Justin Sullivan

Nvidia Company (NASDAQ:NVDA) introduced spectacular fiscal Q3 earnings with triple-digit progress. Nonetheless, this didn’t transfer Wall Road, and the inventory is buying and selling sideways. This development will seemingly proceed for many of 2024 because the market tries to determine out the long-term progress trajectory in Nvidia.

The chip restrictions on Nvidia haven’t been priced adequately. It’s seemingly that a lot of the massive tech firms in China hoarded up the newest AI chips from Nvidia in anticipation of the approaching chip ban. Even Alibaba Group Holding Restricted (BABA) has talked about that the chip ban is a major reason why it’s delaying the spinoff technique of its cloud division. This exhibits the significance of those chips, and most tech gamers would have made larger than ordinary purchases within the earlier quarters. This can cut back the demand for chips in 2024. In a earlier article, it was talked about that Nvidia’s efficiency won’t ship a bullish momentum for the inventory.

Nvidia can even face considerably harder comps in 2024. It’s extremely unlikely that Nvidia will be capable of report triple-digit YoY progress in 2024. Nvidia’s administration has been upbeat within the current earnings and talked about that they see robust demand even into 2025. Nonetheless, at Nvidia’s valuation a number of, Wall Road wish to see onerous numbers earlier than giving one other bullish run to the inventory. Regardless of staggering efficiency metrics within the final two quarters, the inventory has not seen a significant upside. This exhibits that a lot of the present progress projections have been priced in. Traders searching for an AI funding might think about different choices which can be buying and selling at extra cheap ranges.

Troublesome to Impress Wall Road

Nvidia has reported progress numbers that are not often proven by an organization with an identical income base. Nonetheless, this didn’t assist the inventory. Over the previous six months, the inventory has traded within the vary of $400-$500. It will be tough for Nvidia to interrupt this vary within the close to time period as a result of its sky-high valuation a number of.

YCharts

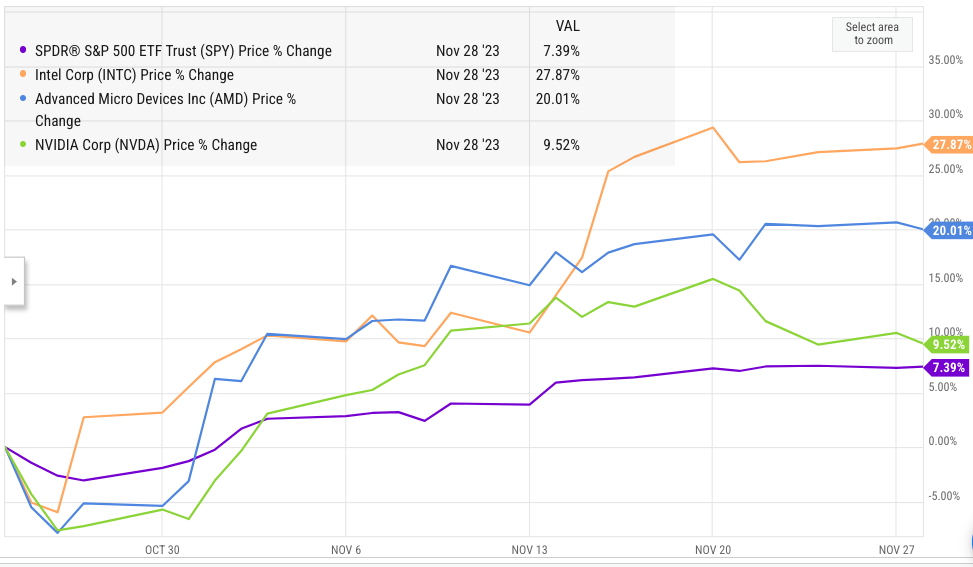

Determine: Worth motion in Nvidia and different chip shares on this earnings season. Supply: YCharts

The current earnings season has proven a transparent development the place Intel Company (INTC) and Superior Micro Gadgets, Inc. (AMD) inventory appreciated considerably as a result of higher ahead progress potential. However, Nvidia’s inventory has corrected a bit since its earnings.

Wall Road is forward-looking, and all the main focus is now on the flexibility of Nvidia to maintain its progress momentum in 2024. Even within the best-case state of affairs, it’s unlikely that Nvidia could have staggering progress in 2024 because it faces harder comps. One other main headwind for Nvidia will probably be market dynamics throughout the AI chip trade.

Headwinds in 2024

Many of the massive tech firms in China had been already warning over attainable restrictions on chip entry within the first half of 2023. A rise in geopolitical tensions between China and the U.S. has hit the superior AI chip gross sales very onerous. It is extremely seemingly that these massive tech firms had made superior purchases within the first few quarters of 2023 in anticipation of a chip restriction. This allowed Nvidia to promote its newest AI chips at a premium and achieve large margins. These superior purchases ought to restrict the demand within the subsequent few quarters.

