DNY59

In contrast to a lot of the alternate traded funds we’ve lined on this platform, BlackRock Brief Length Bond ETF (BATS:NEAR) is actively managed. This fund doesn’t merely construct its portfolio through sampling or replicating a benchmark index. As a substitute, the BlackRock (BLK) workforce makes use of their funding acumen to construct and handle the portfolio. Contemplating this, the annual bills are available in means under expectations.

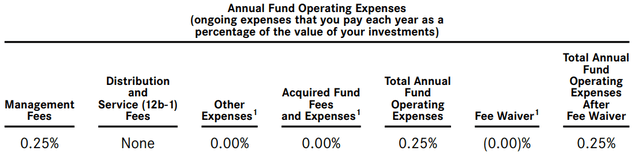

Abstract Prospectus

In response to this website, on a median, passive exchange-traded funds, or ETFs, have annual expense ratios of 0.26% versus 0.57% for his or her actively managed counterparts. The annual bills of NEAR are corresponding to passive autos, and we are able to consider two causes for that. The economies of scale that include the BlackRock title, and the 2013 inception of this fund. The 1 12 months Treasuries yielded subsequent to nothing on the time.

Why does that matter? This fund doesn’t take a lot of a credit score or period danger. On account of holding a decrease danger portfolio, the incomes capability can also be modest, particularly when it began out a decade in the past. The annual invoice footed by buyers needed to be commensurate with the potential revenue inflows. The comparatively low bills have helped the fund obtain optimistic ends in all time frames because it opened for enterprise.

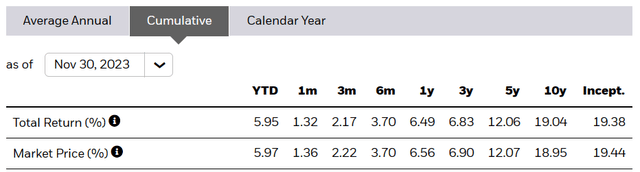

NEAR

The Fund

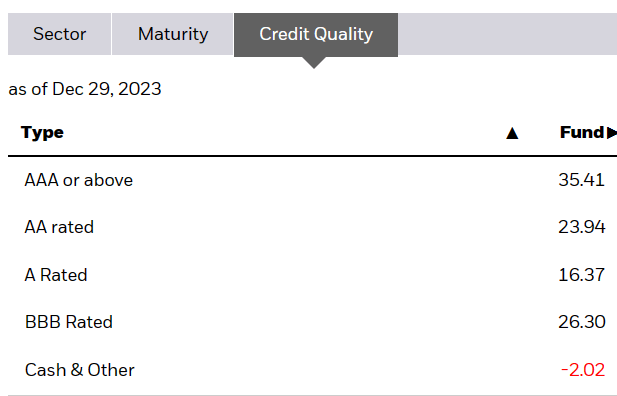

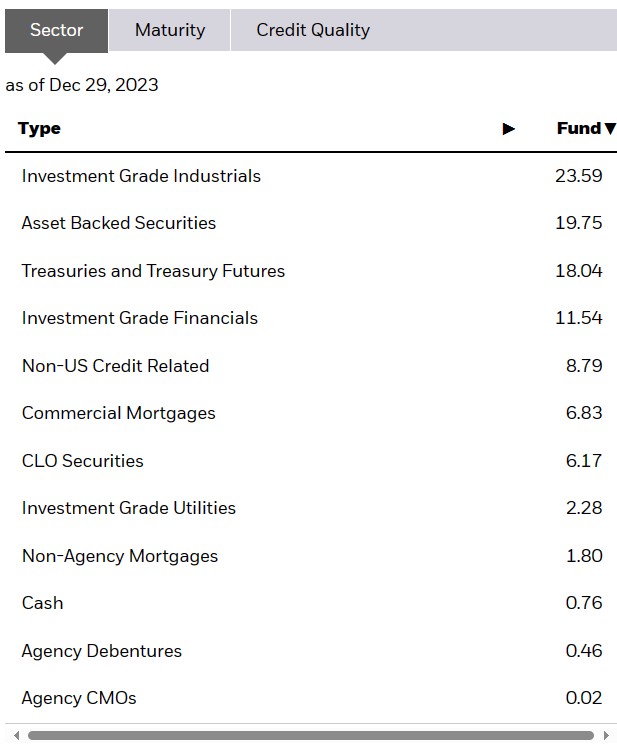

No less than 80% of NEAR’s portfolio is comprised of USD-denominated, funding grade, fixed-income securities. For the steerage on whether or not a safety meets the funding grade benchmark, rankings from both S&P World Scores or Fitch Scores, Inc. are used. NEAR might have securities in its portfolio that aren’t rated by both of the 2, however are deemed to be of comparable high quality by workforce on the helm. Conserving in step with its portfolio mandate, all holdings fell within the funding grade class based mostly on the newest numbers.

