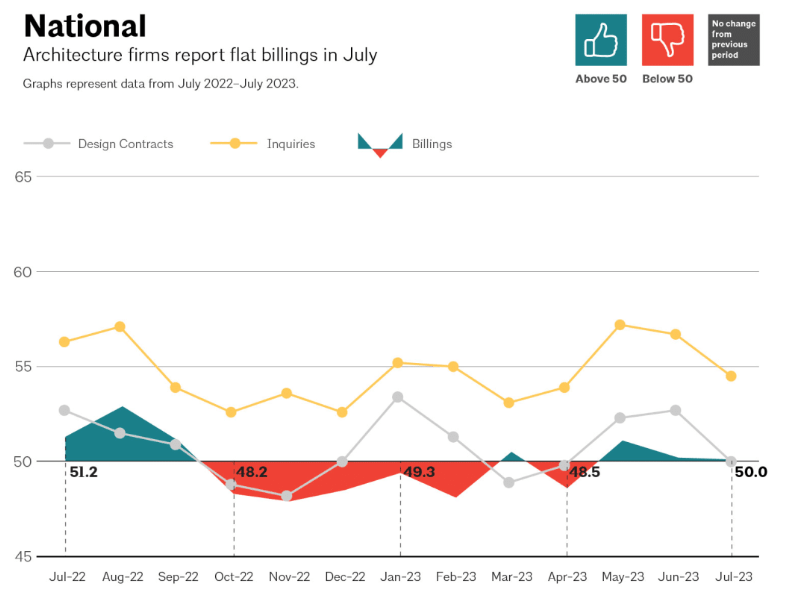

Mining isn’t the one trade that these firms face, though information on the broader infrastructure market is assorted. We see that there’s vital weak point in the mean time as a consequence of provide chain, labor, and excessive rate of interest headwinds around the globe. All over the place, giant tasks are being delayed. There may be additionally a serious threat in China as a development increase continues to create a particularly weak actual property market with the responding waves affecting the worldwide markets. Within the US, information from the AIA suggests that there’s a slowdown in billings nationwide as infrastructure invoice stimulus battles in opposition to a high-cost setting.

Due to this fact, firms providing important autos, tools, and companies equivalent to CAT and Epiroc will see weak, however lasting demand. This can doubtless mirror within the financials as slower income development, however I’ll tackle the monetary implications of cyclicality later. Metso could appear unaffected as a consequence of their publicity to mining, however aggregates are a serious uncooked materials for the development/civil engineering trade and so the financial elements are equally detrimental. For now, I feel the primary takeaway is to know that cyclicality can be ever-present, however main firms can handle their manner by way of the dangers – if operationally and financially succesful.

AIA

Operational Strengths

Caterpillar’s main power is their diversification and main market share throughout all income segments. The corporate focuses on the design and sale of vehicular equipment that drives the fashionable development website, mine, quarry, infrastructure undertaking, and past. Everyone seems to be aware of Caterpillar dump vehicles, shovelers, and lots of different items of equipment, and their maintain over the trade is powerful. Fortunately, the friends I’ll focus on shouldn’t have to immediately compete with CAT.

First, Epiroc does design and promote vehicular development and mining tools, however their experience is specialised in drilling and boring for mines and infrastructure tasks, together with underground materials dealing with. With a deal with promoting attachments and offering companies, margins are the best of the group. This additionally indicators top-tier mental property. Contemplating that many CAT tools house owners use Epiroc instruments, there’s restricted aggressive threat.

That is just like Metso, which is concentrated on automated materials dealing with with tools equivalent to cell and stationary crushing machines, conveyor belts, smelting arrays, and different combination and mineral processing options. CAT doesn’t have stationary materials dealing with options, as an alternative specializing in vehicular transport. Whereas Metso tasks are bigger in scale per sale, and this causes margins to be decrease, the standard is simply as excessive as a consequence of their buyer base and development outlook. Nevertheless, the shortage of diversification could also be a difficulty for some. As such, Metso faces essentially the most unsure future as its companies are way more area of interest and unpredictable.

