da-kuk

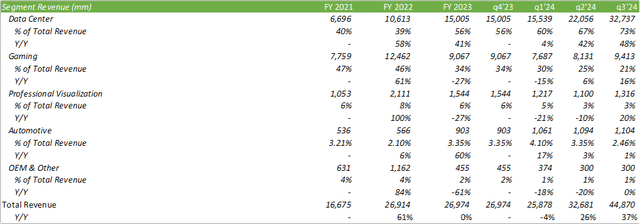

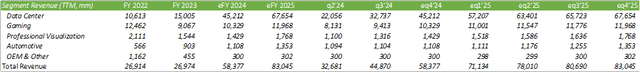

NVIDIA Company’s (NASDAQ:NVDA) income in fiscal Q3 ’24 went into hyperdrive as the info heart grew a large 48% Y/Y on a TTM foundation, with gaming {and professional} visualization returning to high-growth charges of 16% and 20%, respectively. It’s clear the renaissance of generative synthetic intelligence, or AI, is not over the horizon fairly but and that progress will doubtlessly proceed as corporations struggle to stay aggressive with their information lakes. Contemplating Nvidia’s runway for progress, I present NVDA shares a BUY advice with a value goal of $666/share at 20x my forecasted eFY25 income.

The Elephant In The Room

As administration had outlined on their Q3 ’24 earnings name:

These laws require licenses for the export of various our merchandise, together with our Hopper and Ampere 100 and 800 collection and several other others. Our gross sales to China and different affected locations derived from merchandise that at the moment are topic to licensing necessities have persistently contributed roughly 20% to 25% of Information Heart income over the previous few quarters. We count on that our gross sales to those locations will decline considerably within the fourth quarter. So we consider can be greater than offset by sturdy progress in different areas. – Colette Kress, Nvidia CFO.

On January 8, 2024, the Wall Avenue Journal printed a barrage of tales centered round dangers regarding doing enterprise with China which can be very particular to Nvidia. A lot of the data detailed in these articles has been touched up on by Nvidia administration; nonetheless, the challenges confronted could also be extra drastic than what was outlined within the quarterly earnings name. As The Journal reported, Chinese language cloud firms aren’t fascinated about shopping for lower-powered AI chips and that Alibaba Group Holding Restricted (BABA) and Tencent Holdings Restricted (OTCPK:TCEHY) are actively shifting a few of their orders to China-based firms reminiscent of Huawei Applied sciences and chips developed in-house. Different tech corporations reminiscent of Baidu and TikTok are doing a lot of the identical. The article means that these cloud firms had sourced 80% of high-end AI chips from Nvidia and will cut back their publicity to 50-60% within the subsequent 5 years.

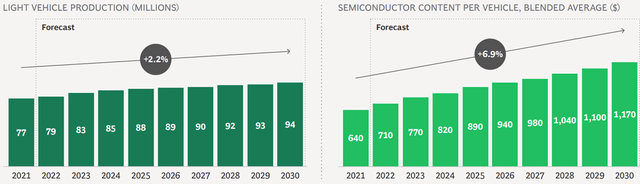

Along with the high-powered chip restrictions, lawmakers are in search of to implement tariffs on less-advanced chips, which might doubtlessly hurt a smaller portion of Nvidia’s automotive enterprise by affiliation. What I imply by that is that with larger prices for analog chips for automobiles might come larger prices for automobiles and doubtlessly fewer automobiles bought because of this, thereby affecting Nvidia’s extra superior chip gross sales to the automotive business. In keeping with Boston Consulting Group, 50% of semiconductor capability progress for the automotive business comes from mainland China.

Boston Consulting Group

So far as Nvidia is anxious, solely ~2.5-3% (automotive & Skilled Visualization) of income is related to the automotive business and that this section taking a small hit will not be damaging to their progress trajectory. Except for the automotive business, tariffs on low-powered semiconductors can bleed into communications, industrials, medical units, and computing, amongst others. Once more, the problem posed by this can be related and never essentially immediately affecting Nvidia’s high-powered chips. Total, I do not consider this can be a lot of a hindrance to Nvidia’s progress trajectory for automotive, particularly given the initiative to fabricate low-powered chips domestically. Actually, Nvidia ought to expertise economies of scale as chips demanded for autos turn into extra superior. The problem I see regarding that is sourcing skilled labor to work on the foundries and the upper prices regarding manufacturing low-dollar chips domestically.

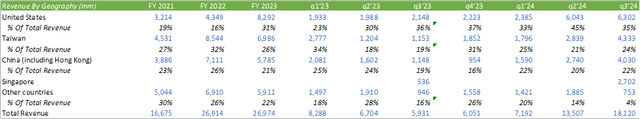

Turning the tables to chip gross sales to China, I consider imposing these tariffs on Chinese language chips together with efficiency restrictions on chips bought to Chinese language corporations might result in longer-term retaliatory results, as gross sales to China accounted for 22% of whole gross sales in Q3’24.

Company Reviews

I consider the 2 largest challenges related to commerce with China can be information facilities and gaming. As mentioned above, I consider cloud computing corporations in China will try to transition away from Nvidia’s chips after inventories and receivables are drawn down. This will likely take by CY25 for the complete results to be felt; nonetheless, administration has already advised gross sales to China can be hindered in This autumn’24.