NEAR

The administration workforce, additionally reserves the right to “use derivatives to hedge its investments or to hunt to boost returns.” At December 29, the portfolio consists of foreign money forwards and margin utilization, mirrored below the unfavourable money place within the above graphic. Coming again to the fastened revenue incumbents that make up the majority of the portfolio, NEAR holds fastened and floating securities of varied sorts. Some examples from the prospectus offered under.

company and authorities bonds, company securities, devices of non-U.S. issuers, privately issued securities, asset-backed securities (“ABS”) and mortgage-backed securities (“MBS”), structured securities, municipal bonds, repurchase agreements, cash market devices and funding firms.

Supply: Summary Prospectus.

At December 29, funding grade industrials and financials, asset backed securities and treasuries (and futures), made up shut to a few fourths of the portfolio.

NEAR

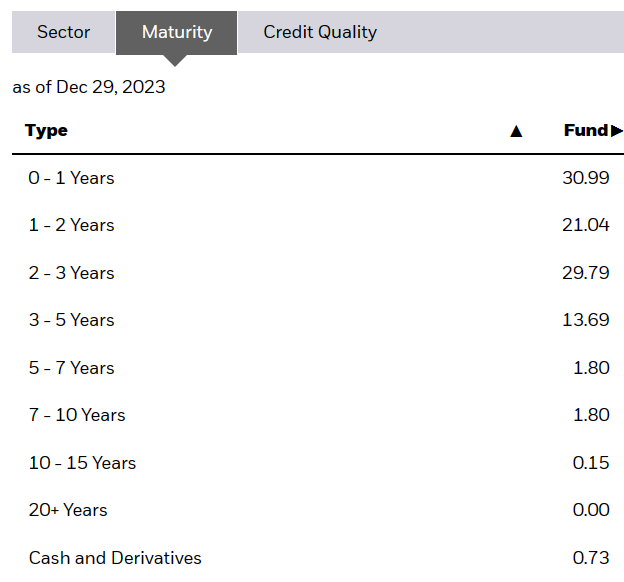

Presently, the weighted common maturity of the NEAR portfolio is simply over 2 years, which is sensible as over 80% of the securities mature in 3 years or much less.

NEAR

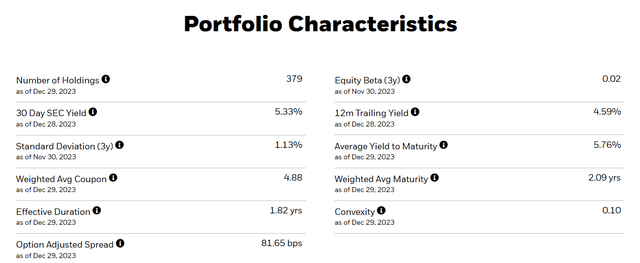

Whereas the fund does have a smattering of securities maturing between 5 to fifteen years, the quantity is insignificant and doesn’t influence the administration’s efficient period goal, which they endeavor to maintain at 3 years or much less. This measure signifies the portfolio’s sensitivity to adjustments in rates of interest. It broadly measures the extent to which the worth of the portfolio declines with each 100 foundation factors enhance in danger free charges. This relationship is inverse, so a charge reduce would have the reverse influence. With an efficient period of 1.82 years, the danger that NEAR’s portfolio will dance wildly to the cacophony of rate of interest gyrations is slim.

NEAR

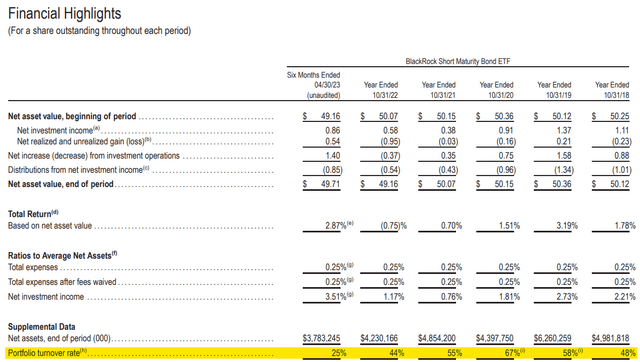

Moreover, an lively administration technique and near 50% annual churn to the portfolio goals to additional insulate this ETF from the gentle publicity to the rate of interest danger a 1.82 yr period brings with it.

Semi Annual Monetary Report

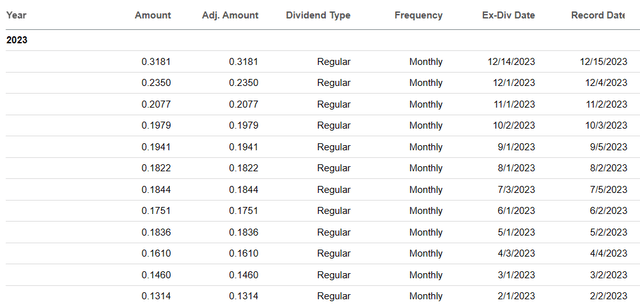

The portfolio has a median yield to maturity of 5.76%, as famous within the “Portfolio Traits” graphic above. This leaves round 5.51% in internet revenue after taking into consideration the annual bills. NEAR distributes on a month-to-month foundation, with the newest quantity being 31.81 cents.

