- The costs of NOT and WIF have declined within the final week.

- This has been as a result of a surge in profit-taking exercise.

Notcoin [NOT] and dogwifhat [WIF] have shed their most up-to-date features. The 2 altcoins have witnessed double-digit value declines prior to now seven days.

In keeping with CoinMarketCap, NOT’s worth dropped by 35%, whereas WIF’s value dipped by 21%. At press time, NOT exchanged palms at $0.016, and the memecoin WIF traded at $2.62.

NOT braces for extra dip

Following its launch on the Toncoin community on sixteenth Could, NOT’s worth climbed to a peak of $0.02 on 2nd June.

Nevertheless, as profit-taking exercise gained momentum, NOT bulls couldn’t defend that value stage, therefore the worth decline. At its present worth, the altcoin’s value has dropped by 20% from its excessive.

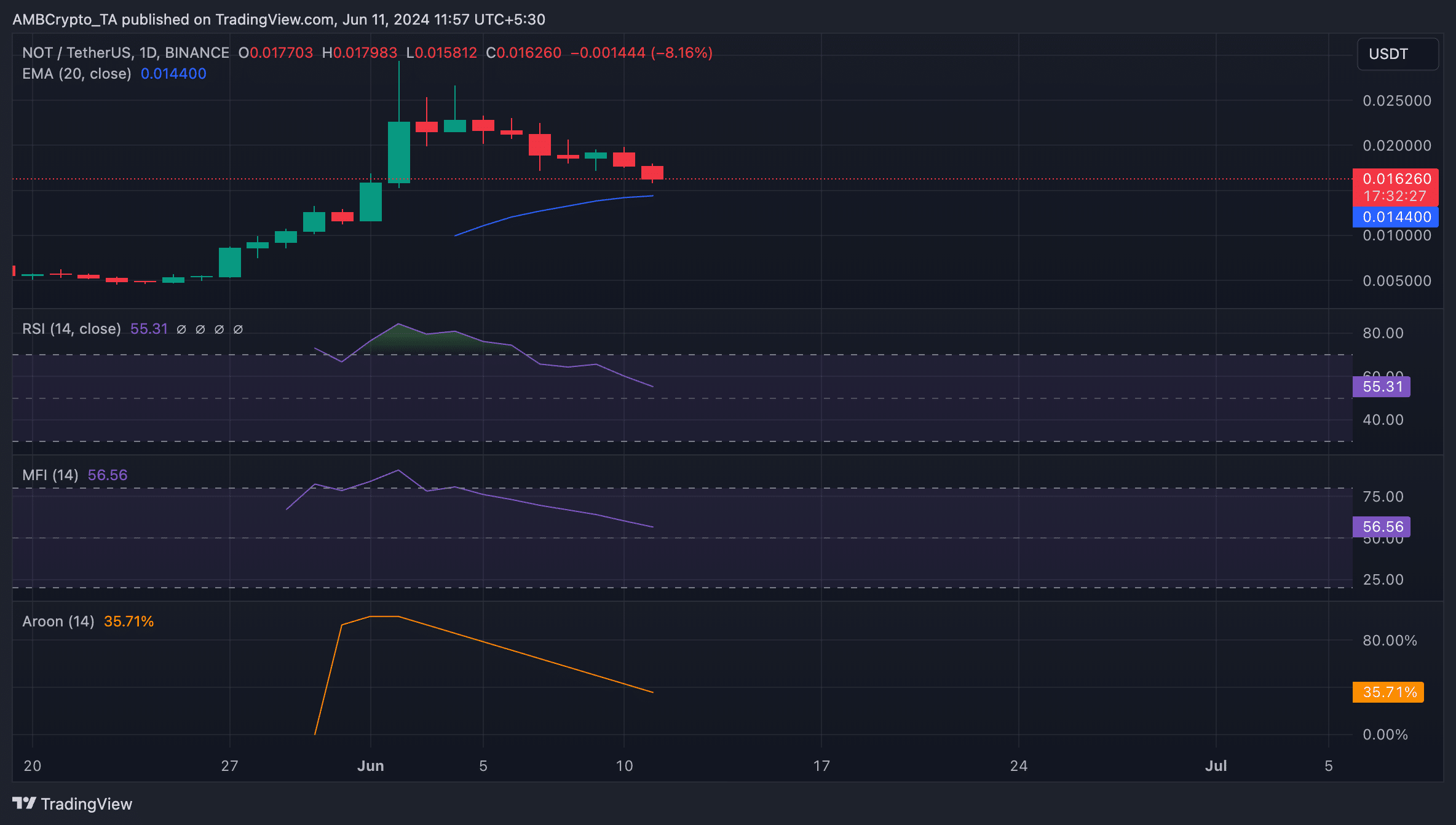

An evaluation of key momentum indicators confirmed the surge in NOT sell-offs prior to now few days.

For instance, its Relative Power Index (RSI) and Cash Move Index (MFI) trended towards their respective middle strains. At press time, the token’s RSI and MFI had been 55.31 and 56.56, confirming the decline in shopping for strain.

Additional, the worth of NOT’s Aroon Up Line (orange) was 35% on the time of writing. This indicator identifies the energy of an asset’s value traits and potential reversal factors.