The early AI hype can also be beginning to turn into much less dominant. Now we have seen slower cloud progress in Amazon (AMZN) AWS and Google (GOOG) Cloud of their current quarterly earnings. It will likely be some time earlier than the monetization of AI instruments gathers tempo, and through this time we might see extra prudent purchases of the newest AI chips.

Change in Aggressive Panorama

In early 2023, Nvidia’s newest AI chips had been the one recreation within the city. This allowed the corporate to cost a giant premium on these chips and achieve big earnings. Nonetheless, that is now altering as new chips are being examined by different opponents. AMD will soon launch its MI300 chips in early December. Amazon’s AWS has also announced Trainium2 chips, which it claims to be 4 instances sooner and twice as vitality environment friendly because the predecessor. Microsoft (MSFT) has also launched its AI chip known as Maia to offer customized AI providers.

The entire massive tech firms have large sources to scale up their improvement efforts quickly. In addition they have their very own cloud service the place the chips can immediately be used as an alternative of ready for out of doors shoppers. This utterly modifications the aggressive panorama, and we might see decrease costs from Nvidia because it tries to retain the market share for its personal AI chips.

Future Trajectory of Nvidia Inventory

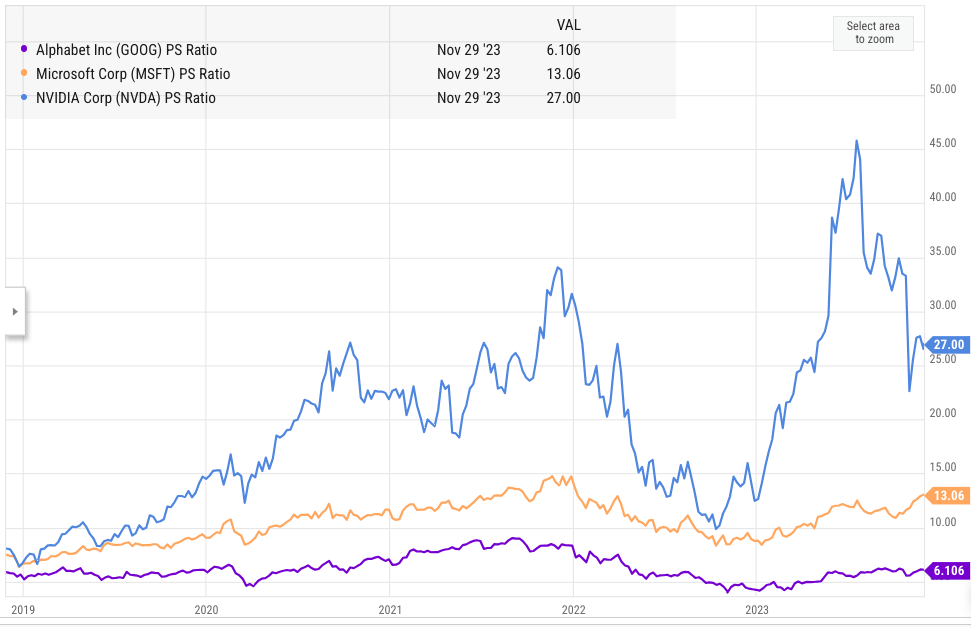

Nvidia inventory noticed an unprecedented bull run within the first half of 2023. This has elevated the P/S ratio considerably. It’s at present buying and selling at a P/S a number of of 27 in comparison with 13 for Microsoft and 6 for Alphabet. Nvidia’s enterprise can also be very cyclical, and we now have already had massive swings within the inventory value over the previous few years. This provides one other danger premium to the inventory in comparison with extra steady earnings shares like Microsoft and Google.

YCharts

Determine: Nvidia’s P/S ratio in contrast with Microsoft and Google. Supply: YCharts

We’re prone to see vital headwinds for Nvidia in 2024. Within the best-case state of affairs, the inventory could have a sideways momentum because it absorbs the worth soar of 2023 and the valuation a number of reaches extra cheap ranges. If the efficiency of AMD’s chips beat expectations, we might even see a giant correction in Nvidia inventory.

Investor Takeaway

Nvidia inventory has not responded to the robust earnings end result reported by the corporate not too long ago. This exhibits that Wall Road has already priced in a lot of the anticipated progress of the corporate. 2024 will probably be a really robust 12 months for Nvidia because it faces harder comps and a extra modest demand atmosphere for its premium AI chips. The launch of aggressive merchandise by rivals can even be a key issue intently watched by buyers.

Nvidia inventory is buying and selling at a major premium to different massive tech shares, which limits an additional bull run within the inventory except there’s a main AI breakthrough in monetization. The present Nvidia Company value ranges are too dangerous to make an entry. Traders searching for an AI play might take a look at different massive tech firms with robust moats that are launching their very own AI chips and providers.

Editor’s Word: This text discusses a number of securities that don’t commerce on a significant U.S. alternate. Please concentrate on the dangers related to these shares.