In search of Alpha

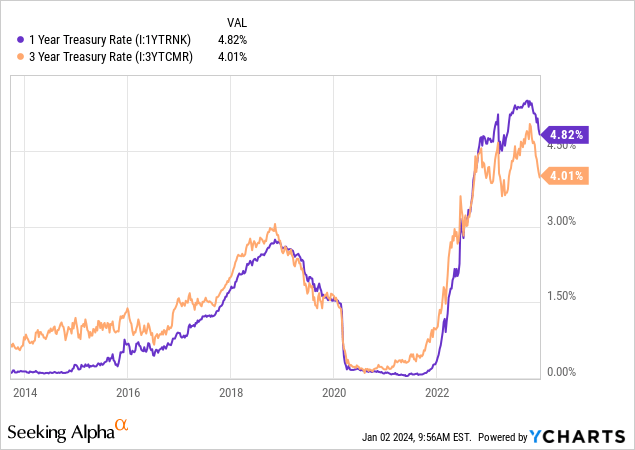

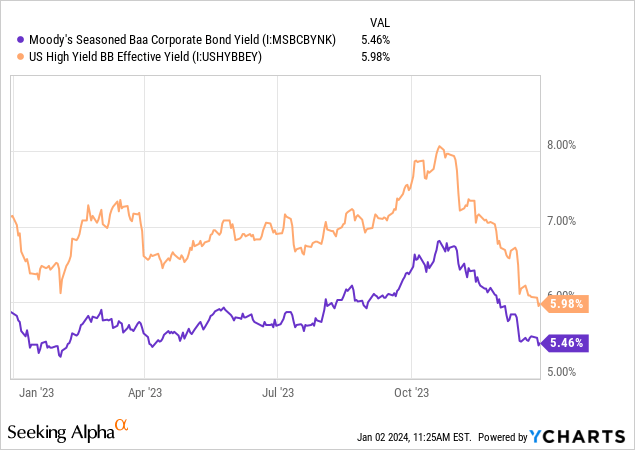

Utilizing the present value of $50.49, this low danger ETF yields 7.56%. Don’t be seduced by this, as this spike is only a operate of rate of interest adjustments of the latest previous (October). Similar to we see the strains of the chart under come all the way down to earth, so will the NEAR distributions.

ETFs don’t make it a behavior to distribute greater than they earn, and NEAR is not any totally different. The earnings are a number one indicator of what the fund distributes down the road, and the 7.56% in distribution yield is simply the results of the time lag. We count on the month-to-month distributions to begin trending down to fulfill the portfolio yield to maturity, internet of bills. Anticipate on common, the distribution to development in direction of 22 cents within the subsequent 6-9 months.

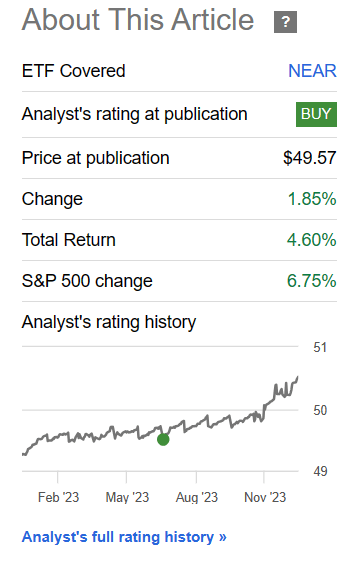

Prior Protection

We had been unimpressed with this fund in November 2020 and October 2021, however lastly rated it a purchase in July of 2023.

In search of Alpha

It served as a money parking car with its 0.45 years in efficient period and had the potential to yield over 6% based mostly on the typical yield to maturity of its portfolio. We anticipated the distributions to development upwards, they usually did (consult with the distributions knowledge offered earlier on this piece). In our opinion, NEAR would have be an acceptable candidate for small place in a conservative portfolio again then. It additionally did fairly properly relative to bonds which went in all places, and managed to make two-thirds as a lot because the S&P 500 (SP500).

Verdict

A number of charge cuts have been priced in right now from The Federal Reserve.

Chicago Mercantile Change, Bloomberg

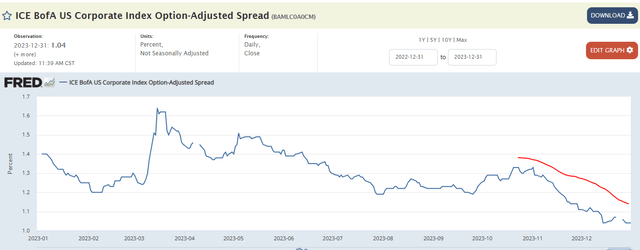

Alongside that, the spreads of funding grade securities have reverted to their lows.

FRED

We do not like the concept of committing right here for the present yield. Proper now, choose shorter-term bonds supply a greater hideout till the spreads blow up. We even mentioned a child sort yielding 8% in a latest piece. BlackRock Brief Length Bond ETF has low credit score and rate of interest danger, however with the present charge construction and credit score spreads, we now not charge it a purchase and are transferring this to a “Maintain.”

Please notice that this isn’t monetary recommendation. It could seem to be it, sound prefer it, however surprisingly, it isn’t. Traders are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their goals and constraints.