Company Reviews

Home gross sales to hyperscalers stay sturdy as extra corporations leverage deep studying and generative AI purposes powered by Nvidia computing. One different problem Nvidia might face is competitors from home hyperscalers designing their very own AI chips in-house, reminiscent of Amazon.com, Inc. (AMZN) with their Inferentia and Trainium chips, Apple Inc.’s (AAPL) M3 GPU, Alphabet Inc.’s (GOOG, GOOGL) TPU v5e, and Microsoft Company’s (MSFT) Azure Maia 100 and Cobalt 100 chips. Many of those chips are both presently obtainable or can be obtainable later in 2024. How a lot this may impression Nvidia’s future progress is to be seen. The impression could also be minimal, because the demand for these high-powered chips stays past Nvidia’s capability to provide them. The impression may additionally be substantial, as prospects might go for different designers’ chips to maintain up with their very own AI developments.

Nvidia additionally sees a market with sovereign authorities our bodies utilizing their chips for AI cloud infrastructure and purposes. Nvidia sees this as an enormous alternative given information privateness and safety legal guidelines for sharing information throughout borders (assume GDPR and CCPA) and the constraints or restrictions of utilizing public cloud providers as a authorities physique. As sovereign governments search to make the most of their collected information for his or her respective use circumstances, I consider Nvidia is positioned effectively in relation to their flexibility to both promote or throttle and promote chips to overseas entities. I do consider that as geopolitical tensions rise, each defending and analyzing information will turn into an increasing number of invaluable to authorities entities that will use Nvidia’s GPUs.

For gaming, Nvidia launched the GeForce RTX 4090 D, a modified model of its GeForce RTX 4090, that was tailored to adjust to U.S. laws. Accordingly, this modified model is merely 5% slower than the RTX 4090.

Outdoors of trade-restricted nations, Nvidia continues to enhance their gaming collection GPUs. The fireplace chat on the CES convention with JPMorgan because the host showcased Nvidia’s new line of AI-enabled RTX SUPER collection, with costs starting from $600-1000. Along with their DLSS 3, management boasts speeds that are 2x faster when in comparison with the 30 collection.

Although administration anticipates a sequential decline in gaming income for This autumn’24 resulting from seasonality, I consider their newest collection of gaming chips can proceed to drive shopper progress, if something, at a reasonable tempo. According to an article published by Barron’s, U.S. shoppers are anticipated to extend spending on tech, reversing a two-year decline. The CTA, or Shopper Know-how Affiliation, forecasts 2.3% progress in {hardware} for 2024, a reversal from the 5.4% decline seen in 2023. The CTA additionally anticipates a 12% progress in gaming subscriptions.

Trying Forward To FY25

Administration outlined of their Q3’24 earnings name that China and different restrictive areas have contributed 20-25% of knowledge heart income over the previous few quarters. Administration additionally believes that they’ll be capable to offset gross sales to those affected areas with gross sales in different nations.

Total, I count on a strong 12 months going ahead. Although I anticipate progress figures to reasonable as new entrants start promoting their aggressive AI chips, I do consider the broader market demand can accommodate for the extra competitors.

Trying to Taiwan Semiconductor Manufacturing Firm Restricted (TSM) for steerage on the manufacturing entrance:

“World semiconductor gross sales elevated on a year-to-year foundation in November for the primary time since August 2022, a sign that the worldwide chip market is constant to realize power as we enter the brand new 12 months. Trying forward, the worldwide semiconductor market is projected to expertise double-digit progress in 2024.”

John Neuffer, SIA president and CEO.

Regardless of the sturdy reported November information, December gross sales declined by 8.4% for a full-year decline of 4.5%.

TSMC December 2023 Income Report

TSM does have a progress plan for 2024 because of Nvidia’s AI chip demand. TSM anticipates doubling their advanced chips packaging capability, or CoWoS, by the tip of CY24. Briefly, the CoWoS platform is used for manufacturing superior chip and supplies the best built-in density for high-performance computing purposes. I consider that this could debottleneck the provision chain challenges Nvidia confronted in CY23 and can enable for better chip manufacturing and gross sales. On condition that this extra capability won’t be finalized till the tip of the calendar 12 months, extra capability will not have an effect on FY25 figures in full and could have extra of an impression in FY26.

Financials

Beginning with income, I anticipate Nvidia to proceed their sturdy efficiency going into the tip of the fiscal 12 months by 2025.

Company Reviews

I do anticipate information facilities to proceed driving the vast majority of progress with sturdy progress in gaming all through 2025. I additionally count on automotive to expertise larger progress mid-eFY25 as extra superior automotive chips develop in demand.

Company Reviews

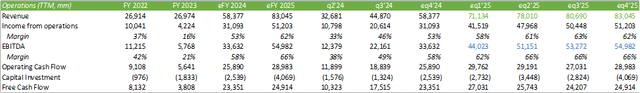

For operations, I count on sturdy margin growth by FY25 as Nvidia experiences economies of scale by quantity gross sales.

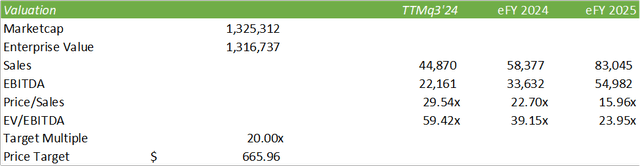

Valuation

Company Reviews

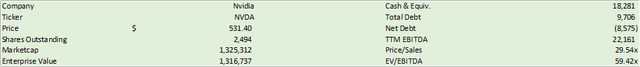

NVDA shares presently commerce at 29x gross sales, a really wealthy and sturdy valuation. Contemplating their progress trajectory, this valuation could also be justified contemplating the lengthy runway for his or her AI chips.

Looking for Alpha

Trying on the agency’s outlay, I present NVDA shares a BUY advice and value shares at $666/share at 20x my eFY25 gross sales forecast for a market cap of $1.6T.

Company Reviews