- ONDO has a strongly bullish bias on the decrease and better timeframes.

- One other 15% transfer larger is feasible, offered the bulls can convert a key resistance to help.

Ondo [ONDO] posted 56% good points for the reason that twenty third of Could and has damaged out previous a two-month-old vary formation. The psychological $1 stage was additionally flipped to help by the bulls.

Bitcoin’s [BTC] current stasis didn’t have an effect on ONDO negatively. Is that this an indication of power, or will ONDO retrace its good points? Technical evaluation revealed some sturdy proof for which consequence the altcoin would witness.

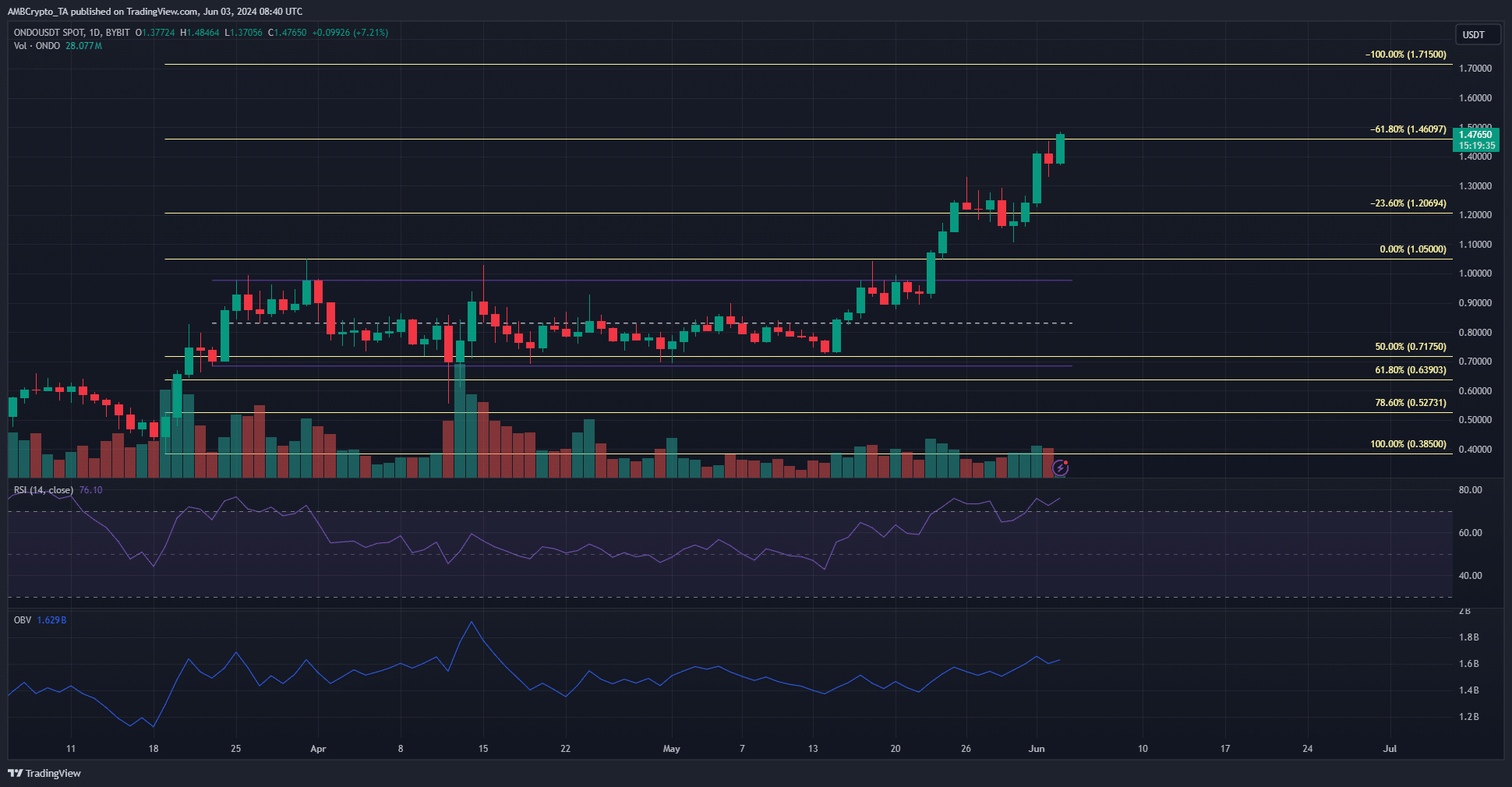

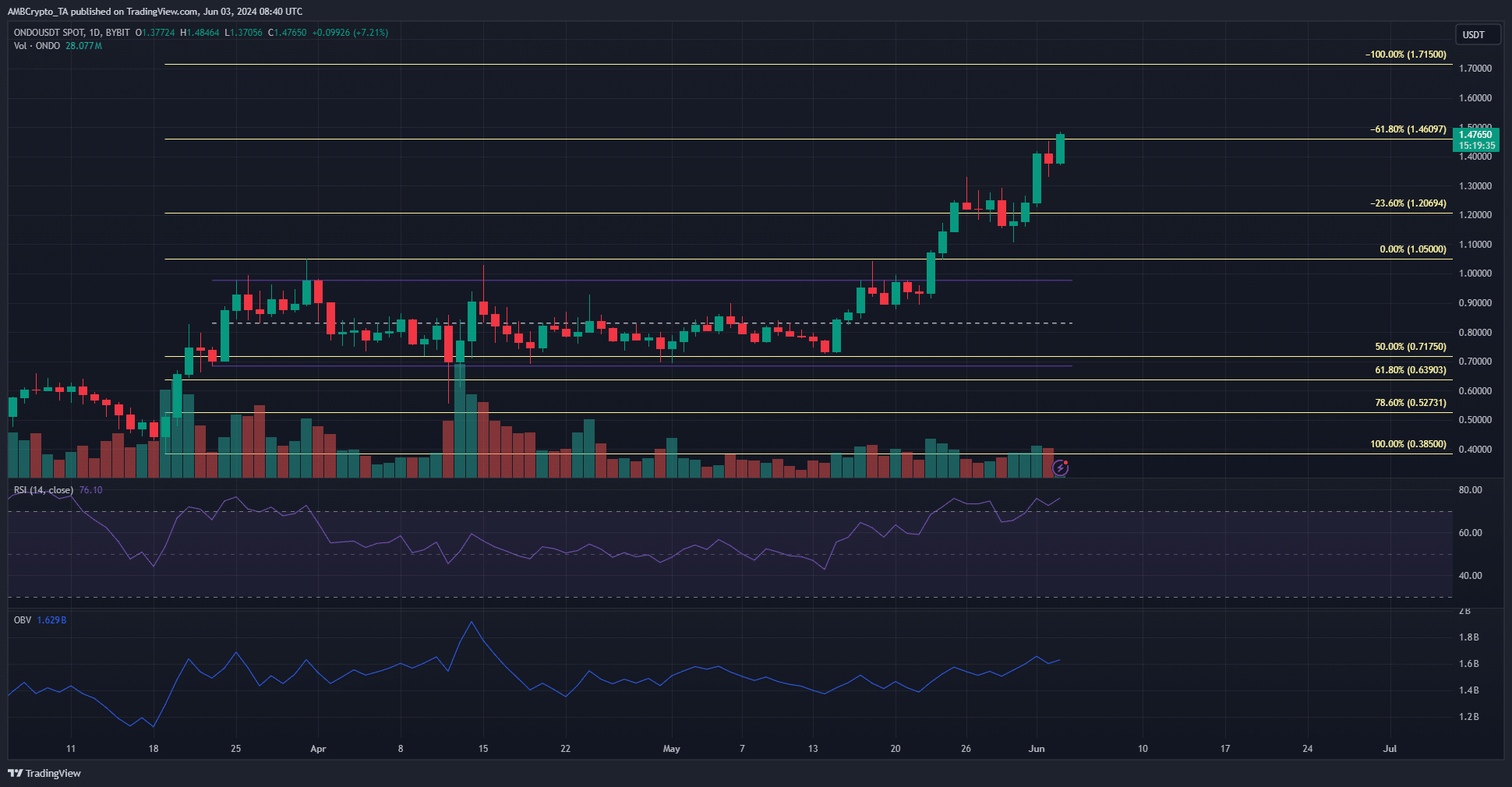

The Fibonacci extension ranges offered the following bullish targets

Supply: ONDO/USDT on TradingView

The rally in mid-March was used to plot a set of Fibonacci retracement and extension ranges (pale yellow). It confirmed that the vary formation of the previous two months discovered help on the 50% retracement stage at $0.717.

Prior to now two weeks, ONDO has flipped the 23.6% extension stage at $1.2 to help and was making an attempt to drive its means above the 61.8% extension at $1.46. The 100% extension stage at $1.71 is the following goal.

The RSI on the 1-day chart was at 76 to sign sturdy bullish momentum. A divergence has not fashioned on this timeframe and signaled continued bullish momentum. The OBV was climbing at a extra sedate tempo.