There may be even the chance for the 2 smaller friends to both be acquired by, invested in, or accomplice with CAT, all of that are favorable actions. The difficulty is that since these smaller friends are extra specialised, cyclicality can be far larger. Some buyers are uncomfortable with that. For those who stick to simply CAT, you additionally get diversification into power era tools equivalent to generators and heavy trade engines. Whereas nonetheless cyclical, the diversification displays financially.

Neither Metso nor Epiroc provide publicity to the same quantity of diversification, so some buyers could hunt down a 3rd small or midcap firm to cowl the hole (provided that they need three increased threat/reward firms reasonably than going with CAT). One instance contains Babcock & Wilcox (BW), though the broader competitors is comparatively weak. Nevertheless, my major thesis is that the 2 highest high quality small friends, Metso and Epiroc, stay the very best different publicity for individuals who need to put money into the sector.

CAT 2022 Annual Report

Metso

Metso

Epiroc Annual Report

Epiroc Annual Report

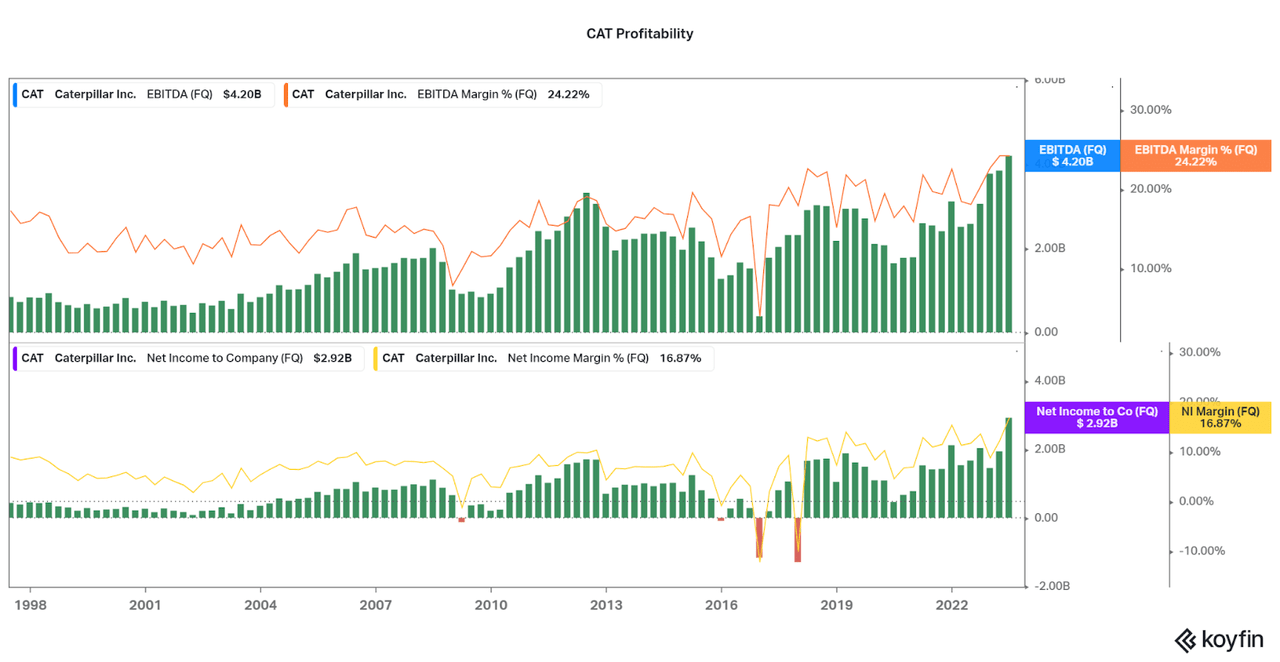

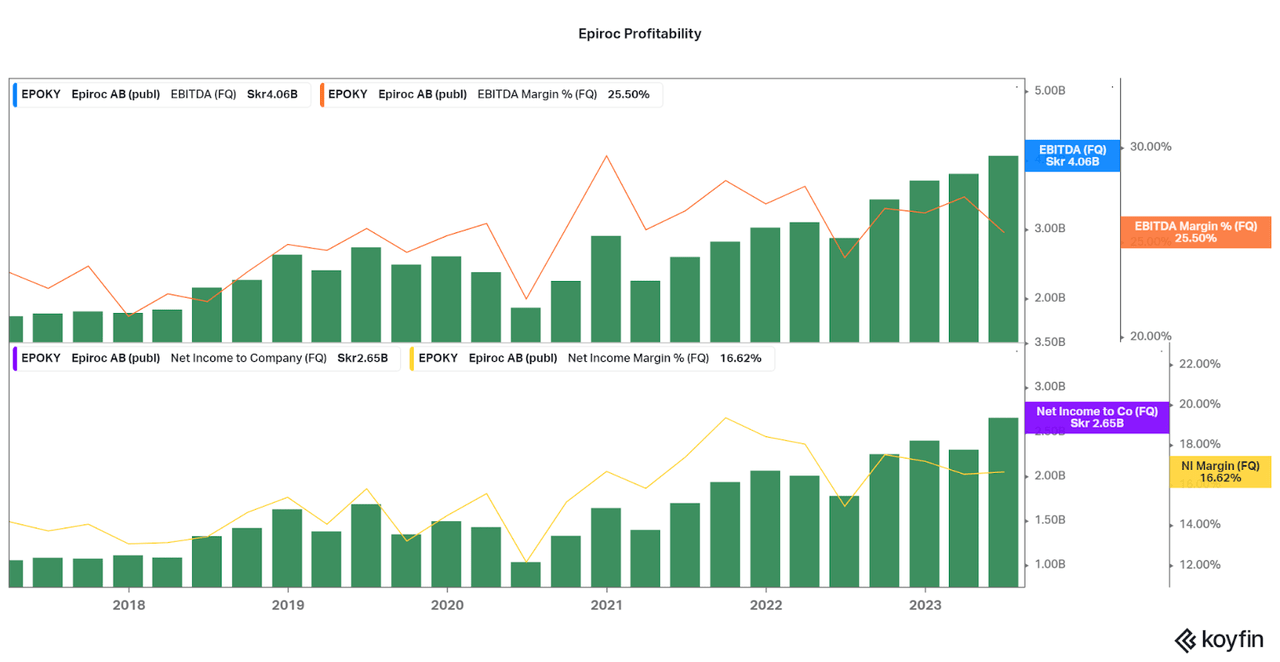

Monetary Summaries

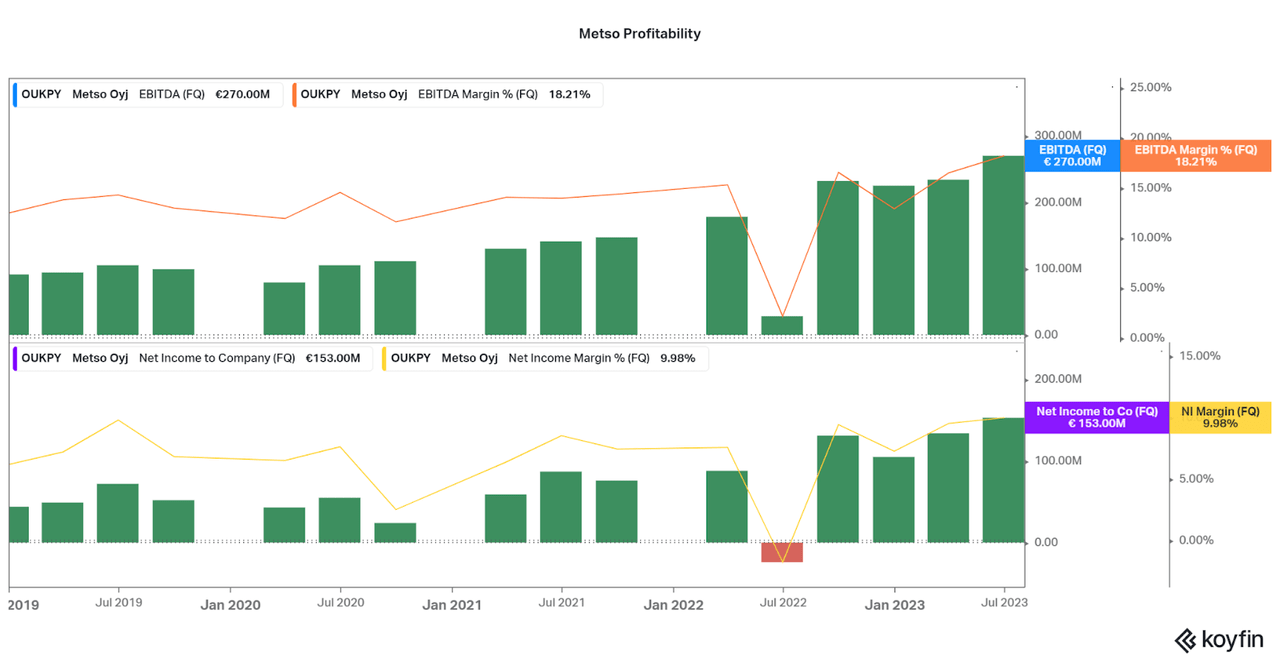

Whereas I may present income development charts for all three firms, there are solely 2 major takeaways: Epiroc and Metso develop quickly in comparison with CAT, and CAT has been very cyclical over the previous three a long time and extra. Due to this fact, I discover it extra essential to evaluate present revenue era because it’s clear smaller friends will develop quicker and the trade will all the time be cyclical. When wanting on the charts beneath, one theme arises: Epiroc and Metso stay aggressive by way of producing earnings on a quarterly foundation. In actual fact, Epiroc outshines CAT by way of revenue era based mostly on margins. Nevertheless, we do see that now we have but to ascertain long-term patterns as quarterly margins fluctuate.

This contrasts with our potential to visualise CAT’s long-term potential to drive new highs in revenue margins regardless of brief durations of weak point. Revenue era is now at all-time highs, and the uptrend seems to be untarnished since a weak 2020/21. Uptrends not often final although, and so I anticipate a downtrend over the approaching quarters. For CAT, the steadiness between falling revenues whereas sustaining these excessive margins will definitely result in a drawdown, however the extent of which stays unclear. As I mentioned, there are headwinds within the worthwhile mining trade, however development will stay a thorn within the facet for a while. Because of this, I additionally imagine that Metso will maintain on to its revenue margins longer over the approaching years. These fascinated by buying and selling round can be aware of these alternatives.

