With 22-year-old portfolio managers shorting power shares and commodities past document ranges to keep away from “profession threat” and fund NVDA longs by leaping on the most important bubble bandwagon because the dot.com days , the inevitable quick squeeze will likely be a sight to behold, and in accordance with Reuters it might have began.

As Reuters power analyst John Kemp write4s, portfolio buyers “recoiled” from quick positions in U.S. crude futures and choices in the newest week as quickly depleting inventories on the Cushing supply level “underscored the danger of a squeeze on deliverable barrels.”

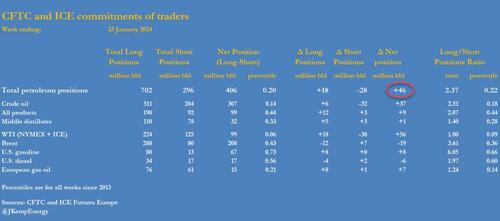

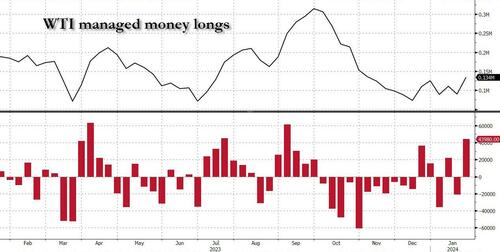

Hedge funds and different cash managers bought the equal of 46 million barrels throughout the six most essential futures and choices contracts over the seven days ending on Jan. 23.

Fund shopping for was dominated by NYMEX and ICE WTI (+56 million barrels) with smaller purchases of U.S. gasoline (+8 million) and European fuel oil (+7 million). Traders offered Brent (-19 million barrels) and U.S. diesel (-6 million), in accordance with information filed with ICE Futures Europe and the U.S. Commodity Futures Buying and selling Fee.

However a lot of the shopping for got here from protecting present bearish quick positions (-28 million barrels) fairly than initiating new bullish lengthy ones (+18 million).

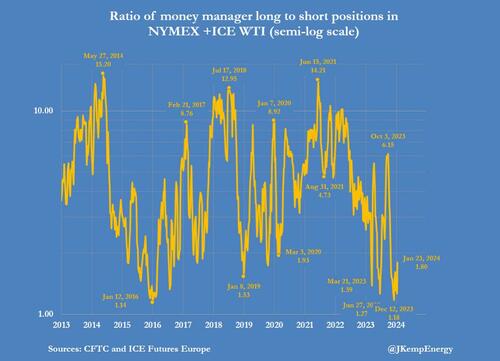

The imbalance was particularly pronounced in WTI the place managers decreased quick positions sharply (-38 million barrels) whereas initiating a smaller variety of new longs (+18 million). As proven within the chart under, cash managers minimize their quick positions in WTI by probably the most since April.

On the similar time, cash managers boosted web longs in WTI by 44k tons final week, probably the most since September.

Consequently, WTI quick positions had been slashed to 79 million barrels from 112 million on Jan. 16 and a excessive of 128 million on Dec. 12.

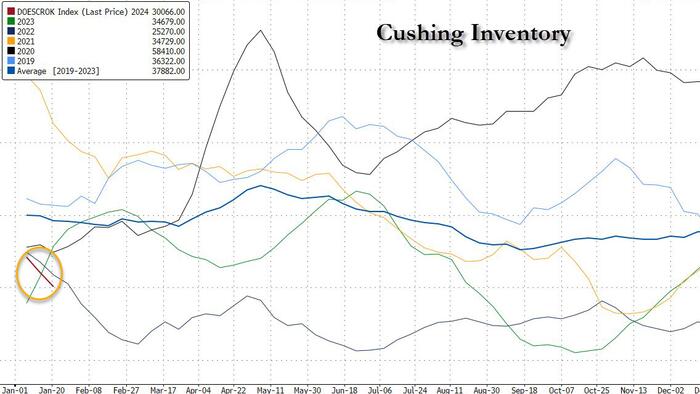

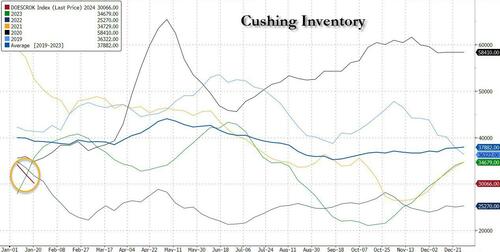

Crude inventories across the NYMEX supply level at Cushing in Oklahoma had depleted to 30 million barrels on Jan. 19 down from 35 million barrels three weeks earlier.