Like the remainder of the market, the buying and selling quantity was weak, however the value motion was bullish.

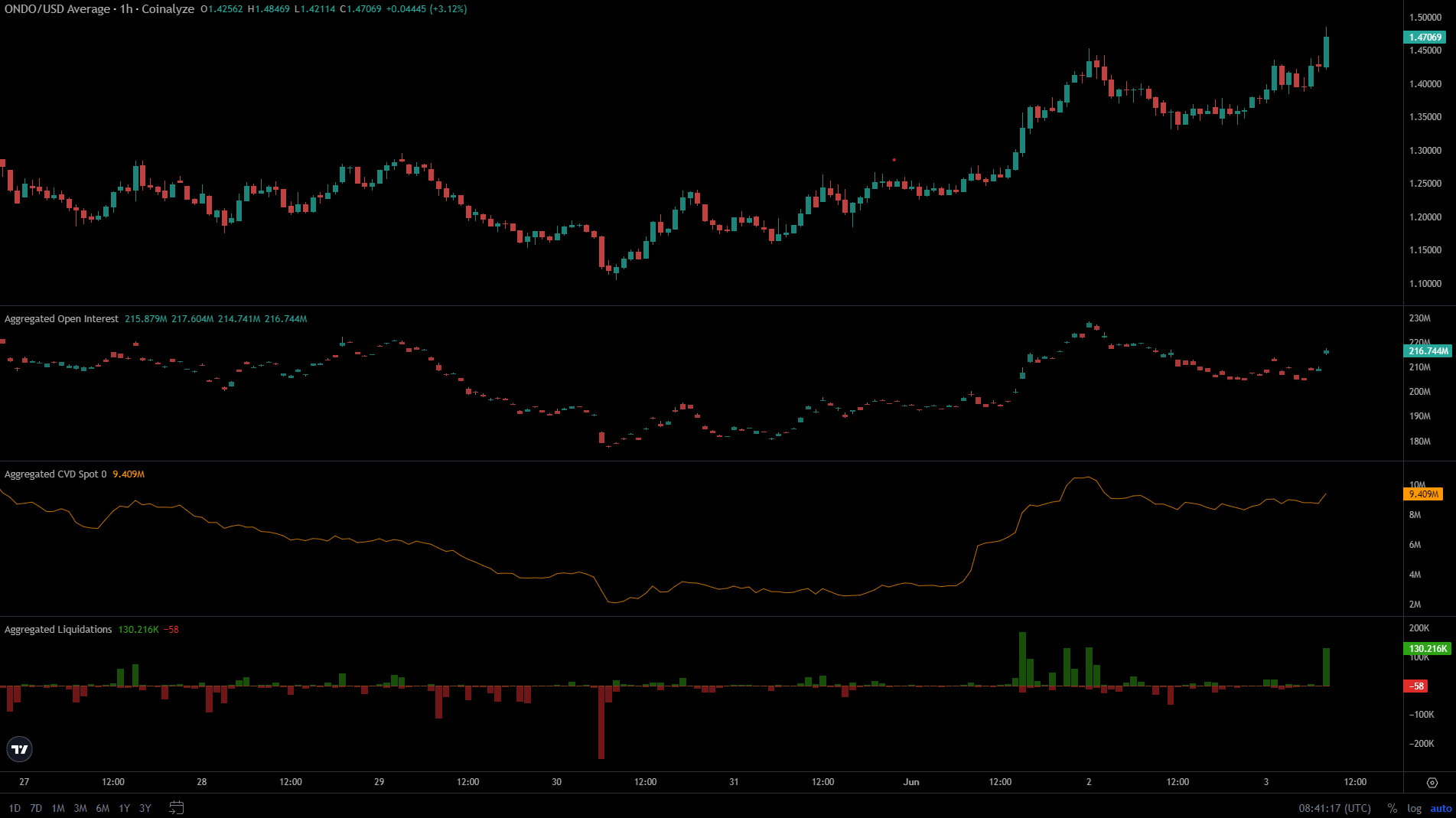

The spot demand and speculative curiosity have been encouraging

Coinalyze information confirmed that the Open Curiosity waxed and waned alongside ONDO’s value motion. This meant that the merchants have been bullish and keen to enter lengthy positions as costs climbed larger.

Learn Ondo’s [ONDO] Worth Prediction 2024-25

The spot CVD additionally maintained its uptrend, though it has slowed down over the previous two days.

The brief liquidations because of the current value surge added to the market buys. General, shopping for stress was current within the decrease timeframes.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.