Koyfin

Koyfin

Koyfin

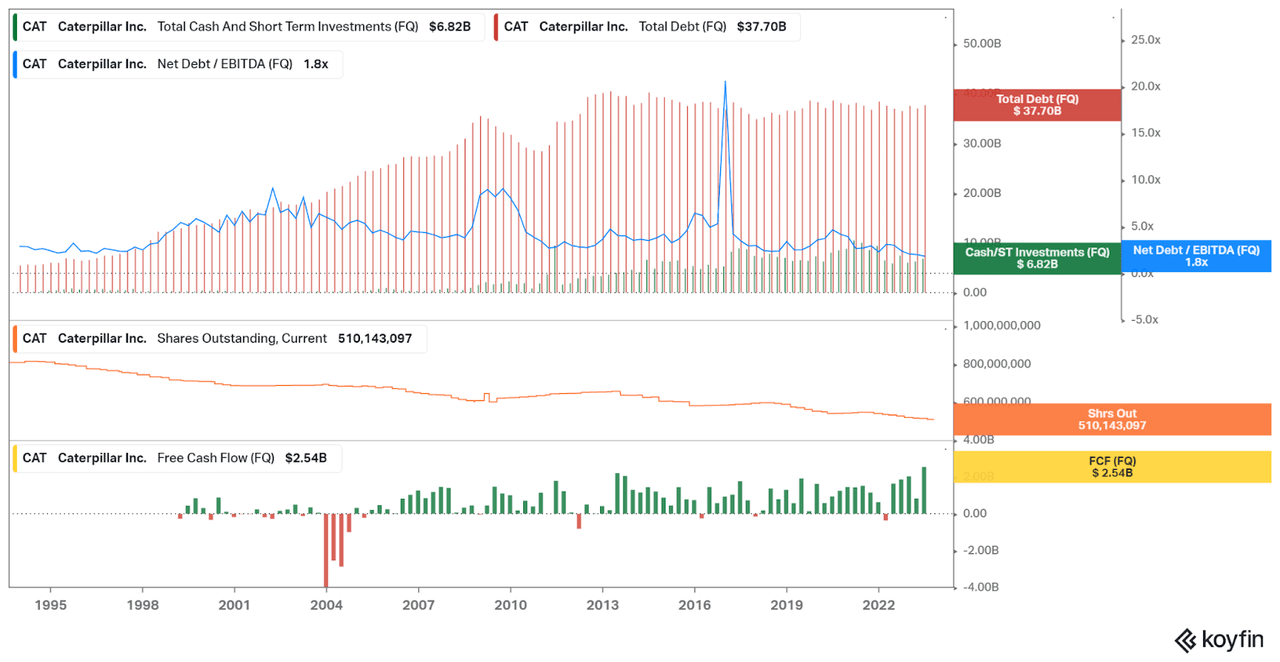

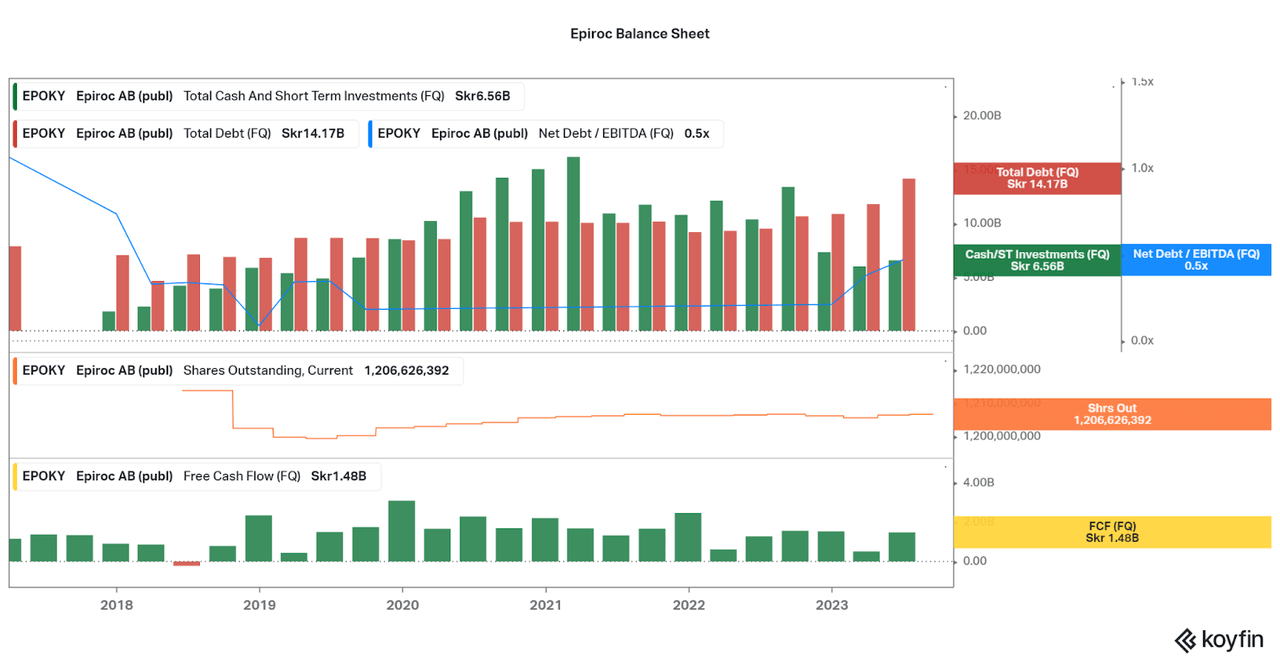

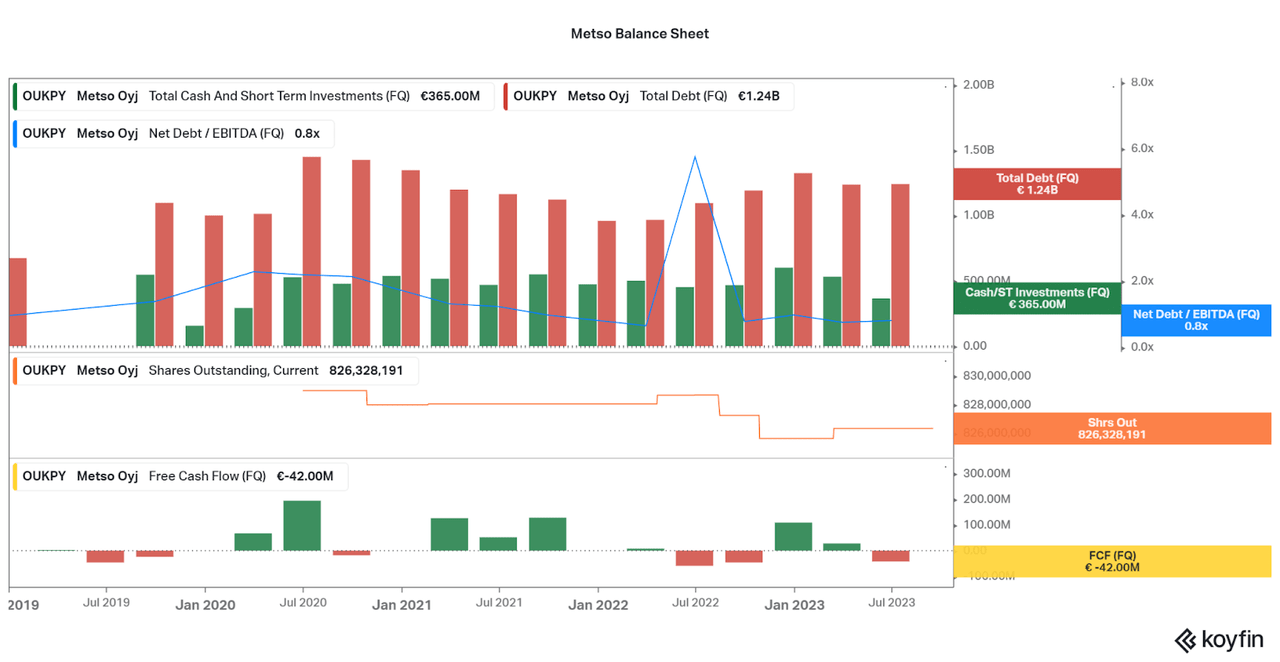

Steadiness Sheet Flexibility

Considered one of CAT’s key weaknesses will all the time be leverage. Nevertheless, they’ve carried out nicely to carry leverage all the way down to ranges not seen since earlier than the 80s. Nonetheless, each Metso and Epiroc are likely to hold leverage beneath 1.0x Internet Debt / EBITDA (TTM). This extra flexibility permits the extra risky friends to outlive trade downturns, and actions equivalent to acquisitions or capital investments will permit the businesses to outperform the competitors. Nevertheless, the smaller firms are new to the market and nonetheless have work to do in regard to dilution.

Whereas share counts should not going up, if these two firms can replicate the buyback sample of CAT then buyers actually need to purchase shares sooner reasonably than ever. For CAT, the ~2% discount in shares excellent per 12 months helps enhance EPS to 9.7%, whilst revenues are flat over the identical time interval. Nevertheless, buybacks could also be withheld as the present share costs stay near all-time highs. As a substitute, search for a robust steadiness sheet to be put to work making tactical strikes, M&A included. In actual fact, a pick-up of Metso or Epiroc wouldn’t be out of the image.

Koyfin

Koyfin

Koyfin

Conclusion

Whereas CAT continues to be a stable performer for conservative buyers because of their main merchandise, diversification, monetary risk-aversion, and earnings development, I hope I launched two kittens that could be influential to any investor, whether or not they personal shares or not. Whereas there’s all the time a case to proceed including or holding Caterpillar, I imagine that long-minded buyers can see shades of CAT’s early days with Epiroc and Metso. It’s true that they have to show themselves over the approaching years, however up to now, they’re performing extremely nicely for his or her measurement and market place. Every investor should assess their targets, however I anticipate that Epiroc and Metso will outperform CAT from this level on.