When an asset’s Aroon Up line is near zero, the uptrend is weak, and the latest excessive was reached a very long time in the past.

At its present value, NOT traded near its 20-day exponential shifting common (EMA), which tracks the token’s common value prior to now 20 days.

When an asset trades near this key shifting common, it alerts a decline in shopping for momentum and a sign that the bears would possibly quickly regain market management.

Supply: TradingView

WIF sellers take cost

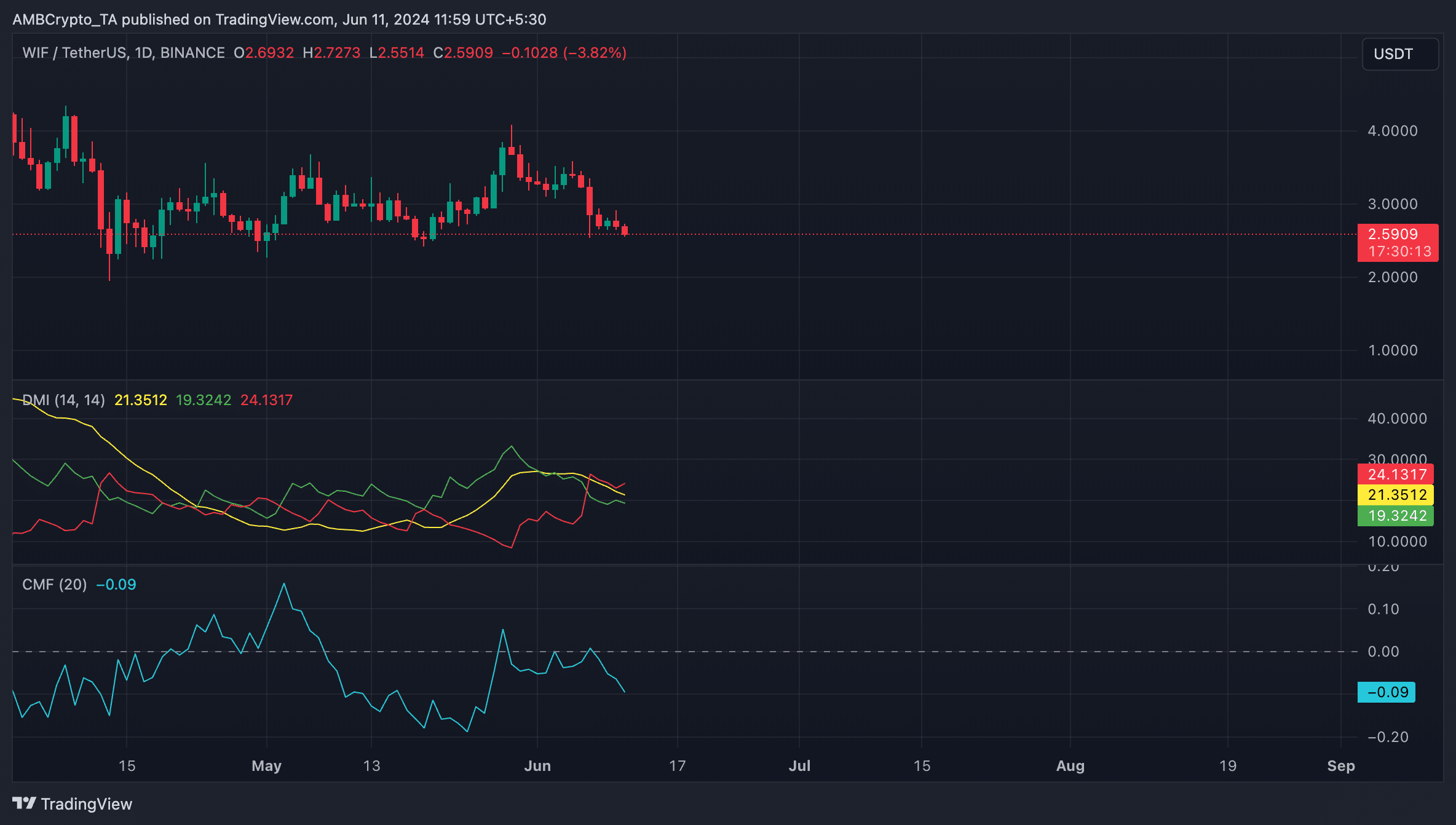

Relating to WIF, its efficiency has not been any totally different, because the bearish bias towards the main meme coin stays vital.

For instance, its Chaikin Cash Move (CMF) rested under the zero line to return a price of -0.09 at press time.

This indicator measures the circulate of cash into and out of the WIF market. When its worth is unfavourable, it alerts liquidity outflow from the market, which is a bearish signal and a precursor to an extra value decline.

Sensible or not, right here’s NOT’s market cap in SOL phrases

Additionally, readings from WIF’s Directional Motion Index (DMI) confirmed its optimistic directional index (inexperienced) resting under its unfavourable index (purple).

Supply: TradingView

Which means that bear energy is extra vital than bull energy. It’s interpreted as a sign that the sellers have market management.