- ONDO fell beneath the $0.83 help stage and retested it as resistance.

- The momentum has shifted in bearish favor.

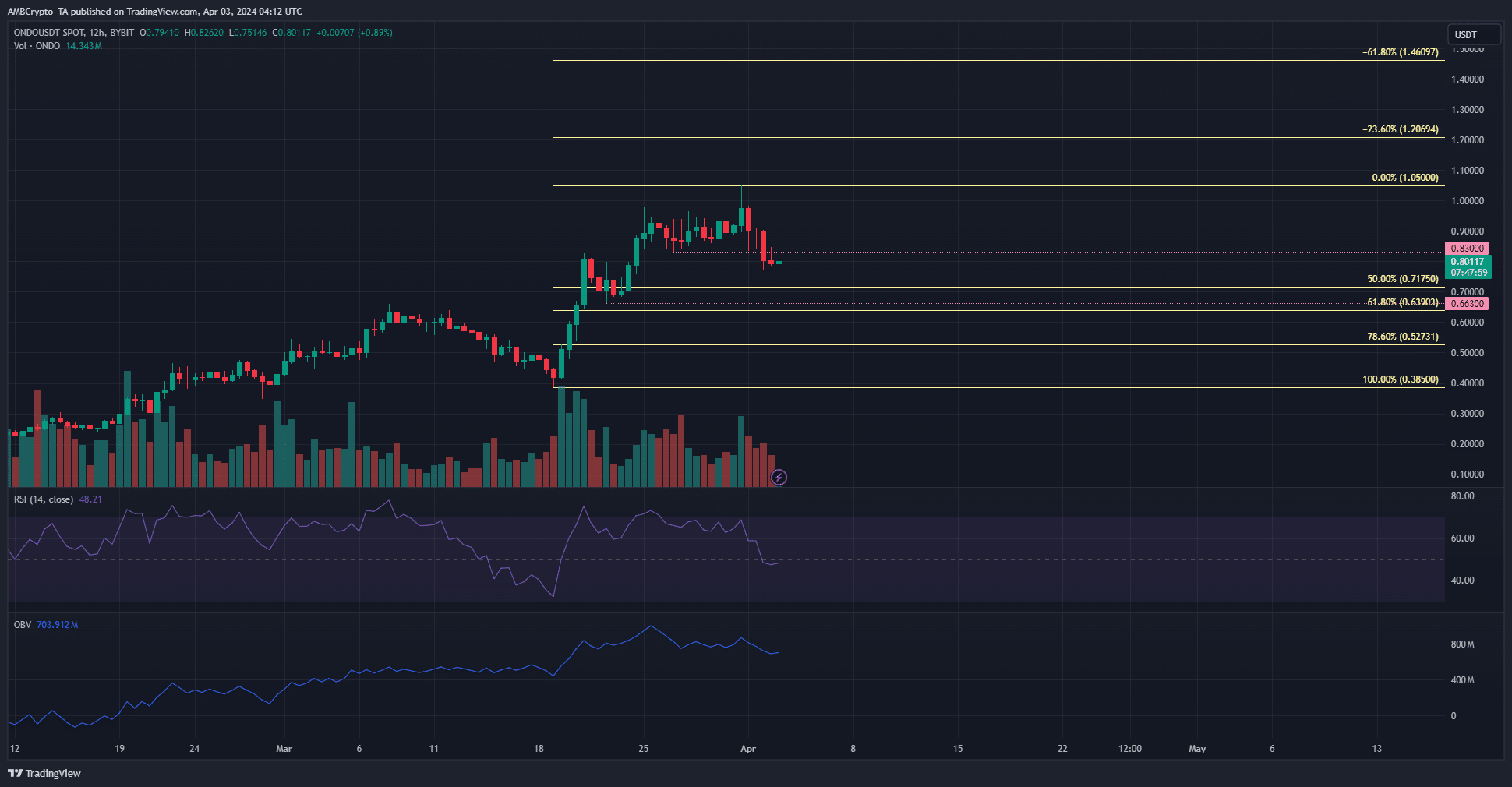

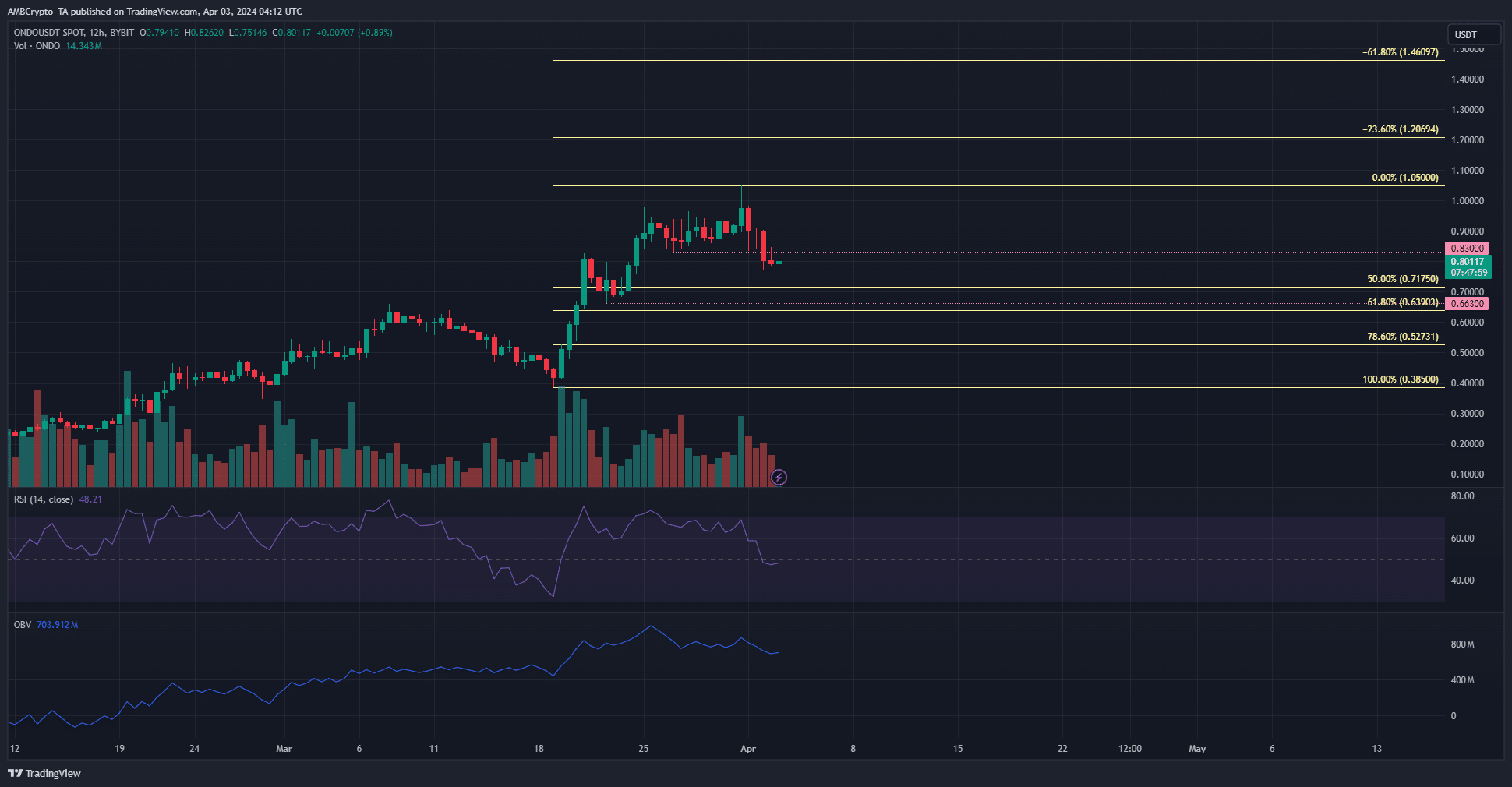

Ondo [ONDO] fell from the current swing excessive at $1.05 to commerce at $0.901 at press time, a 23% decline in simply over two days.

The crypto market was overwhelmed by promoting stress, however most tokens retained their bullish long-term outlook.

ONDO was in an analogous vein. Whereas its indicators confirmed bears had been gaining superiority, the worth motion confirmed that the bulls had been comfy regardless of the current volatility.

The short-term help stage was flipped to resistance

Supply: ONDO/USDT on TradingView

Two decrease timeframe help ranges had been highlighted in pink at $0.83 and $0.663. On the 12-hour chart, the swing low at $0.385 is the one to beat to flip the construction bearishly.

The Fibonacci retracement ranges (pale yellow) additionally underlined key help ranges.

The $0.527 and $0.639 had been probably the most pertinent ones for ONDO bulls. The RSI confirmed that the momentum had shifted bearishly.

The OBV didn’t sink beneath the mid-March lows however has trended downward over the previous week.

The buying and selling quantity was additionally declining, which may herald a section of consolidation for the token. At press time, the bulls haven’t any purpose to panic.

A pointy decline could be welcome, as it will provide a buy-and-hold alternative for the long run.

Ought to traders look forward to such a drop?