I’ll look so as to add these two names to my watchlist because the trade is a bit prolonged for my liking and I can be establishing my preliminary place. Nevertheless, buyers already in Epiroc or Metso could look so as to add shares regularly as predicting the long run is troublesome. Whereas the prospect for shares to go down is actually there, maybe we are going to simply see a flat buying and selling sample as an alternative. So, when contemplating your personal funding, remember to search for the valuation to be simply as interesting because the underlying companies:

-

CAT: The 20-year imply P/E is 21.2 in comparison with the present 17.0x. Nevertheless, the corporate seems to be costly by way of the present P/S (2.1x present vs 1.3x imply) if revenues and earnings fall with trade weak point. If revenues and earnings fall, look so as to add between a 12-15.0x P/E or 1.25x P/S.

-

Epiroc: With the identical market threat as CAT, Epiroc is also dangerous when buying and selling at near the imply P/E, EV/EBITDA, and P/S since IPO. Nevertheless, development prospects additionally negate this threat. Due to this fact, it could be unlikely that it trades beneath the imply for lengthy. I imagine including between a 15-20.0x P/E would be the greatest alternative. Or lower than 3.0x P/S if earnings start to weaken considerably.

-

Metso: Of the group, Metso presents the very best present worth in my eyes, though the corporate has been buying and selling for the shortest period of time. With broader publicity and continued success, I see essentially the most probability for worth enlargement from this title. I’ll look so as to add between a 10-13.0x P/E, particularly if the market begins to wrestle.

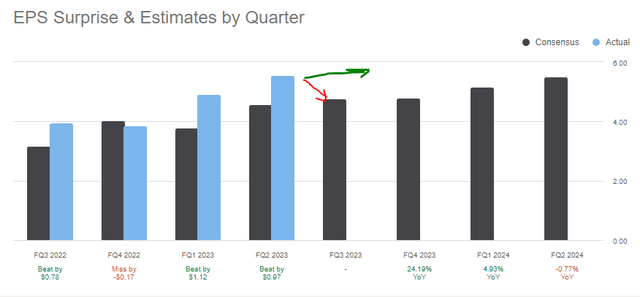

By way of catalysts to search for within the coming months, CAT’s Q3 earnings on the finish of October can be a key indicator for short-term efficiency. Within the first two quarters of the 12 months, CAT handily beat expectations because the market remained robust and recession fears fell. Nevertheless, consensus estimates for Q3 haven’t been considerably adjusted upwards (analysts have moved up, however a decline in earnings continues to be anticipated). That is stunning as CAT had two of their high earnings stories of the previous few years and the financial momentum appears to be lasting. Due to this fact, there could but be an upside shock even analysts stay cautious.

Searching for Alpha

If CAT begins to point out indicators of an earnings decline, earnings will both be in line or beneath expectations. This can trigger the shares to fall throughout the trade, resulting in a chance for my valuation metrics to be met for all three firms. Nevertheless, if the bull development continues and expectations are beat as soon as extra, then I discover it unlikely for Epiroc or Metso to fall to the valuation ranges I laid out. I might nonetheless see a difficulty of a flat buying and selling sample because the economic system slows down as a consequence of increased rates of interest, and so if my valuation necessities should not met I’ll stay on the sidelines.

If the necessities are met, and no different points come up, I’ll actually contemplate establishing a place within the smaller names to intensify my high-growth, low-risk portfolio (please seek advice from my different articles for extra data). I additionally take pleasure in the truth that these names swimsuit my environmentally pleasant asset expectations because of the sale and design of sustainable merchandise. Whereas this isn’t an element for all buyers, I wish to spotlight how Metso’s and Epiroc’s financials stay robust whereas doing so. ESG just isn’t a complete misplaced trigger on this circumstance. I’ll remember to present updates as doable.

Thanks for studying. Be happy to share your ideas beneath.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.