Cushing inventories stood on the lowest for the time of yr since 2012 and had been 14 million barrels (-32% or -1.26 customary deviations) under the prior ten-year seasonal common.

With inventories shrinking, many fund managers concluded it was now not secure to run quick positions probably requiring supply at Cushing.

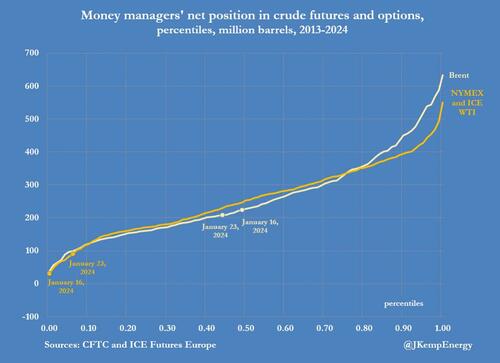

The online place in WTI jumped to 99 million barrels (sixth percentile for all weeks since 2013) up from simply 43 million (1st percentile) the earlier week.

The hole between ultra-bearish positioning on WTI and impartial positioning in Brent narrowed barely however remained very broad.

There was nonetheless important scope for short-covering to carry WTI flat costs and calendar spreads if inventories proceed to deplete.

Nonetheless, regardless of the squeeze, quick positions in NYMEX WTI had been nonetheless nearly 4 instances increased than at the beginning of the present short-selling cycle on Oct. 3. However with the quantity of “pent up” wars world wide, they will not be there for lengthy.

— zerohedge (@zerohedge) January 29, 2024

Pure Gasoline

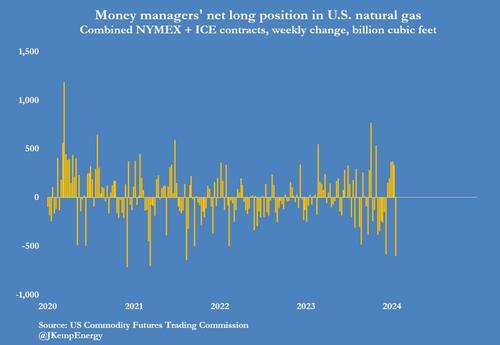

Elsewhere, buyers trimmed positions within the two main futures and choices contracts tied to fuel costs at Henry Hub in Louisiana. Traders reverted to promoting after attempting to construct a bullish place, as the large freeze earlier in January was adopted by milder climate.

Hedge funds and different cash managers offered the equal of 596 billion cubic toes (bcf) over the seven days ending on Jan. 23, the quickest charge of gross sales since August 2021.

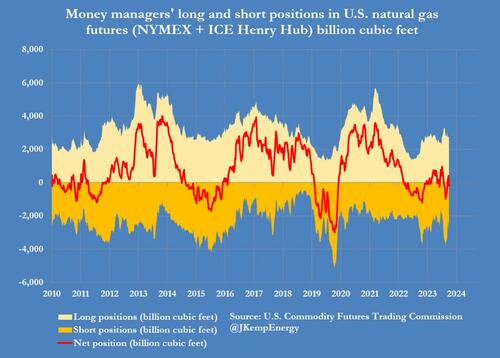

It got here after fund managers had bought a complete of 1,409 bcf over the earlier 5 weeks, in accordance with regulatory information. Funds minimize their place to 186 bcf web quick (twenty sixth percentile for all weeks since 2010) from 410 bcf web lengthy (forty second percentile) seven days earlier than.

Nat fuel front-month futures costs continued to slip and have averaged simply $2.81 per million British thermal items thus far in January (eighth percentile for all months because the begin of the century as soon as adjusted for inflation).

The top-of-winter calendar unfold between March and April 2024 has fallen to flat from a backwardation of 21 cents at starting of winter in early October, as merchants anticipate the market to stay oversupplied.

Traders anticipate fuel shares will finish winter nicely above the long-term common so decrease costs will likely be wanted to encourage extra consumption from energy mills and gradual manufacturing additional.

Loading…