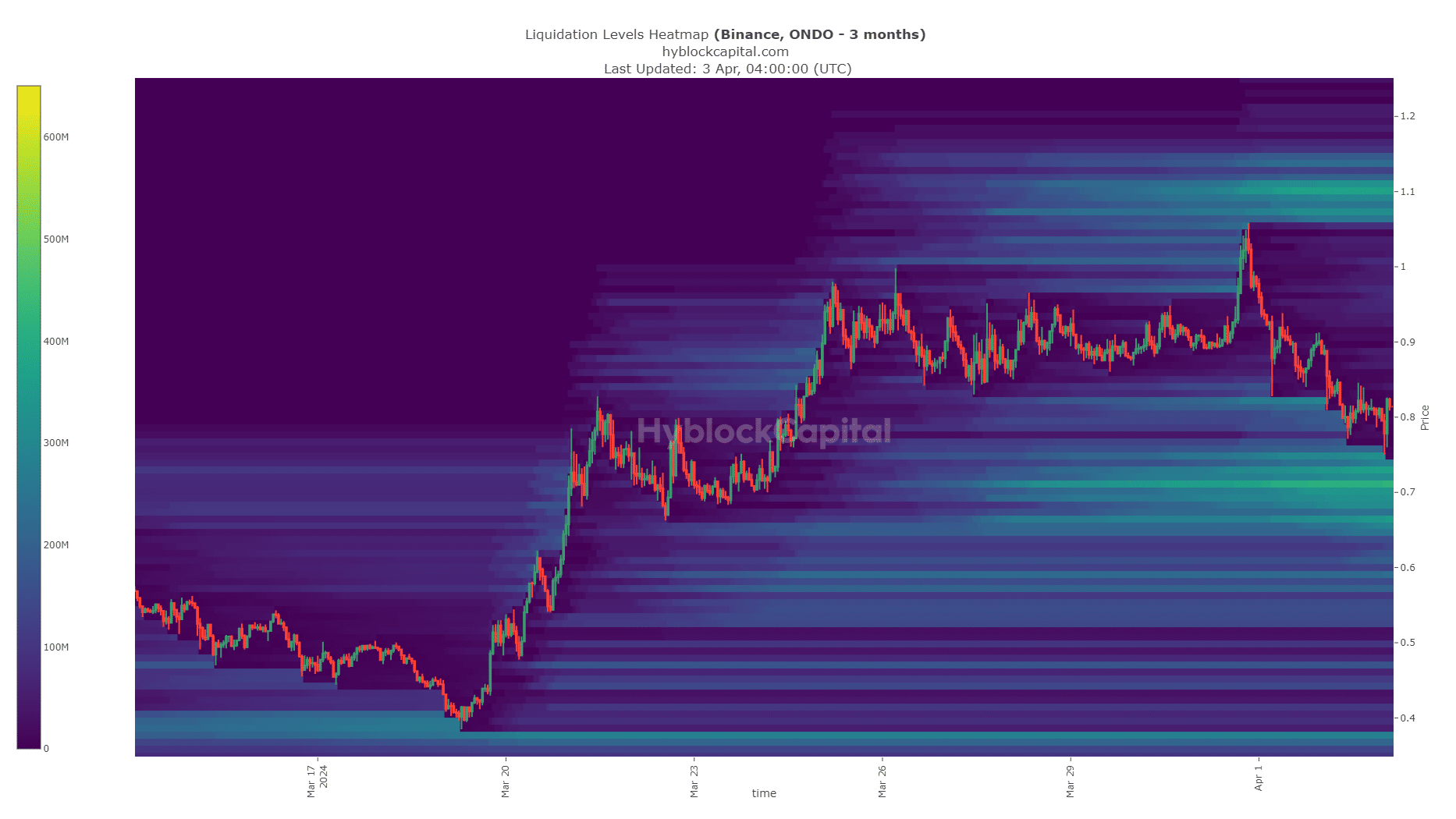

The liquidation heatmap confirmed that the $0.7 space has a considerable amount of liquidation ranges. The realm from $0.69-$0.74 may see the development reverse after ONDO costs sweep the liquidity pocket.

Under $0.69, the $0.59 and the $0.37 ranges had been those to look at. Due to this fact, until the $0.69-$0.71 help zone is breached, holders needn’t fear a lot a couple of steep retracement.

Is your portfolio inexperienced? Test the ONDO Revenue Calculator

In the meantime, the $1.1 was a lovely goal for the bulls. Nevertheless, the short-term momentum would wish to alter earlier than this liquidity pocket turns into the following goal.

A transfer to $0.69 adopted by a surge to $1.1 or greater would take out each swimming pools of concentrated liquidation ranges.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.